Cowrywise will now allow Nigerians to invest in dollar-based assets

Cowrywise—a fast-growing savings and investment platform—has announced the introduction of dollar-based assets, in the form of Eurobond mutual fund, on its platform.

Cowrywise—a fast-growing savings and investment platform—has announced the introduction of Eurobond mutual fund on its platform.

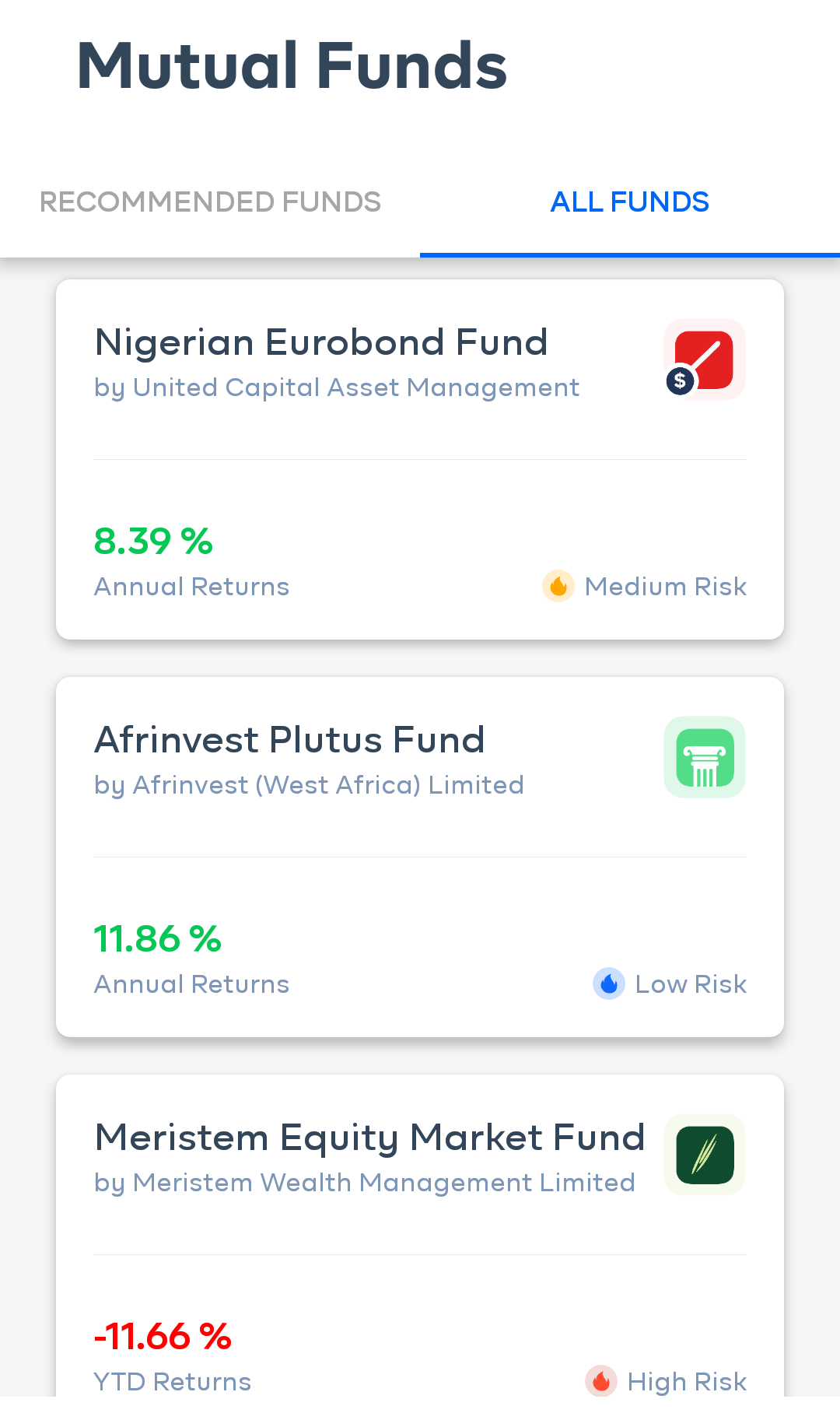

Lagos, Nigeria—In May 2019, Cowrywise introduced mutual funds on its platform through partnership with fund managers such as Meristem, Afrinvest and United Capital. This partnership made it possible for Nigerians to invest in mutual funds with as little as ₦100. But Nigerians want more.

I want return, above inflation of 11%.

— Razaq Ahmed (@razaqahmed1) July 28, 2019

I can't wake up to the idea of losing 1% of my capital.

I want dollar assets at double digits annual return, just like Naira assets.

If I don't have all the above, I can't save nor invest.

....

We have a long way to go on this street.

While some of their demands are outrageous, there are some pertinent questions being asked by Nigerians, who seek financial freedom.

Does saving in dollars mitigate against Naira inflation? @hemical @Mr_Oyedele @Nnannx

— David Agbalagbi Adeleke (@DavidIAdeleke) August 5, 2019

The conventional wisdom is that good investors, their risk appetite notwithstanding, have a diversified investment portfolio. One of the ways they diversify their portfolio is by investing in foreign currency-denominated assets. Hence, the introduction of Nigerian Eurobond Fund by Cowrywise.

Cowrywise first dollar-based mutual fund

The Nigerian Eurobond Fund is being introduced through a partnership with United Capital. With this Eurobond Fund, Cowrywise users can now invest in dollar-based assets, using naira.

As if to live up to its tagline: plan, save and invest, Cowrywise often educates its users (and non-users) on how to make and build wealth. Its infamous post, titled, "Here's why you're not wealthy" is one of the many timely nudges Cowrywise gives its users.

In addition to that, they also host Knowledge Sharing sessions in their office. Among other things being shared, they discuss some financial terms young professionals building wealth should understand.

According to the statement released by Cowrywise on Wednesday, the minimum amount that can be invested in the United Capital Nigerian Eurobond Fund is $100.

On the Cowrywise app, $1 = ₦370.77, this means the minimum investment requirement is ₦37,077. This is remarkably higher than the ₦360 rate of the parallel market and the Central Bank of Nigeria's regulated rate of ₦306.

Cowrywise explained that the Eurobond Fund is a type of mutual fund that invests in dollar-denominated Eurobonds. It is floated by the Federal Government, as well as top-performing companies in Nigeria such as SEPLAT, Ecobank and Firstbank.

The statement released by Cowrywise, in part, reads:

The Eurobond Fund is meant for long-term investments. It is not fit for short-term investments that are below a year. This is to help grow and preserve the value of your investments. There are two sources of returns when you invest in dollar-asset like Eurobond with Naira:

The coupon payment or yield. This is the promised return on the Eurobond. Its return currently sits around 8% per annum.

Return from changes in the value of the Naira against the USD. This simply means if Naira loses value against USD, as a Nigerian who has invested in this Eurobond, you have gained additional return.

Comments ()