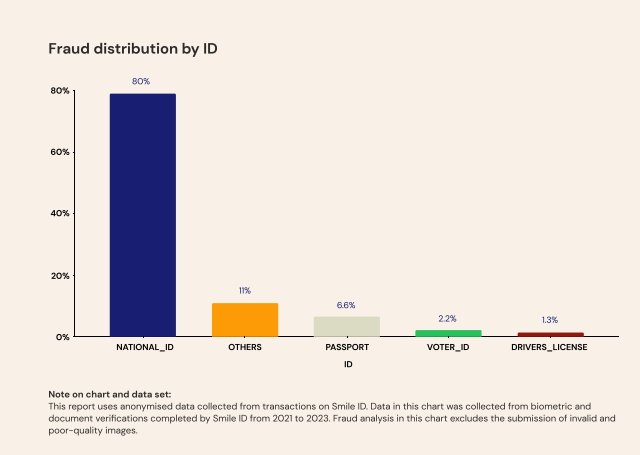

National IDs linked to 80% of identity fraud attacks in Africa

National IDs are the most attacked document type in Africa, according to Smile ID. We examined some of the trends around identity fraud attacks on the continent.

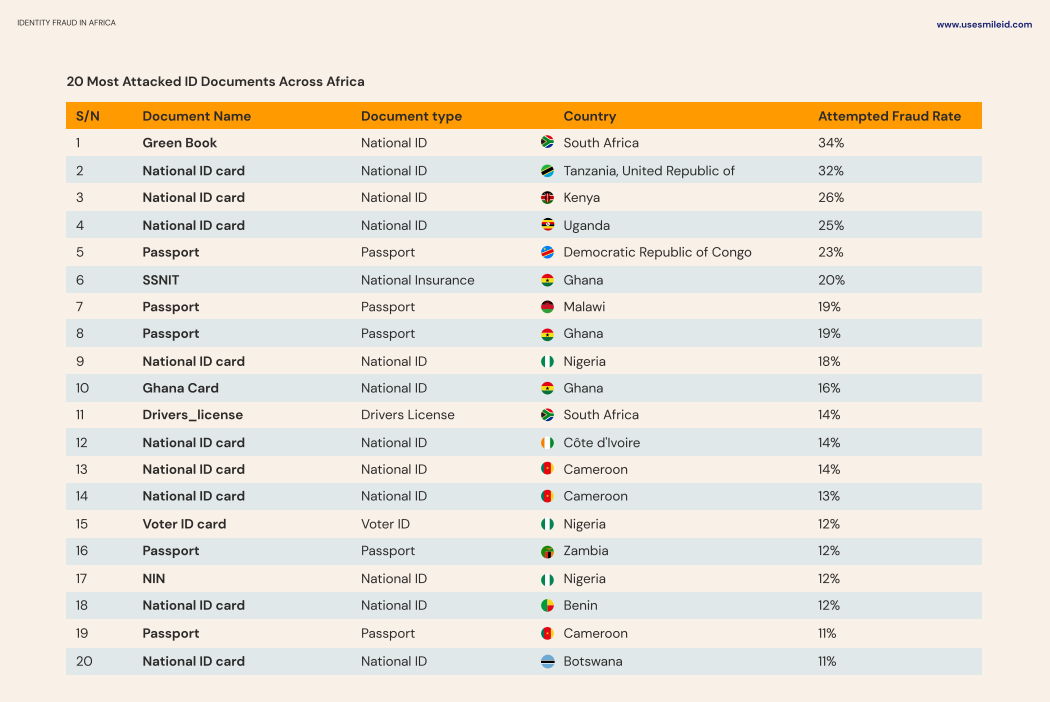

After completing more than 100 million identity verifications across Africa in the past five years, a report from Smile ID, a leading digital KYC provider in the region, indicates that 80% of fraud attacks on the continent are specifically aimed at national IDs, establishing them as Africa's most targeted document type.

The Tanzanian ID is the most vulnerable with a 32% attempted fraud rate. According to the report, "With more national ID documents in circulation than ever before, the chances of them getting lost or stolen get increasingly higher by the year, exposing holders to potential document fraud."

In Africa, many businesses use government-issued IDs such as driver's licenses, international passports, voter's cards, and national identity numbers (NIN) for KYC procedures and the onboarding of customers. Hence, fraudsters have continued to find ways to bypass the onboarding process while trying to access certain platforms, especially financial services; this includes using fake documents (counterfeit, obscured or expired) or stolen IDs.

