BD Insider, Letter 138: Where FTX invested in Africa

In BD Insider, Letter 138, we examine the African startups funded by FTX and Alameda Research and Why Google is restricting illegal loan apps in Nigeria and Kenya.

In BD Insider, Letter 138, we examine:

- African startups funded by FTX and Alameda Research

- Why Google is restricting illegal loan apps in Nigeria and Kenya

- Safaricom's plan introduce mobile numbers for Kenyans under 18

and other noteworthy information like:

- the latest African Tech Startup Deals

- opportunities, interesting reads and more

The Big Three!

African startups funded by FTX and Alameda Research

Why it matters: Last week, Nigeria-based Web3 startup, Nestcoin was the first African company to disclose that it was affected by FTX's liquidity crises. "Last week's events have had an impact on us, as we held our assets (cash and stablecoins) at FTX to manage our operational expenses," Yele Bademosi, Nestcoin's co-founder and CEO, said.

Although the FTX collapse did not "impact on [Nestcoin] customers financially", the company disclosed that it will be laying off some of its employees. According to Bademosi, Nestcoin used FTX to save a "significant proportion of the stablecoin investment" it raised from Alameda Research—one of the investors in its pre-seed round with less than 1% equity in Nestcoin.

Who is Alameda Research?: Alameda Research was Sam Bankman-Fried's first company. He built FTX partly to help Alameda's trading business—Alameda has made more than 150 investments across the crypto industry, according to PitchBook.

Some of these investments were made into African companies like Ovex, Nestcoin, Chipper Cash, Mara and Jambo. Unlike Nestcoin, the aforementioned companies have not disclosed if their funds were held on FTX.

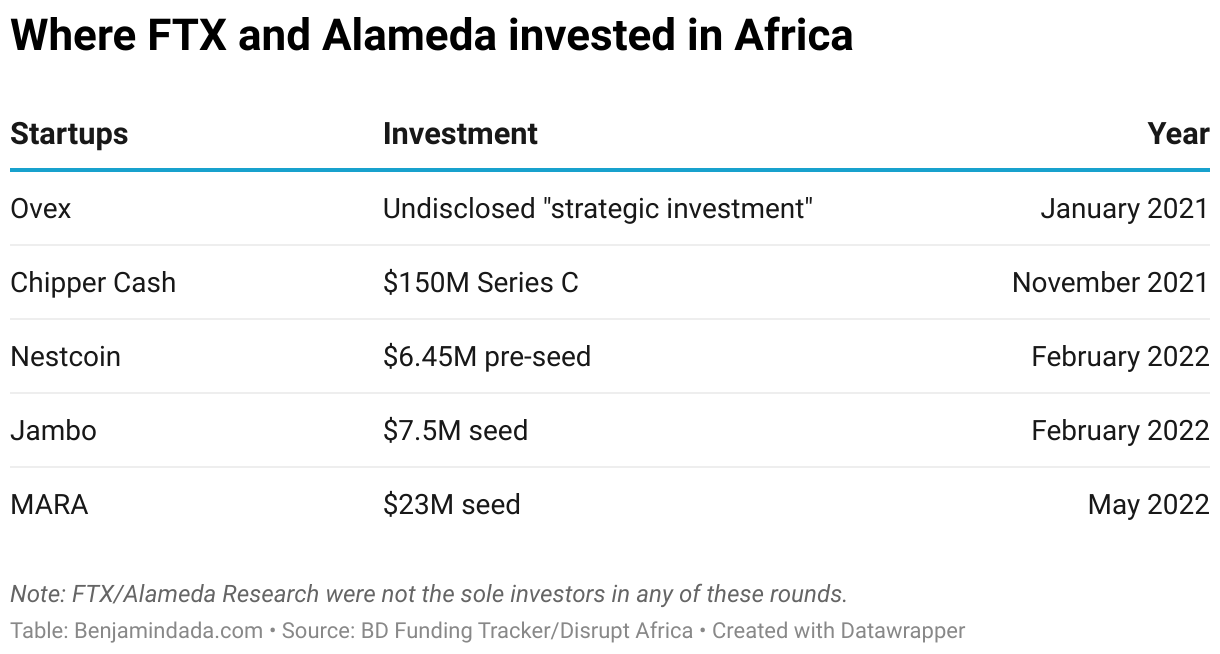

Where FTX and Alameda invested in Africa:

- Ovex, a South African crypto exchange announced an undisclosed strategic investment from Alameda Research in January 2021—this is the exchange's first disclosed investment in Africa.

- In November 2021, FTX led a $150 million Series C extension round in Chipper Cash. This Series C extension pushed the company's valuation to $2 billion, making it the seventh African unicorn.

