What to make of Silicon Valley's interest in African startups

Silicon valley has been showing increasing interest in the African startup ecosystem. They now provide funding, collaboration, incubation and partnerships for African startups. What are the drivers behind this and what does it mean for the ecosystem?

Chipper Cash recently closed its $100m Series C round of funding. The investment was led by SVB, the venture capital arm of Silicon Valley Bank and propelled it to unicorn status. This event has also brought to light a very interesting situation ; silicon valley’s growing interest in African startups.

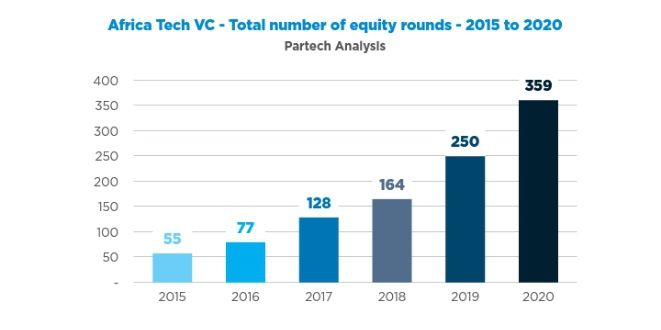

The Series C raise by Chipper Cash is by no means an isolated event; the funding rounds have been getting bigger, with year on year growth for over five years. From $195 million in 2017, it increased by 71.5% in 2018 to reach $334 million and grew by another 46.7% totalling $491 million in 2019.

The top African countries by investor funding in 2020 were

- Nigeria at an estimated $307 million

- Kenya came a close second at $304 million of the total investments in Africa

- Egypt came third, with its startups raising $269 million

- South African startups raised $259 million

- Ghana which saw its startups raise $111 million in investment funds

The collaborations are also becoming stronger and there is a growing synergy between both ecosystems across the atlantic. A telling statistic; out of the six unicorns in Africa, silicon valley investors led the funding round that elevated three to unicorn status.

Tiger Global and Avenir Growth Capital, both US based companies led the Series C funding for Flutterwave. Nigerian fintech Interswitch also reached unicorn status after American payments giant Visa acquired a minority stake in the company. Chipper Cash also closed its Series C led by investment firm Silicon Valley Bank.

What is fueling this interest?

It should first be noted that startup ecosystems are still very complex structures. Even the most mature ecosystems are still prone to chronic startup failure- in the US for example, 90% of new startups fail, while 75% of venture-backed startups fail. Under 50% make it to their fifth year while only 33% of startups make it to the 10-year mark.

As a result, even in the most mature markets, it is still very uncommon for founders to exit, and even more unusual for them to go public. In Africa, the chances are much steeper. Inefficient regulation and a hostile business environment means the chances of startups launching are much lower compared to developed markets; they have to be twice as dogged with much less resources.

But the funding and collaborations have only gotten bigger. Two primary factors may have propelled this initial interest in African startups- expansive broadband/cellular penetration and mass adoption of technological solutions by a teeming youth population.

Africa has a median age of 18.4. This demographic have become the backbone and core user base for the startups. Coupled with the proliferation of affordable smartphone brands, the stage seemed set for the growth of African startups to thrive despite the unfavorable externalities.

As far back as April 2012, Tiger Global, a leading US investment company backed Nigerian startup IrokoTV with $8million. In December 2014, Tanzanian solar power startup Off Grid Electric secured $16 million from SolarCity and other investors. Andela also made the news for its $40 million in Series C funding round led by CRE Venture Capital.

Jumia, the African focused e-commerce platform went public in 2019 in an unprecedented IPO at the New York Stock Exchange. When Paystack got admitted to Global startup accelerator YCombinator in 2016, it was an important global stamp of approval of the budding tech scene in Africa.

The effect of such an accomplishment was that foreign backers now not only sought to merely invest and provide funding, but were now taking a keen interest in the talents of African founders, bringing them onto the global platform.

Where we are now:

Silicon valley’s participation in African startups can be grouped broadly into three categories; funding, partnerships and talent/startup accelerators.

Apart from funding rounds, foreign investors have become increasingly aware of the need to grow local communities to help nurture the immense talents that exist in the African market. Some of the more notable silicon valley accelerators that have a big presence in Africa include

- Ycombinator

- Angellabs

- 500 Startups

- TechStars

- Alchemist Accelerator

Startup accelerators, angel investors and venture capitalists are no longer the only ones leading this drive. Silicon valley tech giants are also setting up programs aimed at supporting talents and disruptive startups to achieve high-growth potential through community support, funding and assisting technical know-how. Examples include Google for Startups Africa and Microsoft startups accelerator.

Partnerships between silicon valley and African founders/teams have also accelerated. Paystack’s exit at $200million was a major example, with Stripe first partnering and then acquiring Paystack to deepen its involvement in African payments.

Payments giant PayPal, which has long restricted Africans from access to its services, recently made a U-turn, partnering with Flutterwave to empower African e-commerce merchants.

These stats point to one obvious fact; Africa is being viewed seriously by every major foreign technology and investment firm. The youthful demographic, a strong sense of community and collaboration and a globally competitive talent pool is helping to propel Africa to the forefront of technological innovation and investment..

Perspectives on the future

From all indications, the startup ecosystem in Africa is only going to get bigger. More funding rounds will be closed and more sophisticated mechanisms for investment, debt financing, equity and acquisition will be adopted. The prospects are huge, the conditions are (mostly) good and the mood is always fast paced. There is no letting up and ideas are being executed at breakneck speed.

The relevant question- is this growth sustainable? On one hand, skepticism is quite justified. Despite the plethora of fundraising, Africa has the lowest unicorn per capita ratio in the world. There is also the question of Africa really having the resources to create unicorns consistently in its current economic and sociopolitical state.

There are also notable cracks in the relationship between regulators and startups. In Nigeria for example, the CBN, SEC and traditional banks at best, have a frosty relationship with startups and while the latter simply choose to innovate around these hurdles, there is only so much you can innovate around.

Internet penetration is also still very low; just over 40% of Africans have access to the internet. Internet costs are also very high, one of the highest in the world, and only about 38% of African adults even have a bank account. These are the challenges, and they are very daunting ones.

Still, the prospects look favorable. There are huge opportunities for growth; the ecosystem still needs more exits, unicorns and maybe IPOs. All these will be merely a revalidation of the impressive collective work done so far.

There is no doubt that these startups are touching and transforming the lives of thousands;

- merchants

- vendors and retailers

- money operators

- the agriculture value chain

- investing and wealth generation opportunities

- freelancing

- healthcare services and so on.

The funding will no doubt keep coming in, the interest is real and optimism is high… It is really only forward from here for the African startup ecosystem.

Comments ()