Highlight of fundraises by Nigerian tech startups in 2020

In this article, we will be taking a look at how much funding Nigerian startups have received in 2020 and where the money went.

Funding for Nigerian startups reached an all-time high in 2019. It was always going to be a tough ask to surpass it in 2020. With the events that have shaped the year so far, staying alive is probably enough for most startups.

The year began with a ban on motorcycle operations in Lagos, Nigeria's commercial capital. The ban was significant because bike-hailing startups like Opay, Gokada, Max.ng had raised north of $188 million in 2019 to expand operations in the country.

Shutting down the biggest market for these startups put a big question mark on their survival. Many of them had to pivot to adjacent services to ensure survival. But the biggest question was about how such a move would affect investments flowing into the country's nascent tech ecosystem.

By March, Covid-19 had become the main story and the country entered into lockdown mode. Many startups suffered as the country endured almost two months of lockdown. Some, like Flutterwave, prospered, as their service remained crucial to many small businesses.

Investors, however, remained on-the-fence about doing deals in the middle of the pandemic according to a report from Endeavor.

In this article, we will be taking a look at how much funding Nigerian startups have received in 2020 and where the money went.

What qualifies a startup to be part of the analysis?

The funding analysis makes use of data from Crunchbase and our local database of investment deals. It only takes deals that have been made public into account. Undisclosed deals will be included in the analysis when they are eventually made public.

Here are a couple of other rules we followed for the analysis:

- The analysis makes use of data from companies that received more than $50,000 in funding in 2020. Although many funding deals happen below $50,000, the net effect is will not significantly alter the total investment flow into the country.

- Startups used for the analysis either have their headquarters in Nigeria or are run by Nigerian founders and have Nigeria as their main operational base. This was done to account for startups like Flutterwave and 54gene which have their operational bases in Nigeria but are registered in North America.

For every startup included in our database, we asked ourselves "Can we confidently say this is a Nigerian startup?" - We also had to answer the question of what companies qualified as a tech startup. For a company to be on the list, it has to own its core technology. The company must also provide a tech solution that users can access. Due to this reason, startups like TomatoJos did not make the list.

Finally, we left out funding rounds that weren't verifiable. For instance, Bitfxt announced a series A round of $15 million in February. However, when we tried to research who the investors were, we were met with dead ends. With many questions hanging around Bitfxt's investment, we decided to leave it out.

Key takeaways

2020 saw a steep drop in funding raised by Nigerian companies. 56 companies qualified to be part of the analysis. The total funding raised by all 56 companies in 2020 was $117,481,508, a 69% drop from Techpoint's conservative estimate of $377 million in 2019.

For more context, the value of all disclosed deal is less than Opay's series B raise from last year November.

The quality and quantity of deals done suffered greatly due to the covid-19 pandemic. As can be seen in the chart below, the number of investments started to fall off in April, after the lockdown was instituted. Since then, it has been topsy-turvy as the ecosystem strives for recovery.

