Piggyvest vs Cowrywise: May the best man win

CowryWise or Piggyvest? Both? Why?

Necessity is the mother of innovation; competition is the antidote of complacency. From the Cola War between Coca-Cola and PepsiCo to the Browser War between Internet Explorer and Netscape, consumers are often the winner in a business war.

In the startup world, where the winner can take all and there is a first-mover advantage, the competition is usually fierce because a foothold can quickly become a stronghold. Think of the big tech companies: Google, Amazon, Facebook, and Apple. They are now very much a threat to everyone and difficult to compete with. To an extent, Youtube has monopolized the video content space while Facebook owns the largest share of the social media market, leaving the likes of Snapchat and Twitter in the dust.

These two Nigerian fintech startups, Piggyvest (formerly Piggybank) and Cowrywise, are not going to let that happen. With innovation, they are bumper-to-bumper.

Piggyvest versus Cowrywise: The tussle thus far….

Piggybank got to the market first. It was launched in February 2016, while Cowrywise arrived a year later in March 2017.

Piggybank got the message loud and clear, so it launched an Android app in July and an iOS app by August 2017. For whatever (strategic) reason, Cowrywise continued to live only on the web. Its only response in that year was the launch of Sisi–a Facebook Messenger bot. Cowrywise launched its Android app in March and iOS app in October 2018, to mark its one year anniversary.

