SEC's new brief targets Nigerian companies offering foreign investments

Contrary to the early reaction from most observers, the SECs directive is not a new law.

On Thursday, April 8, 2021 Nigeria's Securities and Exchange Commission released a circular targeting WealthTech companies offering foreign-based investments in the country.

The circular, pasted below, directs Capital Market Operators to "desist from working in concert" with "online investment and trading platforms facilitating access to trading securities listed in foreign markets".

The directive seems to target WealthTech companies, which have been growing in popularity with upper- and middle-class Nigerians since 2019.

Keywords

- Securities: These are tradable financial assets that are purchased with the intention of holding them for investment. For example: stocks, bonds, futures

- Capital Market Operators: These are intermediaries between investors and the companies they invest in. They include brokers, issuing houses, investment advisors, etc. They are typically licensed by the SEC.

- Online investment and trading platforms: These are platforms that allow users (usually retail investors) to participate in the trading of securities.

Background: How did wealth-techs operate?

With inflation rates averaging around 12% annually over the last 20 years, Nigerians have been forced to look for alternate investment vehicles to help maintain the integrity of their earnings.

Between 2019 and mid-2020, multiple WealthTech startups launched with the aim of helping Nigerians build wealth. While the models differed slightly, the central selling point of these startups was to provide access to dollar-denominated investments for Nigerians. These platforms promised Nigerians access to foreign-based securities (mostly US stocks) for as low as ₦1,000 ($3), called micro-investing.

The most popular examples of these investment platforms are Chaka, Trove, Bamboo and Risevest.

These online trading platforms typically achieve their goals by partnering with CMOs in two countries: the country where the traded asset is domiciled and the country where the traded assets are sold.

For access to US-based securities, most Nigerian WealthTech companies partner with DriveWealth LLC, a US-based brokerage company. DriveWealth allows companies all over the world to offer 4000+ US-based equities and other kinds of securities through API integrations. They also allow companies to offer fractional investing, which allows customers to purchase shares with as low as ₦1,000 ($3). DriveWealth is a reputable company that has been active for nine years.

In Nigeria, WealthTech companies had to partner with local CMOs to be able to offer these securities to users. Companies cannot advertise or proffer investment advice without a broker license. In lieu of a lack of coverage by the SEC, the companies had to enter into these local partnerships. Speaking to benjamindada.com in February 2021, Risevest CEO, Eke Eleanya mentioned that ARM Trustee "oversaw investments on behalf of the company".

Thus,

- Trove partnered with Sigma Securities Limited

- Bamboo partnered with Lambeth Capital

- Chaka's partnered with Citi Investment Capital

- Risevest's structure involves a partnership with ARM Trustees

According to Eke, the partnership structure was supposed to provide some regulatory cover and mirrored the agreements other WealthTech companies had with CMOs. Based on yesterday's release, it may no longer be enough.

Interestingly, Risevest's structure may allow it to escape the current SEC directive as it does not offer stocks to the public. The startup uses a wealth-management model where it invests on behalf of users.

Read: How Risevest is leveling the wealth-creating field for Africans

SEC: Old Laws in a New Era

Contrary to the early reaction from most observers, the SEC's directive is not a new law.

In its release, the commission quoted Section 67 - 70 of the Investment and Securities act (ISA), 2007 and Rules 414 and 415 of the SEC Rules and Regulations as the guiding precepts of its actions.

These rules specify that "only foreign securities listed on an Exchange registered in Nigeria may be issued, sold or offered for sale or subscription to the Nigerian public."

Speaking on the development with Imade Iyamu, a Corporate Lawyer at Banwo and Ighodalo, she said: "The SEC has only provided clarifications on its old rules. These are not new rules. It's the SEC's mandate to protect the investing public by ensuring foreign securities issued are registered with it. If investments crash, the financial ecosystem could be in trouble. That said, these laws do not reflect the new digital realities. There should be carve-out regulations for digital trading platforms with industry-specific safe guards."

The advice for CMOs to desist from working with these companies puts the investment platforms in an uncomfortable situation. For starters, since the investment platforms are unregistered with the SEC themselves, they cannot market their services independently. Continuing to market their services after parting ways with CMOs opens the companies up to litigation from the SEC and other relevant bodies.

What next for these investment companies?

