What to make of Fluterwave's major partnerships

So far in 2019, Flutterwave has announced four major partnerships with Visa, Alipay, Pay Attitude and Binance.

Flutterwave has become a don in brokering strategic partnerships. This year alone, it has announced partnerships with four digital payment services.

Founded in 2016 by ex-bankers and engineers, including Iyinoluwa Aboyeji and Olugbenga "GB" Agboola, Flutterwave is currently operating in nine African countries, namely, Cameroon, Ghana, Kenya, Nigeria, Rwanda, Sierra Leone, South Africa, Tanzania and Zambia. And in three years, it has processed more than 100 million transactions worth over $2.5 billion (₦903 billion).

The partnerships

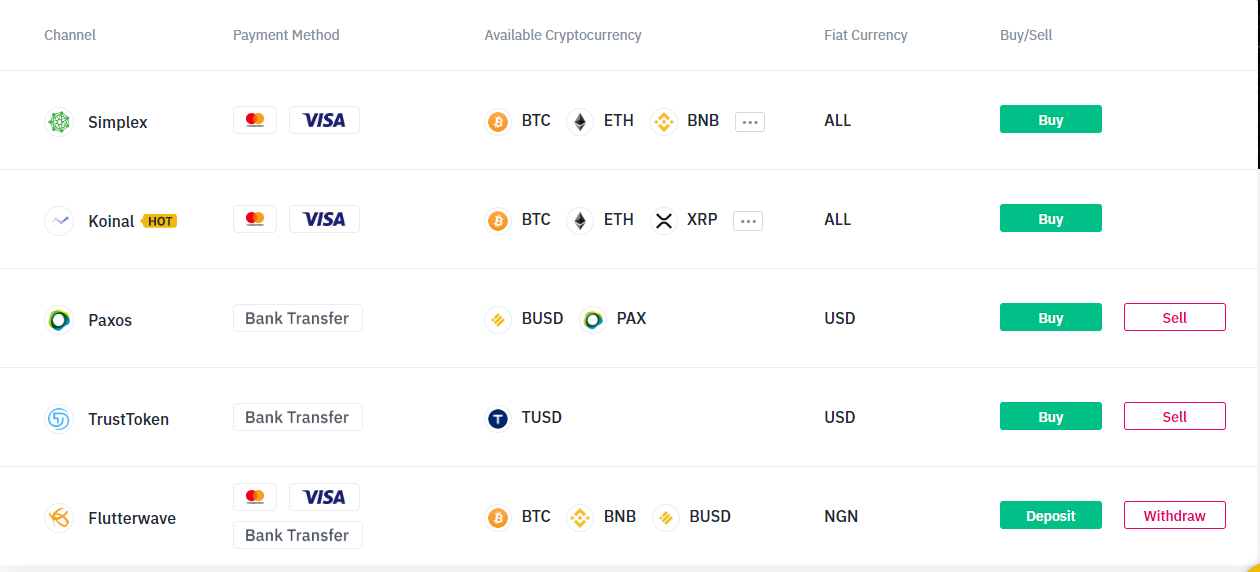

October 24, Binance—one of the leading cryptocurrency exchanges globally—announced its partnership with Flutterwave to allow Nigerian Naira (₦) deposits on its platform.

The new fiat gateway, which is also the first fiat-to-cryptocurrency gateway on Binance, would enable Africans, particularly Nigerians, transacting in Naira to purchase Bitcoins, Binance USD (BUSD) and Binance Coins (BNB) with their debit and credit cards using the Flutterwave channel on Binance.

The partnership is in line with the mission of Flutterwave, according to GB, Flutterwave CEO. It is noteworthy that exactly a year ago, Flutterwave also integrated into Ripple Network—a blockchain technology for digital payment.

At Flutterwave, we create opportunities for the everyday African to reach prosperity levels that were beyond them in the past. That's what this partnership is about. Africans are firmly part of the global financial community, Flutterwave is ensuring this.

The integration of Flutterwave channel would enable the trading of BUSD/NGN, BNB/NGN, and BTC/NGN pairs. To celebrate its first fiat currency listing, Binance has launched a zero fee on Naira deposits promo.

Africa has illustrated one of the largest demands and instrumental use cases for cryptocurrency, notably for financial access. In Sub-Saharan Africa, about 95 million people remain unbanked while many regions in the area, including Nigeria, have embraced new technologies with an increasing amount of innovation. Working with Flutterwave will help bridge the fiat-to-cryptocurrency gap and we hope to stimulate more financial inclusion as Africa demonstrates strong potential in leading crypto adoption.

Earlier this year, Flutterwave had announced partnership with Visa, Alipay and Pay Attitude to ensure Africans and their businesses can make and accept payment from anywhere in the world.

In January 2019, the San Francisco-headquartered company announced a partnership with Visa Inc.—an American multinational payment technology company—to launch a consumer payment product, called GetBarter. Before this announcement, however, Barter had been in operation for more than a year and already gained more than 30,000 users.

Seven months later, Flutterwave announced that it has integrated with Alipay—the most popular online payment platform in China. The integration would enable merchants using Flutterwave's flagship product, Rave, who are estimated to be 6,000, to be able to receive payments from Alipay's staggering 1 billion users.

According to Flutterwave, the integration is in tandem with the interconnectivity it has achieved among African countries.

We've managed to connect African countries...so it was about time we connected Africa to the world. We started with the United States already but you can't connect Africa to the world without China

And just last month, Flutterwave said it has partnered with Pay Attitude—a payment scheme owned by a consortium of leading Nigerian banks that allows people to use their phone numbers to carry out different financial transactions. With this partnership, Flutterwave merchants would be able to receive payment using only the phone number of the customer.

What to make of these partnerships

These partnerships will enable Flutterwave to ensure African businesses can make and accept payment from anywhere in the world, and create prosperity opportunities for Africans.

Ordinarily, partnerships are good for improving business outcomes. But for Flutterwave, these strategic partnerships seems to be existential. They are key to achieving its mission: to inspire a new wave of prosperity across Africa by building payment infrastructure to connect Africa to the global economy.

These partnerships also shows that Flutterwave will continue to serve both individuals and businesses. For instance, partnerships with Visa and Binance enable Flutterwave to provide customers with access to virtual Visa dollar card and cryptocurrency.

Comments ()