As the new CEO of Binance, Richard Teng faces an uneasy task turning fortunes around

Changpeng Zhao's successor has a pivotal role to play in restoring Binance's reputation and preparing the crypto industry for a compliance-forward era.

It's no longer news that Changpeng Zhao has resigned from his role as CEO of Binance after pleading guilty to charges surrounding money laundering and “terrorist” financing. The spectacle, which sees the world’s largest crypto trading platform face an uncertain future, has undermined confidence in the business and the industry at large.

In an ongoing legal battle in the U.S., authorities are going hard on Binance for violating laws meant to prevent money from flowing to terrorists, cybercriminals, and child abusers. The settlement will cost the company $4.3 billion in fines and a heck load of work turning things around.

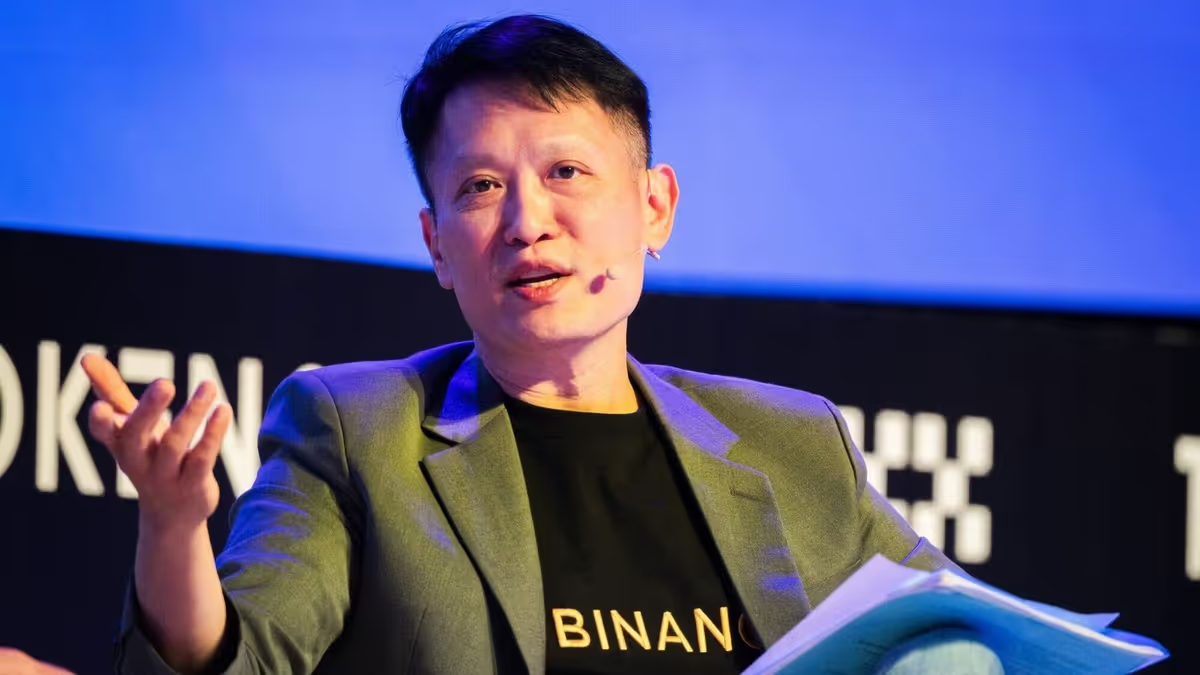

Responding to Zhao’s departure, Binance named Richard Teng, its head of regional markets outside the U.S., as its new CEO. Before joining the company as Singapore CEO in 2021, Teng had served as head of the Abu Dhabi Global Market—an international financial centre in the UAE—and director of corporate finance at Singapore’s central bank.

Binance is betting on Teng’s experience, especially in financial regulation and compliance, to help get into the good books of its American prosecutors and win back the trust of over 150 million customers across the world.

In his first statement to X per the new role, he tried placating users by laying out the grey areas. Chiefly, he sought to reassure customers that the company would do what was necessary to win back their confidence in the platform’s strength, security, and safety.

“To ensure a bright future, I intend to use everything I’ve learned over the past three decades of financial services and regulatory experience to guide our remarkable, innovative, and committed team,” he wrote, before going on the list of the immediate priorities.

Binance’s troubles are not as grim as those of its closest rivals that have been in the same hot seat, at least not yet. However, Teng is tasked with the responsibility of turning the tide and retaining the legacy of one of the world’s largest crypto empires. The company’s reputation has been suffering damage ever since coming under fire not only in the U.S. but in order in key markets.

Richard Teng will be looking to restore the trading volumes lost amidst the drama and maintain its stronghold on the market. Binance’s native token, BNB, dipped 15% after Zhao’s resignation came to light. Further suggesting trust depletion, investors cumulatively withdrew $1.6 billion from the exchange.

What’s more, several top Binance execs have since abandoned ship in response to the DoJ’s investigations into the company, some particularly uninspired by Zhao’s handling of the probe.

General Counsel Han Ng, Chief Strategy Officer Patrick Hillmann, Senior Vice President for Compliance Steven Christie, Global Vice President of Marketing and Communications Steve Milton, and Senior Director of Investigations Matthew Price, all resigned from their respective positions when the crackdown became imminent earlier in the year.

Teng will have to position Binance well enough to onboard strategic talent that would enable the platform to safely navigate the legal tempest. Given the firm’s state of repute, making the right appointments won’t be a walk in the park.

Besides filling vacant positions, Teng will be responsible for implementing a long list of tough conditions U.S. authorities have included in the plea. Failure to comply would attract another fine of $150 million. Meanwhile, the business remains under threat of a lawsuit by the Securities and Exchange Commission (SEC) of the country.

A lawsuit has been filed by the U.S. Commodity Futures Trading Commission (CFTC). From what’s evident historically, this could impact the business in the long term. Should it turn out a win for the CFTC, Binance would pay hundreds of millions more in fines and possibly lose registration privileges in the U.S., a market that brings in 16% of its derivatives revenues.

Changpeng Zhao, known in the industry as CZ, prioritized making customers happy for most of his time at Binance. As CZ’s successor, Teng will have to double down on this legacy while growing the business and sidestepping escalation on the legal front.

The cryptocurrency industry has been hit with back-to-back controversy in recent times. The collapse of FTX, Sam Bank-Fried’s prison sentence, the Terra/Luna meltdown, and court-trailing for key figures like Do-Kwon and [even] Zhao, have brought the space some bad rep.

Teng would go on to play a significant role in not just rescuing Binance from self-inflicted issues but also kickstarting what could be referred to as the crypto industry’s correction phase compliance-wise.

Hirander Misra, CEO of London-based market infrastructure company, GMEX, told Bloomberg that Teng is “swimming against the tide,” as “a culture of regulatory compliance is very hard to instil in an organization that has evolved in an industry with a lack of regulations.”

Experts reckon, however, that the regulatory actions of late are unlikely to batter the crypto market, pointing to assets outside the Binance bubble that have remained stable in value throughout the legal holocaust.

Comments ()