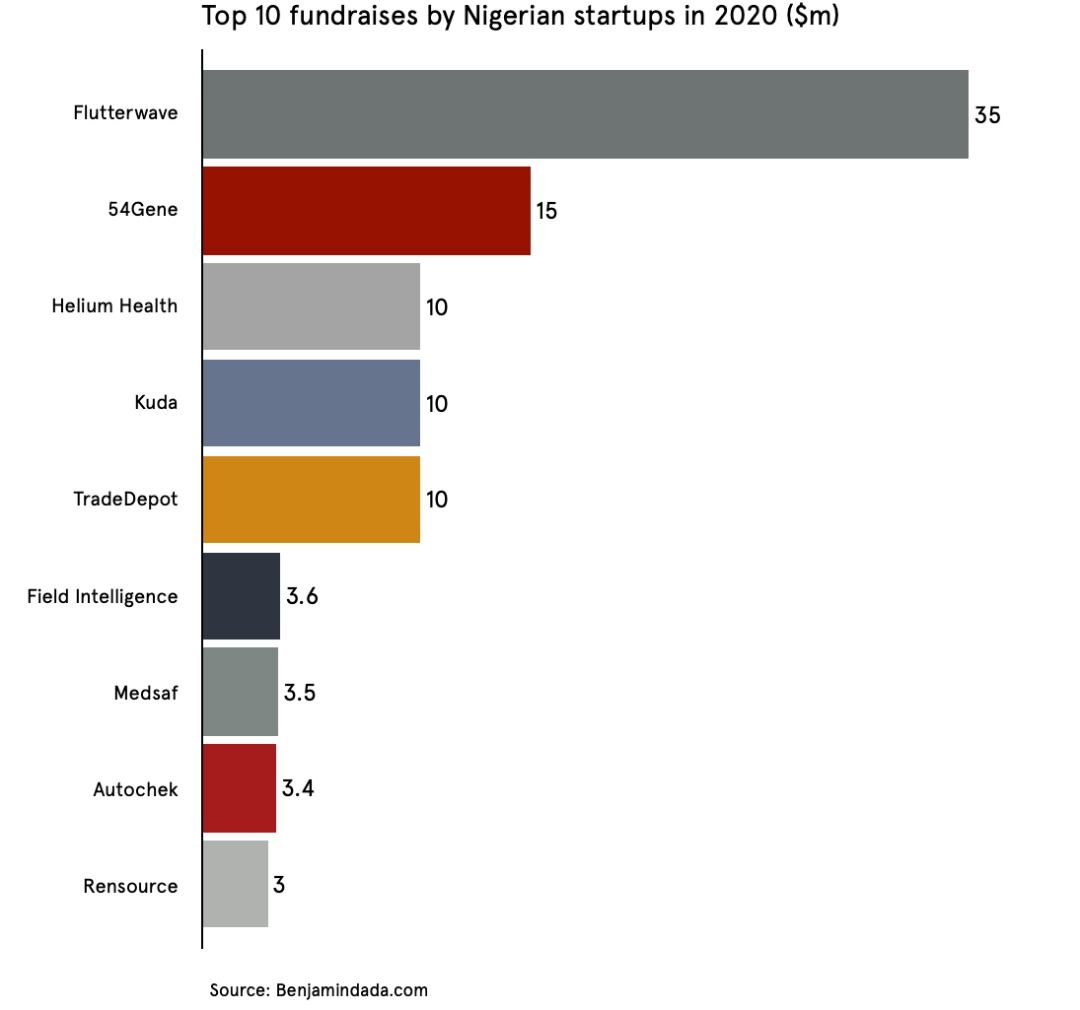

We also looked at the most significant actors in the ecosystem over the last one year. The largest fundraisers are:

- Flutterwave: raised $35,000,000 in its series A in January.

- 54 Gene: raised $15,000,000 in its series A in its series A in April.

- Helium health: raised $10,000,000 in its series A in April.

- Kuda bank: raised $10,000,000 in its seed round in November.

- TradeDepot: raised $10,000,000 in its series B in July.

- Field Intelligence: raised $3,600,000 in its series A in March.

- Medsaf: raised $3,500,000 in its seed round in December.

- Autochek: raised $3,400,000 in its pre-seed round in November.

- Rensource: raised $3,000,000 in a venture round in June.

Demographic distribution

One of the important things we wanted to look at was how evenly distributed investments were across male-founded and female-founded startups. The results showed that female-led startups are still very much underfunded in Nigeria.

Of the 56 startups that were funded in 2020, only three (5.4%) of them were female led. Another three (5.4%) of them had female co-founders listed on their official channels. The rest of the startups had male founders. The implication of this is that less only 10.6% of the startups funded have women as decision makers.

When you follow the money, it tells an even sadder story. Female-led startups received only 3.7% of all disclosed deals. Startups that had at least one female co-founder received 9.5% of the funding. In total, investors have given just 13.2% of their money to women.

All of this is despite evidence showing that female-led startups typically outperform male led startups. Going forward, Nigerian investors have to be more deliberate about investing in female-led startups.

How startups raised across industries

Examining how startups raised across industries gives us a peek into how investors are thinking at this time. Last year, bike-hailing and logistics startups were all the craze. This year, the pendulum has shifted towards other sectors.

The 56 startups were split into 16 broad industries including:

- Fintech

- Healthcare

- Logistics

- Cryptocurrency

- E-commerce

- Media

- Freelancing

- Data security

- Human-resources-as-a-service (Hr-a-a-S)

- Power-as-a-service (P-a-a-S)

- Business intelligence

- Talent Outsourcing

- Ecommerce

- Agritech

- Software

- Marketing

Based on how many companies were invested in, it is clear that Fintech companies were the most sought-after with 17 investments made. Healthcare companies accounted for 10 investments while 9 Logistic companies received funding.

Five (5) Cryptocurrency companies raised money alongside three(3) e-commerce companies. Two media companies got funded while other industries were represented by one company each.

Following the money reveals a slightly different story though. Fintech companies are clearly the most funded with $50.6 million raised. While some might want to attribute the swing towards fintech investments to Paystack's recent acquisition by Stripe, it doesn't appear to be the case.

Of the 17 fintech companies that were funded, 13 of them happened before Paystack's deal was announced. The other four deals that were announced after were likely to have been in advanced negotiations before Paystack's exit.

Healthcare startups also received significant funding with $35 million going to startups like 54Gene, Helium health, Medsaf and others. Interest in healthcare was no-doubt helped by the on-going pandemic. Only two of the ten deals involving healthcare startups was announced before April.

While 9 logistic startups were funded, the amount of funding was a far-cry from what the sector received last year. Only $3.1 million of funding went to logistic companies. Most of that funding focused on last-mile delivery companies, corroborating the importance of those companies during lockdowns.

Conclusion

From a fundraising perspective, 2020 has been a really quiet year for Nigerian startups. However, as vaccines become more widespread and global economies begin to recover, we can be hopeful of strong performances from local startups once again.

Comments ()