Lemonade Finance, a fintech startup easing cross-border transactions for Africans

Cross-border payments are a source of pain for Africans. Lemonade wants to solve the usage restrictions, long transaction completion time and high fees.

Lemonade is a cross-border payment platform tailor-made for Africans, not just in Africa but everywhere—home or abroad.

As the rest of the world moves forward towards creating a tighter-knit global economy, the African continent has, more or less, been left behind.

Cross-border payments for Africans are still a source of pain. It is plagued with three major issues; restrictions in terms of use, long transaction completion time and prohibitive fees. These challenges are what Lemonade Finance has set out to achieve.

Regarding restrictions, most platforms used for international transactions, especially peer-to-peer, are either completely unavailable to Africans or limited. For instance, WorldRemit, allows Nigerians to receive from other countries but prevents them from sending. PayPal does the opposite, allowing Nigerian users to send but blocking them from receiving money. In neighbouring Ghana, Paypal’s service is completely unavailable. It was only recently that Flutterwave announced a partnership with PayPal to allow African users receive payment via PayPal.

Second, these cross-border transactions, where they are available, take very long to complete. Certain services take between 2-4 days to complete transactions. A transaction is said to be completed when there is a corresponding credit to an initiated debit. That is, the recipient receives the value that was sent.

In addition to the delay, the charges Africans have to pay are often higher than the global average. The average cross-border transaction in Africa shaves off 9% of the value compared to a global average of 6.5%.

The cross-border payments challenge hit home for the CEO and co-founder of Lemonade Finance, Ridwan Olalere, who founded forLoop Africa in 2016. "We had problems paying for essentials (hall, and snacks) needed for a forLoop event in Rwanda. We couldn't find any easy way to send money to Rwanda, so we transferred bitcoin to the Country Lead who then converted it to Rwandan franc", Ridwan tells Benjamindada.com.

"As anyone can guess, we lost a fair bit of value on the transactions", he added.

It’s not only people in Ridwan’s shoes that need remittance services. The 60,000 Nigerian students in the USA, UK, Canada, and Malaysia need continued financial support from their parents and sponsors.

Lemonade was founded in August 2020 to solve money problems. Speaking on the company’s approach, Ridwan said, "Today, many Africans face challenges while trying to interact with the global economy, manage their finances, and provide support to friends and family—wherever they are".

"For us, remittance is a natural first step to solving these challenges as it provides the infrastructure and the cross-border financial network that will become the backbone and engine that drives the full suite of financial services that Lemonade will soon offer", he added.

