How smart contracts can promote e-commerce in Nigeria

Nigeria is seeing unprecedented growth in online marketplace consumption. But settlement and disputes issues still remain the same, and can potentially hinder this growth. How can smart contracts make this easier for both parties?

Nigeria is seeing unprecedented growth in online marketplace consumption. The pandemic has accelerated this growth and facilitated a notable shift in consumer habits. But settlement options still remains the same, and with this level of growth, automated solutions like smart contracts may present a new approach to online settlement.

Decentralized systems are a hallmark of 21st century computing technology. They allow for a democratized, distributed and interconnected system where no single entity is the sole authority. This way, each level has a certain level of autonomy and is responsible for the smooth functioning of the system.

Think of this in terms of how Bitcoin is decentralized money. It is not controlled by any single central bank or government, can be sent to anyone around the world and it relies on cryptographic proof and the block chain, to prevent double spend and record transactions on a public ledger.

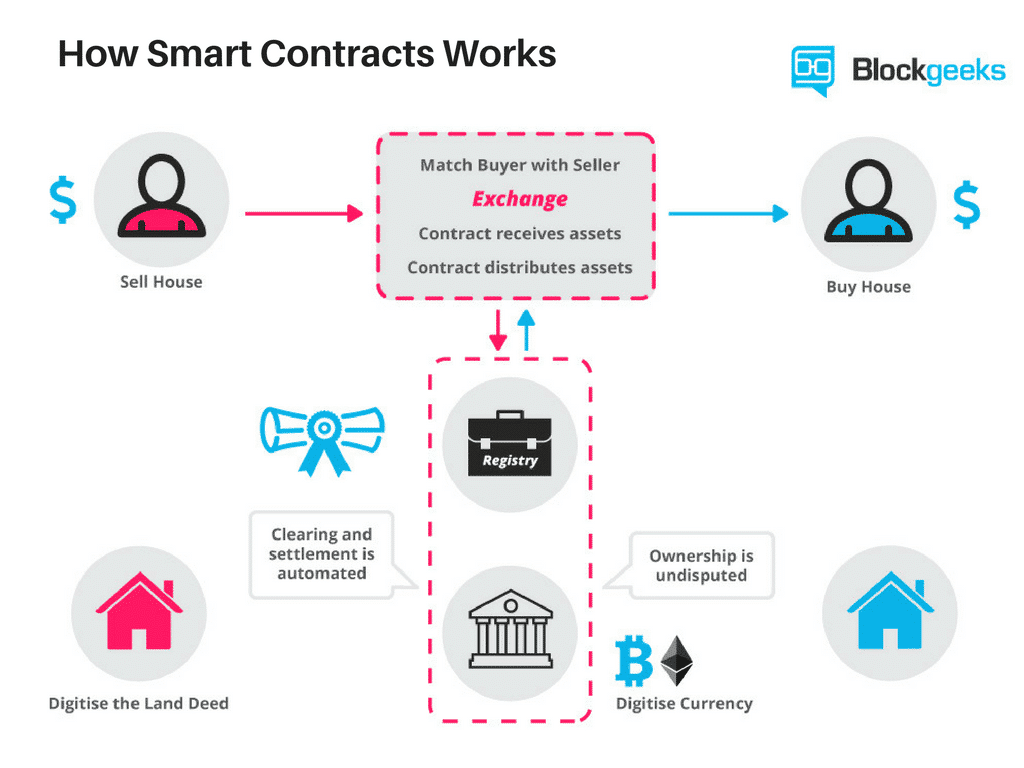

For online transactions, what a smart contract proposes is an immutable, self-executing system which can be accessed by any party to the transaction on the internet. It can then be automated to do certain activities. We can build lending systems, exchanges, financial products and so on, that do not rely on a central authority, not even the original programmer, for it to perform its functions.

So how do smart contracts work?

Smart contracts are basically a set of “if” and “then” propositions. So, if you and I are in a smart contract agreement, if you agree to do X, then I also bind myself to do Y in exchange. So a smart contract between two people is a set of automated, immutable lines of code that manage transactions in a decentralized manner. These smart contracts run on certain pieces of software known as Decentralized Apps or Dapps.

The most widely used infrastructure platform capable of deploying these smart contracts is Ethereum. In fact, it is a Do it Yourself (DIY) platform created specifically for management, execution, enforcement, performance and payments of the smart contracts in these Dapps.

The smart contracts will be third party, trusted and neutral contract enforcers, based on the demands each party to the contract has placed on the other. The underlying purpose is essentially to be an online escrow and serve as a repository for monies or assets, to hold them in safe keeping until certain stipulated events occur as agreed upon by the contracting parties.

The growth of E-commerce and the problem with PoD and Deposit methods of settlement

Nigeria’s digital landscape is flourishing.The Covid pandemic has accelerated the use of online mediums to shop for goods and services. E-commerce is growing steadily and the country is Africa’s largest marketplace for online consumption of goods and products. With the continent’s largest population and one of the youngest worldwide, Nigeria presents a vast digital audience.

