How African tech startups raised funds in H1 2022 in four charts

In H1 2022, African tech startups jointly raised $2.5 billion most of the funds were raised by fintech startups.

In the first half of 2021, African startups raised $1.19 billion in funding, a figure which is more than they had raised in H1 2019 and H1 2020 combined. How was it in H1 2022, amidst the global economic downturn?

Based on data curated by BD Tracker, African tech startups jointly raised $2.5 billion (we did not include other funds raised through accelerator programs, hence the disparity to other sources that have quoted the sum total as $3 billion). In four charts, we will take a look at the funding activities of African tech startups between Q1 2022 and Q2 2022.

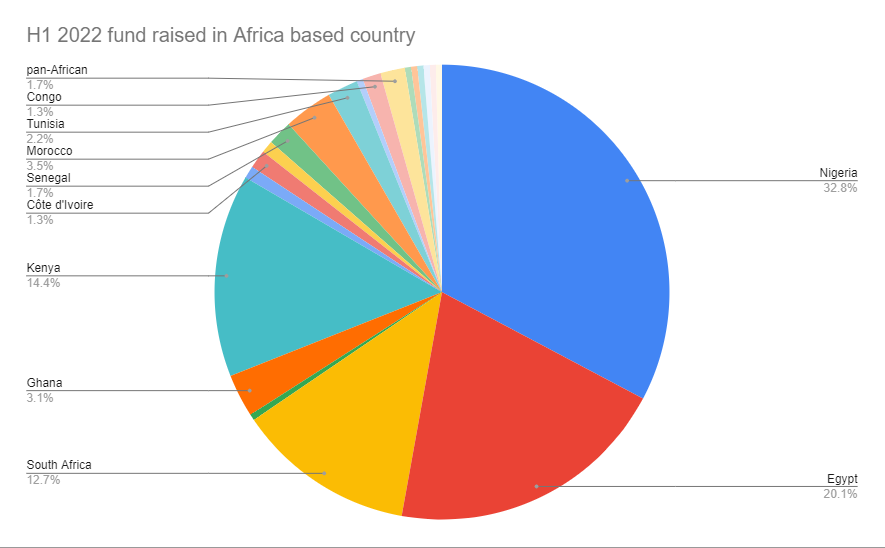

H1 2022 funding based on country

Nigerian tech startups raised 32.8% of the funds. Followed by Egypt (20.1%), Kenya (14.4%), and South Africa (12.7%). Namibia's e-commerce startup, Jabu placed the country on the tracker twice after it raised a $3.2 million seed in January and a $15 million Series A in May.

We used pan-African to refer to startups operating without a disclosed African HQ.

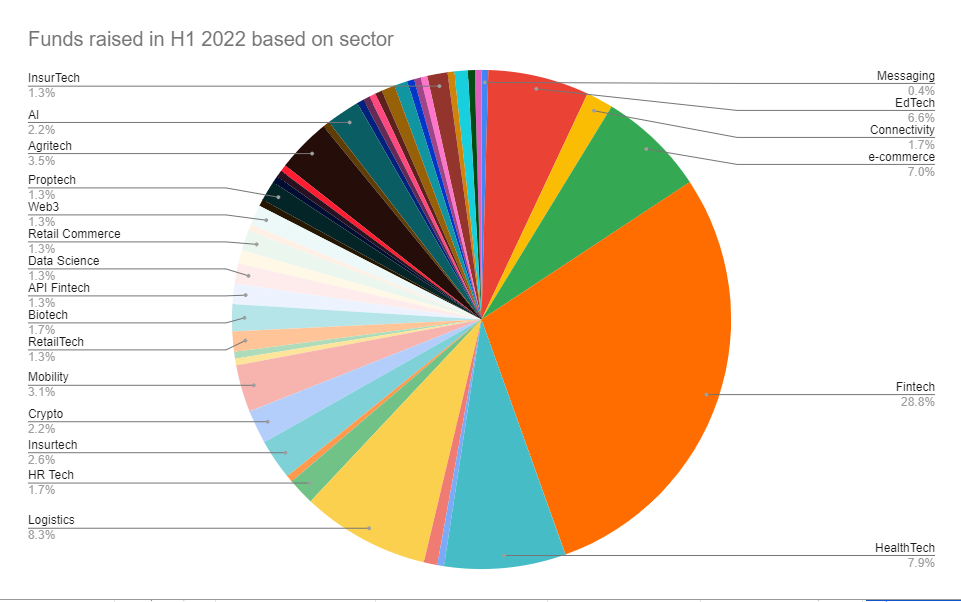

H1 2022 funding based on sector

As usual, fintech startups in Africa took the largest chunk of the funding, raising 28.8% ($845 million). The logistics and Mobility sector raised 11.4% of the funds, making it the second-highest sector. Followed by Healthtech (7.9%), e-Commerce (7.0%) and edtech (6.6%) startups.

