Stitch launches Linkpay to enable tokenised and secure one-click payments

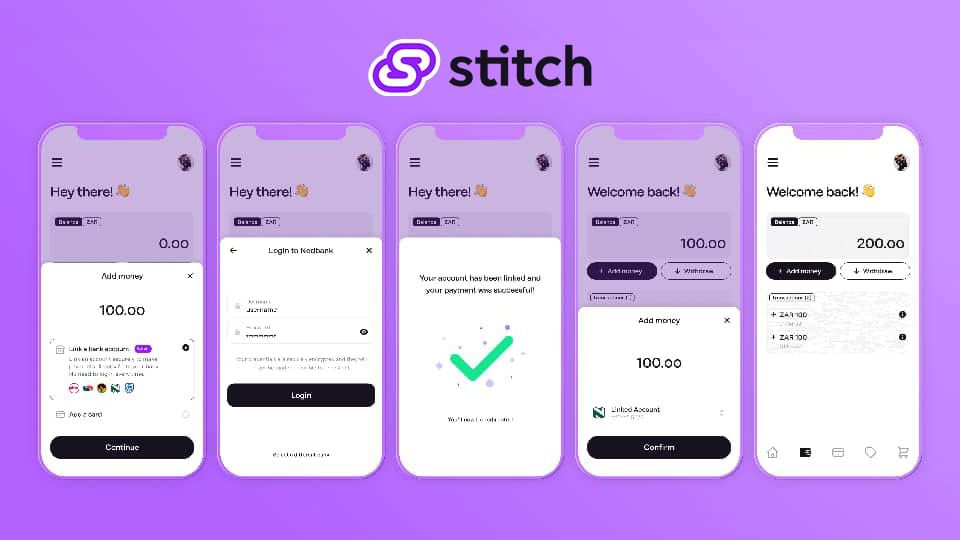

With Stitch LinkPay, businesses in South Africa and Nigeria can enable users to link their financial accounts and pay securely via instant bank transfer, in seconds.

Payments and data API fintech Stitch today announced the launch of its linked-account payments product, LinkPay. With LinkPay, businesses in South Africa and Nigeria can accept secure, one-click payments directly from a user’s financial account.

The payments experience is as convenient as that of a tokenised card, but comes without high fees or chargebacks. LinkPay can be integrated alongside Stitch Payouts and Financial Data products to enable a complete linked-account journey, including verified payments, refunds and withdrawals.

Traditional payment methods are no longer meeting the needs of Africa’s consumers, who demand faster, more convenient and more secure ways to pay. As well, businesses face long settlement times, high fees (up to 3.5% in South Africa) and chargebacks from card transactions, and high rates of fraud, impacting their ability to grow. In South Africa, fraud committed on debit cards was about R520.5 million ($319,952/₦133,000,000) in 2020.

Moreover, payment by manual bank transfer is onerous and high-friction, and repeat transactions require consumers to log in and initiate payments uniquely every time.

Therefore, Stitch an API fintech company that helps businesses easily launch, optimise and scale financial products in Africa has set up its linked-account payments product, LinkPay to help solve this problem.

Stitch LinkPay addresses these challenges with a more cost-effective, frictionless and secure payments product that tokenises user financial accounts to enable one-click payments (known as Instant EFT in South Africa and pay by bank in Nigeria):

● One-click payments for returning users: Returning users can choose to link their financial accounts as a default payment method by logging in via Stitch once, and can top up or checkout in one click every time after - no repeat login required

● Link and pay later: Users can pre-link an account and come back anytime to make a payment. This is useful for products such as scan-to-pay apps, investment offerings, and any fintech application that involves repeat transactions from the same primary financial account

● Verified payments: Once a user’s account is linked, LinkPay can be combined with Stitch Financial Data to reference account details such as name or ID for verified payments with reduced risk of fraud. In addition, balances and transactions history can also be checked for ‘smart’ payments that fail less.

● Seamless payouts over API: Combining LinkPay + Stitch Payouts enables users to receive refunds or make withdrawals to the same verified account used for a pay-in

Commenting on the product launch, Junaid Dadan, Chief Product Officer at Stitch, said: “With LinkPay, Stitch can enable businesses to offer a more frictionless and secure payments experience, making it easier than ever for their customers to pay and save costs.

Combined with Stitch Financial Data and Payouts products, LinkPay offers a truly unique closed-loop linked-account experience for returning users - from fast, seamless onboarding, to one-click payments and payouts.

As a result, businesses will see higher conversion rates, a reduction in costs and ultimately a more convenient experience for their users.”

Core use cases for Stitch LinkPay include:

● Fintechs: Returning users for digital wallets, investment and savings apps, scan to pay solutions and more can make fast, secure deposits, pay for services and withdraw funds whenever they need, via the same verified financial account

● Marketplaces and platforms: Users can link a bank account to their ride-hailing, delivery, or marketplace profile for quick checkouts, and suppliers can get paid same-day

● E-commerce businesses: For e-commerce businesses that enable logged-in checkouts, returning users can pay with one click via their saved payment method

Businesses interested in integrating Stitch LinkPay can access test credentials and get started in minutes via the Stitch self-serve platform. For the next three months, businesses in South Africa integrating Stitch LinkPay can also access Financial Data at no cost.

Stitch emerged from stealth in February 2021 and expanded into Nigeria in October 2021. The firm raised $21 million in Series A funding in February 2022. Backers include PayPal Ventures, TrueLayer, firstminute capital, The Raba Partnership, CRE Venture Capital, Village Global, Zinal Growth (the investment vehicle of Checkout.com founder Guillaume Pousaz) and angels including founders and early builders from Chipper Cash, Monzo, Venmo, GoCardless, Plaid, Unit and more.

Stitch solutions dramatically reduce the effort required for businesses to connect to their users’ financial accounts, to enable instant, secure payments and payouts and to access financial data.