The Bank of Ghana is reviewing the activities of Flutterwave in the country as part of its continuous surveillance of the financial system.

The Bank of Ghana (BoG) is conducting a review on the activities of Flutterwave in the country.

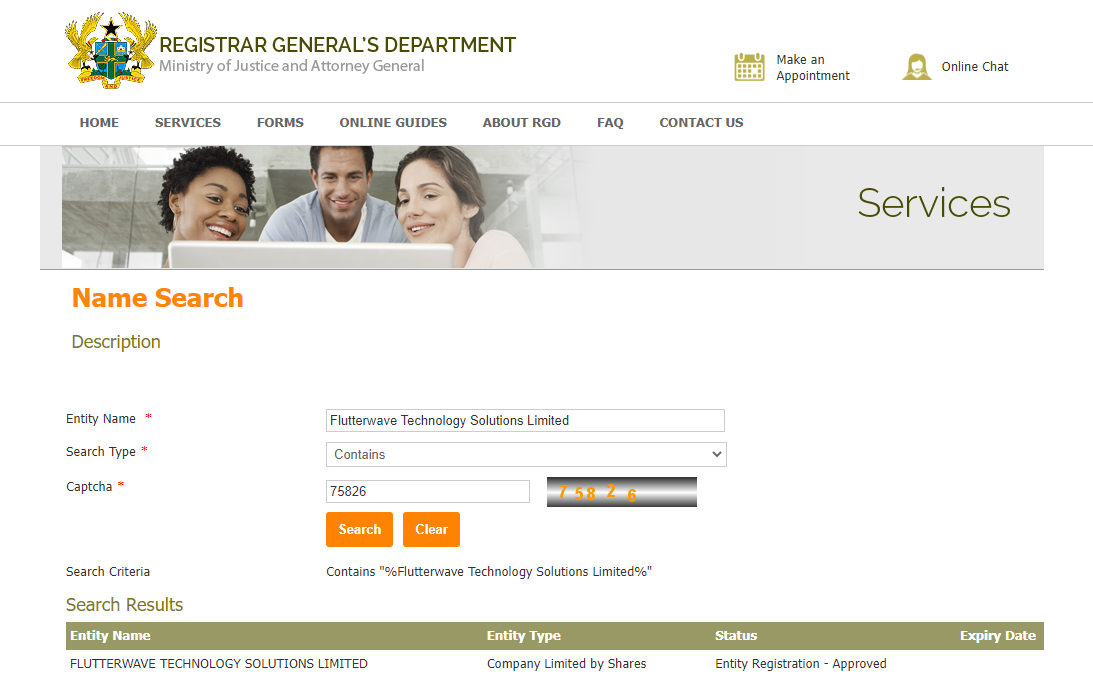

In a request for information letter (dated July 13, 2022) from BoG to financial institutions in Ghana seen by Benjamindada.com, Ismail Adam, the Head of Bank Supervision said: "The Bank of Ghana is conducting a review on Flutterwave Technology Solutions Limited as part of its continuous surveillance of the financial system."

Adam instructed the financial institutions to provide the details of services provided by Flutterwave to their institutions, as well as the fintech company's operational accounts and other financial exposure details. All of this information was meant to be submitted to BoG by July 20, 2022.

Even though Flutterwave has been operating in Ghana for a while, it has not been listed by the BoG as an approved fintech and innovation institution. However, it is not uncommon for African fintech startups to commence groundwork before securing a license.

The ongoing review by the Bank of Ghana is coming within a period where Flutterwave has been accused of several financial misconducts. The Central Bank of Kenya (CBK) recently announced that Flutterwave and Chipper Cash are not licensed to operate in the country.

CBK further instructed financial institutions in Kenya to "cease and desist from dealing with Flutterwave and Chipper Cash". Prior to CBK's move, the Kenyan Asset Recovery Agency (ARA) secured a court order to freeze bank accounts linked to Flutterwave citing "international money laundering". However, the fintech denied the allegations.

Since its launch, Flutterwave has been on a mission to create endless possibilities for customers and businesses in Africa and the emerging markets. To date, the company has processed over 200 million transactions worth over $16 billion across 34 countries in Africa including Nigeria, Uganda, Kenya, and South Africa.

In February 2022, the fintech company raised $250 million in Series D funding led by B Capital Group, with participation from Alta Park Capital, Whale Rock Capital, Lux Capital. Existing investors—Glynn Capital, Avenir Growth, Tiger Global, Green Visor Capital and Salesforce Ventures. The Series D raised the company's valuation to over $3 billion.

Editor's Note:

- This is a developing story, it will be updated as more details emerge.

- August 1, 9:57 AM—We edited the word "investigation" to reflect the BoG's choice of the word "review"

Comments ()