Curb your enthusiasm: payment service banks and financial inclusion in Nigeria

Can payment service banks help Nigeria achieve its financial inclusion target of 95% by 2024?

All the four major mobile networks in Nigeria have payment service bank (PSB) subsidiaries. 9mobile has 9PSB Limited; Airtel Africa has Smartcash PSB Limited; Globacom Limited has MoneyMaster PSB Limited; and MTN Nigeria has MoMo PSB Limited.

Almost a year after they received approval in principle (AIP) from the Central Bank of Nigeria (CBN), 9PSB and MoneyMaster received their licences in September 2020, alongside Hope PSB Limited — the outlier among the PSBs in Nigeria. Hope PSB is a subsidiary of Unified Payment Services Limited (UPSL), a financial technology firm founded in 1997 by a consortium of Nigerian banks.

Airtel and MTN announced they received AIP for their PSB subsidiaries on November 5, 2021. And if they satisfy the 13 conditions stipulated in the approved Guidelines for Licencing and Regulation of PSBs, they could receive final approval in the second half of 2022. (Judging from the precedence of the existing PSBs).

The foray of telecommunications company into financial services makes the day of stakeholders in the tech industry. Many believe telcos have the capacity to bank the unbanked; move the needle on financial inclusion in Nigeria.

But would MoMo and Smartcash really expand financial inclusion and not merely deepen it — providing financial services to the already banked population?

To answer that question, I consider how 9PSB and MoneyMaster have fared, speak to stakeholders in the tech industry, and examine the relationship between PSBs and financial inclusion in Nigeria.

Payment service banks and financial inclusion in Nigeria

The CBN introduced PSB licences after reviewing the 2012 National Financial Inclusion Strategy (NFIS). And the objective is to "enhance financial inclusion by increasing access to deposit products and payment/remittance services to small businesses, low-income households and other financially excluded entities through high-volume low-value transactions in a secured technology-driven environment".

