PayJoy partners Transsion, others to provide instalment payment plans for smartphones

PayJoy has signed an agreement with Transsion Group, Alcatel Mobile, Hisense and D.Light via Skyworth to enable instalment payment plans for their devices.

PayJoy—a consumer and smartphone financing startup—has signed an agreement with Transsion Holdings and three other original equipment manufacturers (OEMs) to enable instalment payment for their devices.

This agreement will enable customers in emerging markets to buy Transsion, Alcatel Mobile, Hisense and D.Light via Skyworth devices on credit and pay instalmentally over a period of time.

According to PayJoy, this compatibility agreement was made possible by the integration of PayJoy Access into the systems of the four OEMs. PayJoy Access is a firmware developed by PayJoy to facilitate the integration of its cutting-edge smartphone locking technology for OEMs, PayJoy Lock.

With PayJoy Lock installed on a device, retailers can afford to sell their devices on credit because Lock will collateralize the device. This means, if the customer misses a payment schedule, Lock will automatically restrict the phone functions to only emergency calls and communicating with the retailer.

By licensing PayJoy Access, these OEMs have shown a strategic commitment to expanding access to their devices for the next billion consumers, which will in turn increase the sales of their devices. PayJoy continues to welcome additional OEMs to our compatibility process and look forward to additional compatibility announcements over the coming months.

Through its Lock application, PayJoy improves repayment rates and make smartphones more affordable. In Mexico, one of the 10 countries where PayJoy operates, PayJoy uses Lock to offer its own monthly payment plans, and it has reduced consumers' default risk by 50%, while enabling increased approval rates.

Sounds like good news but it isn't

This is a laudable initiative that will improve mobile phone penetration in Sub-Saharan Africa at least. GSMA, an association of mobile network operators, projects smartphone adoption in the SSA will increase to 66% by 2025. Providing instalment payment plans for smartphones will accelerate this adoption.

Although most of Transsion's devices (Tecno, Infinix and iTel) are low-cost, an instalment payment plan will encourage more people to purchase its high-end devices, which could cost upward of ₦50,000.

Related: Africa's leading mobile phone maker, Transsion Holdings, goes public

But there is the human factor. Bypassing an application such PayJoy Lock, especially on an Android device, is just a Google search away—"how to get rid of PayJoy app". Consequently, retailers might still get their fingers burned.

Recall that earlier this year PayJoy announced a partnership with the trio of Technology Distribution Limited—a subsidiary of Zinox Technologies and the foremost ICT distributor in Africa, MTN Nigeria and Sterling Bank to launch a 'Device Financing; Pay Small Small' campaign.

With the campaign, all a customer had to do was open an account with Sterling Bank and they will be able to access loan ranging from ₦25,000 to ₦400,000 to buy any Samsung smartphone of equivalent value from MTN Service Centres. The repayment plan was as low as ₦7,500 monthly.

The campaign has, however, been discontinued. Both the website and the customer service number (070078375464) set up for the campaign are no longer working.

The foremost e-commerce store in Africa, Jumia also tried its hands on smartphone financing with Jumia Flex, but stopped just as fast as it started.

Meanwhile, some smartphone retailers have continued to offer smartphone financing to their customers. SLOT, one of the leading smartphone and electronics retailers in Nigeria, through its corporate sales, allow customers to buy its products on credit and pay instalmentally.

Caveat Emptor: While it is really nice to be able to buy Google's Pixel 4 and pay instalmentally, know that when you buy things through hire purchase, you end up paying more because the seller has added their risk cost to the price.

Why is Africa's biggest smartphone seller, Transsion, doing this now?

