InvestSika is making investing accessible to all Africans, starting with Ghanaians

InvestSika is on a mission to make investing accessible to all Africans. With a mobile money account and smartphone, you can start trading and investing in the stock market with as little as GH₵60 ($10 or ₦3,820).

InvestSika is on a mission to make investing accessible to all Africans. And it is starting in Ghana, one of the leading countries in sub-Saharan Africa (SSA).

InvestSika would allow Ghanaians to buy and sell shares in local and foreign companies listed on the Ghana Stock Exchange and American stock exchanges, notably the New York Stock Exchange (NYSE) and Nasdaq. With a mobile money account and smartphone, you can start trading and investing in the stock market with as little as GH₵60 ($10 or ₦3,820).

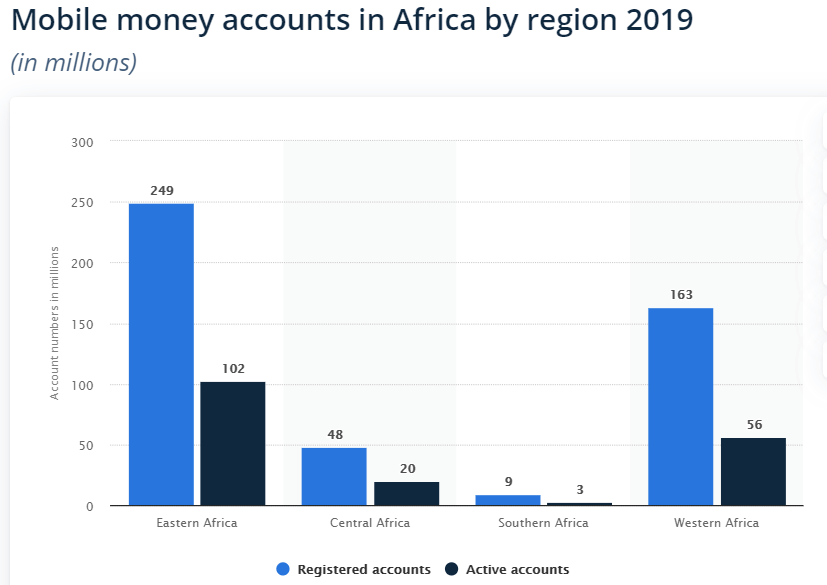

This mobile money focus begins to make sense when you realise that there 181 million active mobile money accounts completing 23.8 billion transactions worth $456.3 billion in SSA.

Positioning itself as the Robinhood for Africa, InvestSika says it is "the fastest way to invest your mobile money". If that already sounds exciting to you, join the waiting list.

Robinhood is an American financial services company that was launched in 2013 to make buying and selling of stocks simple and commission-free. Its founders, Vladimir Tenev and Baiju Bhatt believe investing is for everybody.

Before the launch of Robinhood, stock trading and investing was reserved for only individuals with deep pockets. Also, online brokers, trading platforms and financial institutions had not considered using smartphones as trading tools. Thus, excluding millennials, "the smartphone generation". As of September 2020, Robinhood had 13 million users, 80% of whom are millennials.

The technology boom across SSA is anchored on the increasing penetration of the internet and smartphones. And one of the maturing sectors is the financial technology (fintech) sector, which is fuelled by varied financial inclusion efforts.

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs — transactions, payments, savings, credit and insurance — delivered in a responsible and sustainable way.

Hence the plethora of payment processing companies, payday loan apps, savings platforms, credit card and insurtech startups.

But financial inclusion is not enough. To unlock wealth in Africa, people must be able to invest and earn reasonable interest. In Nigeria, for instance, the high inflation rate not only erodes people’s savings, but it also diminishes the value of the naira. Many investment apps have been launched to address this challenge in Nigeria.

Surprisingly, Ghana does not have an indigenous platform that allows people to invest their mobile money, the co-founder of InvestSika Lotanna Nwose, said.

"InvestSika would officially be the first startup in Ghana that gives anyone with a mobile money account, which is pretty much everybody in Ghana, the opportunity to buy and sell shares in local or global companies listed in the U.S stock market with as little as GH₵60 ($10 or ₦3,820) in real-time".

It is pertinent to note that the Ghana cedi is the world's best-performing currency against the dollar this year.

Lotanna is one of the three co-founders of Investsika. He is in charge of partnerships and operations. The other co-founders, CEO and CTO, are from Ghana and Botswana, respectively. He is also the marketing and partnership lead at JidiTrust, a fintech solution helping small businesses in Ghana grow by providing them with business management tools to record, save, and easily borrow money.

Lotanna spoke to benjamindada.com about InvestSika’s mission ahead of its imminent launch. "We are almost done with product development and are currently tying up a few partnerships”, Lotanna said. “So expect us to launch anytime soon — in a month or two".

Below is the lightly edited interview with Operations and Partnership Lead at InvestSika, Lotanna Nwose.

Finally God answered our prayers

— ⚄ mR sA!Nt ⚄🌱 (@MrSaint__) October 28, 2020

Flipping finally!

— Kwame Apenteng (@nanaoak) October 28, 2020

Oh thank you thank you! https://t.co/UywaOPidQp

Finally 😭😭 https://t.co/X0WHoWDkiY

— ʊռċʟɛ աɨʟʟʏʍɛɨstɛʀ (@grey_hair_boi) October 28, 2020

The engagement on your tweet asking people to join the waitlist suggests people have been waiting for a service like InvestSika

Absolutely. There are no other services currently in existence, so we have the first-mover advantage. And we stand out because we meet the needs of people in their own environment — mobile money. In Ghana, mobile money is the fastest growing medium of transaction and that’s our number one focus.

Why add the option of investing in the Ghanaian stock market when it seems most people are sceptical about African bourses.

We believe the Ghana Stock Exchange with over 50 listed companies is an interesting market. The biggest performing stocks other than MTN are mostly banks. Our research shows that millennials in Ghana are not so interested in the Ghana stock market compared to investment instruments such as treasury bills. But some stocks perform better than T-bills. We believe it’s an education problem and we hope to change their orientation with InvestSika. T-bills in Ghana can return as high as 10% interest in 91 days. With InvestSika, we want people to have a diversified investment portfolio including Global investments with their Momo.

Would InvestSika help people select companies to invest in or every trader would choose by themselves?

The InvestSika app gives you access to invest in over 2,000 stocks and exchange-traded funds (ETFs) in the Ghanaian and American stock market. We are like Robinhood, we provide informational content to constantly educate you, but you choose your stocks, buy and sell all by yourself.

What other investment options would InvestSika offer in addition to stocks and ETFs?

We are democratising access to investments to all Africans through mobile money. And we are starting with the stock market. We are going to be laser-focused on that [the stock market] and make sure we get it right in Ghana and then Nigeria and the rest of Africa.

How does InvestSika work?

With just three clicks, you can find and buy a stock on the InvestSika app. Then you can sell it just as easily as you bought it and the money is sent to your InvestSika wallet. And from there, you can either buy more shares or just withdraw it to your mobile money wallet instantly.

Is InvestSika raising money?

We are currently looking to raise seed investment for InvestSika before the app launch. We have gotten a few angel commitments and are currently looking to meet more VCs whose investment thesis match our vision. They can send me an email.