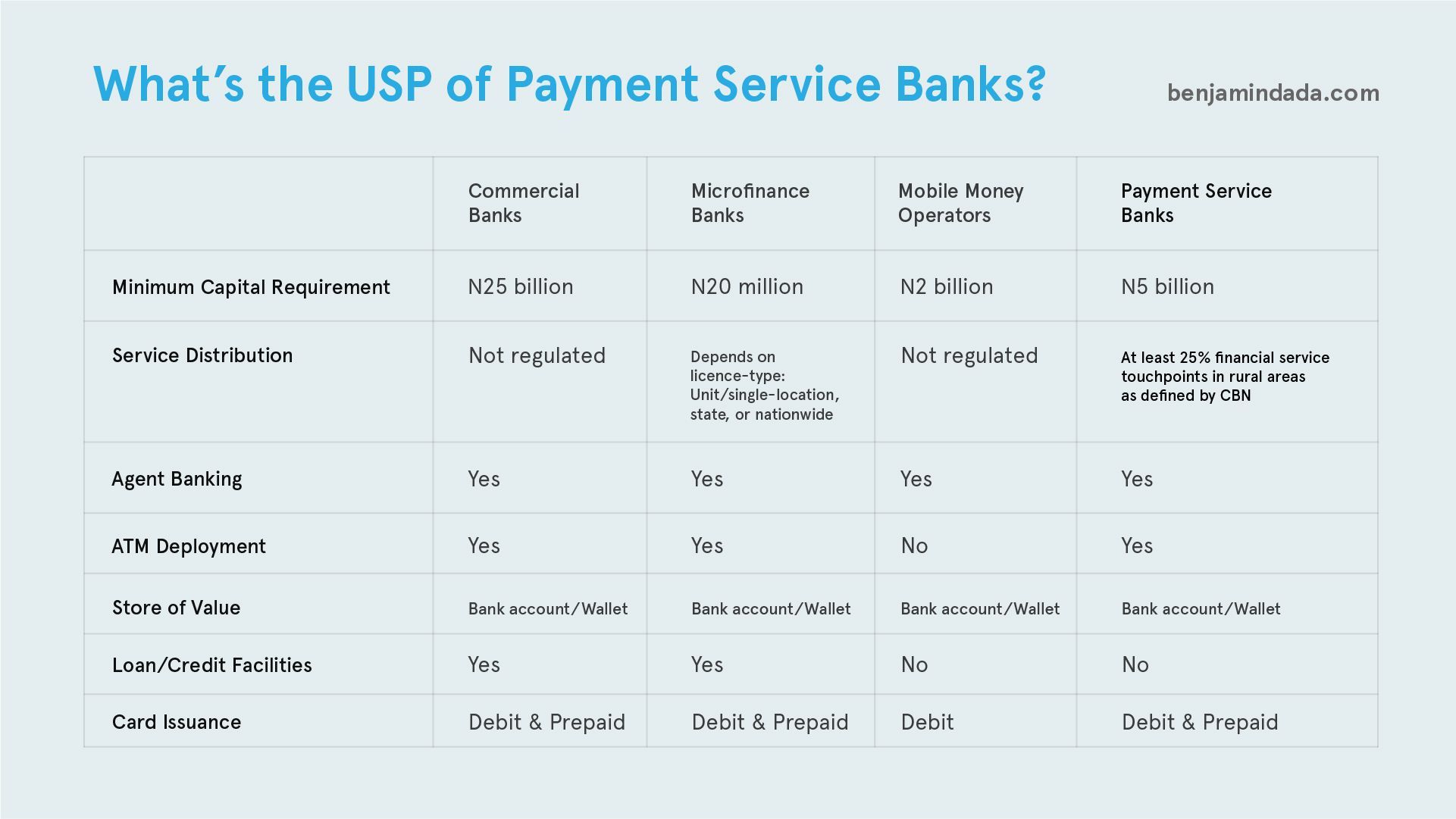

Essentially, PSBs are mobile money operators (MMOs) that can deploy automated teller machines (ATMs) or gagged microfinance banks — that must operate mostly in rural areas and unbanked locations targeting the financially excluded but can't give loans. PSBs must also have up to 25% of their financial service touchpoints "in such rural areas as defined by the CBN from time to time". (How the CBN account for digital financial service touchpoints that can be accessed from anywhere in the stipulated 25% is unclear.)

There's so much similitude between PSBs and other types of banks that the CBN insists every PSB must have PSB in its name, which must not include any word that links it to its parent company, to stand out. (The chart below show the differentiation between PSBs, deposit money banks or commercial banks, MMOs, and microfinance banks.)

Financial inclusion, according to the NFIS, "is achieved when adult Nigerians have easy access to a broad range of formal financial services that meet their needs at affordable costs". Financial services include payments, savings, credit, insurance, pension and capital market products. And Nigerian adults are people of 18 years and above. People not up to 18 years of age — minors — are not bankable because they cannot independently operate their accounts.

The NFIS definition of financial inclusion implies four things and creates four segments of people.

It implies that:

- The requirements for financial services are so simple that all segments of the population can easily access them.

- Financial services are broad enough to enable access, choice and usage.

- Financial services are designed to meet the needs of users, taking into cognisance income levels and nearness to target users through proper and appropriate distribution channels.

- Prices for financial services such as interest rate and other indirect costs are affordable even to low income earners.

And the four segments of people are the:

- Formally banked — adults who have access to or use commercial banks.

- Formal other — adults who have access to or use other financial institutions such as microfinance banks and MMOs.

- Informal only — adults who have access to or use informal services such as cooperatives.

- Completely excluded — adults who don't have access to or use any formal or informal financial products and services.

The banked (or formally banked) and formal other can be grouped as formally served.

Since the NFIS was launched on October 23, 2012 and a revised version released in 2018, the CBN and other stakeholders have rolled out myriads of financial inclusion initiatives to reduce financial inclusion to 20%. Or put differently, ensure 80% of Nigerian adults have access to financial services by 2020. (That target has not been met as of November 2021. But the CBN Governor Godwin Emefiele believes Nigeria will achieve 95% financial inclusion by 2024.)

In addition to PSBs, other financial inclusion initiatives the CBN and other NFIS stakeholders have launched include microfinance banking, agent banking, tiered know-your-customer requirements, super agents, MMOs, Shared Agent Network Expansion Facilities (SANEF), and eNaira.

> Also Read: [An explainer on the consolidation of financial services licences](/5-billion-psb-psp-mfb/)But none of these initiatives have been overwhelmingly successful.

For instance, mobile money customers in Nigeria increased from 5.54 million in 2016 to 15.3 million in 2019. But since 2019, people using mobile money accounts have stagnated at 5.6%. The EFInA (Enhancing Financial Innovation & Access) also reported that only 19% of agents across Nigeria provided account opening or registration service to customers in 2020, compared to the 68% and 51% reported in 2015 and 2017, respectively. People can't access financial services without an account — bank or mobile money account.

The EFInA has been tracking access to financial services in Nigeria through its biennial survey since 2008. The financial deepening organisation said mobile money deepens rather than expand financial inclusion levels because it's mostly people already banked who are using mobile money service.

In its latest report, the Access to Financial Services in Nigeria 2020 Survey, EFInA said 64.1% of 106 million Nigerian adults are financially included. That means 35.9% of Nigerian adults, or 38.05 million bankable adults, remain completely excluded. That's not much of a progress when compared to the figures reported in the 2018 Survey. Then, bankable Nigerian adults were 99.6 million and 63.2% of them were financially included.

