Review: The new Geegpay virtual dollar card is the best in the market for businesses and freelancers

Geegpay's new virtual card works for online payments like Aliexpress, Netflix, Shein, Facebook ads, Upwork credit and Apple Music. Here’s how it works and what you need to know about creating, funding, and using the card.

There's no denying the rise of digital payments in Africa, with each platform offering unique features to stand out. Among them is Geegpay, a fast remittance app designed by Africans, for Africans. Pioneering the path for new payment solutions, Geegpay has established itself as a trusted platform for thousands of users.

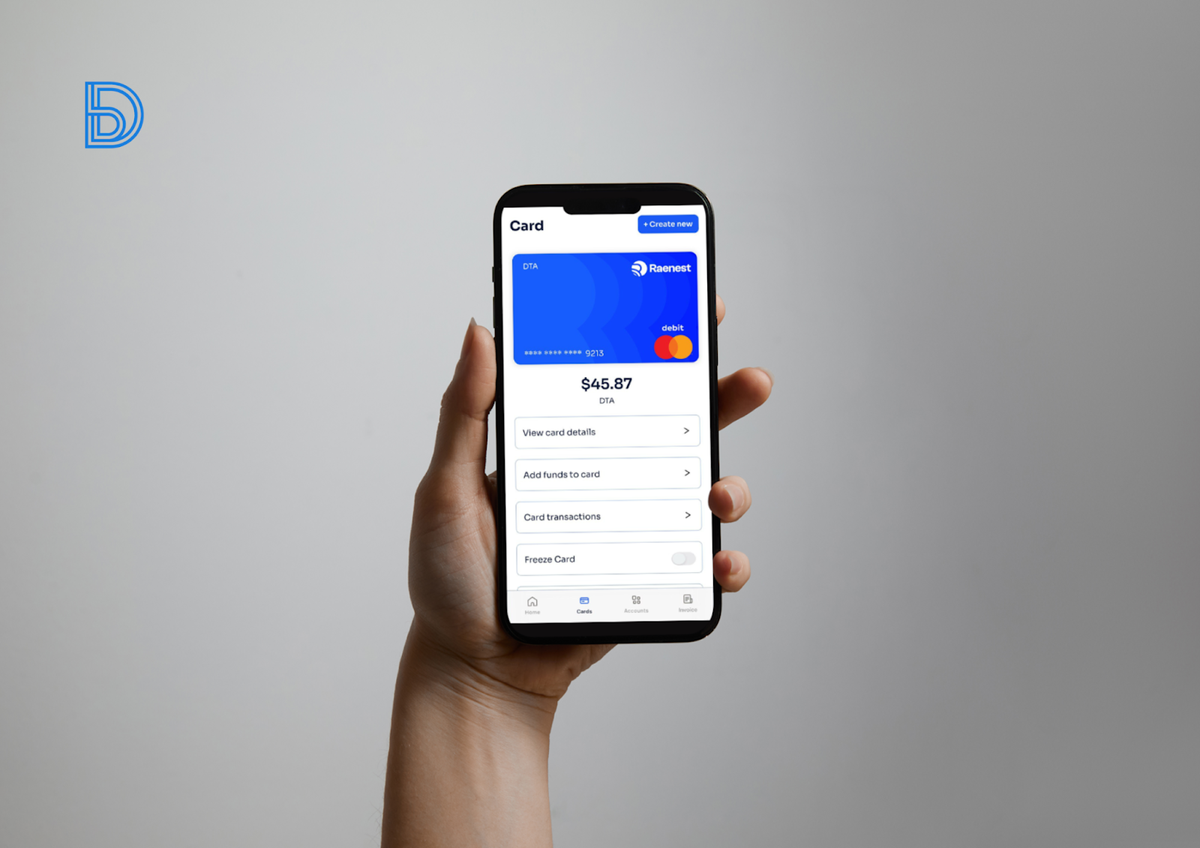

Launched in April 2022 by Raenest, Geegpay has grown to offer a suite of services beyond just receiving payments. Users can leverage the platform to also shop online and even pay bills using their virtual card.

For a nominal fee of $1, you can unlock a Geegpay USD virtual card –your key to convenient online transactions. These cards are compatible with all your favourite platforms and can be linked to either Google Pay or Apple Pay for easy contactless payments right from your phone.

While we won't cover every aspect of Geegpay services, let's explore how their virtual USD card works on an iOS mobile.

Creating and Funding the Geegpay virtual dollar card

You can access Geegpay through the website or app – download the Geegpay app from either the Google Play Store or App Store. Once downloaded, create an account using your correct biodata and complete the standard KYC verification step which would take less than 24 hours to verify.

Creating Your Geegpay Virtual Card:

Now for the fun part! You can create your virtual card using either your mobile phone or desktop.

If you’re using a desktop, visit the official Geegpay website and log in using your registered email address and password. On Mobile, you can launch the app on your phone and navigate to the "Cards" section.

Here's also where you can personalise your virtual card! Give it a name and choose a colour that suits your style. Once you're happy with your creation, click "Continue."

Incase you were wondering, It didn’t take up to 2 seconds for the virtual card to be issued and that alone checks the box for immediate convenience and flexibility to users that need to make payments on-the-go.

