Stitch announces $21 million Series A to enable Africa's fintech sector

With $27 million total funding, Stitch is now the most funded API-first fintech startup. What does this mean for Africa API fintechs?

South Africa-headquartered API fintech firm Stitch has raised $21 million in a Series A round. The announcement comes four months after it secured a $2 million seed extension to its $4 million seed funding raised in February 2021.

This $21 million Series A brings Stitch total funding to $27 million. The Spruce House Partnership — a private pooled investment fund managed by hedge fund firm Spruce House Investment Management — led the round. According to CB Insight, the hedge fund firm has invested in 14 companies and exited two.

Existing investors who had joined the seed and extension round also participated in the Series A round. They include a U.S.-based investment firm The Raba Partnership, London-headquartered Firstminute Capital, and CRE Venture Capital.

New investors that participated in the Series A round include PayPal Ventures, TrueLayer, Village Global, Zinal Growth (the investment vehicle of Checkout.com founder Guillaume Pousaz), Quovo (a data platform which Plaid acquired in 2019), Unit (a Banking as a Service startup), and founders of Chipper Cash Ham Serunjogi and Maijid Moujaled.

It’s pertinent to note that this funding could have been closed in 2021 and just announced in February 2022. It's similar to how their expansion to Nigeria and the appointment of a country manager was announced in October 2021, almost three months after the deal was done. Their payments product was also launched in April 2021 but the announcement was made in September.

Funding announcements should be ads for the next round that you’re currently raising, if they’re not - you aren’t doing it right.

— Harry Hurst (@harryhurst) March 29, 2021

Stitch said the $21 million will be used "to significantly expand the team, launch new product offerings and enter new markets across the continent". While Stitch didn’t respond to my question on the new markets they are considering, I’m putting my money on Ghana and Kenya.

"We are incredibly fortunate to be supported by some of the best investors, founders, and builders in the fintech space globally", Stitch co-founder and CEO Kiaan Pillay said.

They [our investors] are working closely with us to enable the boom we’re seeing in financial technology on the continent. Across the hundreds of customers we work with, big and small, we’re witnessing a record pace of development of new financial products. Our goal is to help fast-growing fintech and embedded finance companies more easily launch increasingly innovative and tailored products, expand into new markets and optimize their solutions — so they can grow even faster.

Kiaan co-founded Stitch with Priyen Pillay and Natalie Cuthbert (CTO) in October 2019. The API fintech company secured a pre-seed a month later and operated under the radar until February 2021 when it announced its seed funding. And that $4 million seed funding was the largest raised by any African API fintech startup at the time. Ditto this $21 million Series A.

"We have been following startups in Africa for many years. Our diligence was very clear that this is one of the most talented teams on the continent, and we are excited to be a part of what they are building at Stitch," Ben Stein, co-founder of The Spruce House Partnership, said.

Stitch started with a data and identity API product that allows developers to connect their apps to financial accounts. And with users' permission, they can access their transaction histories, balances, confirm identities, and perform fraud checks. In April 2021, Stitch launched a payment product that enables bank-to-bank transfers for one-click pay-ins and payouts.

According to the statement shared with Benjamindada, Stitch recorded 44% month-on-month (MoM) customer growth in the last quarter alone, a 72% MoM increase in linked financial accounts on its platform, and a 104% MoM growth in payments value since launch. (It’s not clear whether this is February 2021 or October 2019). Kiaan had told TechCrunch in October that they were on track to facilitate $10 million monthly payments by last year December.

But at the moment, Stitch is not sharing any numbers regarding how many financial accounts they’ve linked and monthly payments being processed since they launched in Nigeria.

"Stitch is building critical infrastructure to enable faster, easier, and more secure payments across Africa", Ashish Aggarwal, Director at PayPal Ventures, said. "We believe they will play a significant role in contributing to the overall growth of the fintech space in Africa — and are excited to be investing at this important moment in their journey".

Stitching Africa’s API fintech sector

Stitch customers range from wallet-based companies such as Chipper Cash, Luno, and Zapper, to financial services providers such as Franc, ImaliPay, and Sanlam, to subscription and e-commerce players like FlexClub, to payment service providers and aggregators such as Paystack, Peach, and Yoco.

But Stitch is not the only API fintech startup in Africa. There are at least four in Nigeria, namely, Bloc, Mono, Okra, and OnePipe. There’s also Pngme in Nigeria and Kenya and Ozow in South Africa with plans to launch in Ghana, Kenya, Namibia, and Nigeria this year. And MoneyHash in Egypt.

Most — if not all — of the API fintechs use the same method: screen scraping.

A representative of Stitch told Benjamindada, "Two things stand us apart. One, we take a payments-first approach to open banking which means that when we build new products, we are thinking about how to improve the payments experience with the new product".

They corroborate this point with an example. "Today, we offer our clients a seamless way to check balance before making a debit, in one single call. A balance check is something that typically falls under what API fintechs call their "Data Product" but we’ve infused that into our payment experience", the rep said.

"Second, we have better UX [user experience] and DevX [developer experience]. We don’t see ourselves competing with other API players from a product point of view but instead, we compete with the dominant online payment method per country we enter. So we set a higher benchmark for ourselves".

In Nigeria, for instance, they said, the dominant online payment method is a debit card. Thus, we are looking to offer a payment experience that either beats the debit card or matches what’s obtainable with the card. Similarly, DevX shouldn’t be underestimated. We target developers, so ease of integration and technical performance of the product matter.

Indeed, API fintechs can’t discount the role of developers. It’s one of the reasons Mono, despite launching some months after Okra, has become Nigeria’s API fintech poster boy. (Mono courted developers better than Okra.) But with a $27 million war chest and organising programmes such as early-stage startup showcase and hackathon, Stitch could soon become the de facto Africa’s API fintech startup. It has already introduced the financial graph and the goal is "to build the infrastructure, developer experience, and core functionality" for this graph.

