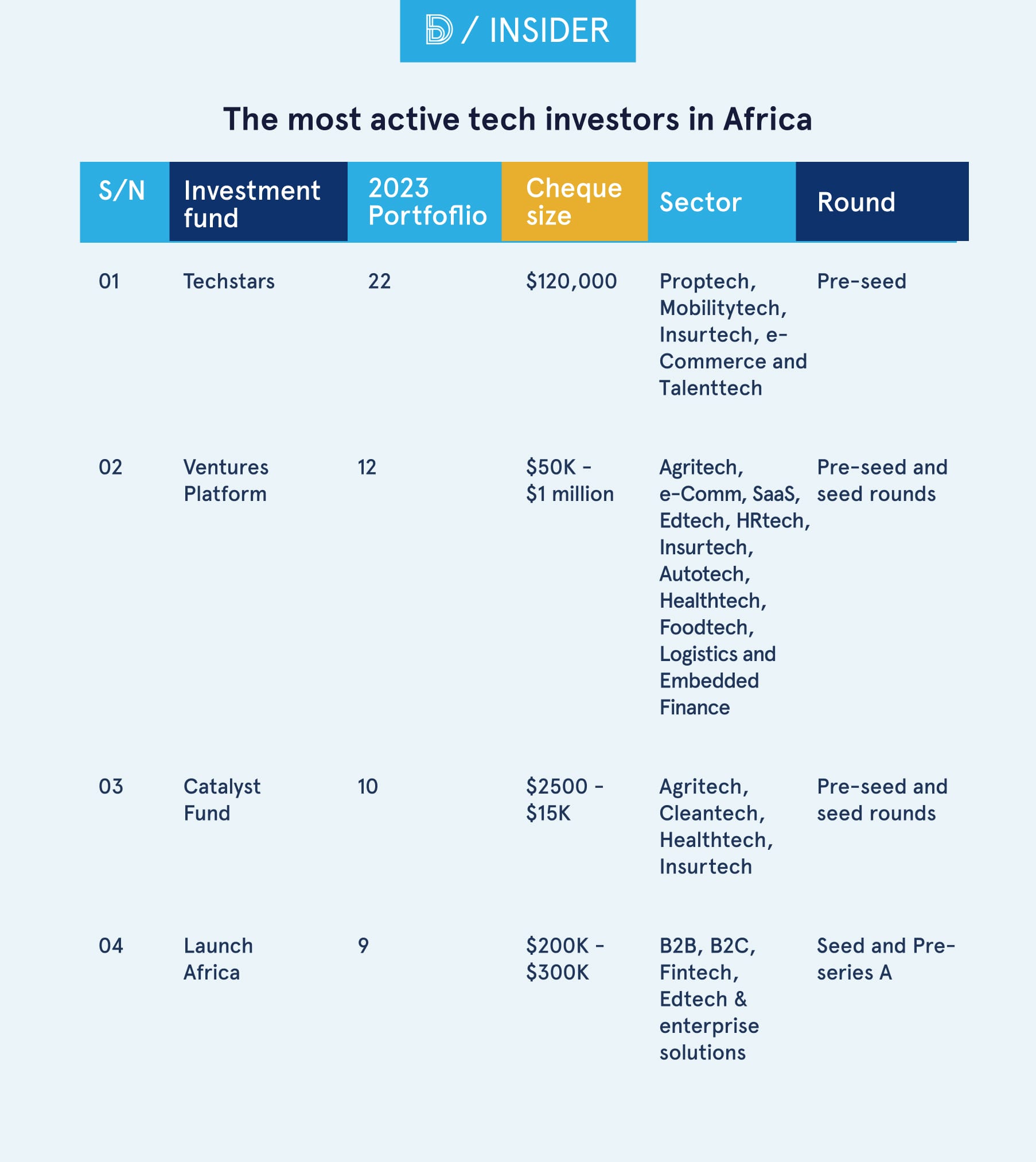

The most active investors in African tech ecosystem in 2023

These 10 Venture Capital firms were in the most prolific in Africa's tech ecosystem in 2023

Since 2015, the African tech ecosystem has grown rapidly. The continent boasts of a large working population that’s projected to account for one in four people across the globe by 2050 according to UN forecasts.

Internet and smartphone penetration has also risen within the past decade. The continent had around 570 million internet users in 2022, a number that more than doubled compared to 2015.

The combination of these favourable factors has made Africa a fertile ground for startups and investors who are looking for the next blue ocean. Consequently, Africa keeps attracting investments from both local and global venture capital firms.

According to the BD funding tracker, in 2022, the continent attracted venture capital investments of $3.6 billion spread across 273 deals – excluding the undisclosed deals – in 22 sectors.

Related post: What is Venture Investments? An explainer,

Despite unfavourable macroeconomic conditions, the pattern of investments in 2023 has followed the same thread. Based on data from our funding tracker, here are the most active venture capital firms in Africa in 2023.

