Moneymie shuts down its digital bank for immigrants to focus on B2B services

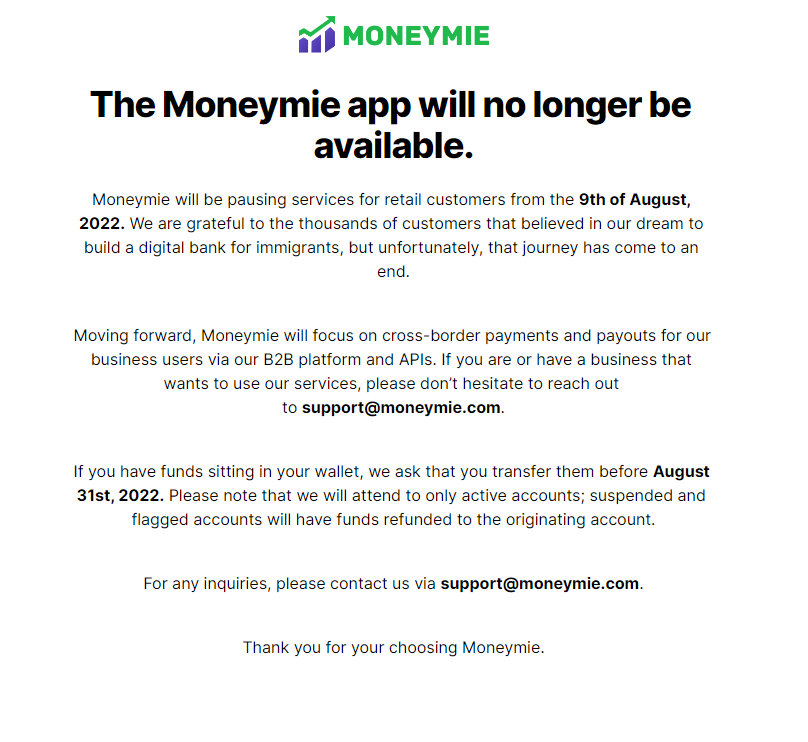

The Moneymie app will no longer be available.

On August 9, 2022, Moneymie paused its digital bank service that enables African immigrants in North America to send and receive from Nigeria, Ghana and South Africa.

"We are grateful to the thousands of customers that believed in our dream to build a digital bank for immigrants, but unfortunately, that journey has come to an end," reads a notification on the company's website.

Although Moneymie is shutting down its B2C services, the fintech company disclosed that it would focus on cross-border payments and payouts for business users via its B2B platform and APIs.

Per Crunchbase, Moneymie was founded by Opeyemi Awoyemi—who previously founded WhoGoHost and Jobberman (exited)— in 2019. According to the notification, in-wallet funds will be refunded to users' originating accounts before August 31, 2022. The Moneymie App has been removed from Google and Apple playstores, but its B2B platform is active. This development came in two months after Michelle Van Staden joined the neobank as CEO.

"While we believe a digital bank for immigrants needs to exist, the infrastructure and regulatory environment on the Nigerian side does not provide a comfort level needed to build a scalable business in that space, immigrants have alternatives including p2p that have to remain unchallenged so far," Opeyemi told Benjamindada.com.

"Our B2B efforts bloom without much focus and as such makes sense to double down on providing services to fintechs and business customers, Moneymie is a licensed money transmitter in the US and Canada."

The remittance inflows to sub-Saharan Africa over the past decade have been upward since 2020; last year, it increased by more than 6% to $45 billion. However, the steady rise of remittance inflows to the region hasn’t made this activity cheaper. According to the World Bank, sub-Saharan Africa remains the most expensive region to send and receive money; sending $200 costs an average of 8% in fees compared to a global average of about 6%.

Per the World Bank’s Remittance Prices Worldwide, transparency among remittance providers is one of the factors that affect these rates. Aside from Moneymie, other fintechs like Lemonade Finance, Zazuu, Vesti App are enabling remittance for Africans in the diaspora.

Related Article: Lemonade Finance, a fintech startup easing cross-border transactions for Africans

Pew Research Center said that immigrants from Africa in the United States were at 4.6 million in 2019 and are projected to increase to 9.5 million by 2060. In addition, four African countries – Nigeria, Senegal, Ghana, and Kenya – are among the top 10 origin countries for Sub-Saharan migrants to Europe.