Flutterwave shuts down Barter, its consumer payment platform

Flutterwave has permanently closed down its consumer payment platform, Barter. The fintech will now focus on its businesses and remittance solutions.

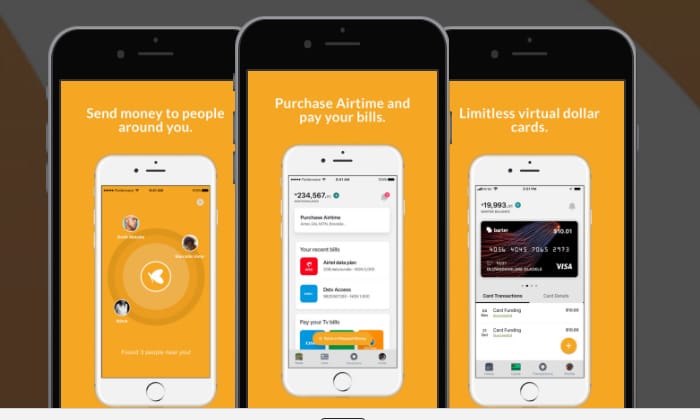

In 2017, Pan-African fintech startup Flutterwave partnered with Visa, a global payments company to launch Barter (then GetBarter), a consumer payment product to facilitate personal and small merchant payments within Africa and across its borders. The product provided a virtual card service.

Following a year-long hiatus to revamp its offerings, Flutterwave has announced the permanent closure of Barter. Citing evolving customer needs and shifting market trends, the platform will cease operations entirely on March 12.

In an email, the fintech informed users that after the date, their Barter accounts will become inactive, and accessing their funds will be impossible.

Barter's virtual card service faced challenges in the past. In July 2022, a temporary halt occurred due to an update with its card provider. Recall that Flutterwave initially launched the product alongside Visa, but it later switched to Mastercard. Startups who had previously issued virtual Visa dollar cards provided by Barter told Bendada.com that it was not reliable enough.

"While retail remains important to us, our immediate focus is optimising services for businesses and remittance solutions," the fintech said.

This news follows the recent temporary shutdown of Disha, another platform owned by Flutterwave. This move aligns with their shift towards enterprise and remittance solutions. We've seen this focus with the rebranding and global expansion of their Send into markets like Canada, the US, and India.

"Everything is growing very fast," said Flutterwave founder and CEO Olugbenga Agboola. "Send app is growing at over 100%, and our portfolio of business is growing massively. So we have been growing massively YoY now."

In the United States, Flutterwave has acquired money transmission licences enabling it to provide remittance in 29 states in the United States.