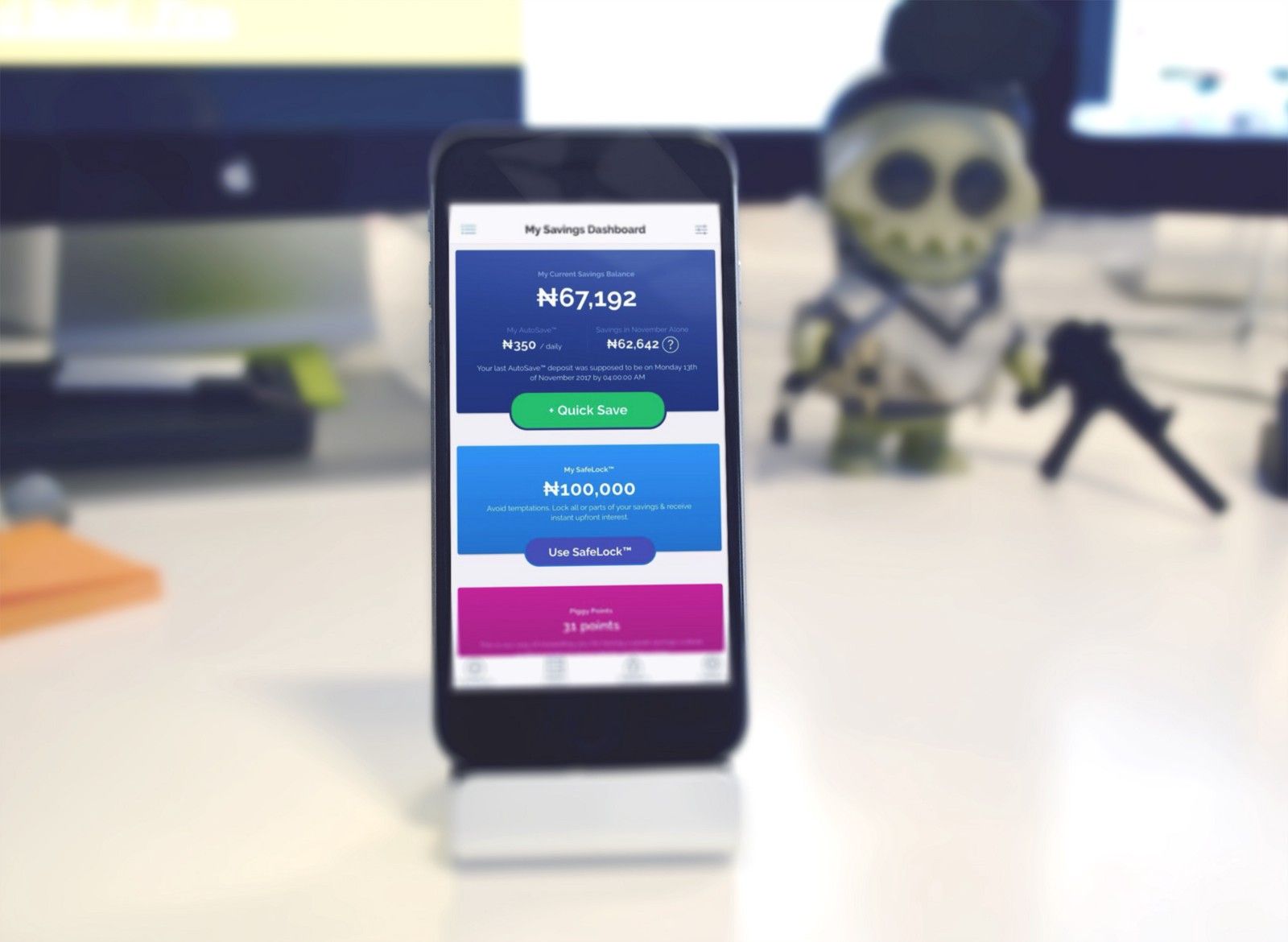

During this period (2016-2018), both Piggyvest and Cowrywise rolled out some additional features on their platforms. Piggybank tweaked its Quicksave feature to allow multiple cards to be used and not just the debit card linked to the account; it launched Piggypoints as a form of reward for saving on the platform; launched PiggyFlex, Safelock with higher interest rates and enabled transfer between PiggyFlex accounts. It is noteworthy that before launching PiggyFlex, Piggybank experimented with Piggylink: a feature that allows their users to receive payment from anyone, including non-Piggybank users.

Conversely, Cowrywise seemed to have come prepared. They have not tinkered with their features that much. In 2017, Cowrywise introduced the Saving Score.

2019 has been quite eventful for both platforms. Piggyvest fired the first shot by launching Investify—an investment feature—which allows its users to participate in crowd-farming and fixed-income investments with as low as ₦5,000.

Cowrywise responded swiftly with Mutual Funds—the feature allows users to invest in mutual funds with as low as ₦100. It also added the Savings Circle, a feature that allows users to do group savings.

Tolu Adedayo, a user of both platforms, shares his experience

Truth be told, the idea of being able to ‘invest’ to some of us seemed unattainable, probably due to lack of financial literacy. It was something you aspire to do when you have a lot of spare cash and understand how the financial market works.But people that have the spare cash then, too, had to go through portfolio managers or investment firms to complete the very formal process of investing.

The good thing now is that innovators are leveraging technology to make investing more accessible in the easiest way possible.

Personally, I ran from using ALAT (Wema Bank’s digital bank) to Piggyvest until Lola (my friend) introduced Cowrywise to me in her subtle way. She said:

I know you have been using piggybank to do your thing o, but if you see what those guys at Cowrywise have built, it’s really amazing. Just check.

When Piggyvest introduced their new investment options recently (April 2019), Lola and I had a very close look at the invest-in-agriculture feature and we opted in. By adding a feature for investment directly from their platform, Piggyvest has changed the game—and I think they are pioneers in this aspect (first-mover) before others catch-up. Now, potential users have another reason to choose Piggyvest over the competition.

During a conversation, I told Lola that the user acquisition team at Cowrywise and their product strategist will be losing sleep over the recent innovation by Piggyvest. And bingo, Cowrywise introduced the Mutual Funds investment feature (May 2019).

I got the Cowrywise update first, so I texted my economist partner. She shouted:

They are copycats!

The guys at Piggyvest and Cowrywise have proven to be great innovators. Customers needs are always changing. Today, customers want to sell; tomorrow, they want to buy. So, why not find a way to address their ‘buy & sell’ needs?

Finally, I can recommend both platforms for your long term savings and investments.

Looking through the crystal ball, what’s next?

Over the past year, fintechs received the lion's share of the startups funding in Nigeria, as high as 89% in Q3 of 2018. The fintech sector continues to grow and the reason is not far-fetched. About 36.9 million Nigerian adults are financially excluded and the 33.9 million adults that are banked desire better services. Thus, the large number of players in the sector.

Cowrywise and Piggyvest are not the first set of fintechs to be pitched against each other. Flutterwave and Paystack, in their early days, had to clearly communicate their differentiation as both of them address the same problem: payment. Similarly, Cowrywise and Piggyvest address the same problem: savings and investment but their approach is what differentiates them (which would be discussed in a subsequent article).

Like most substitute goods and services, however, a flop by one party is beneficial to the other.

This article was written by Tolu Adedayo, a user acquisition specialist with expertise in growth hacking, SEO/PPC, content strategy/development, data analysis and inbound marketing. He currently heads the content team of a digital marketing agency based in Lagos.

Comments ()