How Risevest is leveling the wealth-creating field for Africans

Risevest is a wealth-tech product that allows Africans to benefit from the best wealth-creating opportunities across the world. Its intuitive design and competitive rates have made it a favourite with young investors.

Risevest is a wealth-tech product that allows Africans to benefit from the best wealth-creating opportunities across the world.

Perhaps, the most important understanding of money is that it is a store of value. This is, after all, what allows us to confidently use it in transactions without fear of rejection. But what happens when money fails as a store of value? Or rather when it is a poor store of said value.

Earning and storing wealth in the naira, as most Nigerians do, has proven to be a poorly-rewarded exercise over the years. Between 2000 and 2020, the naira suffered over 1000% inflation - and that is by official inflation statistics.

Earning in naira is unavoidable for most of the population. And for the longest time, investing in naira was the only option available to people. Inflation and the periodic devaluation of the naira have meant that people earning and investing in naira have consistently lost the value it is supposed to hold.

Things are changing, though, as technology keeps making the world smaller and better-connected. The rise of the gig economy means more people are earning foreign currency today than ever before. Wealth-tech companies like Risevest have also entered into the scene to enable people to invest in more stable, foreign-denominated currencies.

What is Risevest’s investment model?

In a previous article, we examined the requirements of beating inflation as a Nigerian. Our research showed that over the last 20 years, you needed to earn at least 12% ROI yearly on investments to at least stay ahead of national inflation.

Unfortunately, traditional investment channels rarely beat inflation. When they do, it is only marginal. According to the global economy, the return rate on the Nigerian stock market averaged 13.82% yearly between 1997 and 2017. That is barely a two percent return rate when the yearly naira inflation is accounted for. Considering that most investors will not match the market’s return rate, the value of money is ultimately lost to inflation.

What Risevest does, in simple terms, is allow people to make dollar-denominated investments in more productive markets. As a store of value, the dollar performs better than the naira. Between 2000 and 2019, the US witnessed only 48.5% inflation compared to Nigeria’s approximate 1000%.

But Risevest is not the only wealth-tech company that allows its users to make dollar-denominated investments. Between mid-2019 and now, at least four wealth-tech companies offering similar services have been floated.

So far, one of Risevest’s unique selling point is its wealth management model. Most companies simply give users access to thousands of stocks listed on the NYSE and other prominent markets, allowing them to pick at random. Risevest, on the other hand, allows users to invest in its wealth management fund, which in turn invests in cherry-picked stocks, similar to investing in an index fund.

The reason for this model is simple—wealth management is a full-time job. Eke Eleanya, CEO of Risevest, knows this better than most. After studying Accounting and Business Management at the South Carolina State University, he worked for three and a half (3½) years as a financial consultant.

For people with full-time jobs, it is difficult to keep track of stock performances and important investment indices while keeping up with the requirements of their daily job.

Wealth management is a full-time job, and most people aren’t trained for it. We want people to focus on doing their best work while Risevest manages all the moving parts of their investment portfolio

Risevest offers three asset classes for now - stocks, real estate, and fixed income. All three asset classes are rated on the application according to their risk factors. Stocks are rated high-risk, real estate are classed as medium risk, while fixed-income investments are designated as low-risk.

2020: The year of rise

2020 was the first full financial year for Risevest. Before its February 2020 launch, it was previously known as Cashestate - an investment service vehicle that allowed Africans to make dollar-denominated real estate investments.

In the one year since its launch, Risevest has had impressive results to show off. With over 60,000 registered users, Risevest has become one of the most popular investment vehicles for young Nigerians.

Although the results are not uniform for all users due to different investment times, this is what the year’s performance looked like:

Return rate for Risevest's assets in 2020

| Asset class | Dollar returns | Naira returns (accounts for curreny devaluation) |

|---|---|---|

| Stocks | 40.77% | 87.7% |

| Real Estate | 16.0% | 54.7% |

| Fixed Income | 10.1% | 46.8% |

If the dollar returns are admirable, then the returns when devaluation is accounted for are even more so. The naira returns prove Risevest’s most important use case—making dollar-denominated investments. In a year when the naira was devalued by almost 30% on the black market, Risevest users have gained more value on their investments than most institutional investors.

