Twiga raises $50 million, early investors receive $30 million in a secondary sale

Kenyan startup Twiga Foods raised $50 million in a Series C round. And some of its early investors received little liquidity through a $30 million secondary sale.

Twiga Foods, a Kenyan business-to-business (B2B) marketplace, has raised $50 million in a Series C round. And some of its early investors received little liquidity through a $30 million secondary sale.

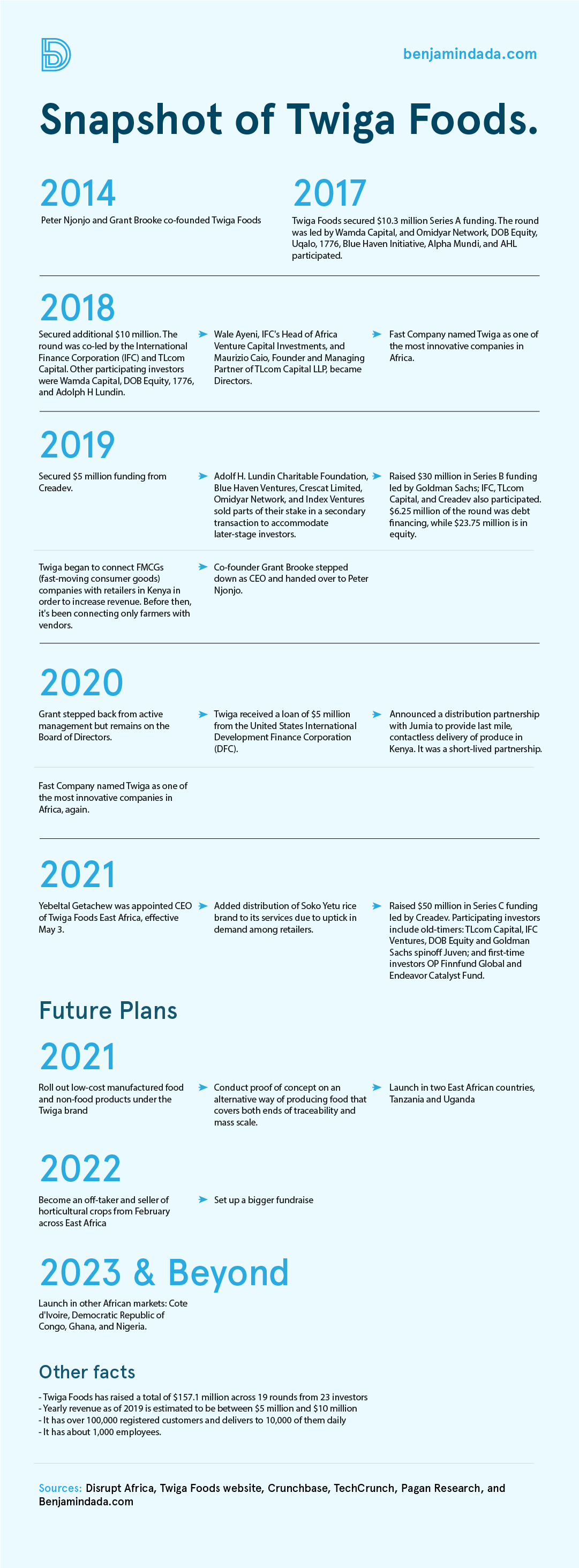

Something similar had happen in 2019 when the Kenyan startup first secured a $5 million funding from Creadev. At the time, earlier investors such as Adolf H. Lundin Charitable Foundation, Blue Haven Ventures, Crescat Limited, Omidyar Network, and Index Ventures sold part of their stake in a secondary transaction to accommodate later-stage investors.

Since its launch in 2014, Twiga has been connecting farmers with vendors across Kenya via its mobile-based, cashless, B2B platform. But preserving the integrity of produce sourced from smallholder farmers—who are core to Twiga's operations—has been difficult.

Therefore, Twiga plans to manage the value chains of some of these produce that are difficult to trace from seed-to-harvest. Part of the $50 million Series C would be invested in proof of concept: an alternative way of producing food that covers both ends of traceability and mass scale.