Techstars Accelerator

Techstars runs over 40 accelerators across the globe, including the Lagos-based outpost. African startups have been mostly accepted into Techstars Barclays Accelerator, Techstars Toronto and New York at various times. In 2023 Techstars Toronto accepted 10 African startups while ARM Labs Techstars Accelerator accepted 12 startups. Techstars focus on startups in these sectors Fintech, Proptech, e-Commerce, MobilityTech and TalentTech.

Selected startups get a cheque of $120,000 as well as curated startup programming and access to Techstars’ vast network of over 7,000 mentors, 20,000 investors, alumni, and corporate partners. Some of the startups in their portfolio include CDCare, Peppa.io, Salad, Sidebrief and Vittas.

Ventures Platform

Ventures Platform is an early-stage discovery venture capital fund founded in 2016 by Kola Aina. The firm invests in startups in Agritech, e-Commerce, SaaS, Edtech, Insurtech, Autotech, Healthtech, Foodtech, Logistics and embedded Fintech.

Ventures Platform’s cheque size was initially capped at $50,000, but that changed in 2021 when the venture capital firm raised a $40 million pan-African fund. Now it can invest more than $1 million in pre-seed and seed startups, including follow-on rounds. In 2023, Ventures Platform invested in 12 startups. Some startups in their portfolio include Piggyvest, Paystack, Bitnob, Bloc and Brass.

Catalyst Fund

The Catalyst Fund is a pre-seed fund and accelerator backing high-impact tech startups that improve the resilience of underserved, climate-vulnerable communities in emerging markets. The accelerator invests in Agritech, CleanTech, Edtech, Insurtech and e-Commerce.

The fund makes grants between $2,500 – $15,000 available to anyone in climate resilience, inclusive fintech and digital commerce. Supported by prominent institutional investors like JPMorgan Chase and Co., Mastercard Foundation, Rockefeller Philanthropy Advisors, Catalyst fund invested in 10 startups in 2023. Startups in their portfolio include Indicina, Jetstream, Lami, Turaco, and Wasoko.

Launch Africa

Launch Africa is a pan-African VC fund solving the funding gap in the investment landscape in Africa. The company targets tech-enabled startups in the African continent, solving the challenges of everyday Africans and entrepreneurs across multiple sectors.

Launch Africa invests between $200K and $300k in startups. The firm founded in 2020 prefers startups operating in B2B, B2C, Fintech, Edtech and enterprise solutions. Launch Africa invested in nine startups in 2023 and some of them include Gameball, Workpay, Credable, Chekkit and Balad.

