Savyt, new digital savings and investment app comes out of beta

Savyt is a digital savings and investment app that wants to help Nigerians earn better returns on their savings and investments.

Savyt, a digital savings and investment platform has launched operations with the goal of helping Nigerians earn better returns on their savings and investment.

With the inflation rate in Nigeria averaging 12% over a 10-year period and economic growth at a meager 2.2%, the dwindling macro-economic conditions have seriously impacted the wealth of Nigerians.

Nigeria has faced two recessions in four years. This has reduced the earning power of the population and put a lot more Nigerians below the poverty line. As a result of these less-than-ideal conditions, it has become difficult for Nigerians to save given the increased loss of jobs and irregularity of income.

For the few that are able to save, inflation and risk-adjusted returns are very hard to come by, while investment options are very concentrated in low yielding money market and government securities. Savyt was launched to fill this gap.

Savyt is an online platform that connects Nigerians to relatively low-risk and high-yield investment opportunities that helps to protect them from the debilitating effects of inflation and currency devaluation. Its platform employs world-class customer data security and authentication standards while collections and payments are processed by a PCI-DSS certified payments company.

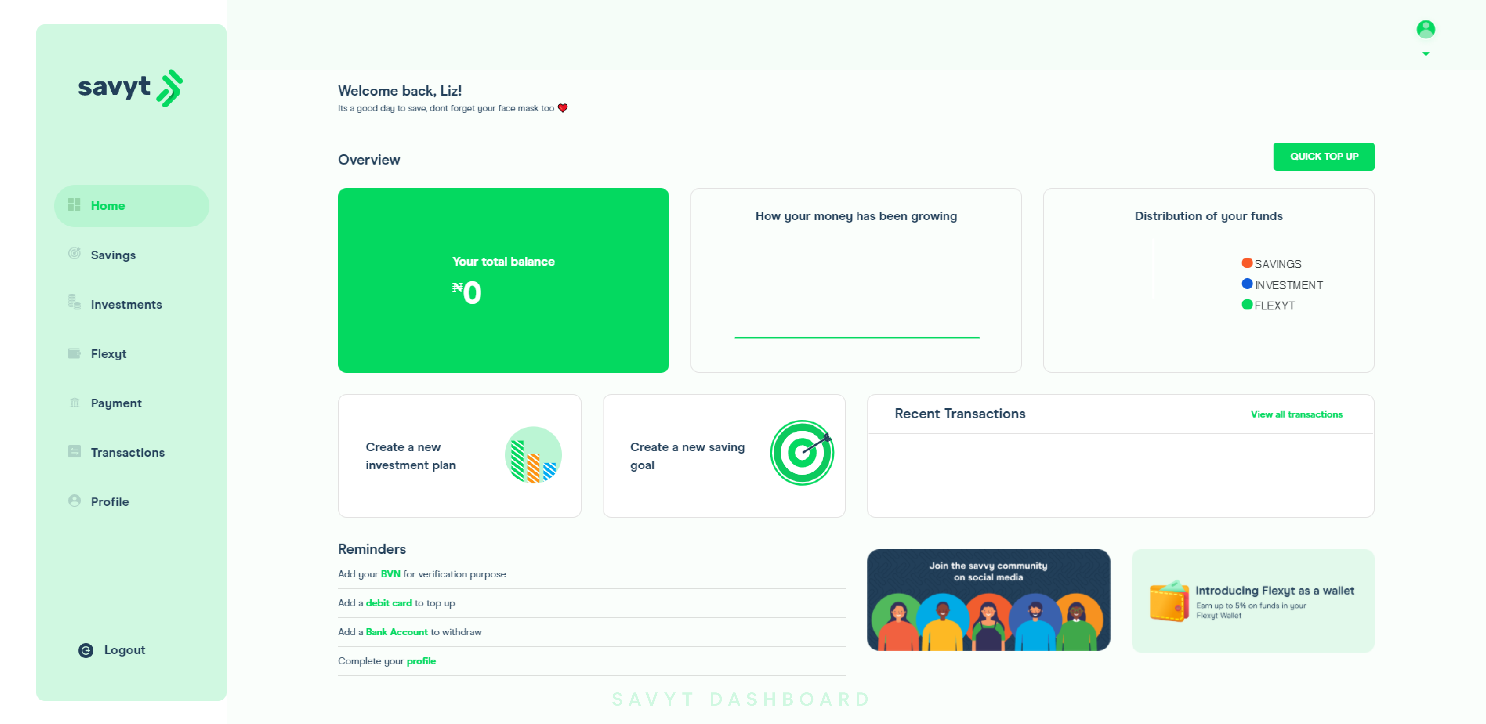

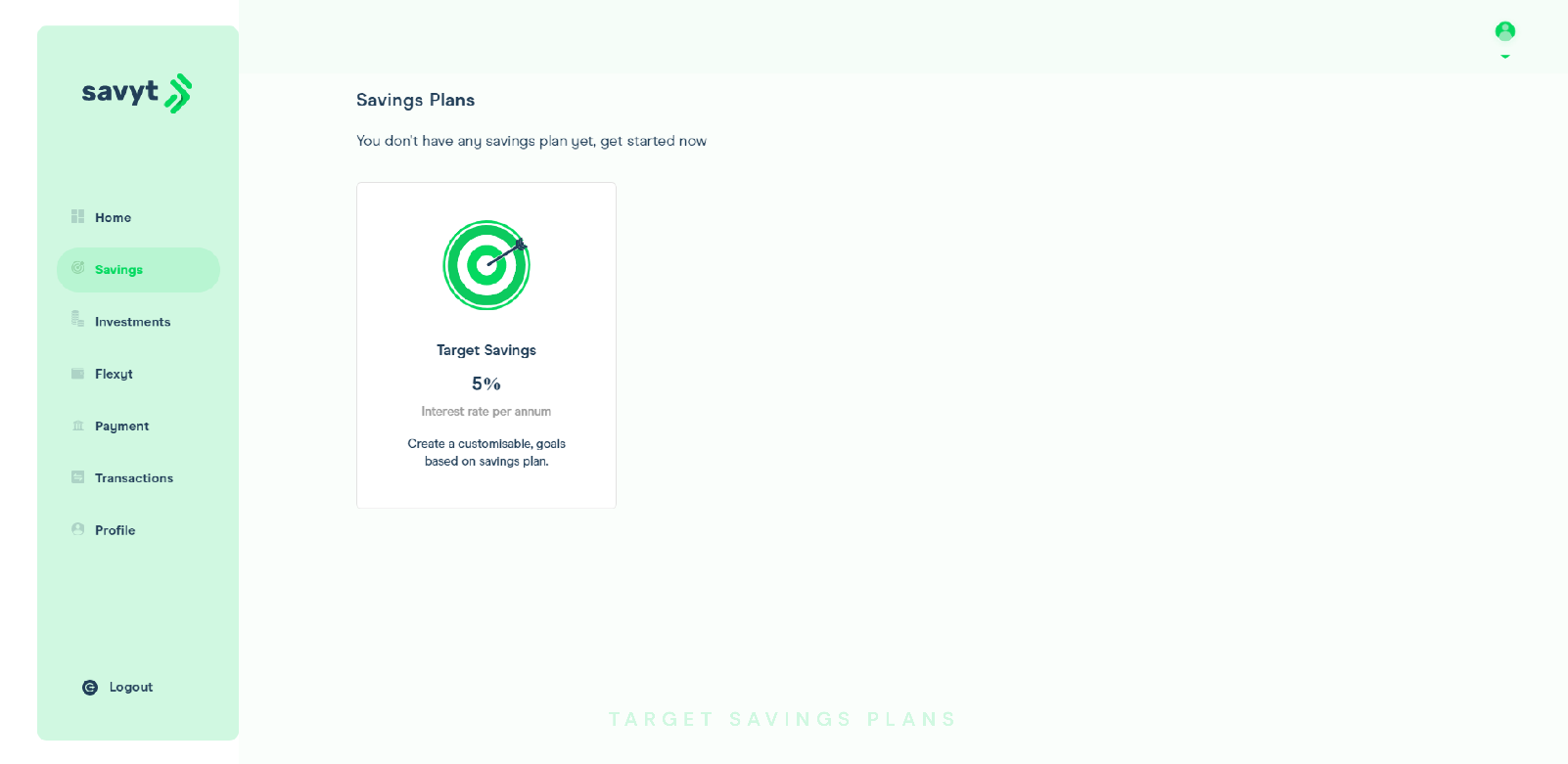

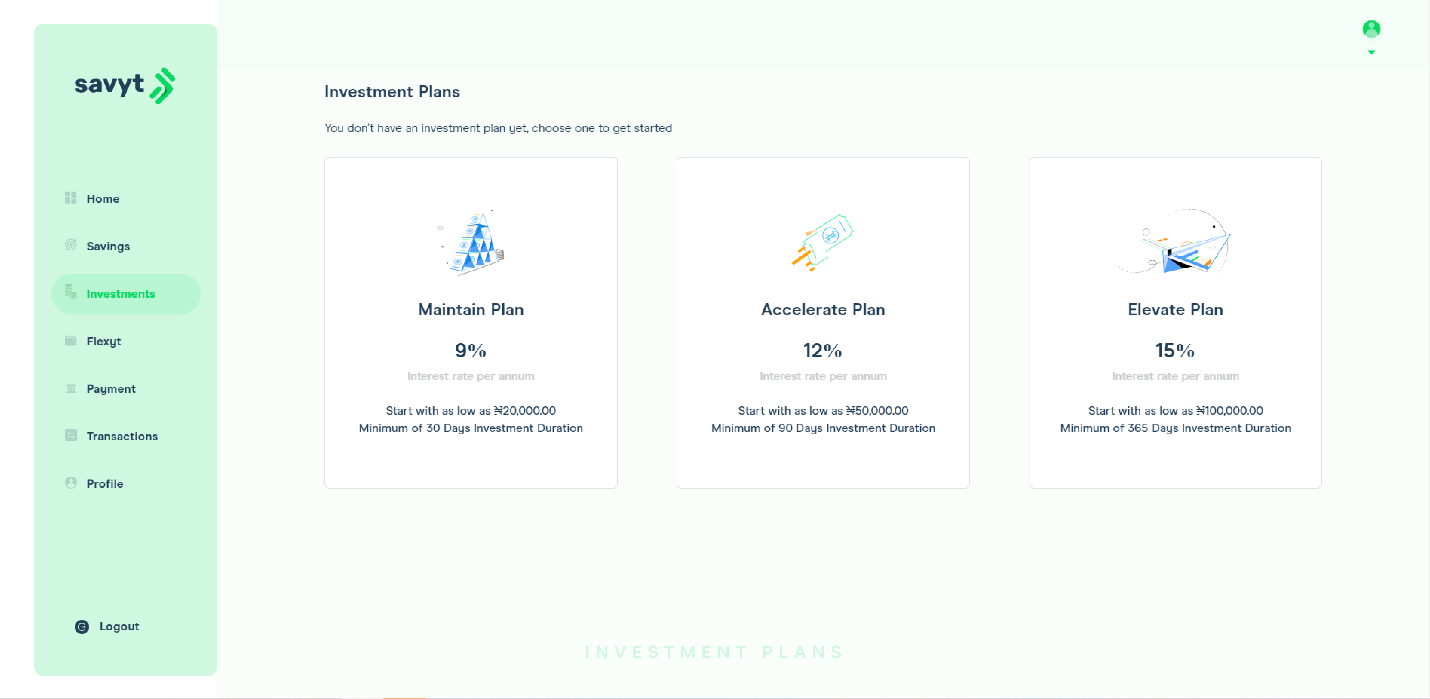

The platform currently has four products namely: Target Savings, Maintain, Accelerate and Elevate Plans. Subscribers will have the opportunity to earn up to 15% per annum on their investments and are assured of the safety of their funds as all deposits are held by a CBN licensed financial institution.

As Nigeria and most countries around the world exit the pandemic induced global recession, it is imperative that the national savings rate (estimated at 23% by the World Bank as of 2019) is increased to a level that ensures adequate capital is available locally to fund economic growth and lift Nigerians out of poverty.

With the ubiquity of mobile phones, the ever-increasing internet penetration, and advancements in payment infrastructure, more Nigerians are adopting new financial innovations that better serve their purposes.

Speaking on the launch of Savyt, Muyiwa Babarinde the company’s Head of Growth & Marketing noted that “Nigeria’s fintech ecosystem has witnessed a lot of innovation in the past few years, however, there is still a lot of room for growth.

At Savyt, we intend to contribute to the economic growth of Nigeria by providing a range of savings and investment products that help Nigerians retain and grow wealth. Our goal is to help more Nigerians imbibe a good savings & investment culture, the ripple effect of this will be an increase in the country’s economic growth.’’

Nigeria’s Central Bank has introduced several initiatives to improve inclusion since the launch of its 2012 Financial Inclusion Framework including: Agency Banking, Tiered Know-Your-Customer requirements, Financial literacy and Mobile Money. The launch of Savyt at this time in the evolution of Nigeria’s Fintech industry is intended to ride on the back of a supportive regulatory environment to drive innovation in savings, and ultimately improve Nigeria’s savings culture.

Savyt is currently available via a web app, and you can kickstart a secure and profitable financial journey by setting up an account and creating a savings or investment plan.

Comments ()