All you need to know about Uber's digital wallet, Uber Cash, launch in Africa

Uber Cash, a digital wallet for Uber riders, has been launched in eight African countries, namely: Côte d'Ivoire, Ghana, Kenya, Nigeria, South Africa, Tanzania and Uganda. Here's all you need to know.

Uber Cash, a digital wallet for Uber riders, has been launched in eight African countries, namely: Côte d'Ivoire, Ghana, Kenya, Nigeria, South Africa, Tanzania and Uganda.

In Nigeria, Uber is partnering with Flutterwave to facilitate Uber Cash. This means riders can preload their wallet with any amount that will be used on upcoming trips. Uber Cash can also be used to pay for deliveries on Uber Eats. And in addition to electronic fund transfer, riders can also add fund to their wallet from Flutterwave’s Barter.

Launched two years after Uber’s entry into Nigeria in 2014, Flutterwave signed Uber up as a client, enabling the ride-hailing company to build customizable payment applications through its APIs. This partnership is a continuation of that working relationship.

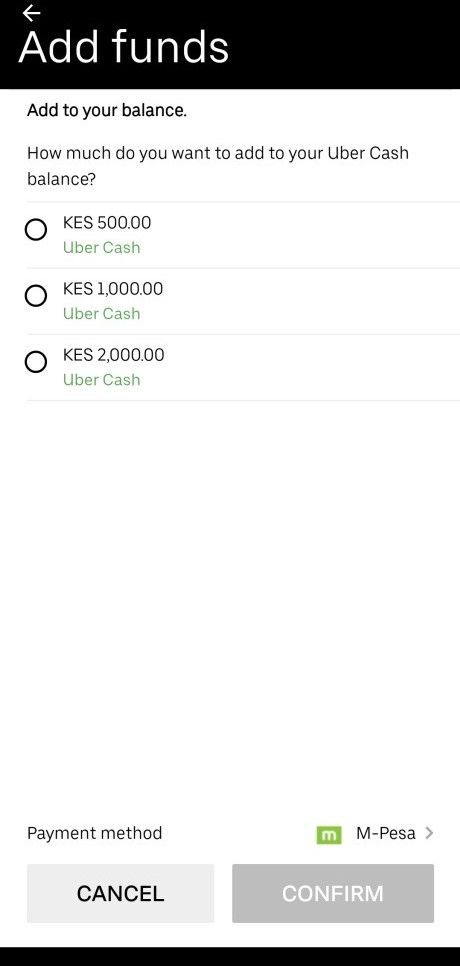

In Kenya, Uber is partnering with M-Pesa to facilitate the use of Uber Cash. This means riders in Kenya can add fund to their wallet with M-Pesa, Vodafone’s mobile money service.

Uber’s General Manager for Sub-Saharan Africa, Alon Lits, explained that different top-up methods applicable in each of eight countries where Uber Cash is launched are available to riders. "For example, in Nigeria, you can use your Verve card or mobile money. In Kenya, you can use M-Pesa and EFT (electronic fund transfer). In South Africa, you can top up with EFT", Lits said.

In a chat with benjamindada.com, Uber revealed that Uber Cash is already available in Nigeria and Kenya. However, "it is a phased launch, so not everyone will see [the new feature on their Uber app] at the same time".

Explaining how it is able to operate a digital wallet in Africa, Uber said Flutterwave is facilitating the process in Nigeria to ensure Uber Cash is in compliance with all local regulations. But it refused to comment on the other countries. It can be inferred that Uber will rely on M-Pesa regulatory infrastructure in Kenya too.

But it is good to note that when Flutterwave launched Barter in partnership with Visa last year, it said the focus would be on "building Barter user base across mobile money and bank clients in Kenya, Ghana, and South Africa". Hence, Flutterwave could facilitate Uber Cash in those countries too.

Flutterwave is licensed by the Central Bank of Nigeria as a payment solution service provider (PSP). Inter alia, a PSP license holder cannot offer a wallet-based service like Uber Cash or mobile money operators.

