My first impression of Trove Finance and a mild introduction to investments

Review of Trove Finance, a platform that allows you to invest in stock markets around the world for as low as ₦1,000.

Trove Finance is a platform that allows you to invest in stock markets around the world for as low as ₦1,000.

Young people, in recent times, have taken on the exploit of investment. In layman terms, to invest means to put money into a scheme or vehicle with the aim of higher returns at a later date.

Investment vehicles include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Investment lingua sounds gibberish to the common man who assumes "it's complicated". But guess what? A lot of millennials make up this "common man" category. At least 1 in every 3 adults aged 20-35 finds investment (and the financial markets) "complex". Yet, they are willing to have someone else make the investment decision for them. Because they know the importance of investing.

To invest in the capital market, where they sell shares and bonds, you'd work with a broker. The broker will find a seller, then, you paid the asking price of the stock alongside his fees.

Although the process sounds simple, it can be time-consuming. Also, it implies that you needed to have a sizeable amount of money before embarking on the journey.

Recall, over the past few years, technology has disrupted savings and investment. From 2016, a new age of fintechs emerged in Nigeria to make savings accessible to everyone. And then a few years in (2019), the fintechs starting hacking at investments. While their users can invest in fixed-income programmes, they are unable to buy shares.

See also: PiggyVest launches Investify

"I've always invested in agriculture via digital platforms", says 24-year-old Banky*. "But I've never invested in the capital markets, talkless of buying the shares of a company". Banky adds that he doesn't know where to start. "When I want to invest in agric, I go through an agritech platform. But if I want to buy the shares of a company, I don't know where to start".

With the internet and globalisation, geo-location has stopped being a barrier to opportunities. So, Banky should be able to buy shares of his favourite companies, whether in Nigeria or abroad.

From 2018, another set of fintechs, micro-investment platforms, entered the space. This time, they were democratising access to capital markets around the world. Thereby, making a micro-investment in foreign companies possible for the average Nigerian.

Another useful thing they made mainstream was "fractional trading". A fractional share is a part of an equity stock that is less than one full share. They don't trade on the open market; the only way to sell fractional shares is through a major brokerage.

The fin-tech offers the tech platform while delivering financial service through licensed partners.

Trove Technologies Limited (AKA Trove) is one of such fintechs founded in 2018. Trove co-founders are Oluwatomi Solanke (CEO), Austin Akagu, Desayo Ajisegiri and Opeyemi Olanipekun.

Trove is backed by Ventures Platform and ARM (Asset and Resource Management company), one of the biggest asset managers in Nigeria. Also, they received a grant from ARM Labs and the Nigerian Stock Exchange.

Trove works with DriveWealth LLC, Sigma Securities Ltd and ARM to provide brokerage services. Securities Investor Protection Corporation

Drivewealth is a member of SIPC (Securities Investor Protection Corporation). Such that SIPC insures Drivewealth's customers. So, your cash and securities—stocks and bonds—are secure up to $500,000.

With Trove, you can buy the shares of US, Chinese and Nigerian companies without human help. Companies from the USA and China dominate the world's list of most valuable startups. Thereby, making them prime for investment. To buy and sell the shares of such companies on an exchange is to trade.

A review Trove's Mobile App

To trade on Trove, users can only make use of funds in their Trove wallet. You can deposit funds into your wallet via two means: card payment or bank transfer. If you choose to make a bank transfer, the Trove app generates a destination account number for you.

But before you even gain access to the Trove app, you need to complete a comprehensive KYC form. KYC (Know-Your-Customer) is a mandatory process of verifying identities before account opening. They breakdown their onboarding process into four steps. The steps are BVN verification, employment details, investment profile, and document upload.

Before digitalisation, customers had to walk into a bank to fill such KYC forms. Fintechs have focused on how to ease the account opening process for their customers. But they can't do much because their partners need the data for regulatory compliance.

Once you've filled out the KYC details, Trove logs you into the app. You will update your profile details by entering your bank account details. Also, you need to verify your email address. It takes about 24 hours for Trove to verify those details.

On the landing page of the mobile app, there are five sections, with a horizontal scroll. The sections are Wallet, Trending stocks, Industry categories, Top Gainers, and Market news.

Each Trove user has two wallets: naira and dollar (more on this later).

If you are new to trading or want to try out the platform, Trove allows you to switch to a demo account. So that you do not incur any personal loss in your "learning" or "window shopping" phase.

