Interswitch's zero integration set-up fee and 5% referral commission for developers

Africa's first and top fintech unicorn, Interswitch is on a growth tear. At an ecosystem event this month, they announced their self-service API platform and a 5% referral scheme for Quickteller Business users.

Interswitch, Africa's leading fintech group, organised an event tagged <codecall Africa/> to share some of its latest company updates with developers, startups, and other stakeholders in the tech ecosystem.

The Interswitch codecall 2022 event took place on Thursday, August 11, 2022, at Zone Tech Park, Gbagada—a venue famous for its tech event hosting.

📍Live @InterswitchGRP Code Call Africa event

— Benjamindada.com | a premium SSA tech publication (@dadabenblog) August 11, 2022

MD, Interswitch Payments, Muyiwa Asagba delivers the Welcome Address

“Before fintech was coined, we were there.

Following the market evolution, we want to share with the ecosystem how you can communicate with us.” pic.twitter.com/PdEchDJO0R

The Managing Director, Paymate, Interswitch Group, Olumuyiwa Asagba who has been at the company for 18 years gave the welcome address. "For two decades, Interswitch has consolidated its efforts in its support for the growth of the African tech ecosystem by availing developers with valuable resources that enable them to build commercially viable products with ease", he said. "Away from that, we also take seriously the need to innovate so as to stay ahead of the pack, which is a core part of who we are as an evolving technology brand."

However, Interswitch was not always as accessible to the average developer or startup. To be fair, at the time they started their business there were no "startups" in Nigeria, as we know it today. So, Interswitch had built its business on servicing banks and other legacy institutions.

