How to be an angel investor with less than $3,000 (₦1.2 million) in Nigeria

How to be an angel investor with less than $3,000: Join an angel network, join a syndicate or angel group, and use tokenized equity platforms like GetEquity and WeFunder.

Venture capital and private equity firms don’t have the monopoly of investing in startups. Many upwardly-mobile professionals and high net worth individuals (HNIs) can invest in startups as angel investors, too. But they are faced with some challenges.

People looking to diversify their investment portfolio through angel investing are often oblivious to the most lucrative deals. And when they are aware of these deals, the size of their cheques might be too small to participate in the funding round — usually pre-seed, seed or bridge round. Also, because Nigeria has no policies or regulations on angel investing, first-time investors are susceptible to unscrupulous founders.

This guide is for anyone with some disposable income — about $3,000 — who wants to be an angel investor.

Who is an angel investor?

An angel investor, according to Investopedia, is someone with excess funds looking for a higher rate of return than those provided by traditional investment opportunities so they invest at the early stages of startups.

Angel investors are also known as angel funders, private investors, seed investors or business angels. They provide early-stage startups with capital in exchange for ownership equity or convertible debt. And their term sheets are usually more favourable compared to other sources of funding for startups. Angel investors often invest as a way of supporting the founding team and as such, they focus on helping the startup take its first steps rather than on their returns on investment.

But this does not mean angel investors are philanthropists or do-gooders. They are in it for the money, too. Jason Lemkin, the founder of Saastr — a leading community of SaaS founders, said a true angel can lose 100% of their investment and not care that much. "They are hunting for that one out of 50 that gives them a 100x+ return. The others don’t need to", he added.

Angel investors are different from venture capitalists (VCs) and limited partners. Limited partners (LPs) are investors in venture firms and they can be individuals or organisations. They are often institutional investors such as pension funds, college endowments, trusts, insurance companies, family offices, sovereign wealth funds, finance and development institutions. VC firms and angel investors can also invest in other venture funds as LPs.

How do angel investors make money?

Angels expect returns on their investment but they are not greedy.

The process through which angels — or any startup investors — make money is called exit. And it can happen in three ways: acquisition, secondary sale, and initial public offering (IPO). I’d give three examples to explain these options.

First is Stripe’s acquisition of Paystack. The deal was announced in October 2020 and closed in January 2021. Tizeti CEO Kendall Ananyi was one of the angels who invested in Paystack in 2016. After the acquisition, he said, "Paystack was a 20x return on my initial investment in dollars and even had a greater exit in pure naira terms (49x) since I invested in Q1 2016 when the exchange rate was still ₦200 to $1 and the exchange is now ₦490 to $1".

The second example is the secondary sale transaction carried out by Twiga Foods. When the business-to-business marketplace closed its $50 million Series C round in November, early investors also received $30 million through a secondary sale.

Lastly, Jumia’s IPO. MTN Group sold 11.7% of its 29.7% stake during the public listing process of the African e-commerce company. The 11.7% stake was sold for $180 million and the remaining stake was later sold for $220 million. MTN made about $157 million from its $243 million investment in Jumia.

In general, angel investors usually expect to receive their money back within five to ten years with returns of 20% to 40%. An analysis of the Kauffman Foundation Angel Returns Study and the NESTA Angel Investing Study, however, shows the best estimate of overall angel investor returns is 2.5 times their investment. That is, an investment of $100,000 would return $250,000.

How to be an angel investor with less than $3,000 (₦1.2 million)

Startups prefer to accept cheque sizes of $25,000 to $100,000 from angel investors. But there are three ways people who have less than that amount can still do angel investing. They can:

- Join a network of angels

- Join a syndicate or angel group/club

- Use platforms like GetEquity, WeFunder, SeedInvest, etc.

Again, before considering the three options in detail, these are some of the reasons why you should be investing in African startups if you’re flush with cash. Africa needs more angel investors who will provide the seed capital startups need to move from the idea phase to the growth phase. In 2018, for instance, VCs invested $135.5 million in Nigerian startups, while the most active network of angels in the country invested only $1.5 million.

In addition to the returns on your capital investment, you also get social returns. Because no one can predict what startups will succeed or fail, Alex Danco of Shopify Money said, angel investing provides a bragging platform. It is half "I saw this potential when none of you did" and half "I was invited to this deal and none of you was". Alex added that social returns aren’t just a happy side effect to angel investing; they are often the main thing people are really after.

Unlike financial returns that might take five years or more, social returns are immediate. They also get reinforced with follow-on fundraises. And in the worst-case scenario where the startup fails, if handled properly, angel investors would still get a lot of goodwill and recognition out of it.

Now, let’s consider the three ways anyone can become an angel investor with less than $3,000 (₦1.2 million)*.

