African tech startups jointly raised over $4.27 billion in 800+ deals in 2021

In 2021, tech startups operating across Africa have jointly raised over $4.27 billion in 800+ deals, this record quadruped the $1.1 billion that was pumped into the continent amidst the pandemic last year.

Since January, tech startups operating across Africa have jointly raised over $4.27 billion in 800+ deals, this record quadruped the $1.1 billion that was pumped into the continent amidst the pandemic last year.

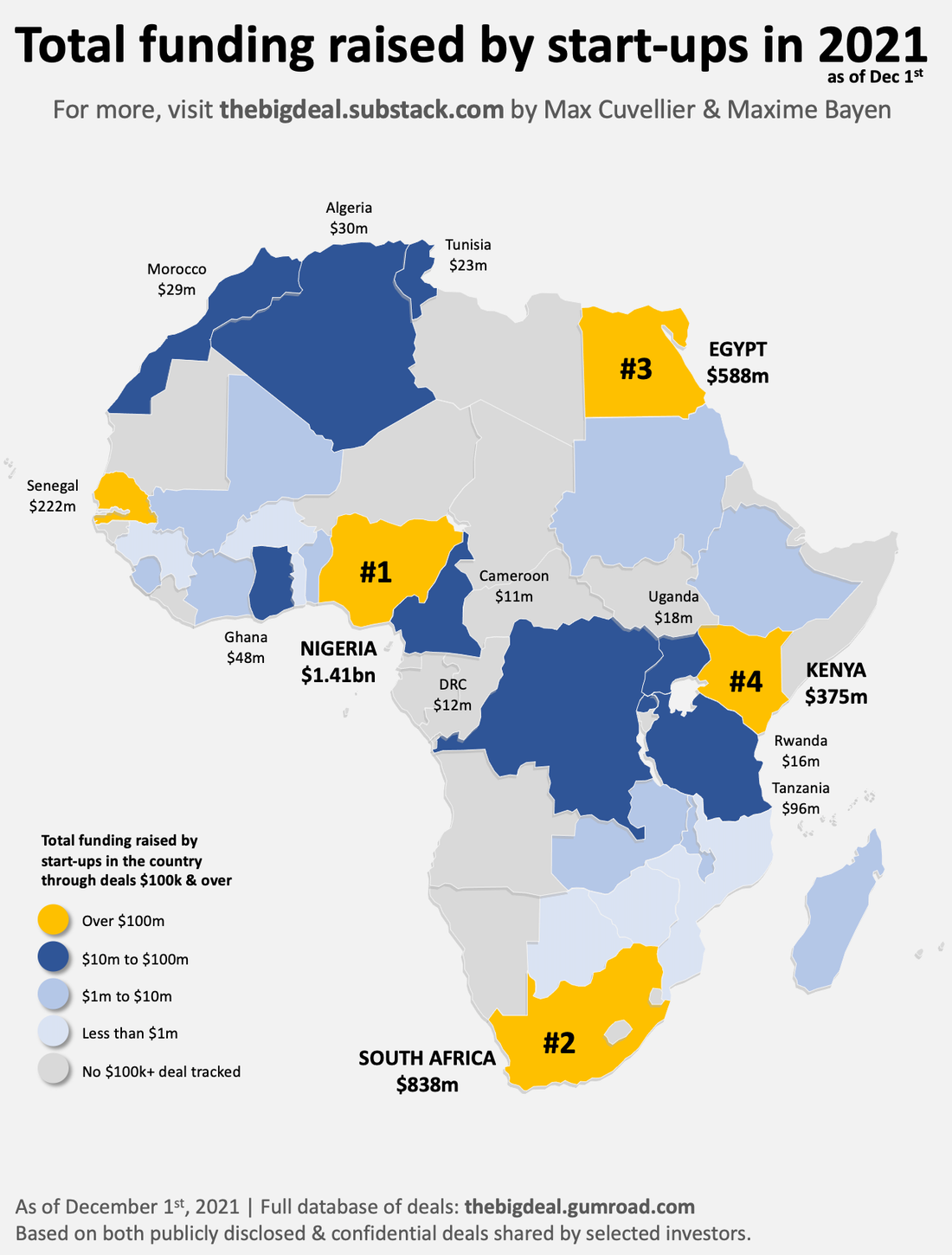

While most of the funding went to fintech startups, Nigeria, South Africa, Egypt and Kenya continued to top the list as the big four — with 80% of the total raised on the continent so far this year (35% for Nigeria alone). In this list, I curated the eleven startups across the continent that arguably raised 44% of the $4.27 billion joint funds in disclosed deals.