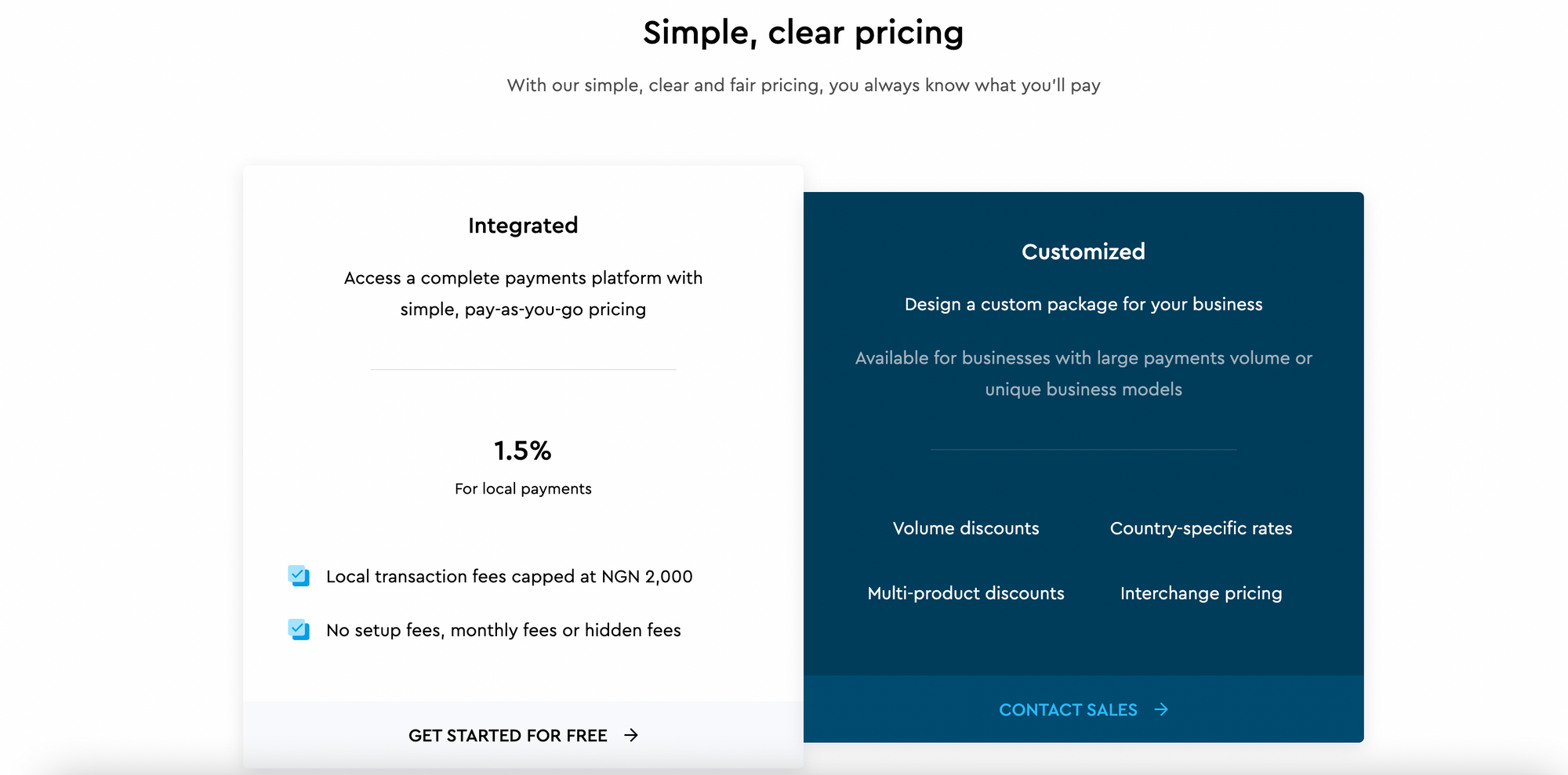

Three things characterise that era. First was the development of enterprise, white-labeled, back-office solutions like funds transfer API, and mobile apps for banks. Their first set of consumer-facing solutions, Verve card—a local card scheme and Quickteller—a platform that gained popularity for allowing users to pay a wide array of billers didn't launch until about seven years after founding Interswitch. Second is the white-glove nature of initiating a business relationship with Interswitch. Potential clients of Interswitch couldn't just come to their website and start using Interswitch's solutions. You would need to contact a Business Development person at the company who would then guide you through working with Interswitch. The third was the pricing model. Then, businesses looking to integrate Interswitch's solutions had to first pay a setup fee of about ₦150,000 alongside whatever transactional fees.

Although Interswitch has since let go of its set-up fee, that memory lingers in the mind of many SMEs and businesses. The company's development of Quickteller Business in 2019 marked its evolution to a pure transactional pricing model, something the new era of local payment startups made popular.

Another speaker at the event was Abdul-hafiz Ibrahim, Group Head, Engineering | Paymate, Interswitch. Abdul-hafiz took us through the revamped Interswitch API self-service portal complete with documentation for reference, a developer console for testing, and a Slack community for further interactions.

"Launching our API Platform was driven by the need to make API integration seamless for developers without the bureaucratic hurdles that have characterized the API-integrating system over the past few years", says Abdul-hafiz Ibrahim."Not only are we making products and solutions development faster, but we are also creating an interface where developers can communicate, share ideas and offer solutions at an accelerated pace."

While it previously took days to go live with Interswitch's APIs due to processes that involved a manual User Acceptance Testing (UAT) sign-off, this revamp should help developers go live in minutes.

What APIs does Interswitch have?

The 20-year-old company has APIs that cuts across nearly every vertical of fintech development in Nigeria. Going by the documentation, Interswitch has APIs for payments—collections and transfers, digital services—value-added services (VAS) and agent cashout, lending—credit scoring, BNPL, and KYC verification—consumer and business identity verification.

At the event, Abdulhafiz emphasized four major APIs, the compliance requirements, and the use cases necessary to work with them. It might be interesting to note that not all of the services require a CBN-issued license. The four major APIs announced at the Interswitch Code Call Africa event are Paycode, VAS, lending service, and collections.

