The top 20 cryptocurrencies make up 85.93% of the total market

Bitcoin emerged as the leader, capturing a significant 49.11% of the market share, followed by Ethereum with 16.50%.

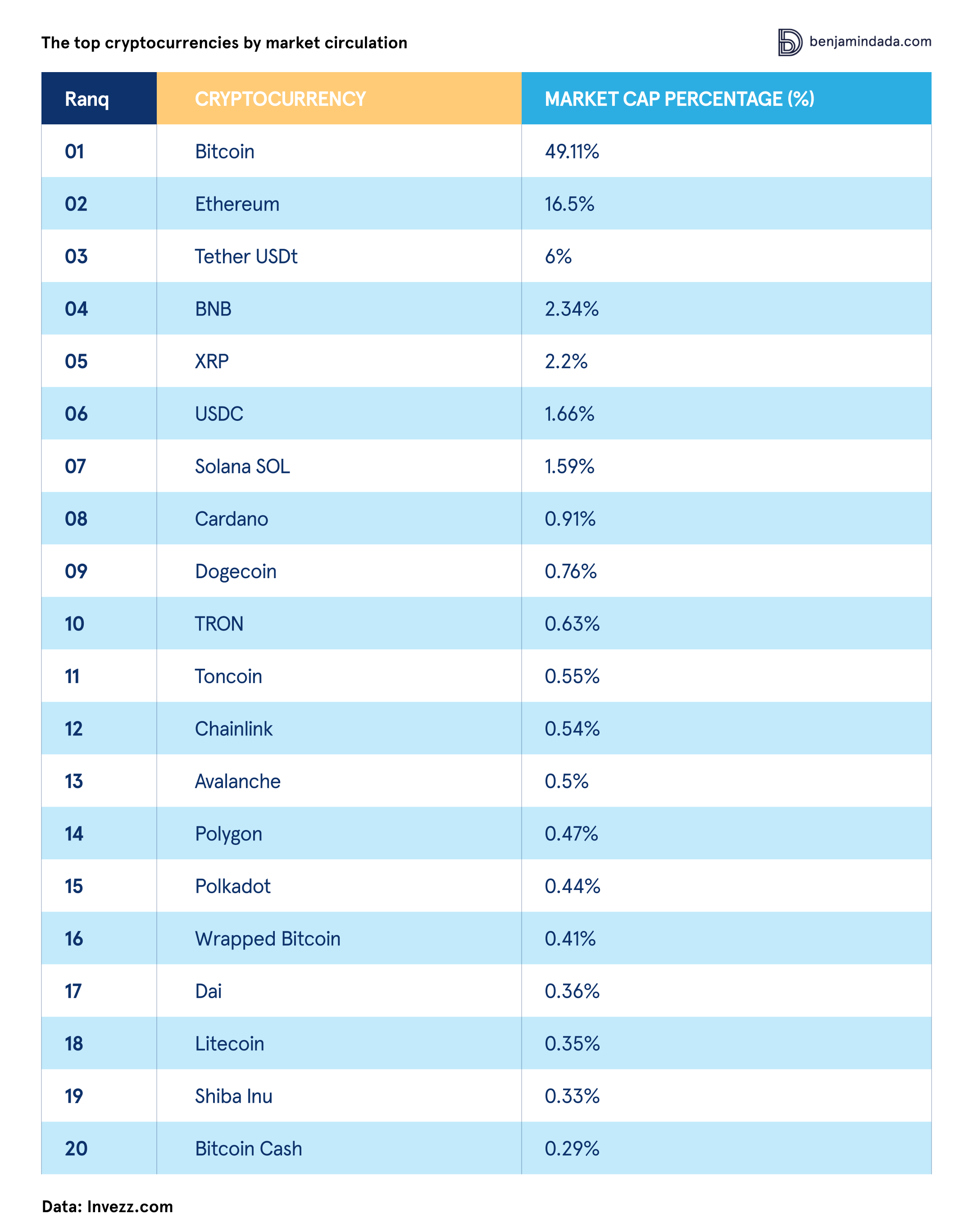

The top 20 cryptocurrencies make up 85.93% percent of the total market, according to a recent report done by Invezz.com, an investment platform. Bitcoin emerged as the leader, capturing a significant 49.11% of the market share, followed by Ethereum with 16.50%.

In a recent analysis, researchers examined the market caps of 2,174 cryptocurrencies listed on CoinMarketCap, revealing that the top 20 tokens command a substantial 85.93% of the total market. It’s worth noting that cryptocurrencies with self-reported market caps were intentionally excluded from the study.

In the crypto scene, market cap is a way to gauge a cryptocurrency’s popularity and potential for growth. Calculated by multiplying the total coins in circulation by the price per coin, this figure helps assess whether a cryptocurrency is a solid choice compared to others in terms of safety and potential returns.

The analysis also unveils that the top 120 cryptocurrencies account for a staggering 93.07% of the total market.

These are the top 20 cryptocurrencies ranked by their total value in circulation, known as market capitalization. It’s not a suggestion on what to buy or avoid; rather, it’s a list of the most significant projects by market capitalization. It gives you an overview of the landscape before making decisions about investing in crypto:

Speaking on the result of the analysis, Invezz Market analyst, Crispus Nyaga commented that: “Market cap remains a crucial gauge of a cryptocurrency’s relevance, despite being criticized for reflecting long-term popularity rather than immediate value. Large-cap cryptocurrencies, with market caps exceeding $10 billion, are generally viewed as safer investments due to their stability compared to smaller assets. Mid-cap cryptos, while more volatile, offer greater growth potential, while small-cap cryptocurrencies are highly risky but may present short-term growth opportunities with the caveat of sudden crashes.”

Invezz is an online financial news platform offers financial information and peer review market analysis related to equities, forex, commodities, real estate and crowdfunding, enabling investors to stay updated about the recent trends in equity, trading and derivative markets.

Comments ()