Stitch expands into additional payment methods with Direct Deposit

Businesses in South Africa can now accept Instant EFT and manual EFT payments, and reconcile transactions in one place, through the Stitch API

Businesses in South Africa can now accept Instant EFT and manual EFT payments, and reconcile transactions in one place, through the Stitch API

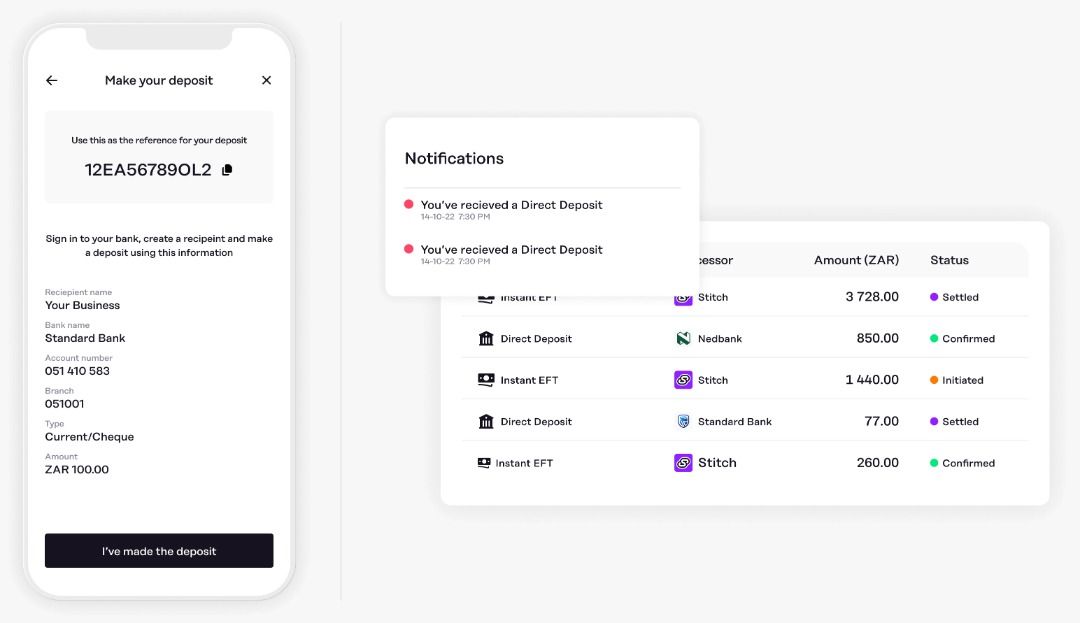

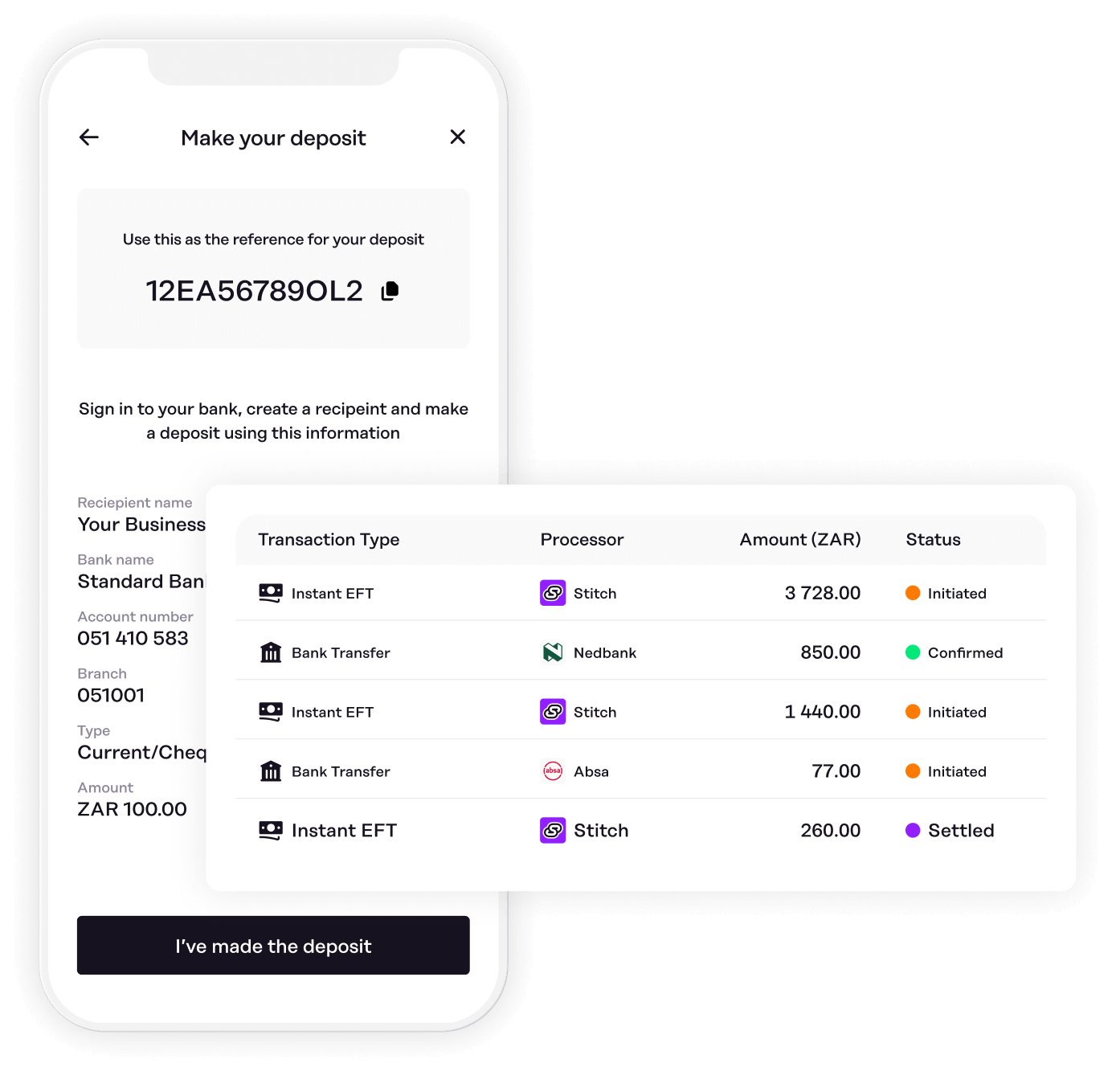

Payments and data API Stitch today announced the launch of a new payment method: Direct Deposit, or manual transfer. Now businesses in South Africa can offer their customers even more ways to pay through a single API, while enjoying seamless reconciliation, instant notifications and faster settlement.

Bank transfer continues to rise as the fastest-growing payment method among consumers in South Africa, with 39% of e-commerce purchases projected to come from bank transfers in 2022, according to Global Data. LinkPay, the flagship Stitch Instant EFT solution, enables customers to link a bank account to the apps and platforms they use frequently to make one-click payments, while Stitch InstantPay enables friction-free Instant EFT checkout even for guest users.

However, some customers prefer to initiate a manual transfer from within their banking apps. As part of its mission to make it as easy as possible for businesses to accept payments and for customers to pay, Stitch has expanded its offering beyond Instant EFT to encompass manual transfers. With Direct Deposit, businesses can:

- Avoid the need to develop and maintain direct integrations with individual banks.

- Receive notifications for payments made via manual EFT

- Reconcile payments seamlessly alongside other Stitch methods

- Enjoy faster settlement times vs waiting days

