Kola Aina urges founders to assess venture scale viability before seeking VC funding

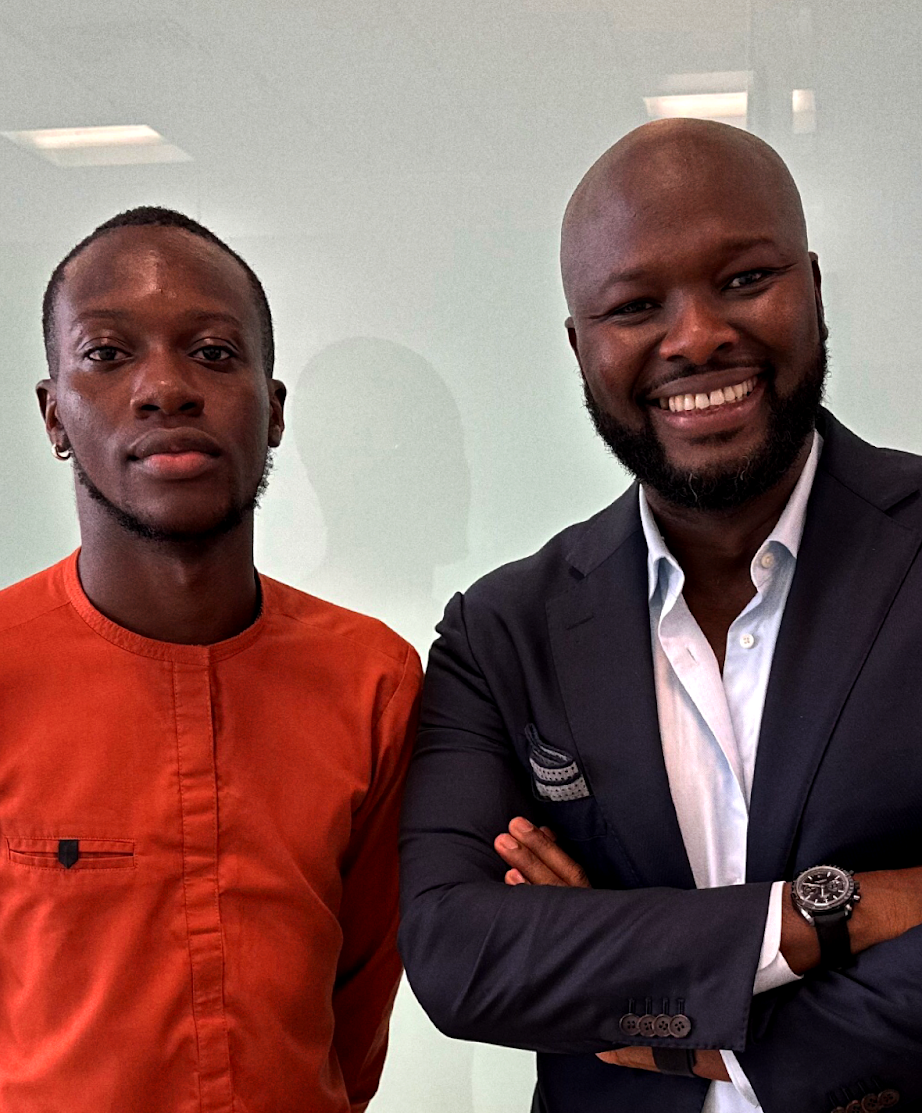

Kola Aina, founding partner at Ventures Platform shares the behind-the-scenes at Ventures Platform and insights on venture scale viability for startups.

In 2016, the Nigerian startup ecosystem was characterised by promising ventures, limited funding, and a relatively small participant pool. Kola Aina, Founding Partner at Ventures Platform, was an early participant who invested in startups like Paystack and Piggyvest.

Fast forward to 2023, the ecosystem has rapidly expanded, and Ventures Platform is now a $46 million fund.

In our meeting at his Lagos office, Kola shared insights on Ventures Platform backing market-creating innovations, the importance of founders assessing scalability before seeking funding, and how his team aided Thrive Agric's recovery.

Ventures Platform: the operator-driven discovery fund

While examining Kola’s LinkedIn bio, the description of Ventures Platform as an early-stage “discovery” venture capital fund caught my attention. In our meeting, I delved into understanding how Ventures Platform embodies this “discovery” aspect.

He explains, “Our focus on "discovery" stems from our position in the early stages of the investment ecosystem. We aim to be pioneers by being the first to invest in companies where we have conviction. We're not hesitant to be the initial institutional check for promising ventures.”