- Nestcoin secured a $6.45 million pre-seed in February 2022, Alameda Research was one of the several investors that backed the company in the round.

- In the same month as Nestcoin, a Congo-based Web3 company, Jambo raised $7.5 million in seed funding from Alameda Research and other investors including Coinbase Ventures and Tiger Global.

- Later in May 2022, FTX through Alameda Research participated in the $23 million seed fund of Mara, a pan-African crypto exchange.

Zoom out: With its collapse, South African cryptocurrency market maker, Ovex has withdrawn FTX's local Financial Service Provider (FSP) licence. "FTX is now unlicensed to market its services in South Africa," Nick Bergonzoli, Ovex's community manager said. "People should avoid using FTX."

The Fincra Writeathon is here!

Write about all the awesome things you’ve built or are building with Fincra’s APIs and stand a chance to win cash prizes 🚀

This is partner content.

Google will now restrict illegal loan apps in Nigeria and Kenya

The News: From January 2023, loan apps operating in Nigeria and Kenya will be required by Google to provide their operating licence in these countries or they will be removed from Google Playstore, according to the company's updated Developer Programme Policy.

In Nigeria, Google said that "digital money lenders (DML) must adhere to and complete the Limited Interim Regulatory/Registration Framework and Guidelines for Digital Lending, 2022 (as may be amended from time to time) by the Federal Competition and Consumer Protection Commission (FCCPC) of Nigeria and obtain a verifiable approval letter from the FCCPC."

For digital loan apps operating in Kenya, Google said "digital credit providers (DCP) should complete the DCP registration process and obtain a licence from the Central Bank of Kenya (CBK). You must provide a copy of your licence from the CBK as part of your declaration."

Why it matters: With the rise of predatory lending practices in both countries, the local regulators have accused Google of aiding the operations of illegal loan apps in their countries.

"We are trying to close some Apps down from Google and there is some resistance," Babatunde Irukera, FCCPC's CEO, said in April 2022—a month after the agency asked Google and Apple to remove some lending apps from their stores.

In March 2022, the Central Bank of Kenya (CBK) also released the Digital Credit Providers Regulations[pdf] to regulate the ongoing proliferation in the digital lending industry. According to CBK, only 10 digital credit providers are licensed to operate in Kenya, out of 288 providers in the country who have active apps on Google Playstore and other platforms.

Safaricom is introducing mobile numbers for Kenyans under 18 years

The news: Safaricom has disclosed that it will launch mobile numbers for juniors (Kenyans under 18 years) allowing them to save money on M-Pesa, text or make calls. The decision has been backed by the local regulator, the Communication Authority of Kenya (CAK).

Why it matters: "Going forward the junior will be able to have their own number but under the parent account and that convert to the junior automatically when they turn 18 rather than having that problematic element that used to happen before," Safaricom CEO Peter Ndegwa said.

According to Ndegwa, the special sim cards will have features protecting juniors from accessing services such as betting and others. "We have simplified the menu that the junior account will have so that they are not able to access certain services like betting," he added.

Zoom out: The debate about the right time for children to own smartphones and mobile numbers has been ongoing for a while now. According to a 2020 UK study, most children own a mobile phone by age of seven.

Currently, there is no legislation on children's phone ownership on the continent. uLesson argues that increasing mobile device ownership drives online learning in Africa.

According to a 2022 report by uLesson, a Nigerian edtech company, mobile phones are a critical tool for modern education. 52% of uLesson learners—mostly under 18—access the app via smartphones.

🧩 BD Trivia: YouTube Black Voices Fund 2023

Which of these stars is not in the YouTube Black Voices Fund class of 2023?

It's Friday and you know we have something fun for you.

— Bendada.com (@bendadadotcom) November 18, 2022

Stand a chance to be our tech bro/sis next week by answering correctly. pic.twitter.com/RPm4RHlcMK

💰 State of funding in Africa

Quick points:

- Amidst the economic downturn, International Finance Corporation (IFC) launched a $225 million venture capital fund to support early-stage startups in Africa, the Middle East, Central Asia and Pakistan.