Stitch CPO Junaid Dadan said: “We want to give consumers more choice in how they wish to pay while ensuring a fantastic experience for them, and taking the headache out of payments acceptance and reconciliation for the merchant. With Direct Deposit, customers can choose to initiate a transfer from their banking apps to a merchant account. The merchant will be notified instantly, and the transactions will be automatically reconciled alongside other payments coming through Stitch - no need for businesses to develop and maintain integrations with each bank individually.”

Virtually any business that accepts digital payments can benefit from Stitch Direct Deposit. Core use cases include:

- e-commerce: Fulfill goods faster and more seamlessly when accepting manual transfers.

- Investment solutions: Automatically trigger account crediting or investment when a customer’s funds clear via manual EFT.

- Digital wallets or accounts: Receive instant notifications when a customer has funded their wallet from outside the app or platform.

- Lenders and insurers: Reconcile premiums and repayments from different payment methods

Businesses that already leverage Stitch InstantPay or LinkPay solutions can easily add Direct Deposit to their existing integration. Stitch emerged from stealth in February 2021 and expanded into Nigeria in October 2021.

The firm raised $21 million in Series A funding in February 2022 from several investors including PayPal Ventures, TrueLayer, Firstminute capital, The Raba Partnership, CRE Venture Capital, Village Global, Zinal Growth (the investment vehicle of Checkout.com founder Guillaume Pousaz) and angels including founders and early builders from Chipper Cash, Monzo, Venmo, GoCardless, Plaid, Unit.

Comments ()