Fintech: Kenya leads US, China, and Africa in Financial Inclusion, Providing Essential Lessons for Other African Countries

Financial technologies have always redefined our lives. 1970 was a great turning point for Fintech in the United States. It marked the establishment of NASDAQ, the world's first digital stock exchange market.

By 1980, the rise of Bank mainframe computers gave opportunities to startups to engage in Open banking, Banking as a Service (BaaS) and platforms would emerge to share financial data between third party companies, benefiting ordinary consumers, mostly across China.

Fast forward 2020, most financial institutions are imploring machine learning and other fintech solutions to offer insights into customer behavior.

Integrated payment services on platforms such as Shopify have changed our approach to even commerce, and financial institutions are leveraging all sorts of modern innovations to better understand their customers. China and India have adopted these technologies to revamp their economies.

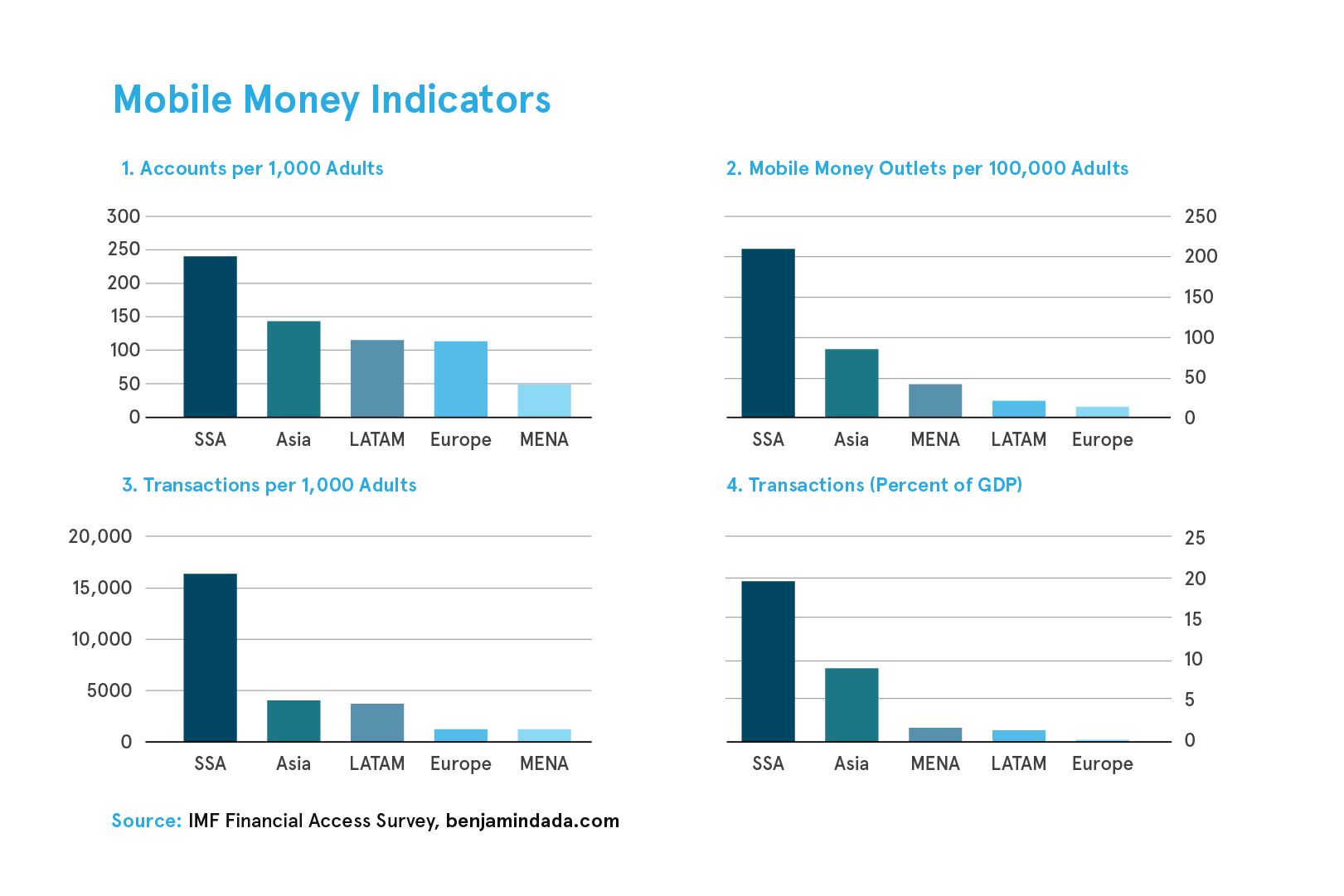

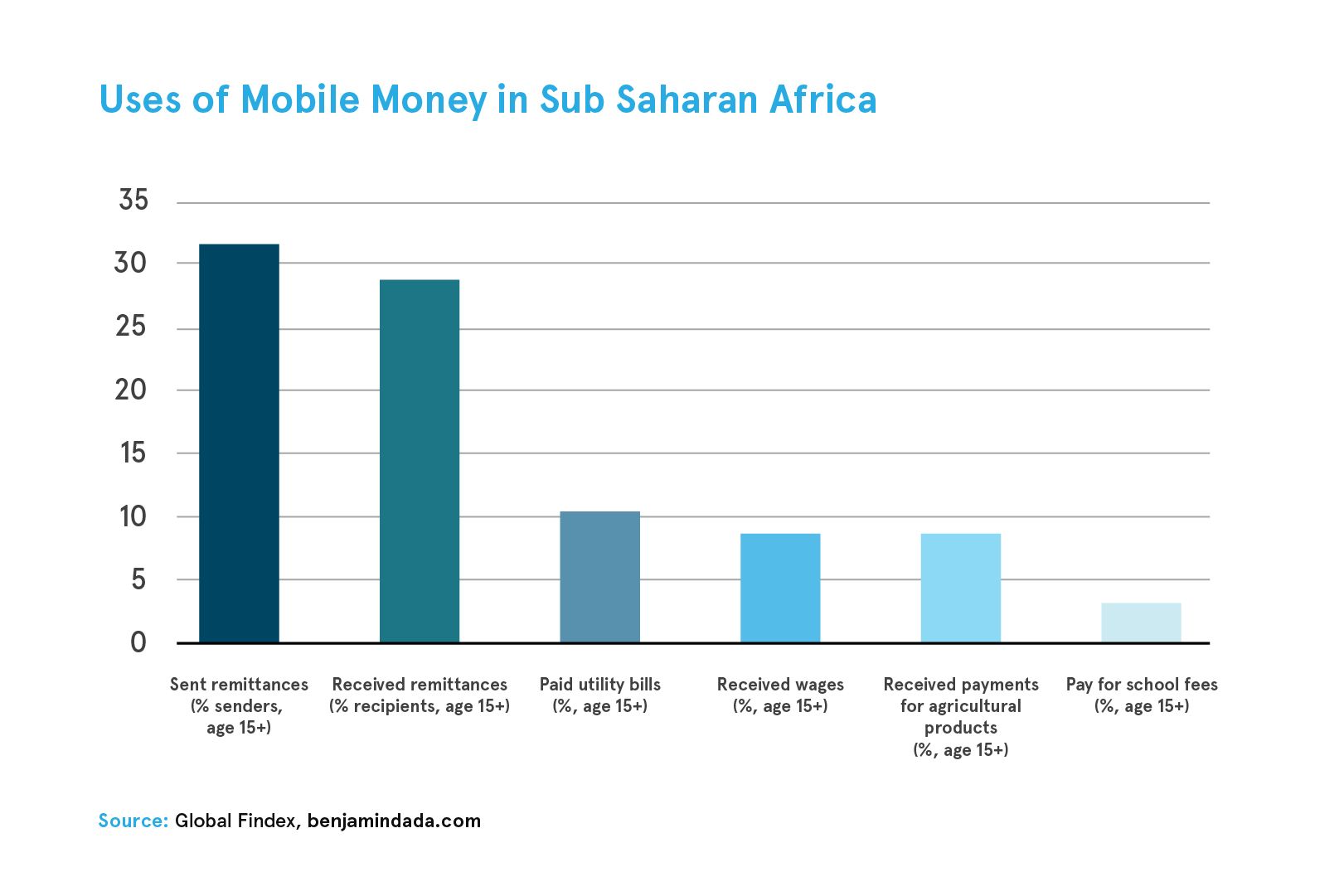

Ordinarily, Africa missed out on the early fintech boom in the United States as well as the early boom of digital banking experienced in some parts of Asia. Yet, the continent is rapidly adopting modern mobile based fintech infrastructure. Sub Saharan Africa leads the world in mobile money adoption and Kenya's Safaricom is a strong leader in this revolution.

