Why CBN banned BVN validation for non-bank financial institutions

The CBN has banned fintechs and non-bank financial institutions from providing BVN validation service. In this story, we explore reasons behind the ban.

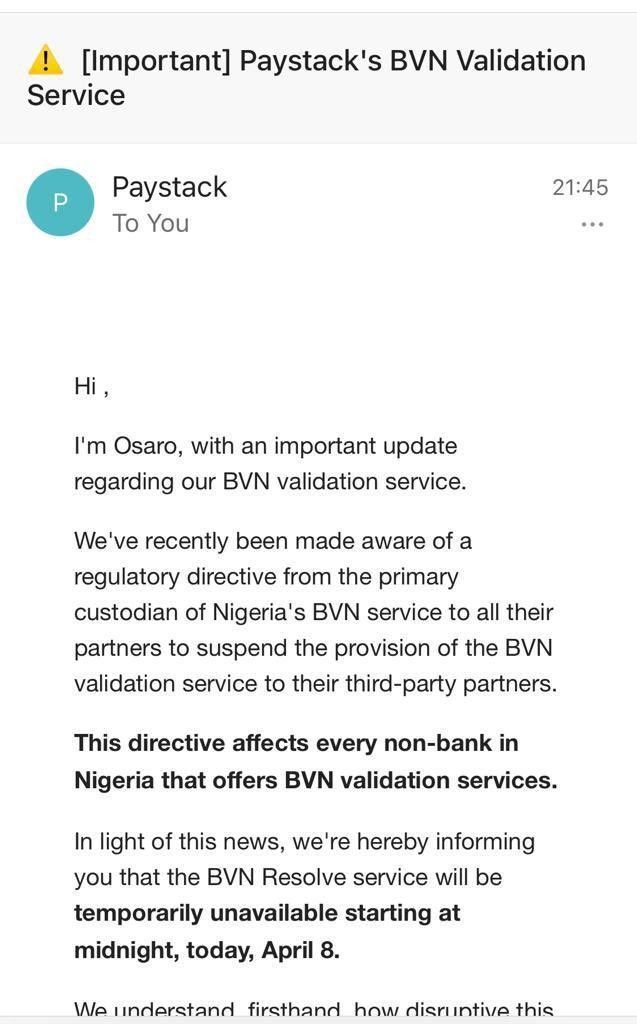

According to an email notification sent by Paystack, the Central Bank of Nigeria has banned fintechs and non-bank financial institutions from providing BVN (Bank Verification Number) validation service.

This announcement affects startups in the savings, lending, trading, crypto, and payment industry.

Before this announcement, fintechs and other third-party partners leveraged the validation service as a form of identification or KYC (Know Your Customer) process. The KYC process involves information like name and physical address. However, only personally identifiable information (PII) like the BVN can validate the customer.

The KYC process was part of the direction the CBN gave to financial service providers in 2018. It allows these institutions to check if their prospective customer is into any crime like money laundering or fraud.

However, this recent direction by the CBN puts a strain on this KYC process. As stipulated in the email from Paystack, effective from the 8th of April 2021, all affected startups will seize to offer the service.

Why will CBN ban the BVN Validation service since given its importance to the KYC process? Perhaps they want to replace the BVN process with NIN (National Identity Number). The BVN is not the only PII needed for the KYC process in Nigeria. Phone number, International passport, biometric information, INEC Voters Card, NIN, and driver's license are all means of PII in Nigeria. But, financial service providers preferred using the BVN validation process.

Speaking with an industry expert Jude Dike, he revealed that the government had plans to replace the BVN with NIN, and they have been rolling out the NIN onboarding process in batches. He opined that against popular opinion, the government is not coming for startups. Instead, they want to leverage a broader PII process.

“BVN is for banking, and about 40% of Nigerian’s are banked. The government wants to use NIN, which is broader. This is why they have been keen on getting people to register for NIN in the past months,” Jude Dike

Should this be the reason, then the NIN onboarding process will take a long while to actualize. Taking a cue from the NCC’s (Nigerian Communication Commission) endless deadlines to deactivate SIM cards not linked to NIN, it is glaring that the NIN SIM onboarding process has not been seamless.

According to the NIMC (National Identity Management Commission), out of Nigeria’s 99 million unique mobile subscribers, only 48.2 million people have linked their NIN leaving out a whopping 58.2 million people. Moving back to banking, the NIBSS reveals that only a little above 44 million users have their account linked to BVN out of 111.5 million active bank accounts in Nigeria. If this disparity exists in BVN linked accounts since it rolled out seven years ago, then the NIN process might take a longer time to achieve.

While the BVN validation process is pending, non-bank financial institutions can leverage other KYC processes peculiar to their industry to onboard customers. For instance, startups in the lending industry can leverage credit-bureau authentication, phone number, and bank account number and name to onboard new customers. Startups in the savings and wealthTech spaces can also leverage same alternative above.

In all, a ray of sunshine exists as affected startups can leverage either the banking information, government-issued ID, or a collaboration with other third-party verification companies to onboard new customers.

Comments ()