To illustrate the fund's pursuit of pioneering status, Kola outlines its rigorous process, saying, “We sift through an extensive volume of deal flow, evaluating over 1500 companies each year at first glance. Our goal is to identify high-potential companies before their potential becomes obvious to everyone. While this approach acknowledges the possibility of occasional misjudgments, we've maintained a high signal-to-noise ratio, at least so far.”

Further distilling Ventures Platform's identity, Kola emphasises, “In essence, our fund strategy signifies our commitment to this discovery-oriented approach. To define our identity at Ventures Platform, we see ourselves as operators disguised as investors. The leadership and senior team members have hands-on experience in building, exiting, or working in startups. This operator-centric approach enhances our ability to discover and practically support promising opportunities.”

Transforming ideas into market-creating innovations

Remarkably, Ventures Platform's discovery philosophy is not tethered to any specific industry; instead, it operates as a thesis-driven fund with a focus on catalyzing market-creating innovation.

Kola provides a concise explanation: “We operate as a thesis-driven fund. This means that our focus isn't on investing in specific segments; rather, the fund targets a specific kind of innovation known as "market-creating innovation." This focus stems from the belief that such innovations are best suited to tap into the venture opportunities in Africa, particularly in addressing non-consumption.

The challenge at hand is significant, with millions of individuals and small businesses unable to access essential goods and services. The key question becomes: How can the delivery of these goods and services be reorganized to enable more people to consume them? This question defines the fund's thesis, driving its mission to find, fund, and support innovations that address this challenge.”

How Ventures Platform defied fundraising odds in 2022

Kola and the team at Ventures Platform started the year on a high note as they closed their Pan-African Fund above its initial target; at $46 million back in December 2022. While this accomplishment stands out amidst the global trend of venture funds experiencing pullbacks, it is not merely a stroke of luck. Instead, it is a culmination of an impressive track record, the success of portfolio companies, and strong interest from local and foreign investors.

Breaking down the factors contributing to this success, Kola explains, “The oversubscription of our funding round can be attributed to several factors. Firstly, our strong track record played a significant role. We've been fortunate to deliver positive results and return capital, which garnered investor confidence.”

Local investors, corporations and development finance institutions (DFIs) also played pivotal roles in the funding success. Kola adds, “Furthermore, we were fortunate to attract interest from local investors. Additionally, the involvement of DFIs further fueled interest in our fund. This success is a testament to the excellent work of our team in building a distinctive brand.”

Kola doesn't forget to credit Ventures Platform's early portfolio companies, stating, “Credit is also due to our early portfolio companies that have executed exceptionally well. Their success contributes to our overall track record, showcasing the effectiveness of our investment approach. While the fundraising landscape is currently challenging, the support from our early portfolio companies, especially the success of Paystack, Piggyvest and others, has validated our approach as early investors in these companies.”

From single-check investor to long-term partner

In July 2023, Ventures Platform reached another significant milestone by co-leading an $8 million Series A equity funding round for Remedial Health. This achievement marks a transformative shift for Ventures Platform, transitioning from a single-check investor to a multi-round, long-term partner.

Kola expresses, “We’ve always aimed to provide ongoing financing beyond the initial round, and we are pleased to see this thesis validated with the Series A raise. This development is a remarkable achievement for us, highlighted by our recent rebrand. We have evolved from a single-check investor to now being a multi-round, long-term partner for companies we invest in.”

The ThriveAgric turnaround and lessons learned

Success is not immune to challenges, and Kola, like anyone else, has faced his fair share. Describing a specific situation that tested him and his team, Kola shared how they assisted Thrive Agric, one of their portfolio companies, during a challenging period and helped it recover.

Ventures Platform was an early investor in ThriveAgric.

“By 2020, Thrive had experienced significant business growth, but certain aspects hadn't kept pace with this expansion. Despite the challenges, the founders demonstrated remarkable diligence. However, a cash flow mismatch emerged, leading to shortfalls and struggles within the business. This situation extended to individual subscribers facing payment delays, which gained attention on social media. This presented an opportunity for Ventures Platform to test the extent of its post-investment support, and fortunately, a positive outcome was achieved,” he said.

Ventures Platform played a crucial role in restructuring the business, bringing in an interim CEO for turnaround management, and facilitating business refinancing. Kola reflects, “Today, Thrive Agric is thriving. The key lesson learned was the importance of constantly cultivating and aggregating assets – people, relationships, tools, and resources that can be leveraged to support portfolio companies.”

Understanding and embracing investment risks in the African market

Investing in Africa is gaining popularity and is sometimes misrepresented as a quick path to wealth. However, not everyone buys into this hype, with some investors still viewing it as a risky venture. Kola, however, diverges from this perspective, emphasising that risk is inherent in startup investments, and understanding and embracing it is crucial from the outset.

