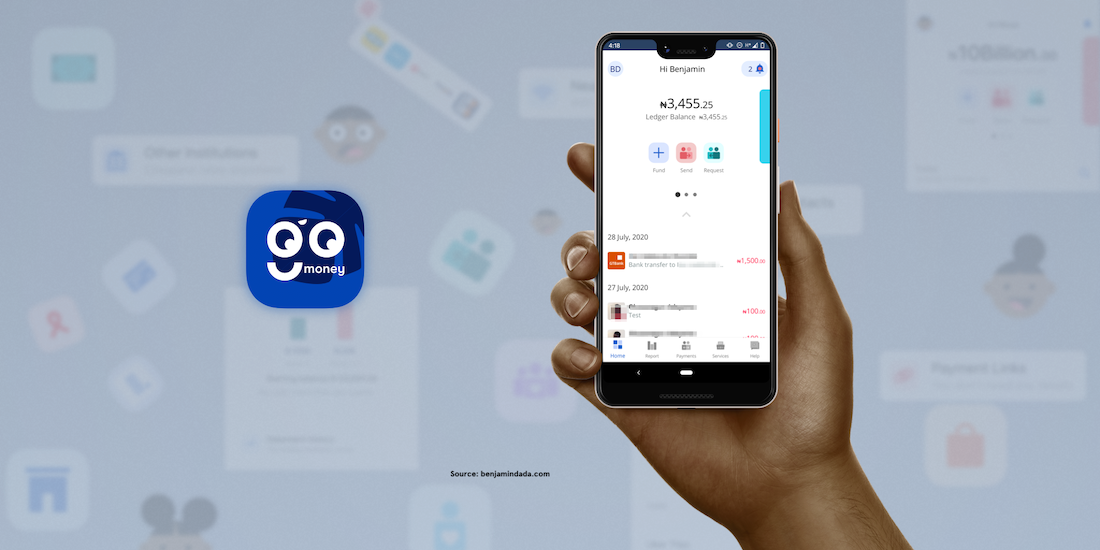

REVIEW: First impression of gomoney Digital Bank App

gomoney app is a new age digital bank that is offering its users a smart way to organise their money. This article contains my early impressions of the app.

gomoney is a digital bank that offers a “smart way to organise money”.

The features of gomoney are similar to that of other digital banks. In that, gomoney allows users to pay & split bills, track expenses, send & request money. Yet, it has some stand-out features. I found its ability to organise my spend, share receipts and profile transactions, interesting.

This review presents to you my first impression of the gomoney app. I imagine that after using it for a while, my opinions might be further refined, but for now, here goes.

Phone: Google Pixel 3

OS: Android version 10

Getting started with gomoney

In this section, I take you through six major phases of using the gomoney app. The phases are installation, onboarding, funding, transfer and reporting. Then, I give my closing thoughts on the app.

Installing the app

Before installing the gomoney app, I checked the download size on the Play Store.

On Google Play Store, gomoney’s app size was 20 MB. But when it downloaded to my phone it unpacked to 44.18 MB.

The difference in app size shows what level of file compression had taken place. It’s preferred for app makers to keep their files small so that it will download faster on their prospective user’s device. Also, because the file size is small, it will use less internet bandwidth.

Sign-up and onboarding

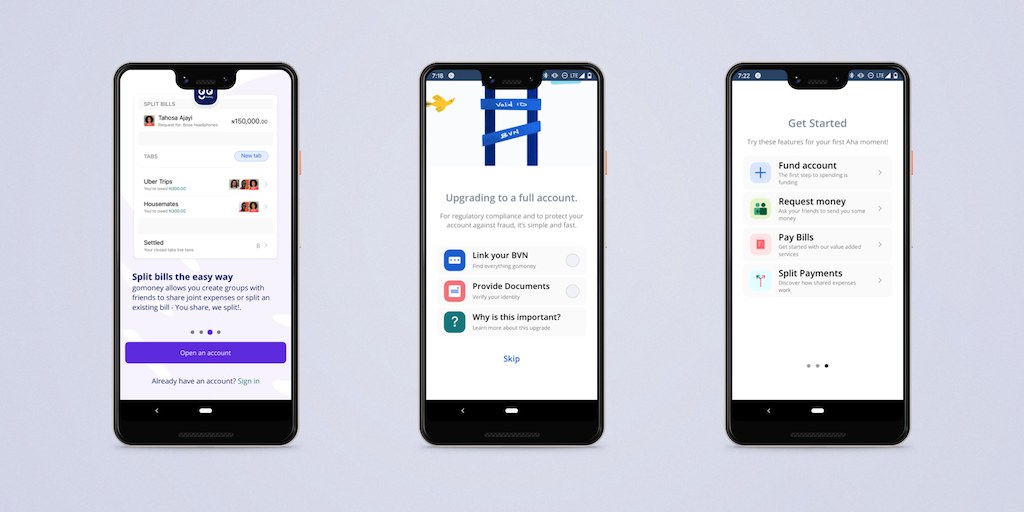

For its onboarding, gomoney makes use of bright colours, illustrations, a conversational User Interface and some nifty app tricks.

In line with the mandatory tiered-KYC requirement of banks and OFIs, sign-up to gomoney was progressive and comprehensive. Thus, without visiting a bank branch, I was able to open a full-service Tier 3 bank account.