- Paycode service is offered by Interswitch to allow end customers of its merchants to withdraw their funds at any participating touchpoint—agents, merchant stores, or ATM without the need for a card (aka cardless withdrawal)

- VAS allows businesses to integrate thousands of billers like cable TV providers (e.g DSTV, GoTV), utility bills payment (e.g Ikeja Electric), and telcos for airtime and data vending

- Lending service supports businesses with credit scoring, loan disbursements, and recollections

- Collections is a term used in the finance industry to typically refer to collecting payments as a merchant. Interswitch has five major payment methods—Card, Quickteller (as a store value), Bank Transfer, QR, and USSD

Interswitch 5 for 5 business referral scheme: Earn 5% for 5 years

At the Code Call event, Interswitch introduced a referral system to reward existing Quickteller Business users—developers and businesses who refer merchants to use Interswitch's APIs. For five years, referees will continue to earn 5% of every transaction fee that Interswitch charges its referred merchant.

The Business Development Manager for merchant acquisition at Interswitch, Sunday Olaniyan said, "Developers will earn 5% of every transaction fee that Interswitch charges on their referred merchants for 5 years".

For instance, say you refer a merchant or help a merchant integrate to Interswitch's payment gateway or any of their APIs for collecting payment, and Interswitch charges that merchant a ₦50 transaction fee. You the referee will earn ₦2.5 on that transaction. The brilliance of per transaction billing is that it compounds well. So, imagine that the merchant receives 10,000 such transactions monthly, it means that you'd earn ₦25,000 every month. If you refer 10 of such customers, it means that every month you will make ₦250,000. And in five years, you'd have made ₦15 million, for doing nothing other than referring customers.

Zooming out

It appears Interswitch is on a growth tear. The already profitable African unicorn is showing startup signs with its aggressive customer acquisition strategy and business restructuring for better scalability. Perhaps, the increasing influx of venture capital into the company and a long-rumoured potential IPO could be driving some of its customer acquisitions and restructuring drive.

Since 2016, there have been talks about an Interswitch dual-listing IPO which would have, at that time, valued the company at more than a billion dollars. "The IPO would have enabled London-based private equity group Helios Investment Partners LLP, a shareholder, to return some money to investors", local newspaper, Vanguard cites Mitchell Elegbe, Founder of Interswitch. But it was put on hold due to the "macroeconomic situation in Nigeria" that limited the availability of foreign currency.

In November 2019, Visa invested $200 million in Interswitch and valued it at over a billion dollars. At that time, Interswitch was linked to a potential 2020 listing on the London Stock Exchange.

In 2021, Benjamin Dada asked Mitchell about the IPO and he said, "If it is true Interswitch has been saying we are going public and we've not gone public, maybe it's time for you to stop worrying about whether we are going public or not." He advised that instead, we should worry about whether Interswitch is making an impact. He admits that Interswitch is owned, to a large extent, by private equity, so, at some point, they'd want to recoup their investments. He listed some of the typical exit options available—a bigger PE firm buying out an existing PE firm's stake, doing a Visa-esque deal, or/and an IPO. But concludes by saying, "if I'm going to raise money today, I'm going to raise money for growth, if IPO becomes the best way to do that, fine."

Indeed, all Mitchell told Benjamin Dada is coming to pass.

Earlier this year, TechCrunch announced that Leapfrog Investments and Tana Africa had invested $110 million in Interswitch. It is believed that Helios Partners, a PE firm that bought a majority stake in Interswitch 11 years ago was able to stake a partial exit through that infusion of cash. Also, Interswitch can then take part of this money and use it to fuel its growth such that if eventually, an IPO occurs, they'd be very well placed.

Taking one aspect of its business—Verve card penetration and dominance, Interswitch posts growth. In December 2016, Mitchell said they had issued 15 million Verve cards, as of H1 2021 when I spoke with him, the number had grown by 2x to about 32 million which represents about 45% of the total number of cards issued by Nigerian banks. Now, it seems they are looking to add software-led growth—which is more scalable—via Quickteller Business promotion.

"Interswitch has developed a strong position at the nexus of Nigeria’s payments ecosystem, underpinned by an offering which is primed for continued growth. The business’ evolution is testament to management’s track record and tenacity. Alongside LeapFrog, we look forward to supporting Interswitch’s next chapter through continued product innovation and growth across the African continent.", says Mark Tindall, Managing Director, and CEO, Tana Africa.