Addressing recent challenges, especially foreign exchange (FX) fluctuations in markets like Nigeria, Kenya, and Egypt, Kola maintains that Africa is a significant market deserving of serious consideration. While acknowledging challenges, he contends that the investment landscape is not inherently riskier than any other market but requires a commitment to due diligence and a clear understanding of local dynamics. He also sees many macro challenges as temporary, highlighting the central bank's commitment to stability in Nigeria as a positive signal.

For investors eyeing the African market, Kola offers actionable strategies:

“First, collaborate with local investors who understand local market dynamics. Secondly, at every stage of fundraising, the most authentic approach involves having a local presence. Even if you are an early-stage fund investing in Africa remotely, consider partnering with local entities. Ideally, at every stage, the investment process should have a local touch. And so, spending time on the ground is crucial. Engage in basic due diligence, get to know the local context, and establish relationships.”

Thriving amidst regulatory, sectoral, and macro challenges

As a VC whose fund has supported more than 140 founders reshaping various sectors, ranging from healthcare to logistics, Kola has witnessed firsthand the recurring challenges that hinder startups from scaling.

He highlights three of these challenges:

“One primary scaling challenge for many companies often lies in navigating regulatory bottlenecks. The best approach to address this is to understand the regulatory landscape of the company before initiating any fundraising efforts. Engaging with regulators instead of avoiding them is key. By doing so, you not only gain insight into the regulatory requirements but also demonstrate transparency to potential investors, ensuring they are informed about the regulatory risks.”

Moving on, Kola delves into another common pitfall witnessed in the startup landscape — entrepreneurs venturing into sectors where they lack the requisite experience or network. “Another common challenge we've observed is entrepreneurs building businesses in sectors where they may lack the necessary experience or network. ”

Fintech, for example, extends beyond just software development; it encompasses AML, compliance, regulation, and treasury management. While early stages may focus on coding, the need for deep financial expertise becomes apparent as the business scales. This lack of relevant expertise can pose challenges, particularly in industries with complex regulatory and operational requirements. Recent public incidents highlight the importance of industry experience beyond just coding skills.” Kola adds, “Solving this challenge often involves strategic senior hiring and forming advisory teams with the required expertise.”

Lastly, he discusses macroeconomic factors in Nigeria as the third challenge. He concludes, “Despite doing everything right at the micro level, external factors such as inflation, exchange rates, and market dynamics can impact growth. Some companies may experience growth in local currency terms but face challenges when translating that success into global terms. Investors who understand and can navigate these macro nuances are essential for successful fundraising.”

The crucial factor founders should assess before seeking VC

Typically, when I interview leading VCs, I always inquire about advice for founders seeking funding. While this routine wasn't any different with Kola, it took an intriguing turn as he provided compelling advice, urging founders to consider the venture scale potential of their business before pursuing VC funding.

In his words, Kola shares, “Firstly, it's crucial to recognize that not every business necessarily needs venture capital. Many impressive businesses we encounter may not fit the traditional venture-backed model. Entrepreneurs should aim to understand the specific business model that aligns with venture capitalists’ business model.”

Expanding on this, he states, “In my case, the key customer is the acquirer of the businesses I invest in. This is significant because my primary goal is to generate returns on invested Limited Partner's capital. Therefore, I assess each business with the question in mind: Can this company potentially provide the returns needed to fulfil my fund's objectives?”

Summing up, Kola emphasised, “Founders need to grasp this perspective. The more they evaluate the venture scale potential of their business, the less frustration they might encounter in the fundraising process.”

It's important to note that various sources of capital exist, including customer payments, grants, loans, and support from family and friends. Exploring these alternative avenues can be beneficial, providing additional funding options beyond the traditional venture capital route.

Kola's threefold vision for Africa's startup ecosystem

Kola ended the discussion by reflecting on the scenario he envisions for the African startup ecosystem in the coming decade. He says, “I have three key aspirations for this ecosystem. Firstly, I aim for a more substantial involvement of local capital. To elaborate, I envision increased capital inflows into venture activities from various sources such as High Net Worth Individuals (HNIs), certain corporations, pension funds, and sovereign funds.

It's noteworthy that the landscape has evolved since our inception in 2016 when we were among the few local sources of capital. Presently, our fund, for instance, comprises about 20% local capital, and I aspire for this proportion to continue growing.

Secondly, I desire greater liquidity and more successful exits, providing concrete evidence of the potential for profitable returns on capital in Africa. This not only strengthens investor confidence but also contributes to the overall growth and sustainability of the ecosystem.

Lastly, I hope for an increasing level of mainstream integration within the ecosystem. At present, startups play a significant role, contributing a notable portion of the GDP through sectors like telecommunications. Looking ahead, I anticipate this contribution to expand, fostering greater diversification in the economy and establishing startups as a more integral part of the broader economy.”

Comments ()