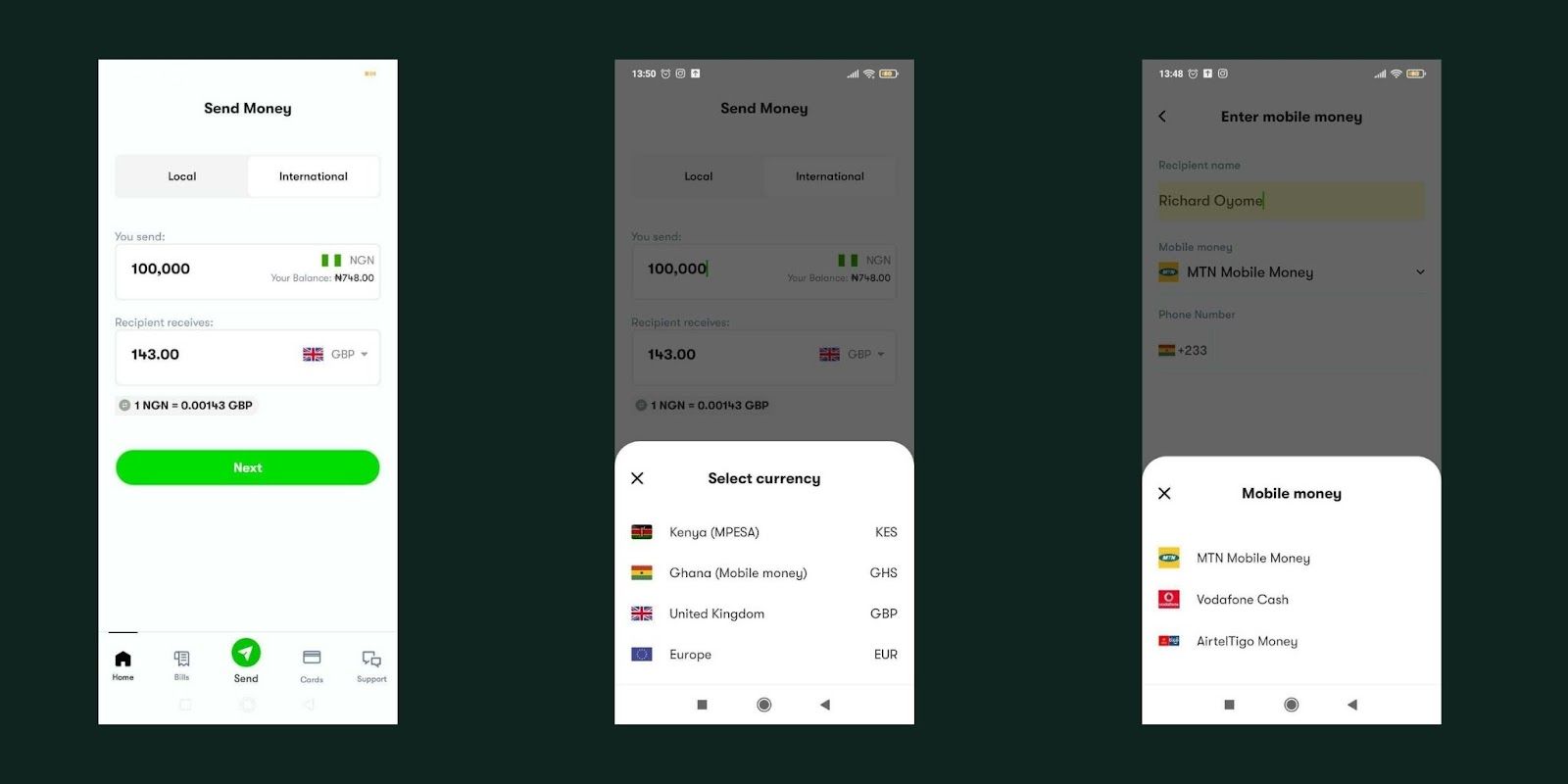

While the journey towards solving cross-border transactions is a long one, the team has already made some significant strides. Its product, the Lemonade app, is available for users in Nigeria and Canada.

Nigerian users on the Lemonade app can transfer to mobile money accounts in Ghana and mPesa accounts in Kenya. And the transaction will be completed in minutes.

A few weeks ago, it announced a new feature—free instant money transfer to the UK and Europe for its users. The feature is available to both Nigerian and Canadian users, who can send funds to any bank account in UK or Europe instantly.

At sign-up, users can send ₦30,000 ($73) to any bank account in the UK or Europe. After BVN verification, the daily limit goes up to ₦100,000 ($244) per day. On completing approved-ID verification, the daily limit is increased to ₦2,000,000 ($4,894).

The investors and partners in Lemonade Finance are yet to be officially disclosed. However, benjamindada.com has gathered that Olumide Soyombo, Kola Aina's Ventures Platform Fund and Acuity Ventures are among.

According to Ridwan, Lemonade is working with licensed partners in Ghana, South Africa and Egypt.

In a conversation with benjamindada.com, he explains that there are three things on their front-burner. One, dropping the transaction rates further, two, ensuring a seamless user experience on the app and three, increasing the number of licenses or license partnerships they have so they can expand.

"Our cross-border payment platform will improve the payment systems for everyone and allow them to personalise how and where they want to remit or receive their payments. We have a lot of exciting features in the works and more countries to be active in before the end of the year", Ridwan Olalere concludes.