Japa ranks among the top 3 savings goals for Nigerians, PiggyVest says

The emigration from Nigeria, often referred to as "Japa," ranks as the third most common savings goal among Nigerian income earners, according to the PiggyVest Savings Report 2023.

According to a report by the UK Home Office's National Statistics, Nigerian citizens stood out as the second-highest group of individuals to receive Work Visas in the United Kingdom between December 2019 and June last year.

In June 2022, a noteworthy 65,929 Nigerians arrived in the UK using study visas. During the same month, the United States of America issued 6,915 non-immigrant visas to Nigerian nationals. It's worth mentioning that this number does not encompass Nigerians who have relocated to the UK via other migration channels, including the Global Talent Visa, which is particularly popular among the country's tech talent.

“Japa”, a Yoruba word which means “to run, flee, or escape”, has evolved to represent the current widespread departure of Nigerians fleeing due to rising economic challenges and incidents of police brutality.

“I come from a poor background, and I had to save a lot to help my relocation. I have a couple of friends who are coming to the UK to do their Masters, but also using it as an opportunity to escape Nigeria,” Chris, a Nigerian immigrant told Okay Africa.

In line with Chris, many Nigerian earners have made saving for Japa one of their primary savings objectives, as indicated by the PiggyVest Savings Report for 2023.

“The data obtained reveals that japa, the emigration of Nigerians, is a major reason many income earners are saving. This is especially true for young people, japa is the number one financial goal for over 50% of Gen Z [on PiggyVest],” according to the Nigerian fintech.

Related Article: Eight steps to settle in the UK as a Global Talent immigrant

Other takeaways from the PiggyVest Savings Report for 2023

These insights are derived from a survey that involved over a thousand individuals from various age groups, genders, and income brackets across Nigeria.

Thriving savings culture

Based on PiggyVest findings, the savings culture in Nigeria is thriving. A significant 79% of Nigerians affirm having a savings habit, with 64% saving regularly and an additional 15% saving intermittently.

According to Odunayo Eweniyi, co-founder and COO of PiggyVest, “Saving money is challenging, especially when income is low or there isn't sufficient knowledge of how to start small. It may not seem like it at the beginning but every Naira counts.”

