MTN Nigeria's Momo Payment Service Bank to commence operations following CBN's final approval

The Central Bank of Nigeria (CBN) has granted MTN the final approval to operate as Momo Payment Service Bank Limited (Momo PSB).

The Central Bank of Nigeria (CBN) has granted MTN the final approval to operate as Momo Payment Service Bank Limited (Momo PSB).

“MTN Nigeria Communications PIc (MN Nigeria) announces the receipt of a letter dated 8 April 2022 from the CBN addressed to Momo PSB conveying final approval to commence operations,” Uto Ukpanah, the company's secretary stated on Monday.

With this approval, MTN Nigeria will be joining Moneymaster PSB, a subsidiary of Glo and 9PSB, a subsidiary of 9mobile, to operate in the fintech space. According to EFInA, about 36 per cent of the adult population, representing 38 million citizens, do not have access to financial services in Nigeria.

The CBN guidelines explained that the key objective of issuing PSB licenses is to boost financial inclusion, especially in rural areas and facilitate transactions. PSBs are expected to function in rural regions and areas where Nigerians do not have bank accounts. They are also expected to have at least 50 per cent physical access points in rural areas.

“MTN Nigeria affirms its commitment towards the financial inclusion agenda of the CBN and the Federal Republic of Nigeria, and we are excited at this opportunity to support its fulfilment.” Ukpanah added.

Related Article: What you need to know about payment service banks and financial inclusion in Nigeria

What are payment service banks?

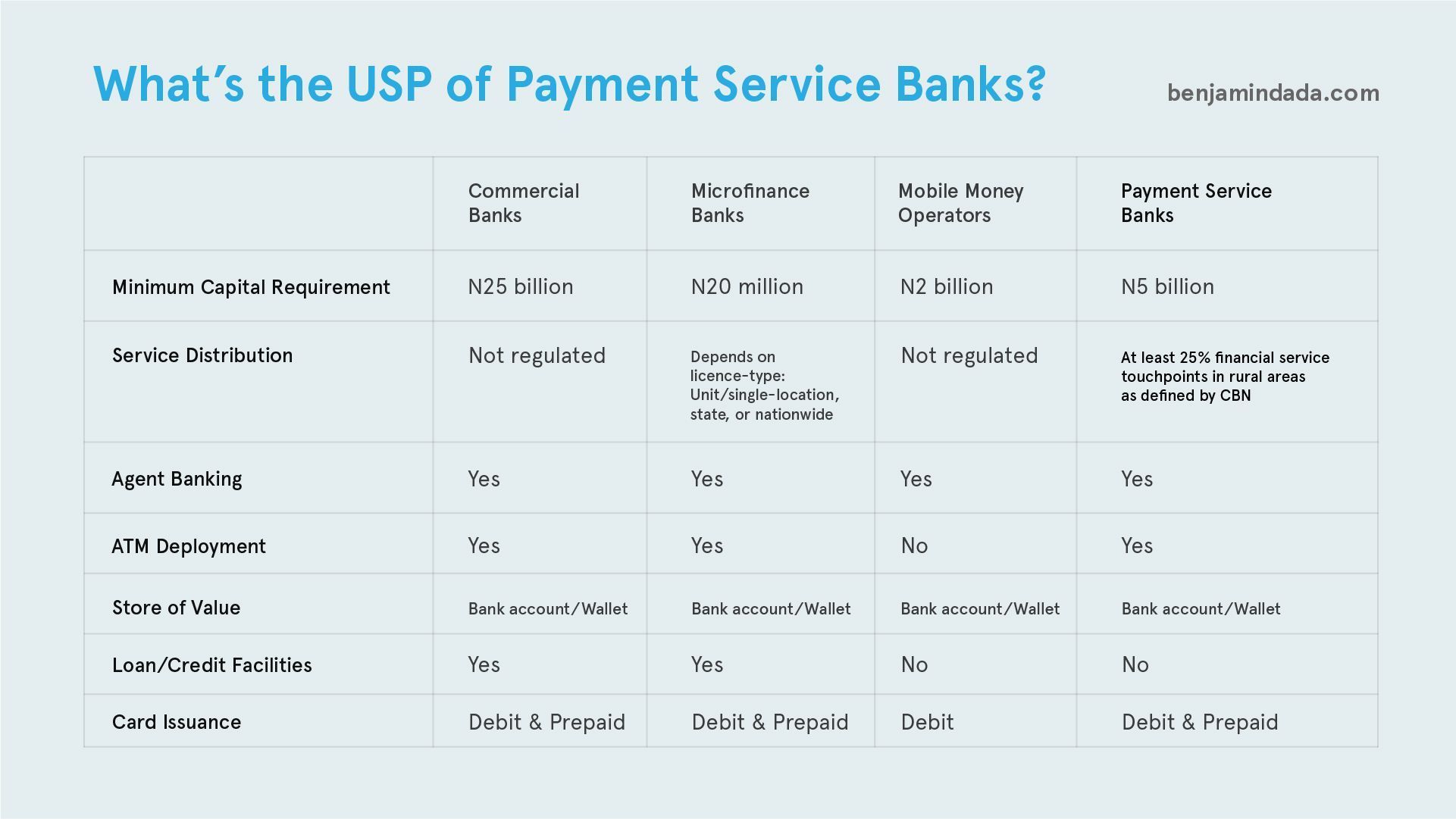

Essentially, PSBs are mobile money operators (MMOs) that can deploy automated teller machines (ATMs) or gagged microfinance banks — that must operate mostly in rural areas and unbanked locations targeting the financially excluded but can't give loans.

PSBs must also have up to 25% of their financial service touchpoints "in such rural areas as defined by the CBN from time to time". (How the CBN account for digital financial service touchpoints that can be accessed from anywhere in the stipulated 25% is unclear). The CBN also set a minimum capital adequacy ratio of 10% for PSBs.

Also Read: An explainer on the consolidation of financial services licences

However, unlike deposit money banks (e.g., commercial banks), PSBs are not permitted to make loans and advances.

Also, the minimum share capital of a PSB in Nigeria is N5 billion and they are also required to maintain a Statutory Reserve just like Deposit Money Banks. The CBN can also require that the PSBs maintain additional capital just like they do when they feel banks are at risk.

Comments ()