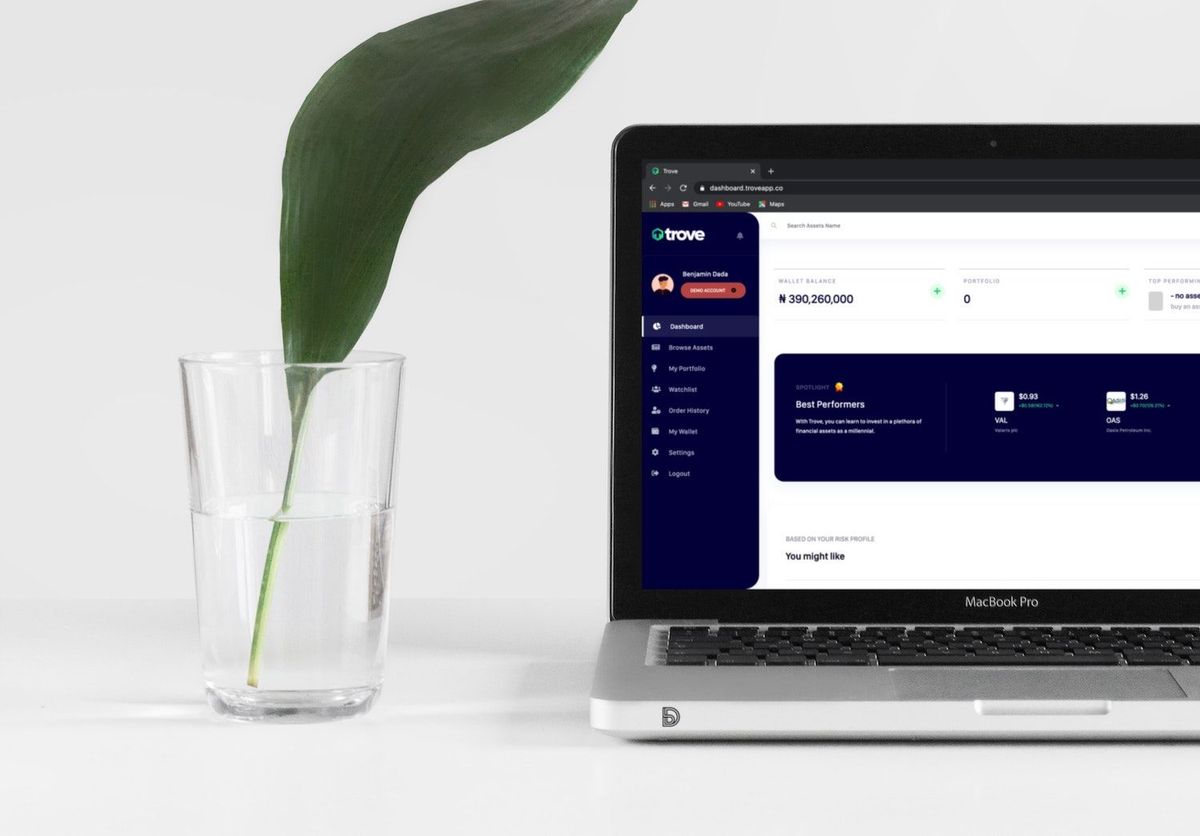

As you can see in Figure 4, the menu bar reveals several features of Trove.

For instance in "All Assets", I can see the different assets classes available for me to invest in. The asset classes include Nigerian, and foreign stocks, ETFs, REITs and Bonds. Under the "Bonds", I only saw the Nigerian Eurobond Fund offered by United Capital. It has an interest rate of about 7%, which is higher than PiggyVest Flex Dollar's 6%.

In "My Portfolio", I can see my total portfolio value and the breakdown: equity, fixed-income, and cash.

"My Cards" refer to my payment cards used in funding my wallet. "My Wallets" shows me the monies I have in both my Nigerian and US Dollar wallet. It also gives me an option to convert funds both ways.

As at press time, I noticed that the exchange rate conversion from Naira to Dollar Wallet was ₦457.38. Trove is more affordable than Flutterwave's Barter currency conversion of ₦460. But it is less affordable than PiggyVest Flex Dollar's ₦445.

Like on the physical stock exchange floor, markets also close on Trove. In the time when markets are closed, no trade can take place.

I quite like the Trove mobile app experience, seems fluid. I've now funded my LIVE account, while I wait for my full account confirmation. My first bet is to invest in the Eurobond which is safer for me. Then, I'll buy shares, only after getting further advice on what companies to invest in.