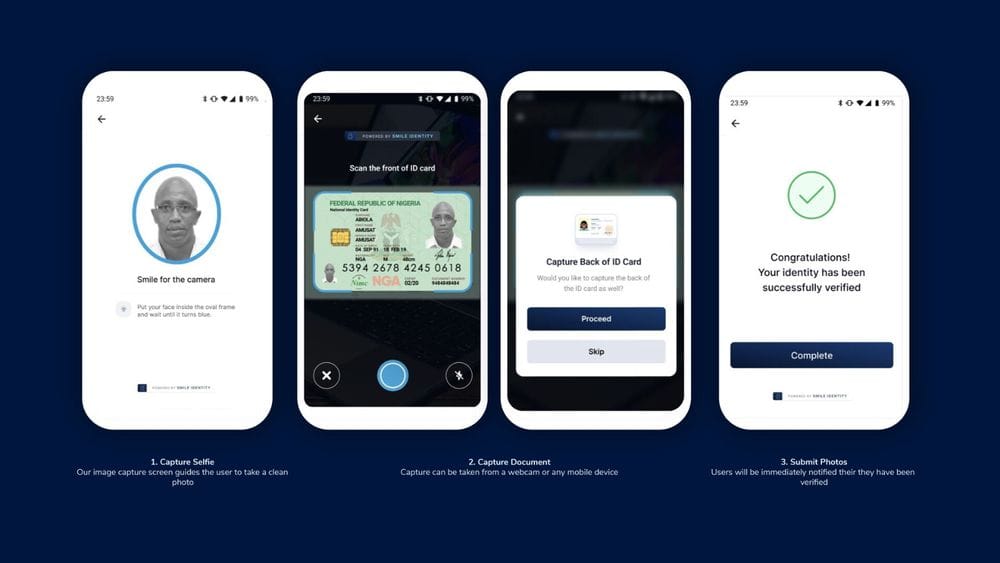

According to Smile ID, "There are two common ways that businesses can fight document fraud. Businesses can either verify the ID's validity against ID authority databases or through document verification by comparing the ID document with authentic templates and security features to find inconsistencies."

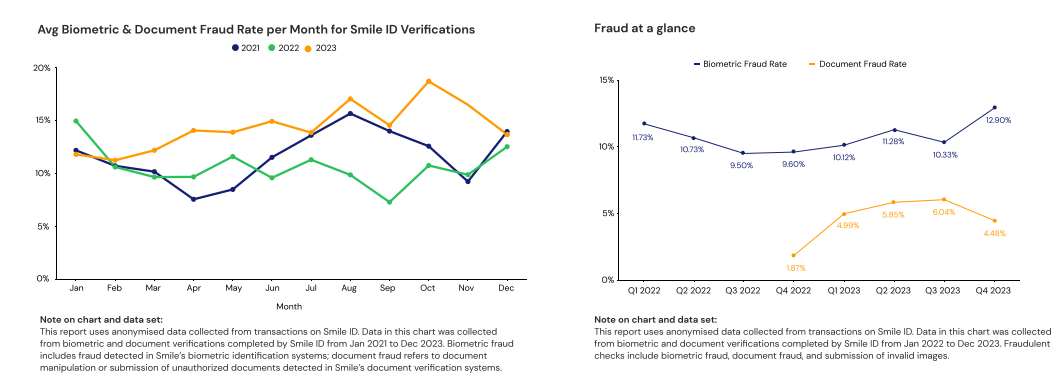

"Incidentally, 37% of the fraud performed on documents was caught due to the biometric component in our document verification solution. Without biometric checks, we estimate more than a third of ID document fraud goes unnoticed," the digital KYC provider said in its 2024 report on Digital Identity Fraud in Africa.

However, when startups and providers like Smile ID and Dojah try to check and confirm user information to prevent fraud, they often face issues with the National ID service going offline. In 2022, Smile ID experienced downtime 6% of the time while using national ID databases. On 61 out of 365 days, some databases were offline for more than 10% of the time.

"The African government needs to build a basic ID infrastructure that is easy to use and reliable," Mark Straub, co-founder and CEO of Smile ID told Bendada last year. "At Smile ID, we have built "fail safes" that make sure that all the traffic sent to us is processed because the national ID infrastructures go down all the time; sometimes throughout the day and that is a real point of friction for everyone."

Meanwhile, IDs belonging to women are targeted almost as much as male-owned IDs, compared to previous years where male IDs were the most targeted.

Related Article: ID-related fraud issues faced by US fintech mirror Africa's trends

Biometric fraud in Africa

Although fraud is being detected as more businesses across Africa are adopting biometrics for identity verification and fraud prevention, fraudsters are also attempting to circumvent the system. "Biometric fraud is usually more complex than document fraud and difficult to catch without advanced prevention tools," says Smile ID.

Fraudsters predominantly employ four methods to manipulate biometrics: no face match, spoofing, duplication, and generative AI (such as deep fakes). No face match constituted 48.5% of all biometric fraud attacks identified by Smile ID last year, followed by spoofing.

However, the Pan-African KYC provider asserts that businesses relying on biometric verification are four times more secure than their counterparts relying on textual verification alone. "Layering biometric authentication on top of textual verification during onboarding offers advanced protection for businesses," Smile ID stated in its report.

Comments ()