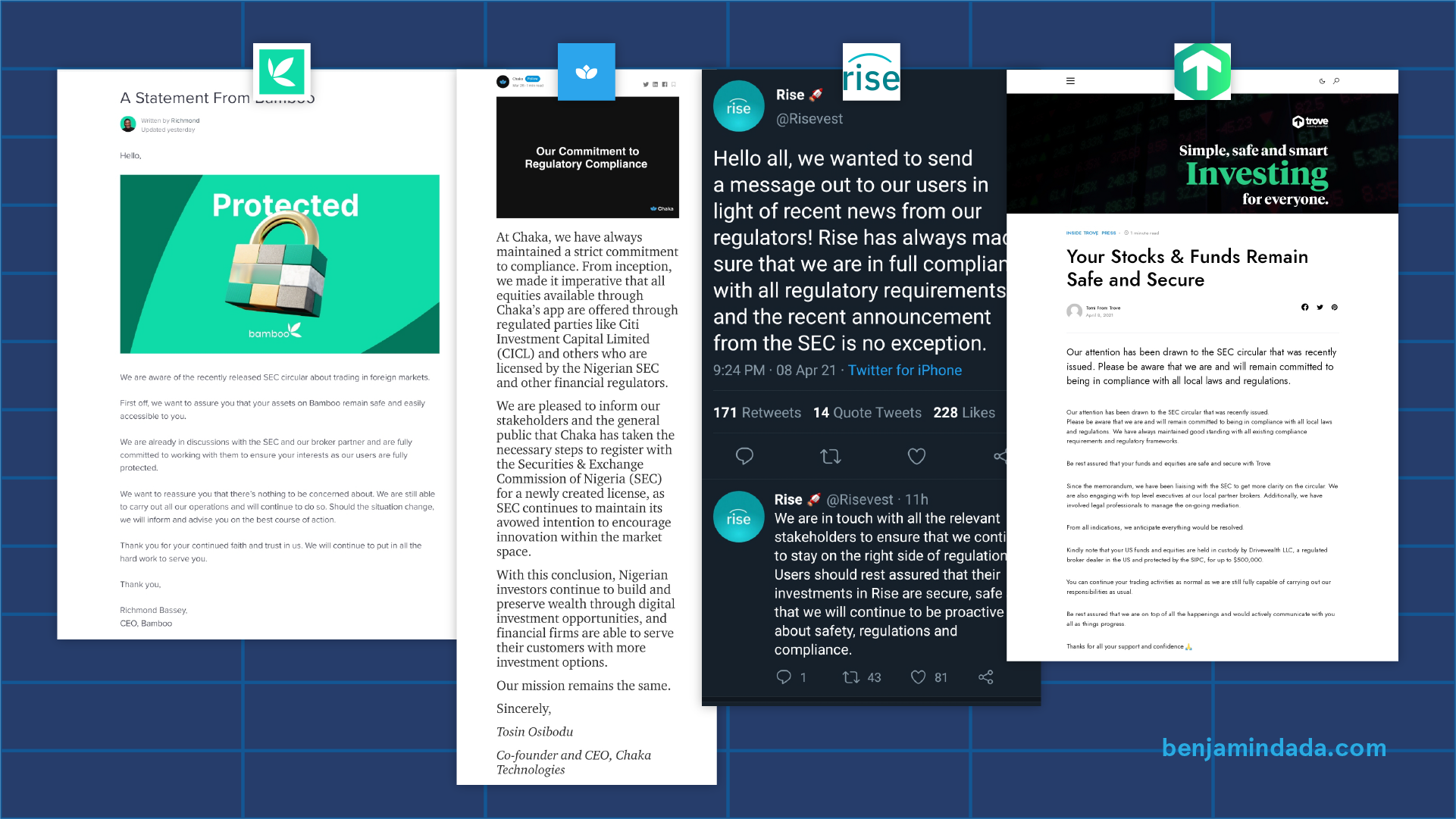

Following the SEC's release, all the affected WealthTech companies have taken to social media to offer reassuring messages to their customers and investors. All companies claim to be in touch with relevant stakeholders to iron out the issues.

Curiously, Chaka claims to have taken steps to register with the SEC under a newly created license.

Do you remember Chaka Technologies Limited that launched in October 2019?

They were one of the first wealthTech startups to have been outrightly restrained from offering their investment service to the public in December 2020. The SEC stated that its activities were done "outside the regulatory purview of the Commission and without requisite registration, as stipulated by the Investment and Securities Act 2007."

It is still unclear what this "newly created license" is and whether it is a like-for-like replacement for the partnership with CMOs.

What is clear right now is that the alliance between CMOs and Investment companies has been jeopardised. At the time of writing, none of the CMOs that partnered with the WealthTech companies have issued a statement.

The SEC has been long regarded as a more amenable regulator than its counterparts, so the company executives are confident about getting them to the table.

Speaking on the way forward, Imade said "It is unclear if the SEC wants these foreign companies to list individually with it or if they want the investment platforms to register as stock exchanges. The best case would be a carve-out solution for digital investment platforms with safeguards and limits similar to what they did with crowdfunding".

Comments ()