The proof of concept, according to the company, aims to reduce the price consumers pay for popular domestic plant-based food products by over 30%. And if the concept is successfully set up, it might be spun off as a separate business so Twiga can maintain a "more asset-light approach to expansion".

The remaining part of the funding would be used to roll out low-cost manufactured food and non-food products under the Twiga brand before the end of 2021.

"For us, it’s choosing value chains where you can manage the traceability issue while there are some value chains that will be harder to manage", Twiga's co-founder and CEO, Peter Njonjo, told TechCrunch. "The key thing is that we now have a more blended approach. It’s not just about working with small[holder] farmers; we still work with them but on some value chains. But we’re looking at having large commercial farms integrated into our supply chain".

In order to increase revenue, Twiga started connecting FMCGs (fast-moving consumer goods) companies with retailers in 2019. And it was targeting a pan-African expansion by the third quarter of 2020, but the global pandemic balked those plans.

Although Twiga said it quadrupled revenues between April 2020 and August 2021. It also announced a (short-lived) partnership with Jumia last year. Under the partnership agreement, Jumia would use its logistics service to provide last mile, contactless delivery of produce from Twiga's sorting and distribution centres.

Now with about 1,000 employees, Twiga's expansion plans are back in motion. It plans to launch in two East African countries, Uganda and Tanzania, before the end of the year. Yebeltal Getachew has been appointed as Twiga Foods East Africa CEO, effective May 3, 2021.

Twiga's also in conversation with development finance partners, such as the International Finance Corporation (IFC) and the United States International Development Finance Corporation (DFC), to work out scaling a proof of concept that would enable it to act as an off-taker and sell horticultural crops across East Africa from February 2022.

As one of the well-funded startup in Africa, Twiga Foods has been fairly successful in Kenya. Its annual revenue as of 2019 is estimated to be between $5 million and $10 million.

"We want to consolidate our dominant position, clear out our proof of concept and expand to the neighboring countries", Njonjo said. "Hitting these targets would set us up for a bigger fundraise sometime next year. Thereafter, we will look at other markets: Cote d’Ivoire, Democratic Republic of Congo, Ghana, and Nigeria".

Njonjo added that Twiga’s expansion into Nigeria might involve some merger and acquisition (eyes on Vendease).

Twiga Foods investors: Who cashed-out?

Twiga has raised a total of $157.1 million from 23 investors across 19 rounds, according to Crunchbase.

Its early investors are Wamda Capital, Omidyar Network, DOB Equity, Uqalo, 1776 Ventures, Blue Haven Initiative, Alpha Mundi, AHL Venture, IFC Ventures, TLcom Capital, Adolf H. Lundin Charitable Foundation, Crescat Capital, Index Ventures, and Goldman Sachs.

In 2019, when Twiga received $5 million funding from Creadev, Adolf H. Lundin Charitable Foundation, Blue Haven Ventures, Crescat Capital, Omidyar Network, and Index Ventures sold parts of their stake in a secondary transaction to accommodate later-stage investors.

Creadev led this latest $50 million Series C. And TLcom Capital, IFC Ventures, DOB Equity, and Goldman Sachs spin-off Juven participated in the round too. First-time investors Finnfund Global and Endeavor Catalyst Fund wrote follow-on cheques as well.

So, which investors received some liquidity through the $30 million secondary sale?

Twiga is yet to respond as at press time. But I presume the investors who carried out the $30 million secondary transaction are Adolf H. Lundin Charitable Foundation, Blue Haven Ventures, Crescat Capital, Omidyar Network, Alpha Mundi, and Index Ventures.

"We are deeply convinced in Twiga’s potential to revolutionize informal retail across Sub-Saharan Africa", said Pierre Fauvet, Creadev's Africa Director.

"Tapping into a $77 billion urban market on the continent, Twiga has gained significant traction since inception, leveraging on technology to optimize the food supply chain in African cities and constantly innovating to better tackle logistics, commercial, social and environmental challenges".

In 2018 and 2020, Fast Company named Twiga Foods as one of the most innovative companies in Africa.

It's also worthy of mention that Grant Brooke, the founding CEO of Twiga Foods, handed over the role to Njonjo in 2019. And some months later in 2020, Grant stepped back from active management of Twiga Foods but remains on the Board of Directors.