1. Join a network of angels

A network of likeminded-investors provides structure and systems that make angel investing easier. By joining a network of angels, you would get access to deal flows, training, syndicates and support organisations.

The Lagos Angels Network (LAN) is the foremost network of angel investors in Nigeria. It was co-founded by Tomi Davies in 2012. Tomi said the network started with five angels and some supporting organisations including Paradigm Initiative Nigeria, Co-creation Hub, Wennovation Hub, KC Lions, Nokia, Digital Bridge Academy, and Mobile Monday.

While Angels are directly exposed to individual entrepreneurs and ventures through LANs sourcing and dealing process, the network strongly advises its angels to invest as a group to leverage their funding, relationships and expertise that’s made available to the investee startups and in so doing also build their portfolio of companies to the numbers required for success as an angel investor. Whilst historically LAN members may have lost money to unscrupulous entrepreneurs, today as Syndicate members with the deal sourcing and due diligence process of the network at their disposal, it’s become an increasingly rare occurrence.

Other angel networks have emerged across Nigeria since the LAN was launched almost a decade ago. Some of them are Abuja Angels Network, Diaspora Angel Network, and South-South/East Angel Network.

There are also angel networks across Africa. The African Business Angel Network (ABAN) is the foremost continental network of angels and Tomi Davies is also the founding president. The ABAN was started with the LAN, Cameroon Angel Network, Ghana Angel Investor Network, Venture Capital for Africa, Silicon Cape, and other supporting organisations including the European Business Angel Network, the LIONS Africa Partnership and DEMO Africa.

Carthage Business Angels in Tunisia, The Cairo Angels in Egypt, AngelHub Ventures in South Africa, and Viktoria Ventures and Angel Investment Network in Kenya are some of the other angel networks in Africa.

However, you don’t have to join multiple networks. As an angel investor in Nigeria, you can join any of the networks across the country or the ABAN. You can also attend high-level events like the AFSIC — Investing in Africa Conference and Expo and the Africa Tech Summit to network with other investors.

According to the Angel Investing in Africa report released by the ABAN in 2018, networks and other angel initiatives use varying operating models. Of the 33 angel investing initiatives surveyed across 22 African countries, 31% provide primarily introductory services, 31% provides structured processes for investment sourcing, 4% operates through clusters of groups like syndicates, and another 4% use the pooled investment vehicles operating model. The remaining 23% either didn’t state their operating model or use other sorts of models.

It’s therefore pertinent to examine the operating model of the angel networks and join only the one that’s best suited for you and your goals.

2. Join a syndicate or angel group/club

People — even those with the best intentions — often confuse syndicates with angel groups or clubs. An angel group is comprised of investors who agree to invest together in a startup. Whereas, a syndicate provides an opportunity for investors to participate in the deals of a professional lead investor. And the angels would pay the lead investor carried interest — a percentage of their returns on investment.

For instance, if the lead investor charges a 20% carry and you invested $2,500. After a successful exit with 2.5x returns ($6250), you’d first receive your initial capital of $2,500 and the lead investor would remove their 20% carry from the profit. That is, 20% of $3,750 which is $750. You’d walk away with $3,000 as your effective returns on investment.

To an extent, angel groups or clubs are unstructured syndicates. An angel investor with $2,500 can convince nine other people in their network to pitch in to raise $25,000 that can be invested in any startup.

Both syndicates and angel clubs have pros and cons. People like to join syndicates because the leading investors are usually professional investors with experience and success. But the carry and subscription fee syndicates charge make angel clubs the better option for some investors.

"Angel investing diligence is much less structured than VC diligence, which takes months. The four components are financial diligence, operational diligence, technical diligence and legal diligence. That’s why they take so long. And most VCs will outsource one or more of those to third-party firms", the co-founder of Startupbootcamp, Zachariah George, said.

Angels don’t have time for that. They have a one or two-hour call with the founding team. And the questions they need to be asking are — how big is this market? What are the average margins? Who are your biggest competitors? And angels get a lot of that done by investing in syndicates. I would suggest being part of a group where you have people with varying expertise.

These are some of the many angel groups/clubs and syndicates across Nigeria and Africa angel investors can join: Rally Cap Ventures, Hoaq Club, Future Africa Collective, Tekedia Capital, CcHUB Syndicate, Investzilla, and FDHIC Catalyst Fund.

i. Rally Cap Ventures is a collective that enables "operators and founders to collaboratively invest in the best early-stage emerging market fintechs". According to its latest deck, Rally Cap charges a one-time administrative fee and a 12.5% carry.

ii. Hoaq Club is an investment group of "creators and operators backing entrepreneurs in building scalable businesses for Africa and its Diaspora". The minimum investment is $1,000 and there’s no limit to the multiples of $1,000 investment you can make.

