Twiga Foods faces a liquidation threat over $263,691 debt

Incentro Africa has filed insolvency against Kenyan agritech startup, Twiga Foods for its failure to remit KES 39 million ($263,691).

Kenyan Google Premier partner, Incentro Africa has filed insolvency against Twiga Foods for its failure to remit KES 39 million ($263,691) as payment for Google Cloud Services and Partner Service Funds that it provided.

“Further take notice that failure to pay aforesaid amount shall result in Incentro Africa Limited filing for liquidation order against you,” read an insolvency notice that expired on Monday (September 25). Twiga Foods describes the demands as “premature” and are made in “bad faith and with an ulterior motive”.

The court will rule today on whether Incentro should go ahead with the liquidation or not. According to local media, Nation, the Kenyan agritech startup has filed a certificate of urgency to halt any liquidation move.

The agritech startup is one of the many startups that the economic downturn has hit. Recently, it laid off about 283 employees. Although it was rumoured that the startup intends to shut down its Ugandan operations, Peter Njonjo, CEO and co-founder denied it. “There is no closure of operations. We continue to operate in Uganda and our farm is operational,” he said.

“The business has undertaken strategic operating adjustments to enhance its service delivery capacity over the past few months. This has been influenced by the current business environment where people’s purchasing power continues to decline,” the startup said in a statement while announcing that it shifted its sales model. Twiga Foods laid off its entire sales team last year.

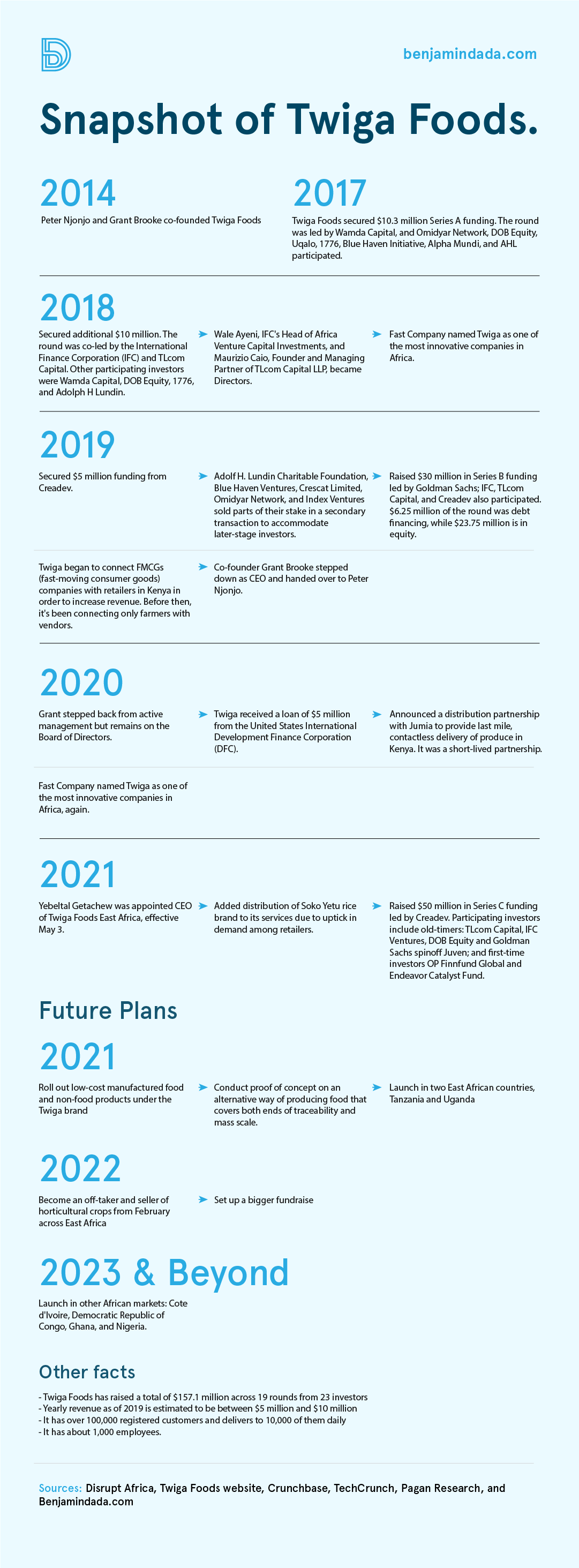

Since its launch, the agritech has raised at least $157.1 million across 19 rounds from about 23 investors, according to BD Funding Tracker. Its most recent round was a $50 million Series C that was closed in November 2021, some of its early investors received liquidity through a $30 million sale.

Comments ()