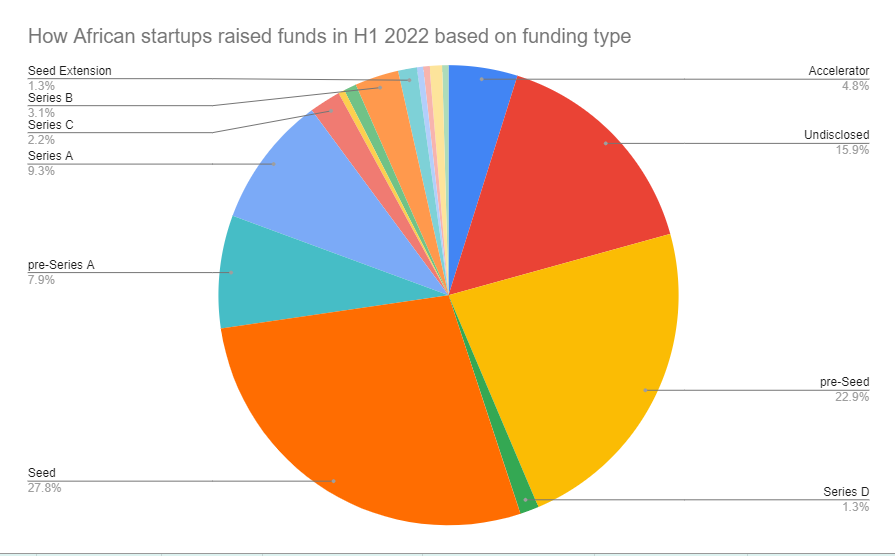

Seed funds dominated the funding chart

More startups raised seed funds in H1 2022, 30% of the funds were seed and seed extensions. Dash's $32.8 million topped the seed fund list. Pre-seed made up 22.9% of the rounds. Followed by Series A (9.3%), pre-Series A (7.9%), Series B (3.1%) and Series (1.3%). Others were undisclosed.

Accelerators played a major role in H1 2022, 24 startups participated in the Y Combinator Winter batch this year, three others participated in the Techstars New York Spring batch and seven in the Techstars Toronto Spring batch. ODX Accelerator also has backed 16 African tech startups.

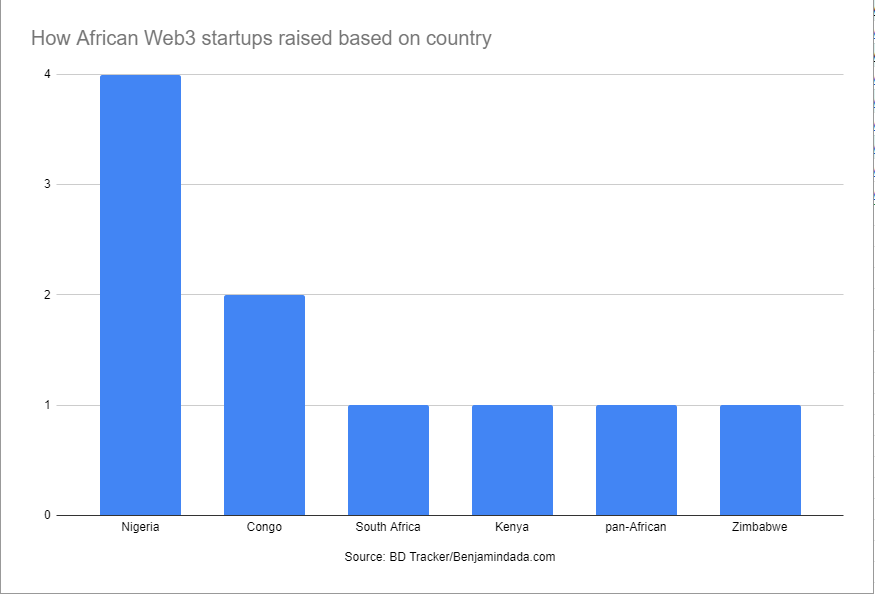

Web3 and Crypto startups raised $139 million

Beyond the social media buzz about Web3, investors are already investing in African startups that are playing in the space. Within H1 2022, 10 African Web3 startups jointly raised $134 million.

South Africa-based crypto exchange, VALR's $50 million Series B was the highest amount raised by a startup in this sector. VALR is now valued at $240 million, arguably the largest crypto funding round in Africa at the time of this report. VALR has seen its valuation grow by more than 10X since it raised its $3.4 million Series A round of funding in July 2020.

Jambo, a Congo-based startup raised a $7.5 million seed fund in February, three months after its launch. The startup later raised a $30 million Series A in March. Jambo is building a Web 3 super app for Africa to democratise access to crypto-based income-generating opportunities.

Crypto is a tool in Web3 with massive adoption in Africa, making it one of the fastest-growing crypto markets globally. Six countries – Kenya, Nigeria, Togo, South Africa, Ghana and Tanzania – gained spots on the 2021 Global Crypto Adoption Index Top 20 list. Crypto is an obvious entry point for any web3 company on the continent. However, regulations have been a limitation.

Other Web3 startups that raised within H1 2022; Mara, Afriex, Nestcoin, Fonbnk, Afropolitan, Ayoken and FlexID. 36.4% of these startups are Nigerian, while South Africa has the second-highest with 18.2%. Countries like Kenya, Zimbabwe and Congo are also on the list.