Flutterwave 3.0: New products, major rebrand as African fintech giant goes beyond payments

A few days after becoming Africa's most valuable startup, Flutterwave hosted a flagship event to unveil its major rebrand and also announce its prospect for the coming years.

What will Flutterwave 3.0 achieve?

In a virtual event tagged Flutterwave 3.0 on Friday, 18th February 2022, Flutterwave unveiled a significant change in brand identity by launching new products.

This follows the announcement of $250M Series D funding last week. The new identity signifies Flutterwave’s mission to create endless possibilities for all, through technology. And as well as introduce new products and services that take the technology leader beyond payments.

The event which was streamed live on Youtube saw the African Unicorn launch a series of products which includes:

- A Fintech as a Service (FaaS) solution which helps startups of all sizes quickly become Fintech companies using Flutterwave’s pre-built API and solutions.

- Capital, a technology platform for businesses & consumers to access Buy Now Pay Later (BNPL) & Merchant lending from regulated and certified credit providers.

- Grow, a B2B product that helps entrepreneurs easily incorporate their businesses globally.

- Checkout, a new checkout experience that is 5x faster, reducing drop-off by 60%.

- Card issuing, technology platform to enable businesses to issue both Mastercard virtual and physical debit/prepaid cards to their customers in partnership with Mastercard. These solutions remain subject to regulatory approval.

Some additional improvements to existing products include; a new powerful dashboard, Barter v4, and an AI-powered compliance process. The Flutterwave visual rebrand comes with six new primary colours which depict creativity, motivation, passion, ease, robustness and eagerness.

Friday’s event saw Flutterwave affirm its commitment to explore more areas of growth for businesses, startups and individuals. The move comes after a significant diversification of products in 2021, whereby the company announced the acquisition of Disha, a creator platform where creatives can receive money from across the world for their craft.

In the same year, Flutterwave went on to introduce Market, an extension of its e-commerce solution, Store to improve visibility and by extension, revenue for small businesses. Alongside global Afrobeats superstar Wizkid, in December Flutterwave launched a remittance solution, Send, to help anyone in the world send and receive money.

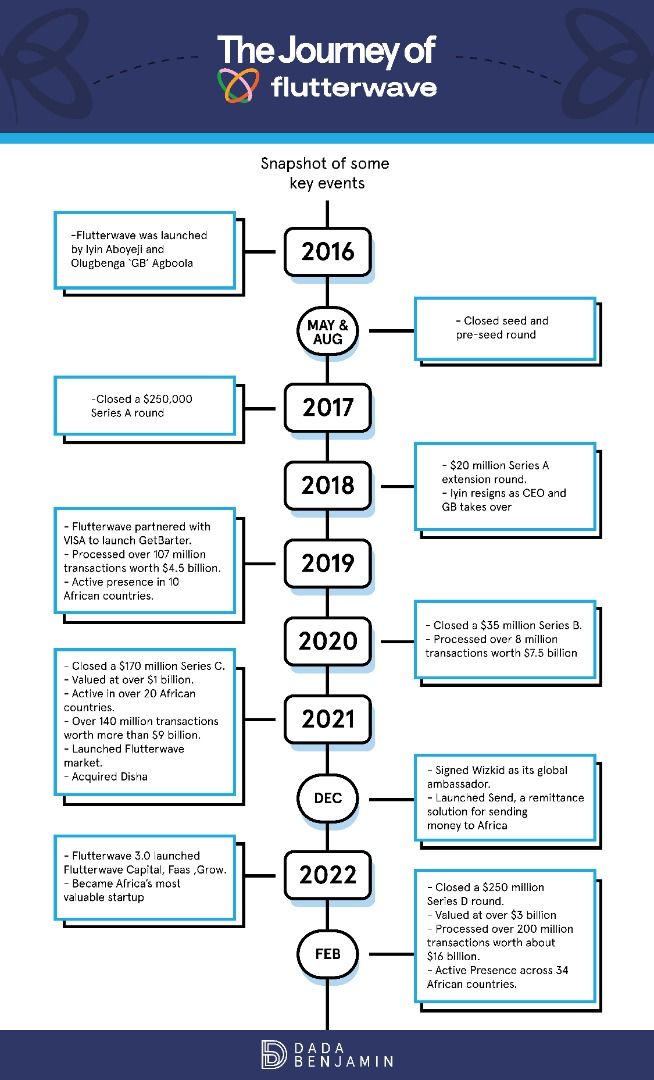

Flutterwave launched in 2016, initially building innovative financial infrastructure to enable payments for banks and institutions, before expanding into checkouts and gateways for businesses of all sizes.

Having invested in and built out a suite of products and services targeted at both consumers and businesses, Flutterwave has gone on to serve over 900,000 merchants, process over 200 million transactions worth over $16 billion to date, across 34 countries in Africa, which has led to the company becoming one of Africa’s earliest unicorns in March 2021.

In a tweet co-founder and former CEO, Iyinoluwa Aboyeji said “I don’t know much about financial valuations but one thing I believe about the Flutterwave vision since 2016 when we began this journey. We have not yet scratched the surface of what becomes possible when Africans and African businesses are connected to the global economy.”

I don’t know much about financial valuations but one thing I believe about the @theflutterwave vision since 2016 when we began this journey.

— iyin.eth (@iaboyeji) February 18, 2022

We have not yet scratched the surface of what becomes possible when Africans and African businesses are connected to the global economy.

“We’re growing and for us, payments have become a means to an end.” Founder and CEO, Olugbenga GB Agboola, said, “Every part of our lives includes some form of transaction. Beyond powering those transactions, we want to also create those transactions. We want to help event organisers seamlessly register and sell out their event. We want to help artists receive money for their craft. We want to help entrepreneurs incorporate their businesses. We want to help startups build financial technology products easily and we want to create endless possibilities for all through technology.”

He also added, “Our new identity is a system that recognises how far we’ve come in our mission. It gives us space to include all of our dreams and aspirations for businesses and customers. It gives us the freedom to do and be more. We’re excited for this new chapter in our growth.”

What is Flutterwave Capital?

As we earlier mentioned, Flutterwave Capital is one of the products that was launched for Flutterwave 3.0. “With Flutterwave Capital, we’re making it easier for business owners to access the funds they require to grow their businesses seamlessly”, Rotimi Okungbaye, a Product Marketer at Flutterwave stated.

Flutterwave Capital provides a business lending marketplace to support Flutterwave’s merchants in growing their businesses.

Powered by Flutterwave in partnership with lending partners—CashConnect Microfinance Bank, MoneyWise Microfinance Bank, Wema Bank, Zenith Bank, Stanbic IBTC Bank and Sterling Bank, Flutterwave businesses can easily access loans without collateral, cumbersome documentation and other stringent terms and conditions.

In its 2020 MSME Survey, PwC said that 22% of MSMEs said obtaining finance was their most pressing problem. In the same survey, only 15% of the businesses surveyed could obtain funds from credit facilities.

Who is qualified for Flutterwave Capital?

According to the fintech startup, interested applicants for the capital must:

- Be located or incorporated in Nigeria.

- Processed payments using Flutterwave for three months or more.

Also, businesses that previously applied for a loan from Flutterwave Capital and got rejected, won’t be eligible to receive a new loan offer until after 30 days.

Businesses that process high volumes through Flutterwave with a consistent and reliable processing record and low rates of unresolved chargebacks are more likely to be eligible for an offer.

Comments ()