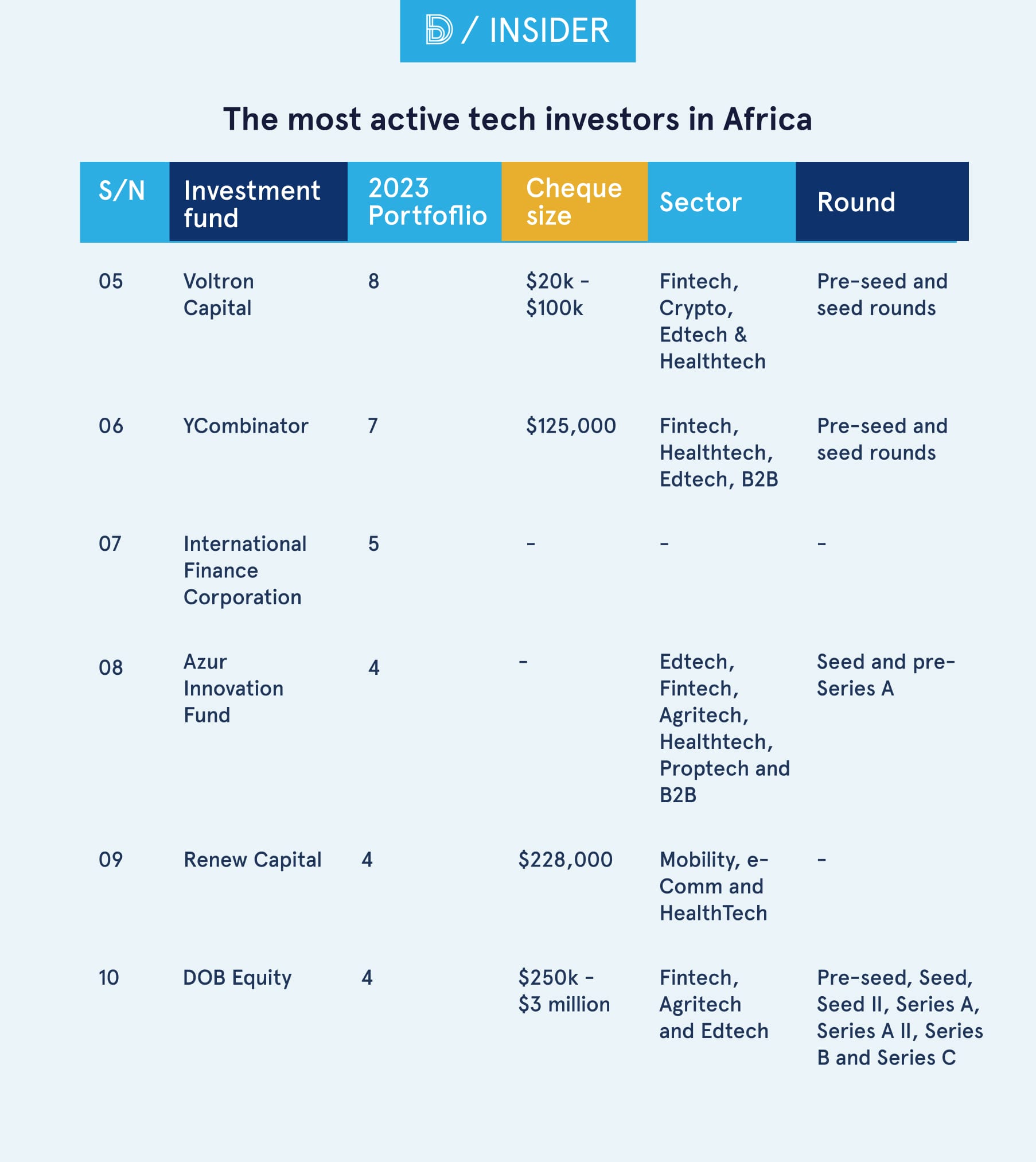

Voltron Capital

Voltron Capital is a venture capital firm that invests in early-stage companies operating primarily in the Fintech, Edtech and Healthtech. The firm is on a mission to back extraordinary entrepreneurs out of Africa solving important problems in large markets.

Related post: Soyombo's Voltron Africa invested in one startup every week of 2022. Here is our analysis

These companies get an investment of between $20,000 and $100,000 from Voltron Capital. Some startups in Voltron Capital’s portfolio are Allawee, Bamba, Altschool, Bujeti and Chargel. In 2023, Voltron Capital has invested in eight startups.

YCombinator

YC is one of the most successful accelerator programs in the world. Its cohort-based program provides funding, mentorship and connections that support founders throughout their company life.

Startups who get into YC prestigious programme get $500,000 ($125,000 for 7% and $375,000 in uncapped SAFE note) funding. YC invests in startups across different sectors including SaaS, B2B, e-Commerce, Artificial intelligence, FinTech, Edtech, Analytics, and many more. Some of YC’s portfolio includes Flutterwave, Prospa, Nomba, Chowdeck, Kobo360, and others. In 2023, YC invested in seven African startups.

International Finance Corporation

Within the past six decades, the International Finance Corporation (IFC) has invested more than $60 billion in African businesses. The sister organization of the World Bank and member of the World Bank Group supports startups in Agritech, Cleantech, Healthtech, Edtech and e-Commerce. Some startups in IFC’s portfolio include Kobo360, Lulalend, Naked, Nuru, Anka, and CSquared. The IFC invested in five startups in 2023.

Azur Innovation Management

This is a public-private seed fund, set up as part of the Innov Invest Initiative launched by the Moroccan government in 2016. Azur Innovation Management (AIM) strives to partner with startups that have the will and the potential to develop ambitious, innovative and disruptive projects.

The fund invests in Moroccan startups in Fintech, Healthtech, Agritech, Biotech, Internet and Software. Some startups in this fund include KoolSkools, Blinkpharma, Agenz, BGEN Technology and Presta Freedom. In 2023 Azur Innovation Fund invested in four startups.

Renew Capital

Renew Capital is an impact investment firm that backs innovative companies with high-growth potential. The firm based in Kampala, Ethiopia was founded in 2007. The African-focused firm operates its exchange hubs across sub-Saharan Africa by organising capital, building a pipeline, providing executive training programs and supporting investments.

The investment firm focuses on startups in mobility, e-Commerce and Healthtech; investing $228,000 on average. Some of the African startups in Renew Capital’s portfolio are Badili, Wazi and Xente. In 2023, Renew Capital invested in four African startups.

Related post: 15 global startup accelerators accepting Nigerian startups

DOB Equity

DOB Equity is a venture capital firm based in the Netherlands that invests in innovative and impactful businesses in Sub-Saharan Africa. The investment firm invests in scalable, innovative, and high-impact companies that solve social and environmental challenges across East Africa.

DOB Equity’s cheque size is between $250,000 to $3 million for startups in Fintech, Healthtech, Agritech and Edtech. DOB Equity invested in four African startups in 2023. Some startups in the investment firm’s portfolio are Kwara, Power, Victory Farms, Zydii and Zuri Health.

Final thoughts

The 10 VC firms listed above are among the most successful and influential in African tech ecosystem as most startups in their portfolios are profitable, or have huge scalability. Working with them can be a game-changing experience for any startup.

Comments ()