Special love & s/o to the key players that made this happen 🙏

— Yewande O (@yewiedewie) May 6, 2021

- @Babajiide & @haydenalcalde - @RallyCapGlobal

- @NubiKay & @joekinvi - @hoaqclub

- Amazing partners & syndicate deals

Also thanks to all the startups that have included us in their journey and growth.

iii. Future Africa Collective is a syndicate that allows you to "invest alongside the Future Africa team on a deal-by-deal basis". It charges an annual subscription fee of $1,000 or a quarterly subscription fee of $300 and a 20% carry. The minimum amount you can invest is $2,500.

iv. Tekedia Capital is an investment firm that provides a syndicate "for individuals, institutions and investment groups anywhere in the world to invest at least $10,000 in technology-anchored companies with a focus on Africa". It charges an annual subscription fee of $1,000 or ₦430,000 and a 20% carry.

v. CcHUB Syndicate provides a platform for "investors all over the world to co-invest in the most innovative companies across Sub-Saharan Africa along with CcHUB". It charges a 15% carry and the minimum you can invest is $5,000.

vi. Investzilla is a syndicate launched by Jason Njoku in January 2021. It provides "access to 25+ investment decks and financials from some of the hottest technology companies in emerging markets. If you are conservative or short term investor, this community is not for you". The membership fee to join is $500 and the minimum investment is $5,000. Investzilla charges a 20% carry.

vii. FDHIC Catalyst Fund connects "qualified investors with investment opportunities in the fintech and healthtech space". These qualified investors include both individuals and corporates.

Individual investors are charged an annual subscription fee of $1,000 or a quarterly subscription fee of $300 and their minimum investment is $2,500. Corporate investors are charged an annual subscription fee of $3,500 or a quarterly subscription fee of $1,000 and their minimum investment is $4,000. The FDHIC Catalyst Fund charges a 20% carry and deducts 1% of each investment to cover the legal and administrative costs of investment.

3. Use platforms like GetEquity, WeFunder, etc.

One of the reasons you should consider investing with other people is to ensure you’re not making emotional investment decisions. However, if you’re up for it, these platforms allow you to invest directly in startups with as little as $100. This is possible through private equity tokenization.

One of the reasons startups don’t accept piecemeal capital from angel investors is because it’d be difficult to manage their cap table. But with these platforms providing tokenized equities, companies can easily manage their relations with small money investors.

i. GetEquity was founded by Jude Dike and William Okafor in January 2021. It provides access to new investment opportunities and enables individuals to trade in digital security assets and invest in small and medium enterprises and startups. You can create an individual, company or syndicate account on the platform.

> **Also Read:** [GetEquity launches additional suite of products, including Dealroom](/getequity-launches-dealroom/)An individual account allows you to buy and sell company shares or assets. A company account allows you to list company shares and create deal rooms to give tokens (equity) to your employees or members. And with a syndicate account, you can have members who trade these tokens among themselves. GetEquity charges investors a token (pun intended) in trading fees.

ii. WeFunder provides a platform for anyone to invest as little as $100 in startups they care about. Because the company is based in the United States and targets Americans, payments and identity verification might hinder angel investors in Nigeria and Africa from using the platform. However, Wise (formerly TransferWise) and other online money transfer platforms are good workarounds for payments.

WeFunder charges investors a 2% fee — minimum of $8 and maximum of $100 — on payments made through banks, wires or cheques. And it charges a 3.5% fee on credit card payments.

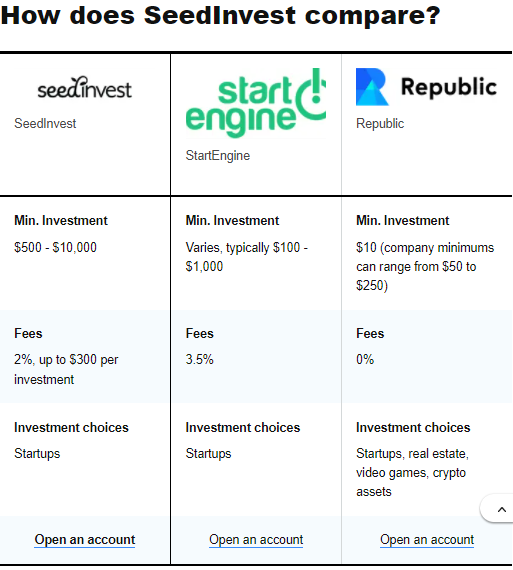

iii. Other platforms include SeedInvest, Republic and StartEngine

Most of the platforms making investing in startups accessible to everyone are based abroad. And as such, investors in Nigeria and Africa interested in using the platforms would have to navigate some bottlenecks.

*Exchange rate as of December 28, 2021.

If you know other networks, angel groups, syndicates, and platforms that should be included, please send me an email or send a DM on Twitter.

Comments ()