EFInA also noted 51% of Nigerian adults are using formal services such as bank, microfinance bank, mobile money, insurance, or pension accounts. That's barely a two-percentage-points increase from the 49% reported in 2018. And it's largely driven by the growth in banking. Forty-five percent of Nigerians are banked in 2020, up from 40% in 2018.

Industry stakeholders thoughts on payment service banks

"Glo, 9mobile and UPSL have previously gotten licences [for their PSB subsidiaries] but their impact has been next to minimal", Trium Limited CEO Adedeji Olowe told me.

"I am very happy that the CBN has given licences to MTN and Airtel. It would bring a significant impact to the game", he said. "My bet is only on MTN though because they have the experience and the execution DNA to make it happen".

People familiar with the matter also said the AIP now granted to MTN and Airtel is an attempt to correct previous error in judgement as there's no justification for denying MTN and Airtel PSB licences ab initio.

MTN has been making attempts to provide financial services in the country for more than a decade, despite its love-hate relationship with the Nigerian government.

"About 2011 or so when they first tried, they had set up a department — I remember speaking to the department head [Usoro Anthony Usoro, General Manager of Mobile Financial Services] — branded kiosks, trained agents, prepared publicity and were ready to go hard", Awabah co-founder Tunji Andrews said.

MTN was lobbying for a mobile money licence similar to what Paga got in August 2011, he added. "MTN also tried to partner with a few banks to overcome regulation but I guess it wasn't profitable".

In partnership with banks, both MTN and Airtel have been providing mobile money service through Airtel Money and MoMo. But they've not recorded as much success as they did in other African countries, particularly MTN whose mobile money service is huge in Ghana. Interestingly, Airtel has sold parts of its mobile money business to TPG Capital and Mastercard.

"MTN desperately wants to be rid of the chokehold banks, especially the Tier I banks, have on it", Olowe, who is also a Trustee of Open Banking Nigeria, told me. (Tier I or FUGAZ banks refer to First Bank, UBA, GTCO [formerly GT Bank], Access Bank and Zenith Bank.)

In 2019, MTN secured a super agent licence for its subsidiary, Yello Digital Financial Services (YDFS). It enabled MTN to recruit agents and extend the scope of its retailers across the country to include providing financial services such as cash transfer through mobile money wallets. And within the first few weeks of obtaining the licence, more than 100,000 MTN retailers applied to be part of YDFS super agent scheme.

Airtel also announced on November 15, 2021, that its subsidiary, Airtel Mobile Commerce Nigeria Limited, has received AIP to operate as a super agent.

When asked if PSBs inability to provide loans limits their impact on financial inclusion, Olowe said no. Because PSBs can partner with lenders who can provide their customers credit facilities. "From a business model point of view, it may even be beneficial as PSBs can earn fees without the burden that NPLs [nonperforming loans] bring to the balance sheet", Olowe said. "But it comes at the risk of diluting the relationship they may have with their customers".

For many people who are financially excluded, PSBs would provide a means for them to get their first account, he added.

Indeed. According to the EFInA, 35 million unbanked Nigerians own mobile phones and could be reached with mobile money.

"MTN and Airtel have experience building payment services but Nigeria is different", Lemonade Finance CEO Ridwan Olalere said.

"It would have been a different scenario if they were licensed 10 years ago. But now, interoperability and portability already exist with a lot of other players. Instant payment in Nigeria is also very mature".

Olalere added that business models have evolved and capital also exist with a lot of other players. "Most of the markets mobile money really succeeded didn’t have an NIP-type solution at the time mobile money boomed", he said.

How has 9PSB, Hope and MoneyMaster fared?

Since they began operation in September 2020, 9PSB has been able to garner only 1,930 agents across the country. Whereas on Google Play Store, its agent app show 5,000+ downloads. And its user app has 10,000+ downloads and 3.6 out of 5 rating. Last month, 9PSB and Flutterwave announced a partnership to make banking more accessible.

Hope PSB app shows 10,000+ downloads with 4.1 rating.

Surprisingly, Glo's MoneyMaster does not have an online presence — no website or application. And its Head of Assurance, Compliance and Fraud Management, Sammy Mogusu, is yet to respond to my request for comment.

Also, MoneyMaster is not listed among the banks that allows NIBSS Electronic Fund Transfer or NIBSS Instant Payment. It's hard not to conclude MoneyMaster, which Glo poached about 20 top employees of Kenya's Safaricom to work on, is not a phantom.

It's pertinent to note all three entities were sent request for comment but none of them has responded as of press time.

Like other types of banks, PSBs have pros and cons, and some of them will fail. They are not a silver bullet to financial exclusion. Even in India, where they are called payment banks and launched in 2013, PSBs have not taken off and they are still working out the kinks. The story will not be any different in Nigeria.

Featured image credit: UNCTAD

Comments ()