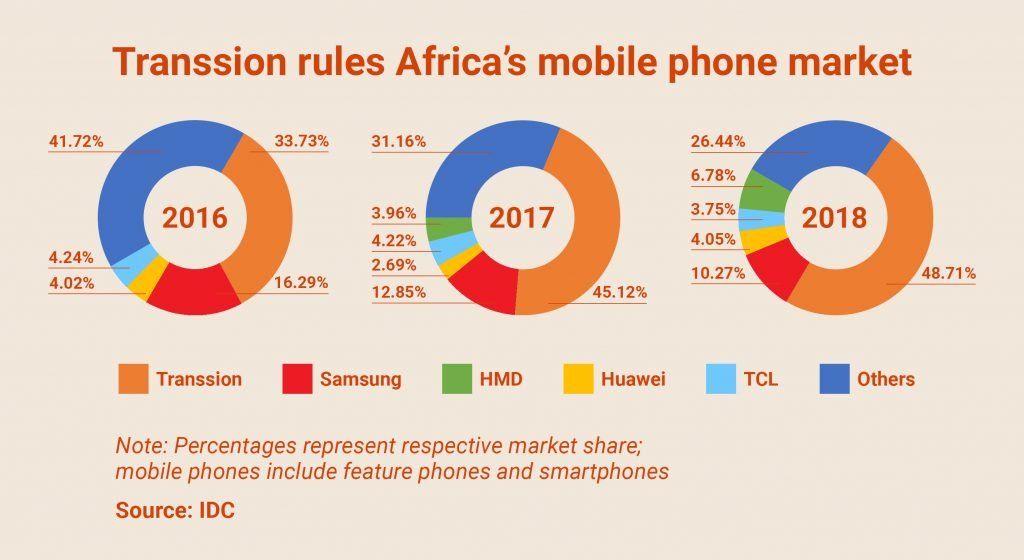

Transsion already rules Africa, why is it partnering with PayJoy to provide smartphone financing? To drive more sales and fend off competition.

The partnership will not only increase the sales of Transsion's and the other OEMs devices, as Mark (PayJoy's Chief Business Officer) rightly said, it also fits into Transsion's strategy to fight competition from the likes of Huawei and Xiaomi.

Xiaomi, whose first foray into Africa was in 2015—five years after it launched, has opened two stores in Nigeria and Kenya, respectively, to boost its presence in Africa. In Kenya, the Beijing-headquartered electronics company partnered with Aspira—a product-financing startup—to enable smartphone financing.

Similarly, Huawei—the dominant telecoms equipment provider in Africa—was also rumoured to have filed a lawsuit against Transsion ahead of its IPO last month, over alleged copyright and intellectual property claims.

In response to the increasing expansion of fellow Chinese OEMs in Africa, Transsion is quickly expanding to other markets, including Bangladesh, Pakistan, India and Southeast Asia.

According to Tencent's Digital Visualization, Transsion isn't particularly known for its strength in research and development, hence, it's been focusing on markets which require lower thresholds of technological advantages. Hence, partnering with PayJoy to provide smartphone financing in these emerging markets makes perfect sense.

In Nigeria, also, through its sister company, Transsnet Financial—a joint venture with NetEase—Transsion Holdings is offering smartphone financing. Last month, Transsnet Financial Nigeria Limited (TFNL) launched a mobile app for the Easybuy programme, which allows Nigerians to buy any phone of their choice and pay instalmentally.

Easybuy provides customers with loans capped at ₦50,000 with repayment period ranging from 91 days to 180 days at 6% to 9% monthly interest rate. This means if customer collects a ₦50,000 loan for six months at 6%, they will be repaying ₦68,000 (principal + ₦18,000 accrued interest for the six months).

For Transsnet Financial, which already provides loan service through PalmCredit, Easybuy is just another way of providing credit facility. What could not be confirmed, however, is whether the devices purchased through Easybuy are collateralized with PayJoy Lock.

About PayJoy

Inspired by his work in the pay-as-you go solar industry and at Google Maps, as well as a Peace Corps volunteer in West Africa, Doug Ricket founded PayJoy in 2015 to make technology and financial services affordable to the underserved people living in developing countries.

Earlier in May 2019, the Silicon Valley-based startup raised $20 million from Greylock Partners, Union Square Ventures EchoVC and Core Innovation Capital. This brings total fund raised by PayJoy since 2015 to between $40 million and $70 million.

With a growing workforce of 115 people, PayJoy facilitate the offering of affordable smartphone payment plans to underbanked people in 10 countries, including India, Indonesia, Nigeria, Kenya, Guatemala and Mexico.

Comments ()