The Raba Partnership Founder George Rzepecki said: "Today, there is over $180 billion in (largely bank) financial services market cap across Africa, and we believe this will grow by multiples over the coming decade. Stitch will help enable this growth, where banks, mobile money, and fintechs access the "financial graph" and change how consumers and businesses both verify and move money across the continent".

The graph brings clarity and trust to transactions, lowering costs and with it creating enormous economic value. Stitch is building API first, modern payment rails, and with it the future of finance across Africa, where we will see more than 500 million people transact online and become depositors, access credit, and build their financial identities, leading to an economic path that is orders of magnitude larger than what was possible only a few years ago.

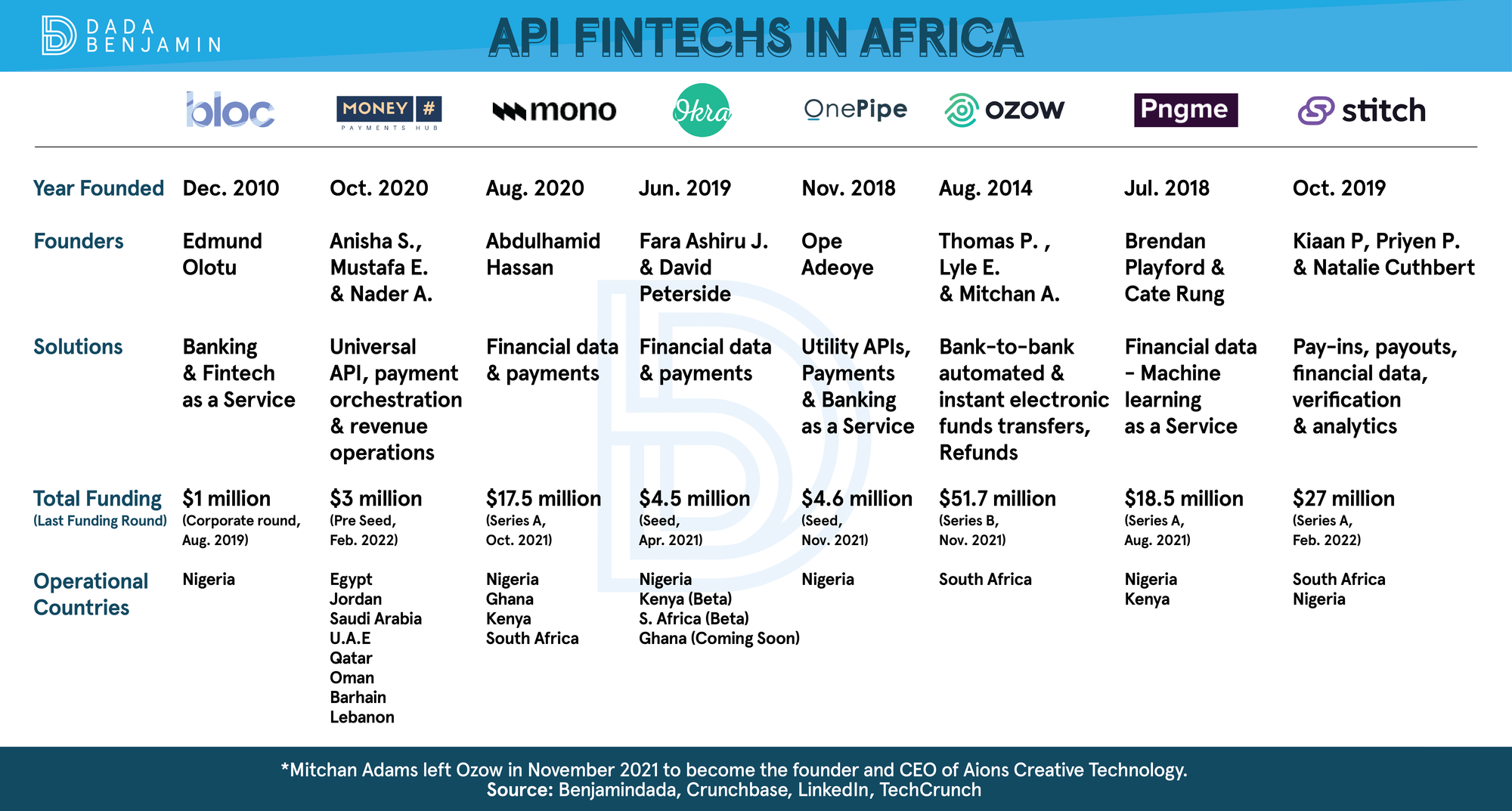

The chart below shows the snapshot of the aforementioned API fintechs — Bloc (formerly TechAdvance), MoneyHash, Mono, Okra, OnePipe, Ozow, Pngme, and Stitch. It shows the year they were founded, total funding raised to date and last funding round, solutions they provide, and countries they are operating in or have coverage.

From the eight startups mentioned in the chart, only five have more than one founder and four of them have a female founding team member. Namely Okra (Fara Ashiru Jituboh, CEO/CTO), Pngme (Cate Rung, COO) Stitch (Natalie Cuthbert, CTO), and MoneyHash (Anisha Sekar, CPO).

The chart also shows that Ozow, which launched in 2014 and has raised Series B, is the most funded API fintech with $51.7 million raised. It’s closely followed by Stitch with $27 million.

Nigeria is also leading the API fintech effort in Africa. Six of the eight startups have footprints in Nigeria. And four of the six are founded by Nigerians. The two companies not active in Nigeria, Ozow and MoneyHash, have plans to launch or hire in the country. Similarly, Okra plans to launch in Ghana sometime soon.

Comments ()