Nigerian banks restrict transactions to neobanks amid rising fraud concerns

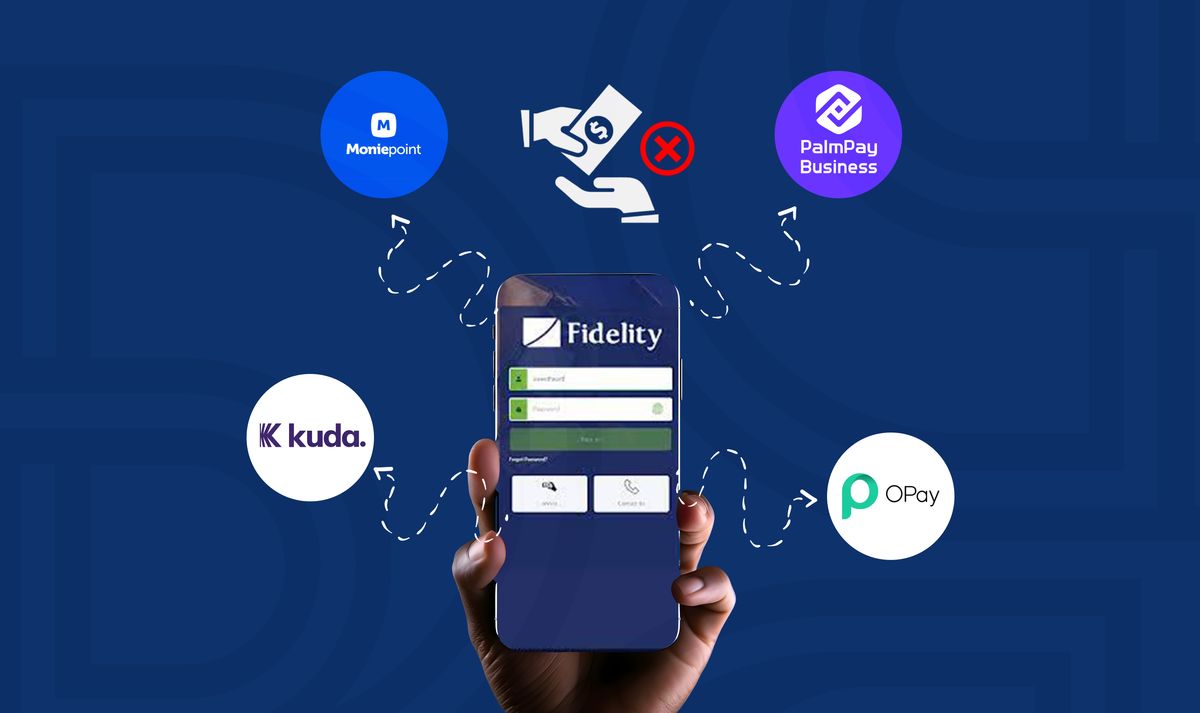

Nigerian Banks such as Fidelity and Standard Chartered have imposed transaction restrictions on neobanks like Moniepoint, Kuda, Opay, and PalmPay, citing mounting concerns over fraud.

Out of the ₦2.59 billion that was involved in fraudulent activities in the first quarter of 2023, Nigerian banks lost ₦472 million to POS and mobile fraud, according to the Nigeria Deposit Insurance Corporation (NDIC). This can be largely attributed to the increasing popularity of these payment methods in the country.

The report indicates that while the number of reported fraud cases has decreased, the ongoing presence of fraudulent activities remains a major concern. In March, Semafor Africa reported that certain Nigerian fintech startups, including neobanks like Kuda, commenced a dialogue aimed at formulating a unified strategy to address fraudulent transactions occurring within their networks.

This report came in the wake of the reported ₦2.9 billion cyber breach at Flutterwave in the same month, an incident that the fintech has subsequently refuted. A separate report emerged in July about an internal breach at Glade, a fintech startup backed by Techstars, which was likewise denied.

Notwithstanding these denials, a report by Smile ID, Africa's foremost identity verification and onboarding service provider, identified Nigeria as one of the high-risk countries in Africa for fraud. “Fraud rates move up and down across countries as growth and user behaviour changes in response to new products, services or changes in regulations,” says Smile ID.

In an attempt to combat this issue, certain commercial banks in Nigeria have reportedly taken measures to block transactions heading to neobanks such as Kuda, Moniepoint, Opay, and Palmpay.

TechCabal reported on Wednesday that Fidelity Bank has removed these neobanks from the list of bank options within its mobile app. While official sources from Palmpay denied the imposition of such restrictions, the report indicated that Moniepoint acknowledged its implementation. A Standard Chartered Bank customer confirmed to Bendada.com that they too faced transaction restrictions of a similar nature.

It's also uncertain whether the aforementioned banks have notified the Central Bank of Nigeria about its actions concerning these licensed financial institutions.

“Maybe the banks are afraid of their own porous systems and those using Opay accounts and others are just using them to collect money because they can avoid scrutiny, but these will be small amounts. Fraud is a systemic issue, and blocking isn't the answer, it is collaboration,” Victor Asemota, a leading African tech entrepreneur, posted on X. “The real fraud problem with banks is inside the banks. If your systems can be compromised, it is either they are weak or there are insiders facilitating the crimes. This is the real problem they should tackle.”

His assertion is consistent with the findings of the NDIC. The corporation revealed an 89.47% increase in staff involvement in fraudulent incidents at Nigerian banks, leading to 15 employees losing their jobs.

Looking at it from a different angle, Opeyemi Awoyemi, the founder of Fast Forward Venture Studio, shared that due to the higher number of accounts opened on neobanks like Opay compared to traditional commercial banks, there's a greater likelihood of encountering more fraudulent accounts. “It's disingenuous to put the blame on someone who is faster,” he added.

Nevertheless, certain public pundits have alleged that commercial banks, sometimes referred to as legacy banks, are engaging in gatekeeping practices with these restrictions. While we cannot verify this assertion independently, experts have suggested that the path to combating the rising fraud issue lies in fostering collaboration and reinforcing Know Your Customer (KYC) procedures.

“I will advise that you should not even launch your product without fraud mitigations built-in, this is because fraudsters are amongst your first adopters. Fraudsters are on top of everything that is happening in fintech, their common tactic is referral fraud,” Wiza Jalakasi, director of Africa Market Development at Ebanx, a LatAm fintech unicorn, told Bendada.com.

“You are going to start seeing fraud losses from the day you launch your product; and the sooner you can mitigate it, the better,” Jalakasi added.

Related Article: Understanding user onboarding and fraud in Africa

Editor's Note: This is a developing story

Comments ()