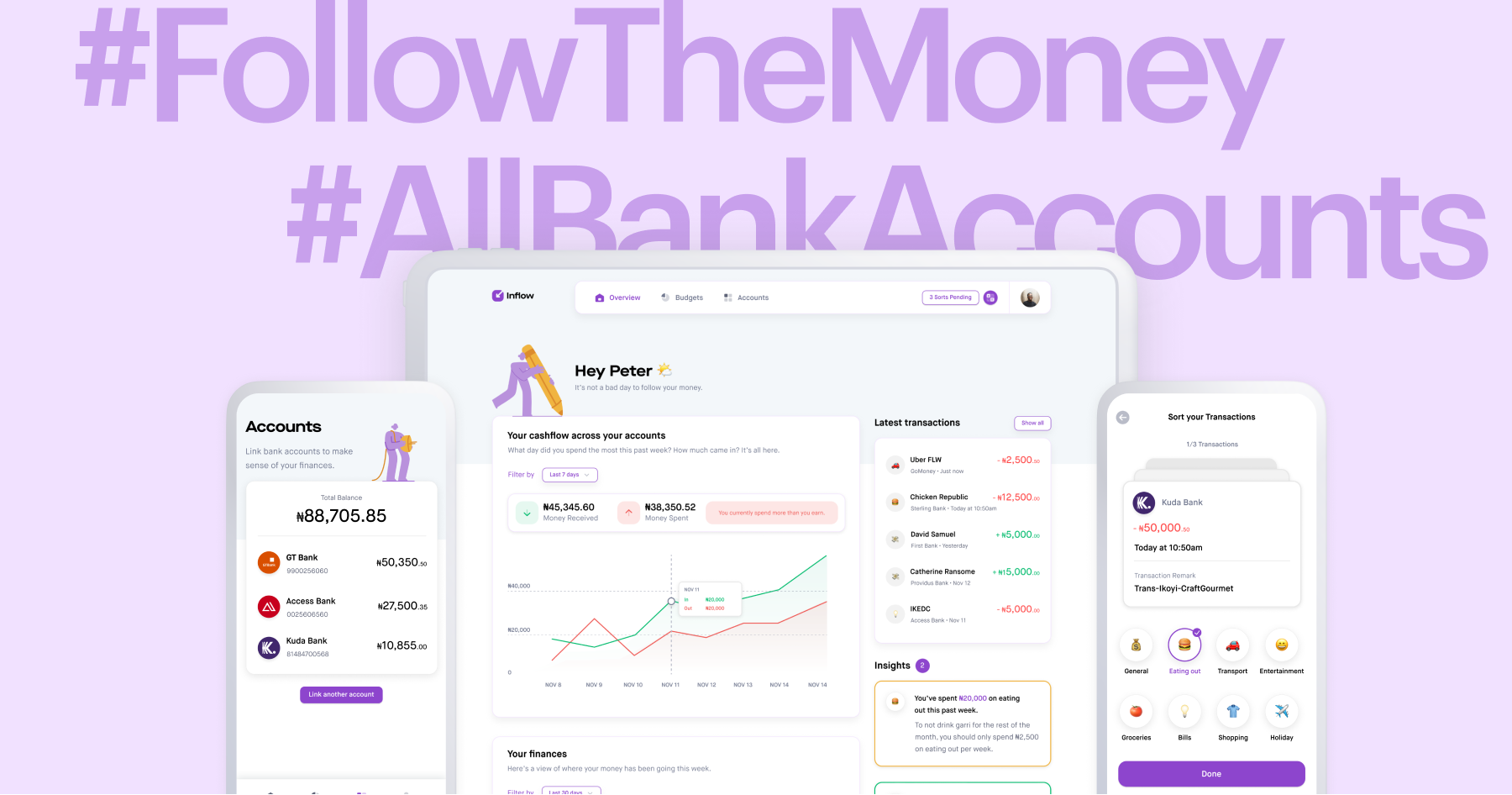

Inflow Finance is building Africa’s ultimate personal finance management tool

Inflow Finance is a personal finance management tool that allows users to track their spending across multiple bank accounts

Inflow Finance is a personal finance management tool that allows users to track their spending across multiple bank accounts.

Meet Michael, a Reconciliation and Settlement Officer at a FinTech in Nigeria.

When he was younger, his parents opened a kid’s savers account for him. With this account, his parents could send him pocket money while he was at the University.

But after his tertiary education, he had to open another bank account as stipulated by the National Youth Service Corps (NYSC) programme. NYSC is a mandatory one-year programme set up by the Nigerian government to involve Nigerian graduates in nation-building and the country’s development. This new bank account was the only way the Government was going to pay Michael his monthly stipend.

