#TechMeetsBanking 2020: Rubies to roll out more financial solutions

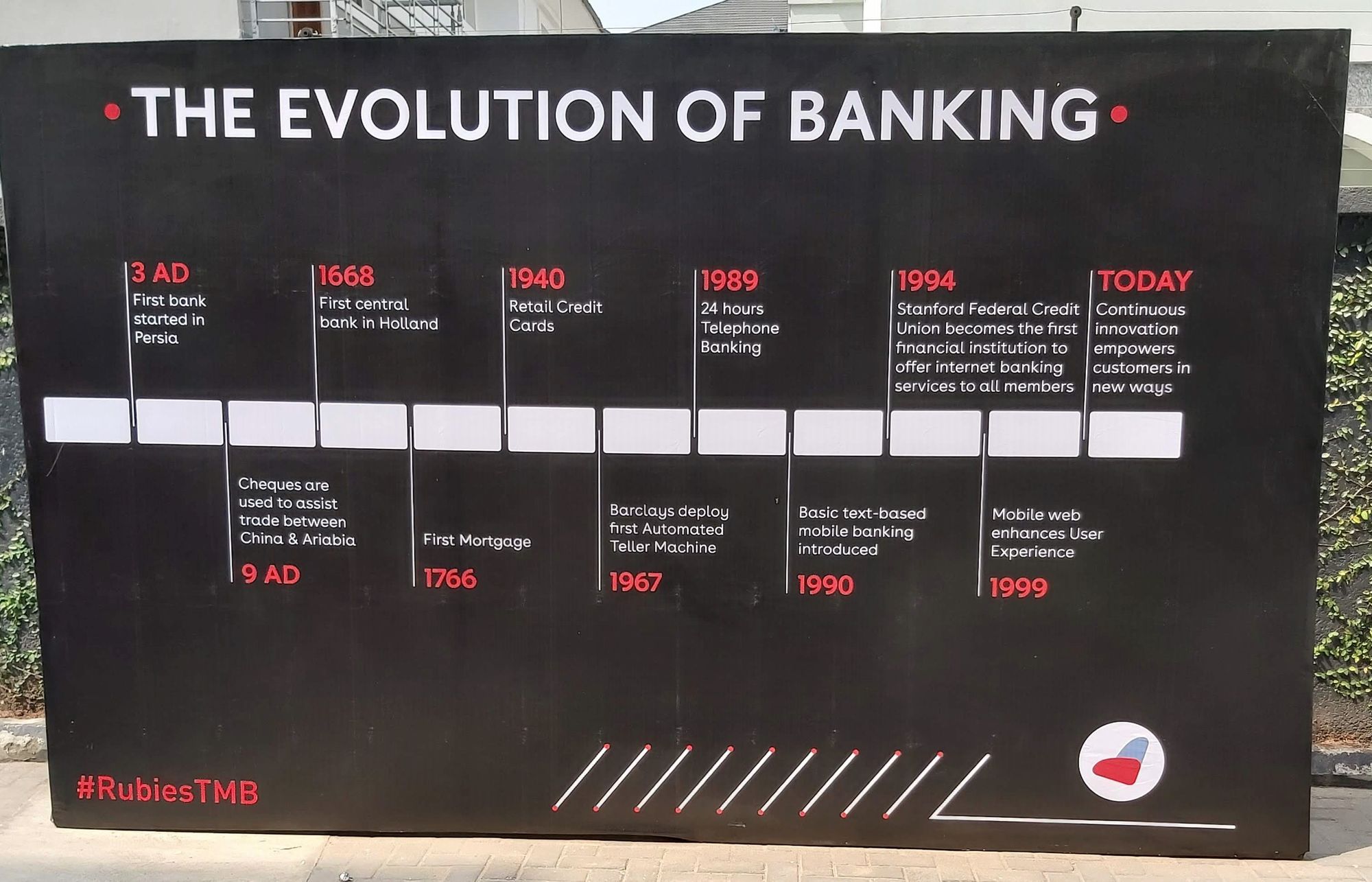

Rubies Bank recently held its inaugural fintech event, where its array of solutions were introduced to stakeholders in the banking and finance sector.

The event, which was themed Tech Meets Banking, brought together financial institutions, insurance companies, investors, bankers and tech enthusiasts to experience the array of solutions Rubies Bank provides.

The fintech event, which was tagged #RubiesTMB2020, is expected to become a yearly event. Segun Awosanya (AKA Segalink) and a representative of Nigeria Inter-Bank Settlement System (NIBSS) were also present at the fintech event which was held on February 21.

Speaking at #RubiesTMB2020, the CEO of Qucoon Limited—the parent company of Rubies Bank—Yinka Daramola, said one of the challenges Rubies face is the lack of a regulatory framework for the fintech sector. He said, "Regulators must understand that wherever tech and innovation meet is always hard to regulate. An example is how it is difficult to regulate Uber even in developed countries."

He explained that Rubies obtained a microfinance bank licence to be able to operate as a digital bank. And with that licence, Rubies Bank would be pushing the envelope of banking with technology.

> **Related Article:** [What is possible with a microfinance bank license?](https://www.benjamindada.com/5-billion-psb-psp-mfb/)According to Rubies Bank, since its launch in June 2019, it has garnered about 90,000 customers, records 50,000+ daily transactions and supports 300 fintechs across the country.

The array of solutions exhibited at #RubiesTMB2020 include a payroll solution (QuSquare), a core banking system (PowerBank) solution, an equity and crowdfunding platform (QooVest), and a payment gateway (AfroPay).

Patricia Technologies Limited—an ecommerce platform for trading gift cards and bitcoin—also showcased its latest product which was made possible through a partnership with Rubies.

Patricia Card allows users to easily withdraw their bitcoin at any automated teller machine.

Daramola, who is also the CEO of Rubies Bank, said QuSquare does not only make the work of the human resources department easy, it also provides an opportunity for employees onboarded on the platform to easily access payday loans. "We are building an ecosystem," Daramola said.

He added that the core banking solution has also been approved by NIBSS and would be deployed sometime in April.

Comments ()