Payhippo appoints new CEO, as Bijesse joins board

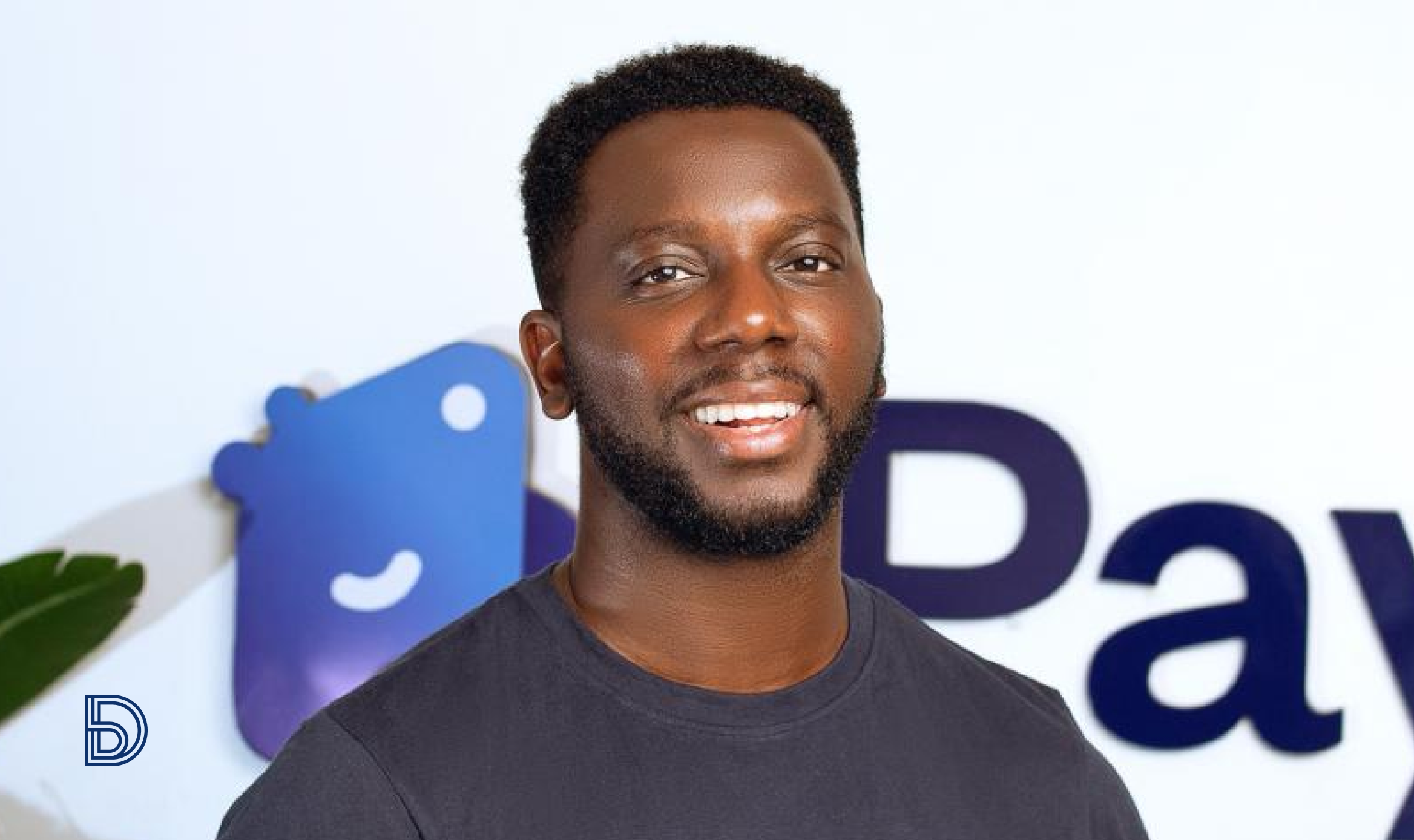

YC-backed Nigerian fintech startup, Payhippo has appointed Dami Olawoye as its new chief executive officer. The outgoing CEO, Zach Bijesse will join the startup's board.

Nigerian fintech startup, Payhippo has appointed Dami Olawoye as its new chief executive. Before this role, he was the startup's finance chief. “I am deeply honoured to become CEO of Payhippo,” Olawoye said.

During his tenure at Payhippo, Olawoye has successfully expanded product offerings, spearheaded fundraising initiatives, and launched a partnership platform. His leadership has also driven profitability enhancements.

“Payhippo is a leading player in Nigeria's fintech sector, and I am excited to lead the company's growth and continued support for small businesses across the country. I am particularly passionate about Payhippo's new products, which will help small businesses in the renewable energy sector to scale up and create jobs,” he added.

“Dami's extensive experience in the Nigerian market and his deep understanding of the challenges and opportunities facing small businesses make him the ideal person to lead Payhippo into its next phase of growth," said Zach George, Managing Partner at Launch Africa. “I am confident that under his leadership, Payhippo will continue to innovate and provide small businesses with the financial and other resources they need to succeed.”

Olawoye will succeed Payhippo's co-founder, Zach Bijesse, who is taking a role on the company's board of directors. “As I transition from CEO to board member, I'm especially grateful to Chioma, Uche, and Dami for their contributions to Payhippo's success. They are the ones who helped build this company from scratch, and I'm excited to continue watching it grow up,” Bijesse said.

He co-founded the company in 2019 to provide capital for SMEs. Since then, Payhippo has disbursed over 36,000 SME loans and has secured $16 million in equity and debt funding. Last year, the YC-backed fintech startup acquired Maritime Microfinance Bank to enable its users to accept deposits from its customers and integrate with NIBSS.

“Payhippo is poised to capitalize on the growing demand for asset financing in Nigeria. I do not doubt that Dami, Chioma, and Uche will continue to build a successful business together. I have known Dami for many years and have been impressed by his vision, leadership, and execution skills,” Dave Uduanu, CEO of Access Pensions, who is an angel investor at Payhippo, said.

Comments ()