Funding your mutual funds with Stash will now cost a dime

The love of Ope from Cowrywise costs a dime. A processing fee will now be applied when funding your mutual funds with Stash.

Cowrywise—one of the leading savings and investment platform in Nigeria—has introduced new updates to its platform. Henceforth, a processing fee will be applied when funding your mutual funds with Stash.

Ope—a dynamic, anonymous character Cowrywise created—sent a 'love letter' to Cowrywise users on January 17. Sending love letters is Ope's 'Thank God It's Friday' tradition. The love letters usually contain financial wisdom, report and announcements.

The letter sent on January 17 says five new updates have been made to the Cowrywise app:

- Downloading confirmation letter for your investments and account statements for your plans is now possible

- Changing your phone number from within the app is now possible

- Daily added returns can now be viewed in "My Earnings"

- Dollar mutual fund now has a more transparent breakdown

- Processing fees will now be applied when funding your mutual funds with stash

The processing fee for the naira mutual fund, according to a Cowrywise staff, was waived when transferring from Stash to investments initially but that was not the plan. "It was an oversight," he said.

The processing fee, which is 1.5% and capped at ₦2,000, covers the transaction fees from the payment gateway and other fund manager processing fees. It’ll be available on the web this coming week

Meanwhile, since Stash was launched, there has been a transaction fee of ₦25 on transfers to bank accounts.

Guilty As Charged

Cowrywise is not the only platform with processing and transaction fees. OPay and Eyowo are also guilty as charged.

Last year, OPay charged different transaction fees for bank transfers before settling for ₦45 on first transaction of the day and 1% for subsequent ones.

We have now reviewed our bank transfer fees and from 6 AM tomorrow, the fee for our bank transfers will be N45 for the first transaction of the day and 1% for subsequent ones.

— OPay (@OPay_NG) November 5, 2019

Again, we apologise. Thank you for your understanding.

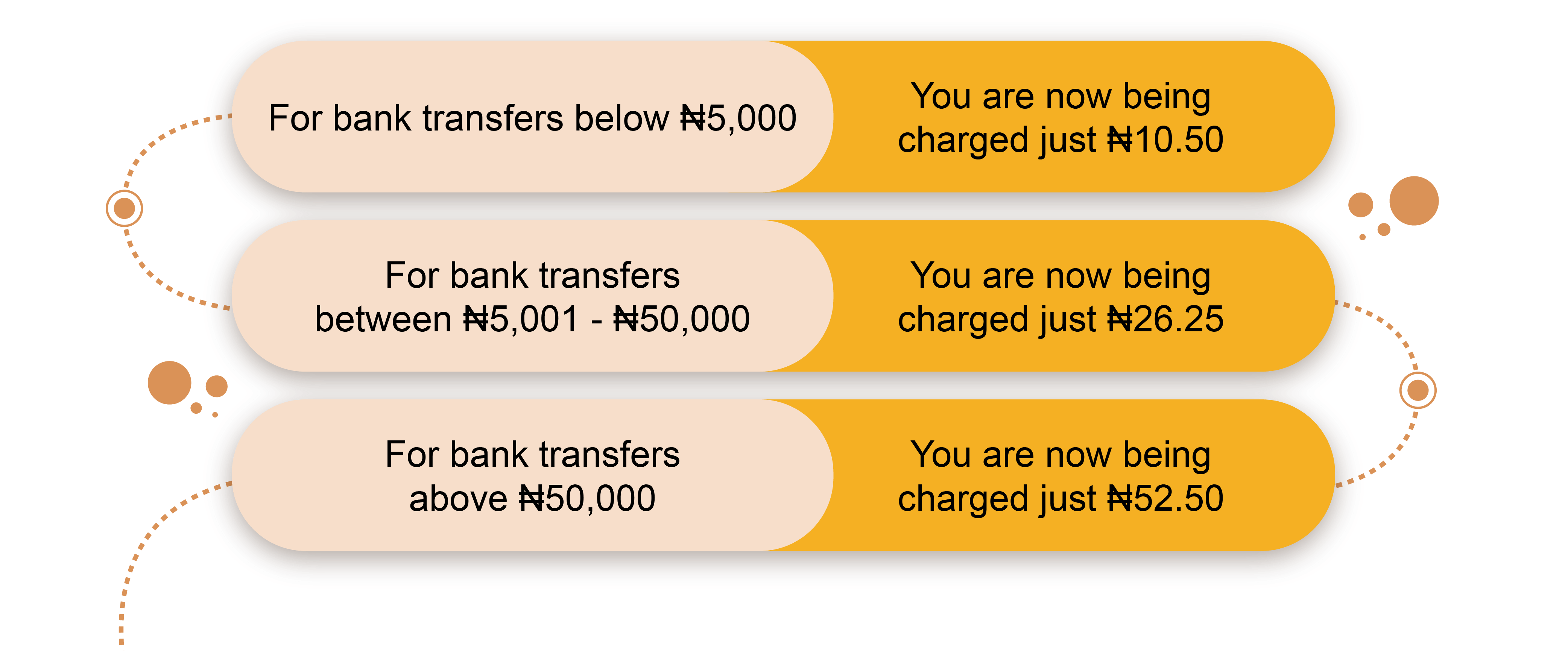

Eyowo also announced new bank transfer charges 13 days into the new year. The digital bank said in a statement: "Eyowo will now charge as low as ₦10.50 but never more than ₦52.50 for bank transfers. The exact amount you will be charged for a bank transfer is dependent on the value of the transaction."

Discharged and Acquitted: Bank of the free

In the land of charges and transaction fees, two fintech startups have remained unblemished: a digital bank, and a savings and investment platform.

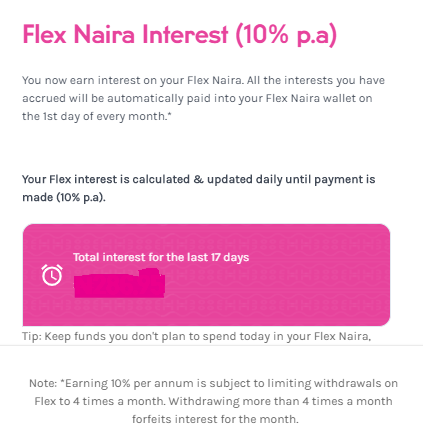

Since Piggyvest (formerly Piggybank) launched PiggyFlex—the equivalent of Cowrywise Stash—in July 2018, it has been free of charges. And from late last year, Piggyvest users can also earn 10% interest on funds in their PiggyFlex (or Flex Naira) account.

Lastly, the Bank of the Free—Kuda Bank—offers 25 free interbank transfers for a month and charges ₦10 on subsequent transfers in the month.

Comments ()