Funding your Geegpay Virtual Card:

The Geegpay dollar card typically works like a prepaid debit card, so you'll need to add some money to it before hitting those online stores. Thankfully, funding is done directly within the app or through supported billing sites and freelancer platforms, making it a quick and convenient process.

The recent update brings some exciting changes. Remember when it used to cost $3 just to activate your card? Well, not anymore. Now, setting up your card is cheaper with a one-time fee of $1. Although, you would need to add another $1 upon card creation. So, in total, you only need $2 to start using your card. This covers the $1 creation fee and the initial $1 funding amount.

And that's not all! You can now create up to three virtual cards at once, allowing you to manage your finances with even greater flexibility. Each card can be used separately, making it easy to categorise your online spending (e.g., one card for subscriptions, another for shopping).

Subsequently, if you need to add more money to your card, you can follow any of these simple steps.

From Geegpay's Virtual Wallet:

- Tap on the "Cards" tab in the app to navigate to your virtual wallet.

- Select "Add Funds to Card."

- Enter the amount you want to add.

- Confirm the transaction.

Through an external platform's withdrawal option:

- Log into the billing site or freelancer platform where you have funds.

- Go to the withdrawal section.

- Choose to withdraw to a card or bank account.

- Enter your virtual card’s account number and other required details.

- Specify the amount to withdraw.

- Complete the transaction, double-checking that all details are accurate to avoid any issues.

Voila! Your Geegpay card balance will be updated, and you're ready to start shopping online with ease.

Using the Geegpay dollar card

Now that your virtual card is set up, funded, and ready to unleash its potential, it might please you to know that Geegpay offers seamless integration with many popular platforms, making it easy to manage your subscriptions and bills.

For added convenience, you can transfer funds directly from your Deel, Stripe, Brex, Fiverr, and Upwork accounts into your virtual card. You also have the freedom to withdraw funds from your virtual card back to any of your wallets within the Geegpay app, giving you control over your money.

Mobile Wallet Integration:

Digital Nomads are not left out as there is now an option to add your virtual card to your mobile wallets.

For Apple Pay users, you’ll want to open the Wallet app on your Apple device. Once there, tap the ‘Add Card’ option and follow the on-screen instructions to enter your Geegpay virtual card details. After entering the information, you may need to verify your card, but once that’s done, you’ll be all set to use it with Apple Pay.

On Google Pay, enabling the secure contactless payment process is just as straightforward. Open the Google Pay app on your Android device and tap on ‘Payment’ at the bottom of the screen. From there, select ‘Add Payment Method’ or the ‘+’ sign to proceed. You can now enter your Geegpay virtual card information into the fields provided and complete any necessary verification.

Should you run into any snags or require additional help, Geegpay’s customer service are available to guide you through the setup process.

Geegpay Card Spending Limits

With international spending at the heart of the request for virtual dollar cards, fintech platforms offering the service have placed limits on the amount a user can spend daily. The virtual dollar card has no maximum funding limit. Users can manually set transaction limits based on their KYC limit. These limits can be increased by contacting Geegpay customer service if needed.

A major perk to note in comparison to other fintech apps we have reviewed is Geegpay’s transparent fee structure. There are no hidden transaction processing fees (Mastercard’s processing fees are standard) on top of the exchange rate, and there are no inactivity fees. This makes it a cost-effective option for frequent online shoppers.

What are the steps to using a Geegpay virtual card?

Here's a quick guide:

- Log in to the Geegpay app.

- Go to the "Cards" section and select your virtual dollar card.

- Make sure your card has enough funds for your purchase.

- Tap the "Show Details" option to reveal your card information.

- Copy and paste your card details directly into the biller’s payment gateway.

Can you make withdrawals using the virtual card?

Yes, you can withdraw funds from your virtual card to your wallet. However, keep in mind that the exchange rate may be less favourable than the rate you received when you funded the card.

As of writing, the exchange rate from USD to NGN is approximately ₦1,095.

Pros: Why users love the Geegpay dollar card

Geegpay's virtual dollar card emerges as a strong contender in the Nigerian market. Here's a breakdown of its key strengths:

- Fast and Easy Setup: The card creation process and overall usability on the Geegpay mobile app is straightforward.

- Competitive Exchange Rates: You can enjoy favourable exchange rates when funding your card.

- No Maintenance or Funding Fees: There are no hidden fees to worry about, making Geegpay a cheaper option.

- Top-notch Security: Geegpay prioritises your security with 3D Secure and other features, allowing you to enter your card details with confidence.

- Responsive Customer Support: Several users have reported experiencing swift and helpful customer service from issues relating to the Geegpay dollar card. Kyrian Obikwelu, a Geegpay user, shared a positive experience on X, where the support team resolved his card issue despite encountering new X payment rules.

“I just had the most helpful encounter with @geegpay_hq support. It took a couple of days but my card issues were resolved and my balance recredited...

Don’t just take our word for it. There's nothing quite like hearing directly from more satisfied users.

In conclusion

Overall, Geegpay's virtual dollar card presents itself as a valuable tool for anyone looking for a secure and convenient way to shop online using US dollars. With its combination of user-friendly features, competitive rates, and excellent customer support, Geegpay is definitely worth considering.

Comments ()