The stock’s portfolio performance is particularly impressive. It outperforms even the S&P index —the most popular index in the world— by almost 25%. Again, the returns are not uniform. According to Eke, some users made more than 40% on their stock portfolio (over 90% in naira terms) because of when they entered the market and how long they stayed invested.

Risevest is not guaranteeing stellar performances every year; after all, its results are based on what the market offers. What it promises, however, is protection from devaluation and high quality asset curation. Even in a worst-case scenario, users will have their funds held in a devaluation-resistant currency - for most users, that is enough.

Redesigning Risevest and educating users

In the final quarter of 2020, Risevest embarked on a redesign of its mobile application. The latest iteration of the app was released in December 2020 to much excitement.

I’m never impressed but I have to say the new @Risevest app is quite something. Well executed, good job @eldivyn. Thanks for raising the stakes to this level.

— Stone Roach (@StoneAtwine) December 8, 2020

The new app was a product of listening to users and studying their behavior. According to Eke, the company had noticed that users were creating individual plans for each asset class. They would fund one asset class (i.e. Real Estate) and then come back in a few months to fund the next (i.e. Stocks).

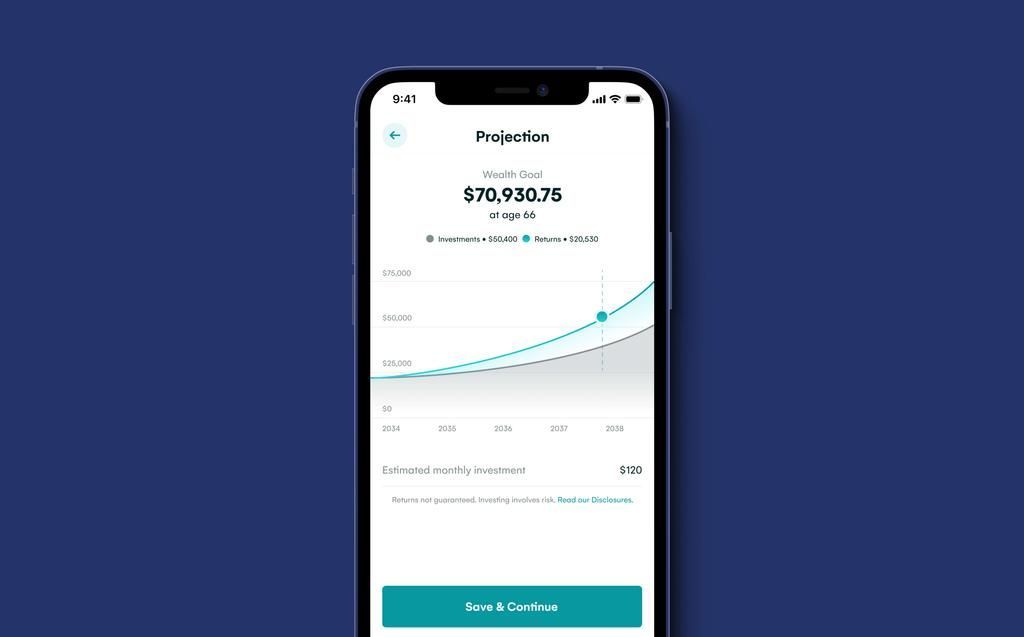

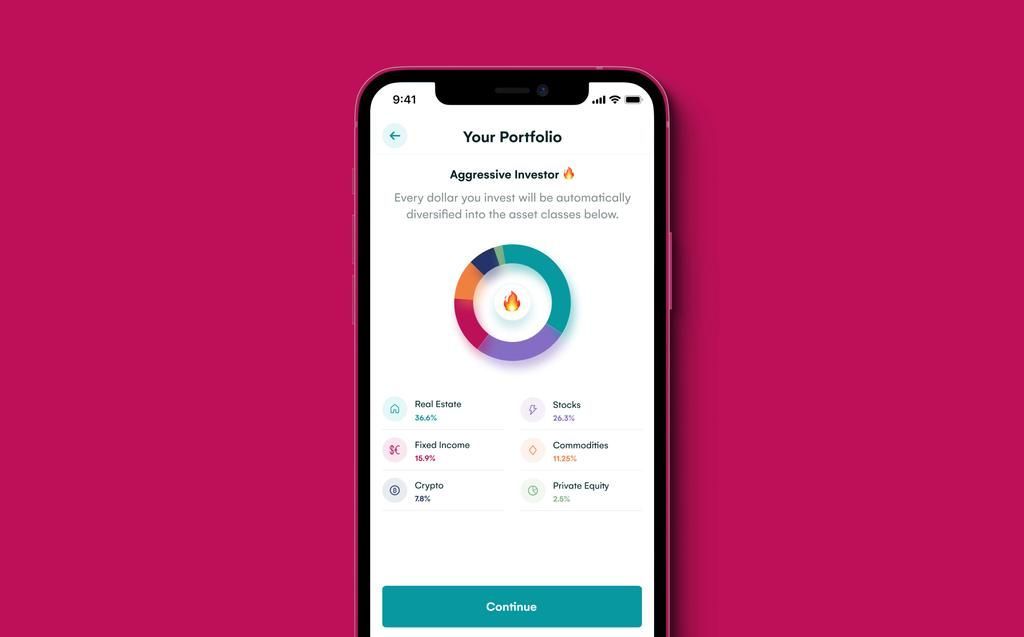

So, Risevest did what any customer-first company would do - take on the role of allocation. With the new application, users can create plans based on their income, goals, and risk appetite. Once you open an account, Risevest asks you a couple of questions to gauge your risk-appetite and makes recommendations from there.

The Build Wealth plan allows users to make long-range investments based on their income and goals. Once you answer a few questions, it generates an investment plan for you with all the asset classes in different percentages. It also lets users know how much they should invest weekly, monthly, or yearly to meet their goals.

Among the reasons for delving into allocation is the need to encourage young people to take more risks with their investments. According to Eke, most of the company’s users invest in medium to low-risk investments. Real estate has the most number of investments, followed by fixed income.

For young people, focusing on high-risk plays is typically more advisable because they tend to yield higher returns in the long run.

People in their 20s should take more risky investments and optimize for growth. In your 50s and 60s, you can optimize for income and stability.

However, he recognises that it won’t be easy. Most of the population is scared by tales of investments gone wrong. In a country with very limited expendable income, such fears are not unfounded.