From the way Barter works, however, Flutterwave has a partnership with Wema Bank. The two Barter accounts I created are domiciled in Wema Bank. "Your Barter balance is reserved/pre-authorized in your financial institution", a footnote in Barter read. This is not outlandish for fintechs in Nigeria.

Many fintechs have partnered with a bank to provide their users with additional services. For instance, Cowrywise and Piggyvest partnered with Providus Bank to give their users NUBAN (Nigeria Uniform Bank Account Number).

Barring any unforeseen circumstances, Flutterwave is a don in brokering strategic partnerships and making them work. Last year, Flutterwave announced partnership with four digital payment services.

Uber Cash is different from Uber CASH

Uber CASH is a payment option Uber introduced in 2016 that allows riders to pay drivers cash at the end of their trips. Uber has said existing payment options such as cash, debit card and gift cards will still be available alongside Uber Cash.

The main aim of providing Uber Cash is to allow more people to use Uber’s apps (Uber and Uber Eats), especially those who don’t have cash or cards at hand, according to the statement sent to benjamindada.com.

While funds in Uber Cash wallet "will never expire and you can top up at any time", you cannot transfer the funds onto other payment cards outside the Uber ecosystem.

Uber began to roll out Uber Cash in September 2018. It was launched by Uber Money, the division of Uber in charge of its financial services: credit cards, digital wallets for riders and instant payment for drivers.

Uber Cash would pose a problem for drivers who prefer cash trips

According to Uber, it has introduced instant payment for drivers. "To help create a reliable cash flow, drivers can now cash out to their bank account once per day instead of weekly, putting drivers in control of when they get paid", Uber told benjamindada.com.

However, all the Uber drivers I spoke to said there is no such thing as instant payment. "We still receive our money weekly, mostly Mondays", one of the drivers, Henry, told me.

The drivers also lamented that the feature might reduce the number of cash trips they get. "The reason some people use cash on Uber is that they don’t want to put their debit card on the app or they don't have a card", Henry said. "But with Uber Cash now, they can just add fund to their wallet from their bank account and go about their day".

Most ride-hailing drivers, including Bolt and Oride drivers, prefer cash trips. With cash trips, drivers would be the one to remit the agreed percentage to the ride-hailing company. But some drivers often divert the money to personal use or emergencies and pay the company at a later date.

Henry explained, "If I get like five cash trips in a day, and by the time I get home an emergency come up, I can use the money I made from those trips to sort the issue. And later, I will source for money to pay Uber".

To ensure drivers pay them their percentage after cash trips, ride-hailing companies block owing drivers from getting riders until their debt is paid.

Dammy, another Uber driver spoke to, said the weekly payment is better. "I prefer card trips and like how they [Uber] pay us weekly”, Dammy said. "I see it as a weekly saving that I receive every Monday".

The introduction of cash payment in 2015 was a wise choice Uber made to serve more communities. Albeit a deviation from Uber's cashless vision. The launch of Uber Cash in Africa signal Uber is still very keen on the cashless vision and will continue to find ways to dethrone the king — Cash — in most developing countries.

Every company will be a fintech company

The launch of Uber Cash in Africa is timely as it would serve as a means of contactless payment during the global pandemic. It would also help riders and drivers to adhere to social distancing measures and limit physical contact.

In a recently released announcement, Uber stated that everyone who makes use of the platform must wear a mask. "Whether you are a rider, driver, or delivery person—everyone must share in the responsibility of helping stop the spread of COVID-19. We're leveraging facial recognition technology to check that drivers are wearing masks before they go [to pick riders]", Lits said. In Africa, Uber is also experimenting with impact-safe plastic dividers for its cars in Kenya and Nigeria.

Uber Cash also strengthens the expansion of the ride-hailing company into financial services. That is why Uber Money division was created in 2018.

At the core, the launch of Uber Cash in Africa is a way to spread Uber financial services to more cities, and strengthen its position among tech companies providing financial services. WhatsApp also recently launched payments in Brazil.

Cover image courtesy CNet