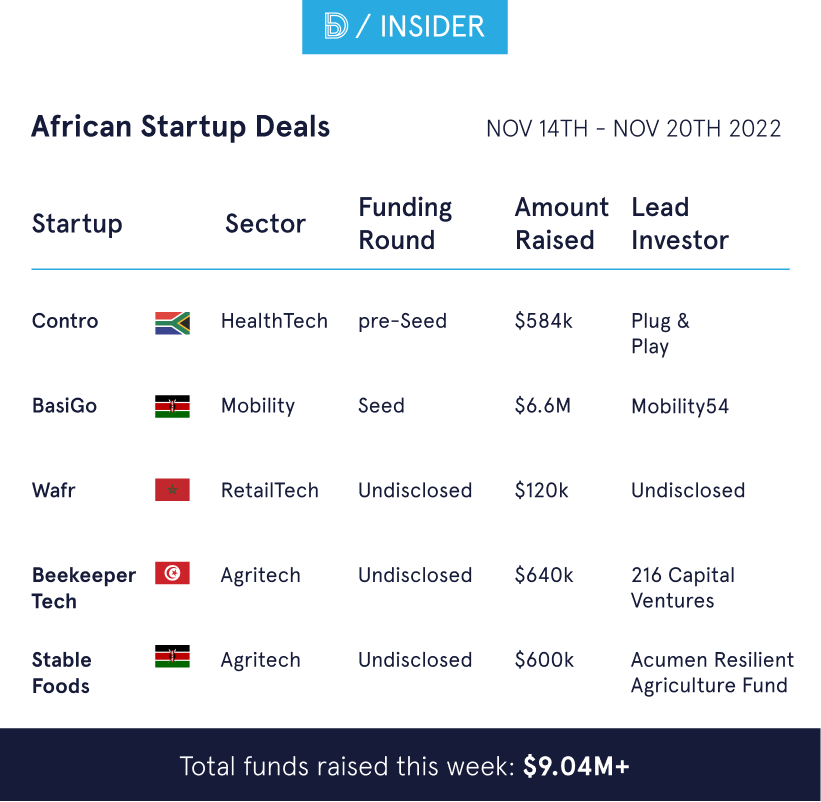

- Five African startups jointly raised $9.04 million between November 14-20, 2022—BasiGo's $6.6 million seed was the largest amount raised in the week under review.

Merger(s) and Acquisition(s):

- Pan-African cross-border payment app Chipper Cash is set to acquire Zambian fintech company Zoona Transactions International.

Get free access to our carefully-curated, real-time updated Funding Database for 2022.

📚 Noteworthy

Here are other important stories in the media:

- Why Jumia is suspending its loyalty subscription offering: African e-commerce company, Jumia has suspended Jumia Prime, a subscription-based delivery service providing customers with free shipping on its marketplace.

- Twiga Foods lays off 21% of its employees: Twiga has laid off 211 of its full-time employees due to restructuring—this has eliminated the startup’s in-house sales team.

- How CBN intends to protect Nigerians in unbanked areas amidst Naira redesign: Ahead of the circulation of the new Naira notes, the Central Bank of Nigeria, CBN has disclosed that agency bankers have been accorded priority to enable cash collections in unbanked areas.

- Paystack is now a licensed Payment Service Provider in Kenya: The Central Bank of Kenya (CBK) has granted Paystack a Payment Service Provider licence to operate in Kenya. The Nigeria-founded fintech company has also launched its private beta in the country.

- Meet the Africans in YouTube Black Voices Fund music class of 2023: Ahead of 2023, YouTube has named 40 Black musicians across the world, including six Africans as part of the music class of 2023.

- Inside the “Ethereum Climate Platform” launched at COP27 to address carbon emissions: Leading technology companies have collectively launched “Ethereum Climate Platform” initiative to address Ethereum’s former proof of work carbon emissions.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Payhippo — Head of Product

- Canonical — Head of Design (Lagos, Nigeria)

- Paystack — User Operations Specialist (South Africa)

Data & Engineering

- M-KOPA — Software Engineering Team Lead (Accra, Ghana)

- Stears — Data Analyst, Content & Engagement (Nigeria)

- Yassir — DevOps Engineer (Dakar, Senegal)

Admin & Growth

- Apple — Senior Artist Campaign Manager (Lagos, Nigeria)

- Binance – Growth Marketing Manager (Lagos, Nigeria)

- Klasha — Marketing Lead (Lagos or Cape Town)

Other opportunities

- For blockchain enthusiasts in Nigeria: NITDA in partnership with Domineum has launched the NITDA Blockchain Scholarship programme that will train 30,000 Nigerians to become blockchain developers.

- For young Africans: Applications are open for the Binance Charity Tech Scholarship, the programme aims to educate over 53,000 Africans with various skills including data science, UX/UI science, product management and software development.

Events

- The Lagos Digital Summit, themed "Scaling Businesses leveraging Digital Technology, will hold this Friday, November 25, 2022, at The Zone Tech Park, Gbagada Lagos by 10 AM (WAT). Here's why you should attend.

- The 4th annual Africa@Scale Summit by Africa Foresight Group will hold from December 1 - 2, 2022 at the Mount Nelson Hotel in Cape Town, South Africa. Reserve a seat.

To advertise with us, please reach out to david@benjamindada[dot]com, and cc: hello@benjamindada[dot]com.