After his one-year NYSC, he got a job at his current workplace. Similarly, the fintech required him to open a specific bank account for him to receive his salary.

Recently, Michael has also caught the neobank/digital bank buzz, and he wants to take advantage of the convenience and reduced fees they offer. So, he opened yet another account for his finances.

All four accounts are active. He could have decided to close the bank account used for his NYSC, but the stress of going to a bank to queue has deterred him. Also, his parents still send him money occasionally, so that stays.

Given his multiple income streams, Michael is close to being a millionaire (in naira), yet, something is holding him back. He happens to be spending more than he is making and can not seem to track his expenses. Attempting to reconcile all four accounts separately is a nightmare.

Most Nigerians can relate with Michael's personal finance challenges. Tracking expenses and budgeting can be nightmarish when you're dealing with multiple bank accounts

Although many adult Nigerians (~ 35%) are still outside the financial system, those within it tend to have multiple bank accounts. As of April 2020, the Nigerian government had recorded 41.7 million BVN registrations while the number of bank accounts stood at over 125 million. BVNs are a unique identification number for every Nigerian in the financial system. Since 2014, when BVN registrations commenced, it has been impossible to open a bank account without having a BVN.

Since BVNs represent unique owners, using the data above, the ratio of bank users to bank accounts is roughly around one to three. That is, the average bank user has at least three accounts.

Quick survey for something I'm working on. How many bank accounts do you have (digital banks + traditional banks)

— Hachi (@senor_hachi) February 23, 2021

Michael’s challenges are also relatable as most people struggle to keep track of their spending, subscriptions, charges, and earnings across all their accounts. This makes it impossible for many to create proper budgets.

For Olusesan Peter, Team Lead at Inflow Finance, the idea had always been in his head - something that allows him to manage his finances in a seamless, stress-free way. According to Sesan, he currently has 10+ bank accounts, ten banking apps, ten different usernames, and ten different password combinations. Tracking spending and budgeting are challenges he is acutely aware of.

"On the idea, It's always been in my head kind of. A couple of weeks after companies with the right APIs came along; I figured this was actually possible to build."—Olusesan Peter

By “companies with the right API”, Sesan is referencing the Fintech API companies that have been building critical infrastructure for Africa’s Fintech. The entrance of these companies into the fintech ecosystem have made solutions like Inflow Finance easier to build.

The team consists of eight friends who, as Sesan describes it, are “ just great people solving hard problems” Apart from Olusesan Peter and one teammate who cannot be named for personal reasons, the other teammates are:

- Oyegoke Tomisin

- Aliu Abdul-Mujeeb

- Odemwingie Oghogho

- Momoh Great

- Anifowose Quadri

- Balogun Olajuwon

The team has a strong belief in their competence to make the project a success. Many of them have worked with top companies in the Nigerian fintech ecosystem, including Okra, Binance, Eyowo, and Softcom.

How does Inflow Finance work?

Although the product is still only in beta testing, we’ve had a chance to see how Inflow Finance works. Though the web development started in August, the design has been underway for much longer. Put together, Sesan estimates that it has taken eight months to get to where they are today.

"We could have launched earlier, but we're trying to build and ship something beautiful that works well, so for us, it's quality over speed. There's no point shipping something that doesn't work or looks ugly"—Olusesan Peter

At the heart of it, inflow is a personal finance management product. Users can link all their bank accounts to their Inflow account, where they can see a compilation of all inflows and outflows as far back as the last three months.

Users can then sort their transaction history into pre-set categories, including transport, groceries, food, shopping, family, charity, bank charges, holiday, bills, entertainment, and others. After sorting the transactions, users receive a breakdown of their spending by category.

Once it has been set-up, Inflow Finance continues to track all transactions on the linked accounts, giving its users an accurate picture of their spend across all bank accounts.

Users can also create a highly detailed budget based on the spending categories. This budget can be used to benchmark both overall spending or spending on specific items. That way, users are always aware of their spending relative to their budget.

What does the future have for Inflow?

The first thing down the roadmap for Inflow Finance is to launch the product for public use. Right now, the team is targeting the end of Q1 to make it available to the public. Between now and then, it hopes to clean up all the bugs and optimise the product based on user feedback.

Inflow Finance is a very early-stage startup. The startup is self-funded by the team members, but they’re open to raising a pre-seed once the product gathers some traction. Till then, the team is focused on increasing its workforce and polishing its service. Quite recently, it added a new member to help with graphics for social media.

Product-wise, there are multiple updates the Inflow team wants to make in the coming weeks. The startup sees Mint by Intuit as the model they want to follow for their product. For now, that means developing solutions that help people track subscriptions, have a better budgeting experience, and even track assets across other fintech platforms.

Inflow Finance wants to be the choice personal financial management tool for people across Africa - young and old.

Comments ()