Toju joins the race to "Bank the Unbanked"

Toju is making it easier for unbanked Africans to access financial services without breaking the existing layer of trust

By a number of estimates, Africa’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population. The mission to promote financial inclusion across the continent is one that Toju, a Nigerian fintech startup have adopted.

Local saving clubs, credit unions, and non-banking microfinance services have been to most unbanked populace in Africa a reliable market for financial services — savings and loans. Ideally, most patrons of these Alternative.

Financial Services, know and trust employees from these organizations. Otherwise, customers in such markets watched their thrift collectors grow, lived with them, and are friends or acknowledged members of their societies.

However, this Alternative Financial Service is riddled with risks and inconsistencies. Some of these local savings clubs and microfinances are unable to keep up with the provision of loans; often, most of their clientele withdraw their savings at the end of the month. Some of these local solutions have poor record keeping habits, use a long reconciliation time coupled with low liquidity.

In making it easier for unbanked Africans to access financial services without breaking the existing layer of trust, Olaide Oladipupo, Sodiq Tijani and Byron Neji co-founded Toju out of the 2019 Accion Accelerator.

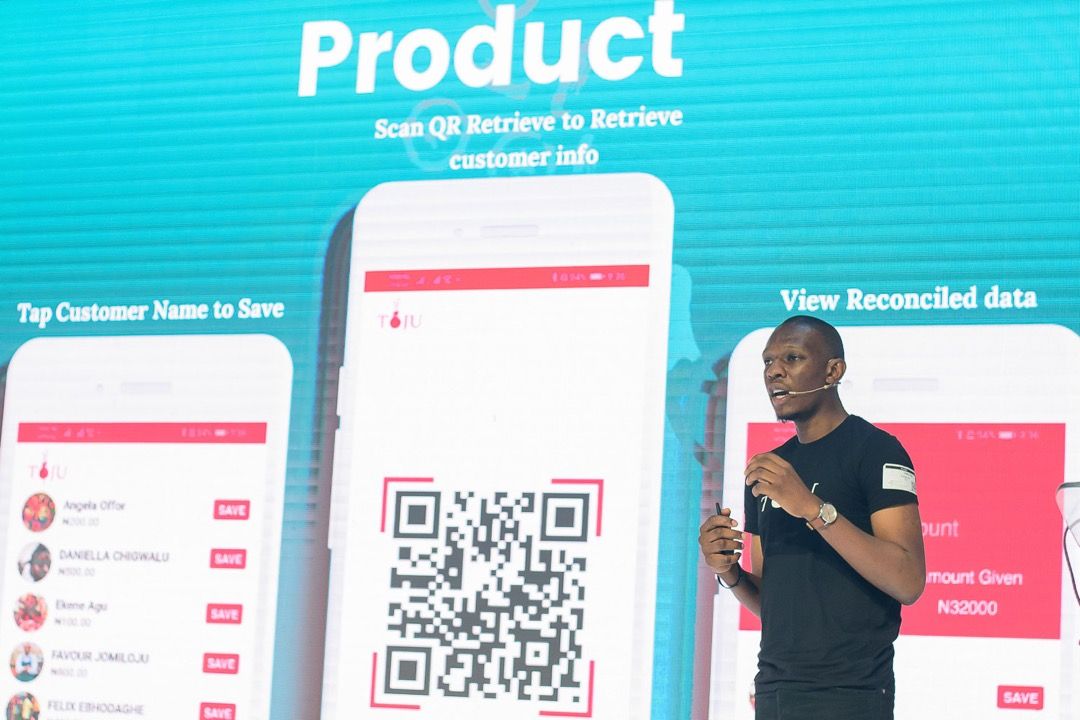

Toju provides an infrastructure for lenders and micro-finance institutions to continue their businesses swiftly. Toju's platforms allow businesses and customers to grow alike without destructing the ledger of trust between both parties.

Toju is currently undergoing the Seedstars Investment Readiness Program and won the Entrepreneurship Migration Prize in 2021, preparing them for the fast growing fintech market in West Africa. The startup launched in Nigeria and are looking to expand to Ghana, given the rapid growth of their products and services.

The fintech company erupted from Nairapacket during the 2019 Zenith Bank Hackathon during which the co-founders sought to provide financial inclusion to marginalized customers.

"Our goal is to democratize access to financial services the African populace, increasing the economic viability of underserved businesses and individuals in Africa", Sodiq Tijani, one of the co-founders of Toju stated in a conversation with us.

According to Sodiq Tijani, “informal microfinance institutions exist independently with segregation of consumer data. Ordinarily, we sought to aggregate isolated data from consumer operations in order to build credit engines and provide other financial services to lenders". Asked about growth, Olaide added that “since inception, we have facilitated disbursement of loans of over US$1 million to small businesses”.

Given the early adoption of TojuSave, Toju is focused on relying on this height to build subsequent products for underserved users across emerging African countries.

Comments ()