Why African fintechs' revenue might reach $230 billion by 2025

An analysis by McKinsey estimates that Africa’s financial-services market could grow at about 10% per annum, reaching about $230 billion in revenues by 2025.

Fintech revenues in Africa are expected to grow by 10% a year until 2025 with payments and wallets being the fastest-growing products, according to research by McKinsey. Although less than 15% of financial transactions on the continent are digital, African fintechs jointly recorded $4-6 billion in revenues as of 2020.

Fintech is the fastest-growing startup industry in Africa, five out of the seven unicorns on the continent are fintech companies. Per BD Funding Tracker, fintech startups in Africa accounted for 28.8% of the venture capital VC raised on the continent in H1 2022, jointly raising over $845 million. Global accelerators like Y Combinator and Techstars have also channelled most of their African investments towards fintech.

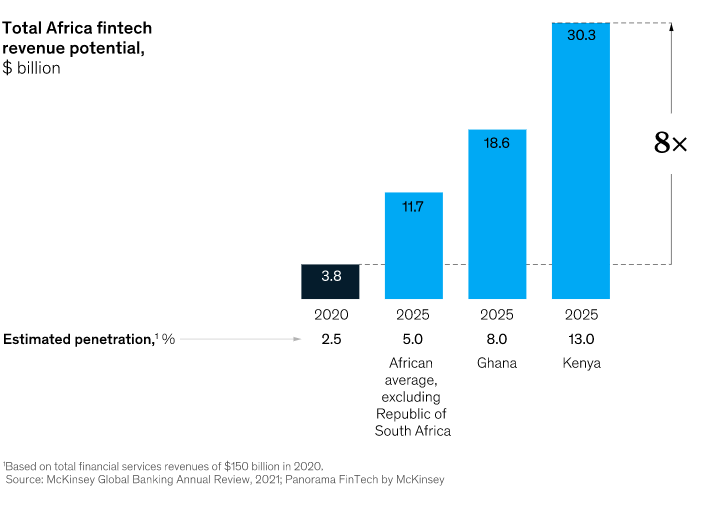

McKinsey believes that the dominance of cash in the African payment ecosystem will make room for fintechs to thrive especially as the focus on financial inclusion is heightening. "If the sector overall can reach similar levels of penetration to those seen in Kenya, a country with one of the highest levels of fintech penetration in the world, we estimate that African fintech revenues could reach eight times their current value by 2025," the strategy consulting firm said.

The McKinsey analysis [pdf] tagged Fintech in Africa: The end of the beginning estimates that Africa's financial-services market could grow at about 10% per annum, reaching about $230 billion in revenues by 2025 ($150 billion excluding South Africa, which is the largest and most mature market on the continent).

The analysis also noted that fintech growth across Africa's 54 countries will not be uniform. While the lion’s share of value in the market (approximately 40% of revenues) is currently concentrated in South Africa, which has the most mature banking system on the continent.

Ghana and parts of francophone West Africa are expected to show the fastest growth, at 15% and 13% per annum respectively, until 2025. Nigeria and Egypt follow, each with an expected growth rate of 12% per annum over the same period.

According to the analysis, economies with more mature financial systems and digital infrastructures, such as South Africa and Nigeria, are likely to see more innovation in advanced financial services, including business-to-business (B2B) liquidity and regulatory technology such as anti-money laundering and know-your-customer (KYC) compliance.

Meanwhile, countries where financial systems and infrastructure are still growing, such as Egypt, are likely to see advances in financial services such as underwriting, servicing, claims, and assessments in insurance; banking-as-service and embedded finance in operations and infrastructure; and buy now, pay later services in retail and small and medium-sized enterprise (SME) lending.

Amidst the global economic downturn that has led fintech startups like Wave to pause their expansion plans and has impacted the disposable income and purchasing power of Africans, fintech startups on the continent will be confronted with four key challenges, McKinsey revealed. These challenges includes: reaching scale and profitability, navigating an uncertain regulatory environment, managing scarcity, and building robust corporate governance foundations.

"Poised at the start of a new era, fintech players in Africa have a good reason for confidence; significant white spaces and underserved opportunities still exist in all markets. However, the path ahead will not be smooth. In addition to existing roadblocks, a tightening funding environment will likely put more pressure on Africa’s nascent fintech sector. Nevertheless, if stakeholders can work together to build on the momentum gained in recent years, the prospects for African fintech are strong—and the next marvel of African unicorns is ready to emerge," McKinsey said.

Comments ()