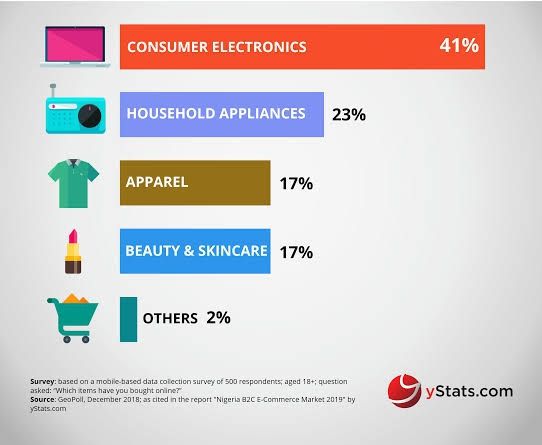

Nigeria also has a B2C index value for e-commerce of 53.2 points, the fourth highest in Africa. The B2C E-commerce index measures an economy’s preparedness to support online shopping by taking different indicators into account. The most valuable e-commerce sector in Nigeria in 2020 was travel and accommodation, which achieved 3.2 billion U.S. dollars in consumer spending. Overall, the number of visitors in online marketplaces is also growing constantly, exceeding 250 million in 2019. In addition, different surveys show that Nigerians have a very positive attitude towards online shopping.

The most popular marketplace in terms of visitor numbers is Jumia. Other popular online marketplaces in Nigeria are Jiji, Konga, and Cheki. Apart from consumer goods, marketplaces for higher end products like cars are also very popular. Some 14 percent of all online marketplaces present in the country specialize in vehicles.

Despite the widespread popularity and adoption of these online mediums, especially among the youth demographic, payment on demand or PoD and direct deposits are still the two main ways transactions are settled online.

The major problem regarding PoD is that customers may default and decide to reject them after the business has expended time and resources to deliver the goods With deposits, online marketplaces may default, deliver defective goods or late deliveries of goods ordered by customers. Both situations leave the either party at a huge disadvantage

How smart contracts can solve this problem

Now, with the use of Ethereum platform, escrow functions can be easily written and implemented while still being decentralized and trustless. This way both parties are confident they will not be cheated during the exchange.

For example, an e-commerce transaction may go like this:

The seller and buyer can both confirm and agree to the terms of the trade, as already placed in a smart contract and deployed into the Ethereum platform by the seller. The buyer places funds into the smart contract with one click, thereby providing proof of funds and allowing for a much easier trade. Once goods/product(s) have been delivered, the buyer successfully confirms receipt and releases the escrow, thereby completing the trade.

It will be of course much more complex than this model, but this represents a simple representation of the potential of such a system.

What are the use cases?

There are lots of possibilities regarding the simple model of smart contracts in e-commerce. Online trade and transactions will only get bigger in Nigeria, and it means the issue of security for both parties will always be paramount. A situation where smart contracts can easily be deployed to cover as many situations as possible will be a big win for the growth of the Nigerian tech ecosystem. Some notable use cases include

- E-commerce

- Online orders and demand for services

- Contracts of different types including employment contracts, tenancy agreements etc.

- Payments

- Online retail

- Freelance agreements

- Cross border transactions

- Tokenized commerce

Trust will always be a big issue with online shopping in Nigeria, so online platforms can provide an escrow safety net that ensures purchases made on their websites are protected, while customers can ensure that the right products are delivered to them in due time based on the terms in the smart contract.

What are the challenges?

Ecommerce in Nigeria is still fraught with so many challenges, even apart from settlement and disputes. Also, the idea of Defis and decentralized apps and smart contracts is still very much in its infancy in Nigeria and even the continent as a whole.

It is not even merely the problem of finding use cases for these type of decentralized apps, but the information gap, suspicions and general apathy among Africans regarding anything crypto related. This is even more exacerbated by the endless moves by regulators to cast cryptocurrencies in a negative light and paint it as illegal, invisible money.

Jude Dike, founder of startup investment platform Getequity, notes to Benjamindad.com that the major challenges to smart contract adoption in Nigeria are issues surrounding scalability, existing technology, gas fees and exchange rates due to the sharp fall of the naira.

Existing technology and infrastructure will be a major challenge to widespread adoption, he notes. Gas fees which is the amount to required to conduct a transaction on the Ethereum blockchain will be a major problem, as the charges will go up with larger transaction volume. Who will shoulder these costs? The gas fees also give rise to issues of exchange rates, consumers are unlikely to want to shoulder these blockchain costs, especially since they are going to be paying with Naira.

The successful implementation of Defi systems in Nigeria would rest majorly on how innovative thinkers and builders solve these challenges, and a major shift of consumer habits and Nigeria to a cashless society. The latter may be a more foreseeable reality, as consumer shifts take very long to happen.