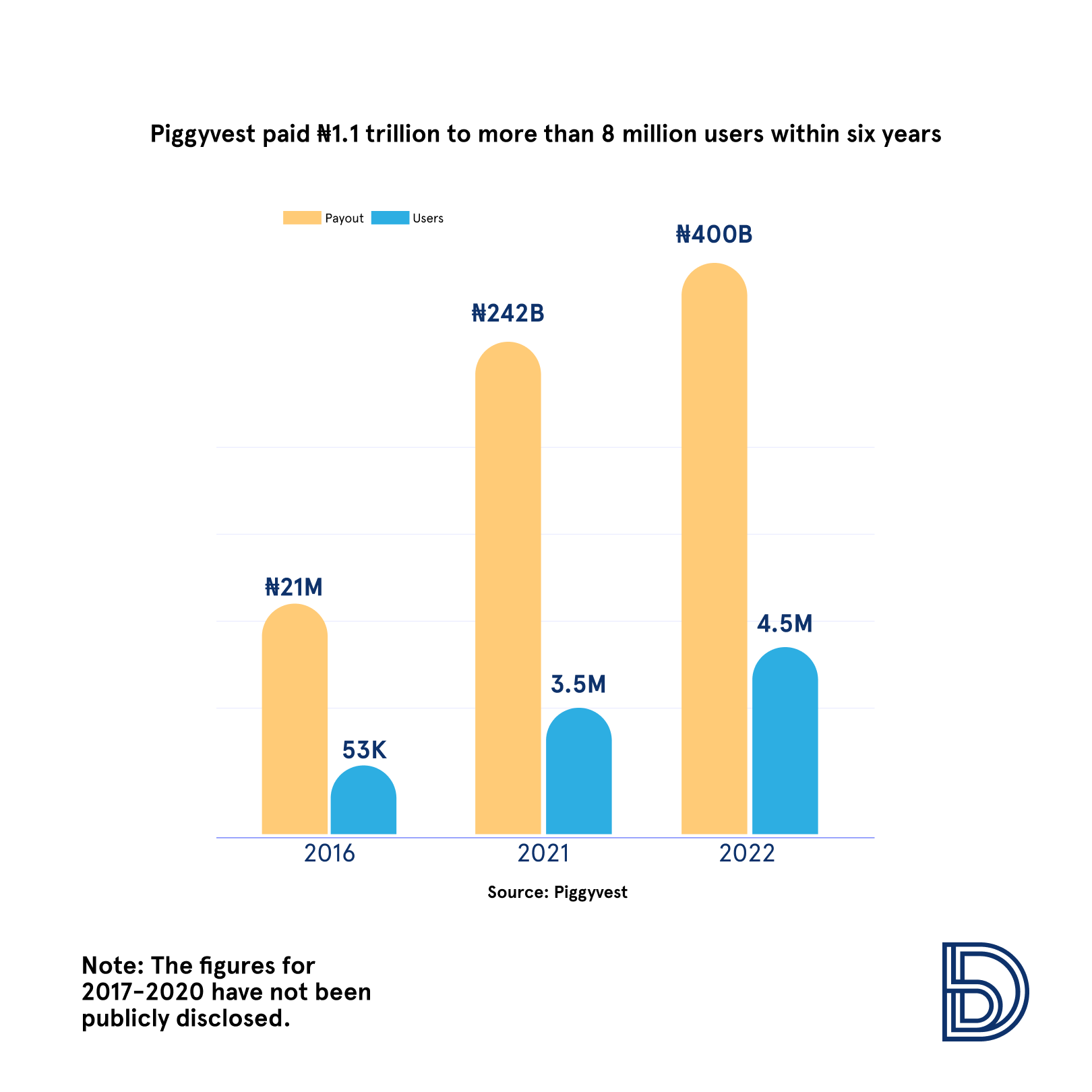

In 2022, PiggyVest disbursed approximately ₦400 billion to its users, resulting in a cumulative payout of over ₦1.1 trillion since its inception. “Our disbursement model means that this amount is money that people saved and requested. Only a few people withdraw their money. It represents the liquidity we had to return their money,” according to Josh Chibueze, PiggyVest's co-founder and CMO.

Of debt and black tax

Furthermore, a notable revelation from the report centers on black tax and debt. The report uncovers that about four out of five Nigerian income earners contribute to black tax, signifying its substantial financial impact on a considerable number of Nigerians.

Additionally, more than three out of every 10 Nigerians acknowledge being indebted to various sources, including family and friends, loan applications, banks, or other creditors.

Generation X and Millennial Nigerians are the generations most prone to being in debt, while those aged 57 and above are the least likely to be indebted. The report also indicates that, in terms of gender, men are more likely to be in debt compared to women.

Related Article: Predatory lending in Nigeria—what is the way forward?

In 2020, the global COVID-19 pandemic plunged millions of people into financial distress. Job losses, factory closures, business shutdowns, and widespread lockdowns affected people worldwide.

Nigerians were also significantly impacted. According to the COVID-19 impact monitoring survey published by the Nigerian Bureau of Statistics, approximately 42% of Nigerians who were employed before the pandemic lost their jobs due to its effects. Faced with this financial instability, many individuals turned to digital lenders, which seemed to be the sole source of financial assistance during that challenging period.

In light of the insights gathered in the survey conducted between April and May this year, PiggyVest advised Nigerians to cultivate responsible money management habits. This includes aspects like budgeting, setting financial goals, establishing emergency savings, and assessing and repaying debts.

Download: The PiggyVest Savings Report 2023