Peach Payments partners with Stitch to offer one-click payments across South Africa

Stitch partners with Peach Payments to enable more South Africans to pay with instant electronic funds transfer (EFT).

By 2028, the South African e-commerce market size is expected to surpass $25 billion. Customers in the country are demanding faster, more convenient and more secure ways to pay as digital transactions.

As a result, more merchants are coming online, relying on payment gateways like Peach Payments to enable their customers to transact digitally. For merchants that want to offer a variety of payment methods and access a wider market, instant electronic funds transfer (EFT) by Peach Payments is one of the fintech products offering the second most popular online payment method in South Africa.

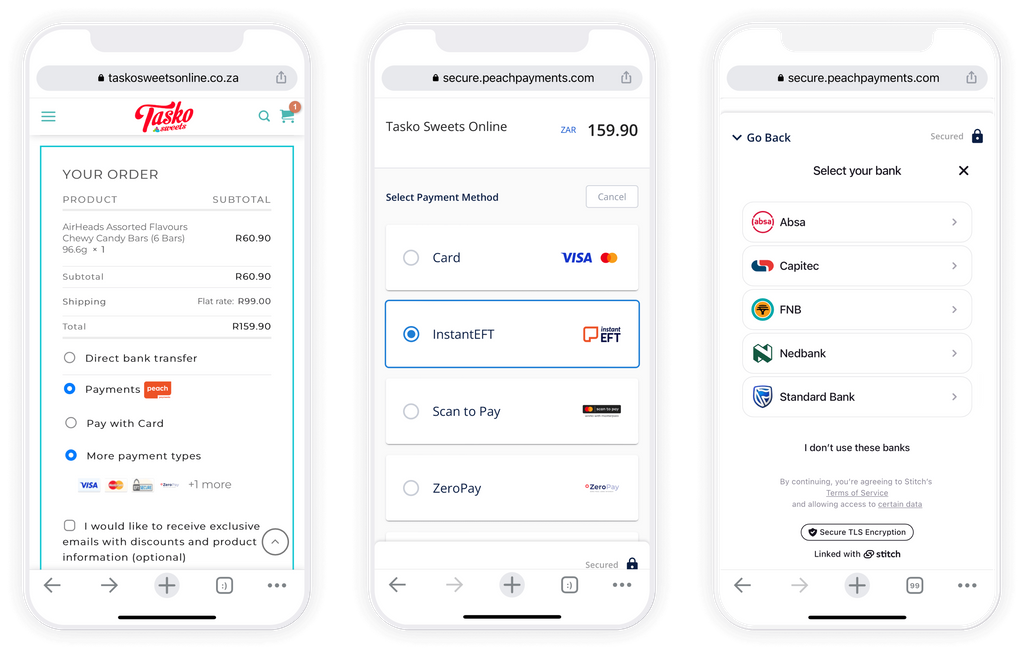

To drive on-click payments in South Africa, digital payments gateway Peach Payments and API fintech Stitch have partnered to enable online merchants across South Africa to accept secure, low-cost instant EFT payments.

"In South Africa, Statista found that debit cards make up 33% of all online transactions and credit cards a further 17% — meaning that 50% of online shoppers need other payment methods to complete their purchases. We have found that offering a wide variety of different payment methods makes a real difference to businesses’ bottom line," Rahul Jain, CEO of Peach Payments, said.

"Instant EFT by Peach Payments gives shoppers an additional way to pay, meaning that even if their card doesn’t work, the transaction can still be completed," he added. The payment method is available to all Peach Payments merchants, on any integration platform, as ‘Instant EFT by Peach Payments’ and is enabled by contacting support[at]peachpayments[dot]com, where the support team is available seven days a week.

For over ten years, Peach Payments has made online commerce and digital payments accessible to small and large merchants across the African continent. It works with businesses in Kenya, Mauritius and South Africa, providing a toolkit that enables them to accept, manage and make payments via mobile and the web.

Related Article: The payouts landscape in South Africa

"Our goal is to make it as easy, secure and cost-effective as possible for customers to pay online – which ultimately means more growth for online merchants who are massive drivers of South Africa’s economy. We’re thrilled to partner with a leading player in payments like Peach Payments to help more merchants get paid easier, and receive their funds faster with our Instant EFT solution," Junaid Dadan, Stitch CPO.

Stitch launched in February 2021 and is live with its payments and financial data API in South Africa and Nigeria. The firm recently raised $21 million in Series A funding, and in April announced the launch of LinkPay, the first payments solution in Africa that tokenises user financial accounts to enable one-click, verified payments and seamless payouts for returning customers.

This article was contributed by Thea Sokolowski, Stitch's Head of Marketing and Communication.

Comments ()