To begin:

- I entered my phone number

- gomoney sent my number an OTP

- then, automatically detected the OTP

That way, it was able to verify that I was the holder of the phone number. Verifying phone numbers is important to digital banks as that serves as the user’s account number in their bank.

After verifying my number, it asked for my email address. Then, I entered my full legal name & Date-of-Birth, home address, and selected my gender. Next, I set-up my security questions and that automatically put me on the Tier 1 account type.

Afterwards, I had a chance to get straight into the app or upgrade to a full account (Tier 3). I decided on the full upgrade. To upgrade, I entered my BVN, took a selfie, scanned my signature and provided a Government ID (Driver’s Licence, in my case).

Depositing money

By default, bank accounts are empty. We fund them by depositing money into them. Today, to fund my traditional bank account, I either:

- walk into a bank branch to deposit money or

- receive a transfer from another banking channel. For this to happen, I give the depositor my account details; bank name and account number

gomoney is no different. I was able to fund my gomoney account by receiving a transfer from:

- a gomoney user,

- my other bank account, and

- a payment link

The funding process was straightforward, as gomoney even had a button for me to share my account details with anyone. Yet, unlike some other digital banks, I was unable to fund my gomoney account with a card. Although, I can request money from anyone by sending them a web link.

Transfer from gomoney

You can send money from gomoney in three ways. Send:

- to gomoney user

- to a bank (account)

- by link

Notice a trend? gomoney’s transaction covers both people on its network (other gomoney users), and people outside its network (e.g users with other bank accounts).

When it comes to outbound transactions, there are layers of middlemen which need to be settled. Thus, the need for a transfer fee. On gomoney, that transaction fee is ₦8.5.

According to the comparison table in this report, gomoney has the lowest transaction fee, when considering absolute figures. The digital banking players that come close charge ₦10 per interbank transaction. One digital bank offers free transfers for the first 25 transactions and begins to charge ₦10 from the 26th transaction within that month.

Card Management on gomoney

gomoney offers cards and provides a way to manage them. As at the time of my review, I was able to create a virtual Mastercard. From the app, I can freeze and block the card. There is an option to get a physical card but on the app, it says “Coming Soon”.

But, I did not see the option to create a virtual dollar card which has now become a staple of many digital bank offerings. Creating a virtual dollar card comes with its own set of complexities but it has been the life-saver of Nigerians who need to buy from certain international sites.

The regular Mastercard denominated in Naira will work for local and foreign payments but some sites don’t accept it. Hence, the need for a card denominated in dollars.

Update, 13/08/20: I was able to make use of my gomoney virtual card to pay on Heroku

Guys! not only does gomoney's virtual MasterCard work on international site, Heroku.

— Benjamin Dada (@DadaBen_) August 13, 2020

It has the BEST industry rate! $1 - ₦395

I literally just saved a whole ₦800! pic.twitter.com/uCr8itI9vz

Expense tracking and reporting

Many banks get carried away with functionality, integration and aesthetics that they de-prioritise expense tracking and personal finance management. As part of digital banks push to disrupt traditional banks, they are touching on transaction insights and finance management.

After I came across a personal finance management app in 2015, my expectation from my banking app’s experience has been heightened. Because it’s not enough for my bank to show me transaction history but can it make me smarter about my finances. Can I see:

- how many times have I sent money to my mother?

- how much I’ve spent on food and the internet in comparison to family and house upkeep?

- who spends more between me and my girlfriend?

Enter Report on gomoney. A tab on the mobile app that shows me an account summary over a specified period, my spending overview, and a downloaded monthly statement.

So, you can imagine my excitement the first time someone sent me money on gomoney and I saw a section showing “History with Tosin*”. Finally, it was something beyond the regular debit or credit alert. Instead, through this new app, gomoney, I can keep track of the people I pay, how many times I pay them and whether they send me money.

Final words on gomoney

I stand by the position that digital banks provide marginally better offerings than their competition.

That said, I like gomoney's attention to detail. Pre-gomoney, I had to take a screenshot of my transaction page as proof that a transaction was successful. But now, all of that will not be necessary as I can easily share the receipt in PDF or image format.

P.S—One of my other banks allow me to share transaction receipts as PDF but not as a picture.

There are other features of the gomoney app I didn’t get to experience. Like their scheduled and nearby payments functionality.

But in testing their “send by link” feature, I noticed a double charge on both the sender and receiver’s end. Myself and the beneficiary claiming the money sent via a link were charged a transaction fee of ₦10.75. The beneficiary was also charged a VAT of 7.5%.

I have two issues with that. First, gomoney's transaction fee is ₦8.5, so being charged ₦10.75 seemed off. Second, if the receiver was going to be charged a fee for claiming their money into their chosen bank account, as opposed to a gomoney account, then, I should not have been charged a separate fee for that transaction. Plus, if for any reason gomoney was going to charge me a fee for the transaction, I should have been notified before proceeding with the transaction.

I have since reached out to the team on the double charge, and they assured me that they are looking into it. I will bring you updates in due time.

With all of that being said, competition in the digital banking space is very welcome. I think, gomoney, despite being in its early phase has put a strong foot forward. For me, their expense tracker and reports module is a winner and I can't wait to explore this over a longer period of time. You can visit gomoney.global to learn more about what they are building.

If you will like a digital banking report, subscribe to our newsletter to get notified once it is out.