Opay

In August, the Chinese-backed and Africa-focused fintech company OPay raised $400 million in a Series C round led by SoftBank Vision Fund 2, valuing the company at $2 billion.

The fundraise made the Nigeria-based company the second African fintech unicorn after Flutterwave and the third African unicorn after e-commerce giant Jumia. OPay’s fundraise is the largest of the lot in terms of size and value.

Wave

Wave closed the largest Series A round for an African fintech with $200 million in September, making it the first Francophone unicorn at a $1.7 billion valuation. The Senegal-based platform is similar to PayPal — with mobile money accounts, not bank accounts) and runs an agent network that uses their cash on hand to service Wave users.

Andela

In a Series E financing round led by Softbank Vision Fund 2, Andela raised $200 million placing the ed-tech startup at a $1.5bn valuation. Andela became the third unicorn behind Senegal’s Wave and Nigeria/US-based Flutterwave.

Between 2014 and 2019, over 130,000 applicants joined Andela’s six-month training program at boot camps in four African countries — Nigeria, Kenya, Uganda, and Rwanda.

Tymebank

Tymebank, a South African digital bank completed a US$180million capital raise from Tencent and CDC in December. It is important to note that the Series B round was TymeBank’s Series B was completed in two rounds: ~$110M in February and $70M in December. Founded in February 2019, TymeBank has grown rapidly and now has about 2.8 million customers.

Flutterwave

In March, Nigeria-based fintech startup, Flutterwave raised $170 million Series C funding shooting its valuation to over $1 billion, making it the fourth African unicorn.

The fundraise came on the back of an impressive run of 4 years in which Flutterwave reached over 290,000 merchants and over 500,000 registered Barter users, launched a range of new products and partnerships and expanded its infrastructure into over 33 countries.

Read Also: 15 global accelerator startups accepting Nigerian startups

Chipper Cash

In November, Chipper Cash, an African cross-border payments company, raised $150 million in a Series C extension round led by Sam Bankman-Fried’s cryptocurrency exchange platform FTX.

The funding earned it the highly coveted unicorn badge at a $2 million + valuation. Founded in 2018 by Serunjogi and Maijid Moujaled to offer free cross-border payment service in Africa via a mobile app, the company currently operates in seven African countries — Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya.

Jumo

JUMO, a South Africa- and London-based raised $120 million in unspecified funding led by Fidelity Management & Research Company, LLC. Per Times, the funding round increased JUMO's total funding to $200 million and took the company’s valuation to $400 million.

MNT-Halan

In September, Egyptian fintech startup MNT-Halan secured a US$120 million investment. Launched in 2018 as a ride-hailing app for two- and three-wheeler vehicles, MNT-Halan has morphed into a super app of sorts, and in the process became Egypt’s largest and fastest-growing lender to the unbanked.

TradeDepot

This month, TradeDepot, a Nigeria-based fintech startup secured $110 million investment through equity and debt financing to support its buy now, pay later service and expand its merchant platform across Africa.

Novastar, Sahel Capital, CDC Group, and Endeavor Catalyst participated in the $42 million equity round, as well as extant investors Partech and MSA Capital who co-led

TradeDepot's $10 million Series B funding last year. TradeDepot said the $42 million raised through the equity round is part of its Series B funding, bringing the total to $52 million.

MFS Africa

MFS Africa, a South African-based digital payments hub raised $100 million in Series C financing — split between $70 million equity and $30 million debt. Private equity fund AfricInvest FIVE co-led the Series C round with existing investors Goodwell Investments and LUN Partners Group.

Also Read: Highlight of fundraises by Nigerian tech startups in 2020

Chipper Cash

Prior to attaining unicorn status in November, Chipper Cash closed a $100 million Series C round in May. SVB Capital, the investment arm of U.S. high-tech commercial bank Silicon Valley Bank led the round. Others who participated in the round include existing investors — Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures, 500 Startups, Tribe Capital and Brue2 Venture.

Final thoughts...

Despite a dip in investments in 2020 due to the COVID-19 pandemic, 2021 remains a memorable year.

From all indications, the startup ecosystem in Africa is only going to get bigger. More funding rounds will be closed and more sophisticated mechanisms for investment, debt financing, equity and acquisition will be adopted. The prospects are huge, the conditions are (mostly) good and the mood is always fast paced. There is no letting up and ideas are being executed at breakneck speed.