But stock investments are routinely in the red; they only compound when left for long periods.

It takes a lot of work getting people comfortable with seeing their portfolio negative. It’s a huge psychological bar, and I hope we can help people break it.

User education is a big part of what Risevest is doing. That is why a significant part of their new update is letting users speak with financial consultants for free. With just a click of a button, Risevest’s users can talk to a financial expert who will provide clarity on their investment options. The real kick in this—the advice can prove useful even outside of their investment decisions with Risevest.

Rise for the future

The future for Risevest centres around one thing—connecting as many people as possible to the best wealth-creating opportunities.

Rise wants to be the hedge fund that everyone has access to. We want to build the best investment experience in the market

The company is already wrapping up an undisclosed seed round to help fast track its goals. New asset classes are underway too. Crypto-as-an-asset-class should be available for investors by mid-year. Once again, it will take the wealth management fund model. Rise picks a basket of vetted crypto-currencies that users can invest in knowing that they have a world-class team managing their investments.

The startup is also entertaining the idea of listing startups-as-an-asset class. As regulations around accreditations for investors continue to loosen up, it will open the door to more people to participate in seed and pre-seed rounds with the hopes of earning significant income when the companies go public or get acquired like Paystack.

A savings product might also be on its way depending on user feedback. Right now, though, the company is focused on helping users maximise their investment returns.

Regulation is one significant worry for investors and users. In December 2020, the SEC hit one of Risevest’s competition, Chaka, with a ban, restricting them from advertising and offering for-sale securities.

For now, Risevest’s structure involves a partnership with ARM Trustees - an SEC licensed entity that oversees the investments on behalf of Risevest’s users.. The arrangement provides Risevest with some regulatory cover, and mirrors similar arrangements by other fintech companies in the space.

Eke says Risevest will do all it can to avoid a similar situation to Chaka’s. He said, “Regulations are for both the regulators and the safety of our users. We’re always willing to sit down with the SEC to see how we can achieve what they want.”

Although the journey has just begun for this startup, Risevest has its sights set on being the number one tool for building the future — something young Nigerians, and Africans eventually, can use to build wealth. Risevest wants to help users in Ibadan, Maiduguri, Kampala, Jo’burg, and Addis Ababa beat the S&P 500 and secure their financial future from the comfort of their mobile devices.

Comments ()