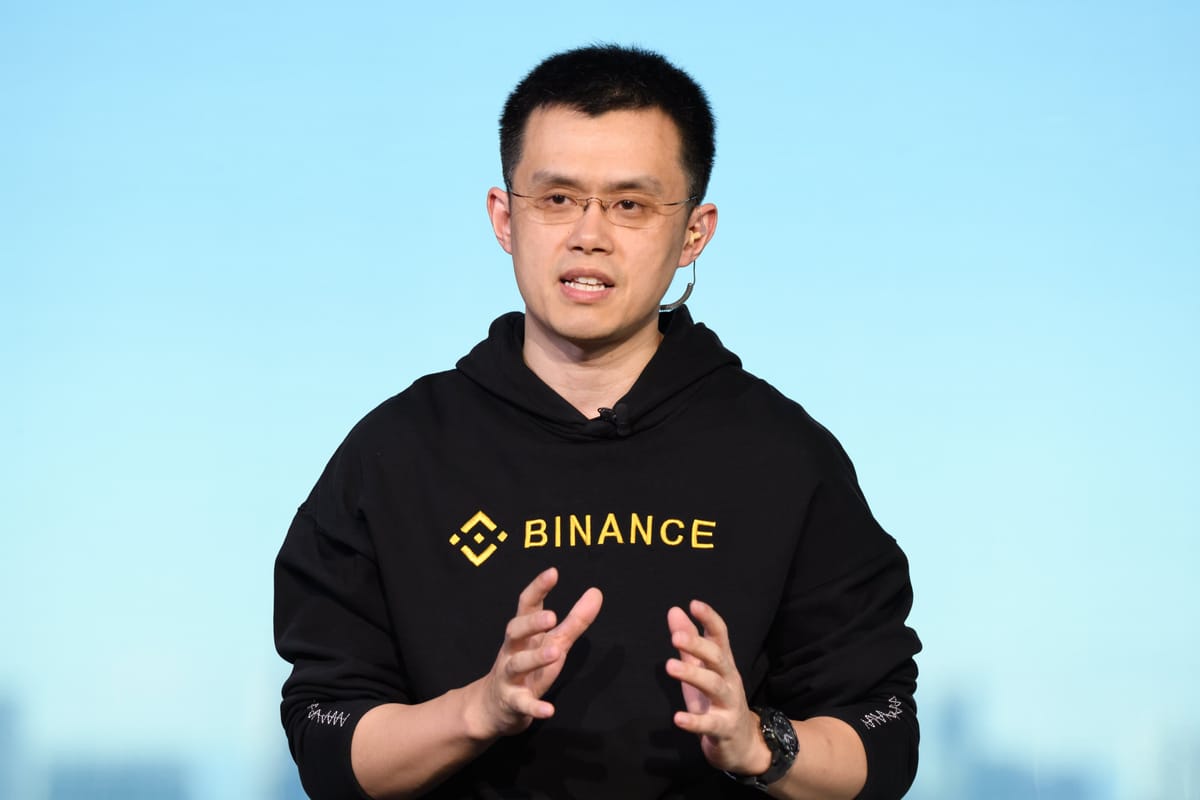

Binance CEO CZ is the latest crypto boss found wanting by U.S law

Changpeng Zhao who served as the CEO of Binance has resigned from his position and has plead guilty to several infractions raised by the Department of Justice and other U.S. agencies.

Adding to the count of well-fledged, so-called borderless fintechs that have recently faced the wrath of U.S. law, Binance, the world’s largest crypto exchange, is coming under the pressure of American justice.

In the late hours of yesterday, Changpeng “CZ” Zhao, announced that he is stepping down from his role as CEO of Binance, in a post with which he also admitted to having made mistakes during his time at the company he has led since its inception.

“Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself,” Zhao wrote in a post to X.

CZ’s resignation climaxes yearslong investigations into Binance by the U.S. Department of Justice, inspired by suspicions of violating anti-money laundering laws and other sanctions. Ending the criminal investigation, Zhao has pleaded guilty and looks to resolve a $4.3 billion penalty with the government.

According to the Treasury Department, Binance failed to sidestep and flag transactions associated with terrorist entities, referencing both ISIS and Al Qaeda. In addition to the settlement, Binance will be monitored for further compliance for five years.

“Binance turned a blind eye to its legal obligations in the pursuit of profit. Its willful failures allowed money to flow to terrorists, cybercriminals, and child abusers through its platform,” Treasury Secretary, Janet Yellen, said during a press conference.

Zhao’s departure marks the end of an era, but he will not be entirely separated from the business. As a founder, CZ remains the largest shareholder and will forthwith serve as a key consultant to Binance. Richard Teng, an exec at the firm, would succeed Zhao as CEO.

While Zhao was—and is possibly still—easily the richest figure in crypto, Sam Bankman-Fried was the most popular. An MIT graduate who founded FTX, Sam became the face of the second-largest crypto exchange in the world and an unofficial industry ambassador.

But, as it came to light in November 2022 that some of the FTX team used customers’ money for highly questionable purchases, Sam’s crypto empire cratered overnight. Interestingly, at the time, Zhao said Binance would ditch its FTX tokens, sparking the drama that turned Bankman-Fried’s fame sour.

He was arrested earlier this year, having been found guilty of what is described by American prosecutors as one of the country’s biggest financial frauds, one which sees Sam face up to 110 years in confinement. He has admitted to making mistakes but denied fraudulence.

Related Article: "Binance operations in Nigeria are illegal," SEC reiterates

Similarly, Do Kwon, the South Korean who co-founded Terraform Labs, a billion-dollar stablecoin developer whose value wipeout saw it become branded as a glorified Ponzi scheme, faces multiple criminal charges in South Korea and the U.S.

Bankman-Fried and Do Kwon aside, the concern is whether Zhao’s plight, as well as that of Binance, is finally over or has only begun. Where do things go from here? Time will tell.

Binance’s regulatory scandals have not been particularly happening in isolation. In June, Nigeria’s capital market watchdog, the Securities and Exchange Commission (SEC), issued a circular restricting the platform’s operations. Little over a month later, the SEC declared Binance’s Nigerian activities illegal, effectively bringing them to a halt.

Back in 2021, South Africa’s financial regulator, the Financial Sector Conduct Authority (FSCA) alleged that Binance was not legally operating in the market and may be in breach of local laws. The FSCA called on the public to be “cautious and vigilant” when dealing with the group.

Around the same time, similar troubles rocked the company in Singapore. The country’s central bank, the Monetary Authority of Singapore (MAS), stated that Binance’s local operations may be in contravention of its Payments Services Act. MAS also warned that the company is not licensed to process payments in Singapore.

Binance has also battled regulatory issues in the U.K., Netherlands, Germany, Thailand, Japan, Hong Kong and Lithuania.

Comments ()