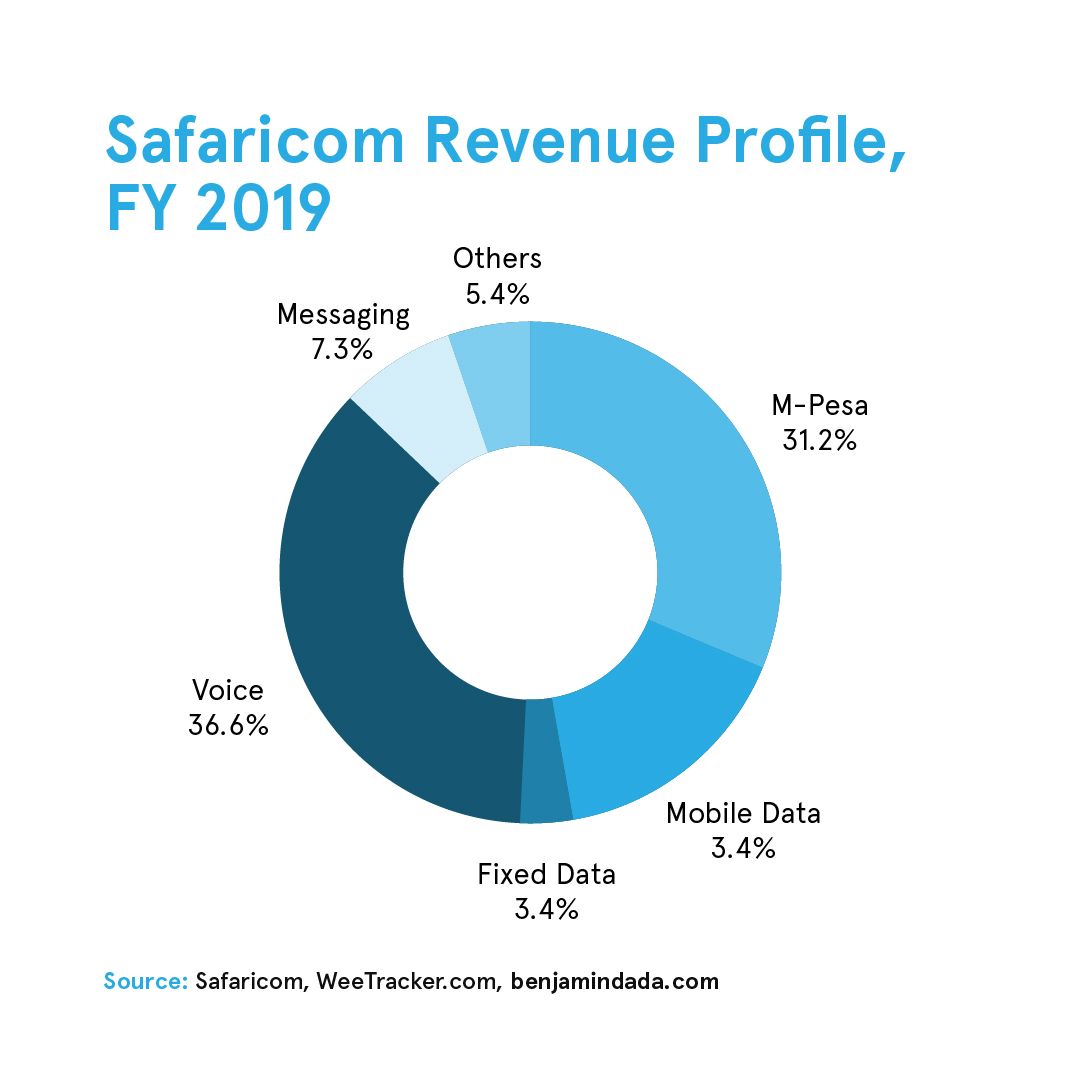

Kenya houses about 150 fintech companies. Market leader, M-Pesa, was formed in 2007 and currently has a market share of about 65%. Airtel's mobile money Launch in 2011 created alternatives for consumers and in recent times, Equitel, with a 22% share of the Kenyan fintech market, are offering full suite banking services to Kenyans.

According to the 2019 FinAccess Household Survey, 82.9% of Kenya's adult population has access to at least one financial product. This high rate of financial inclusiveness has created numerous opportunities in open banking for SMEs in Kenya.

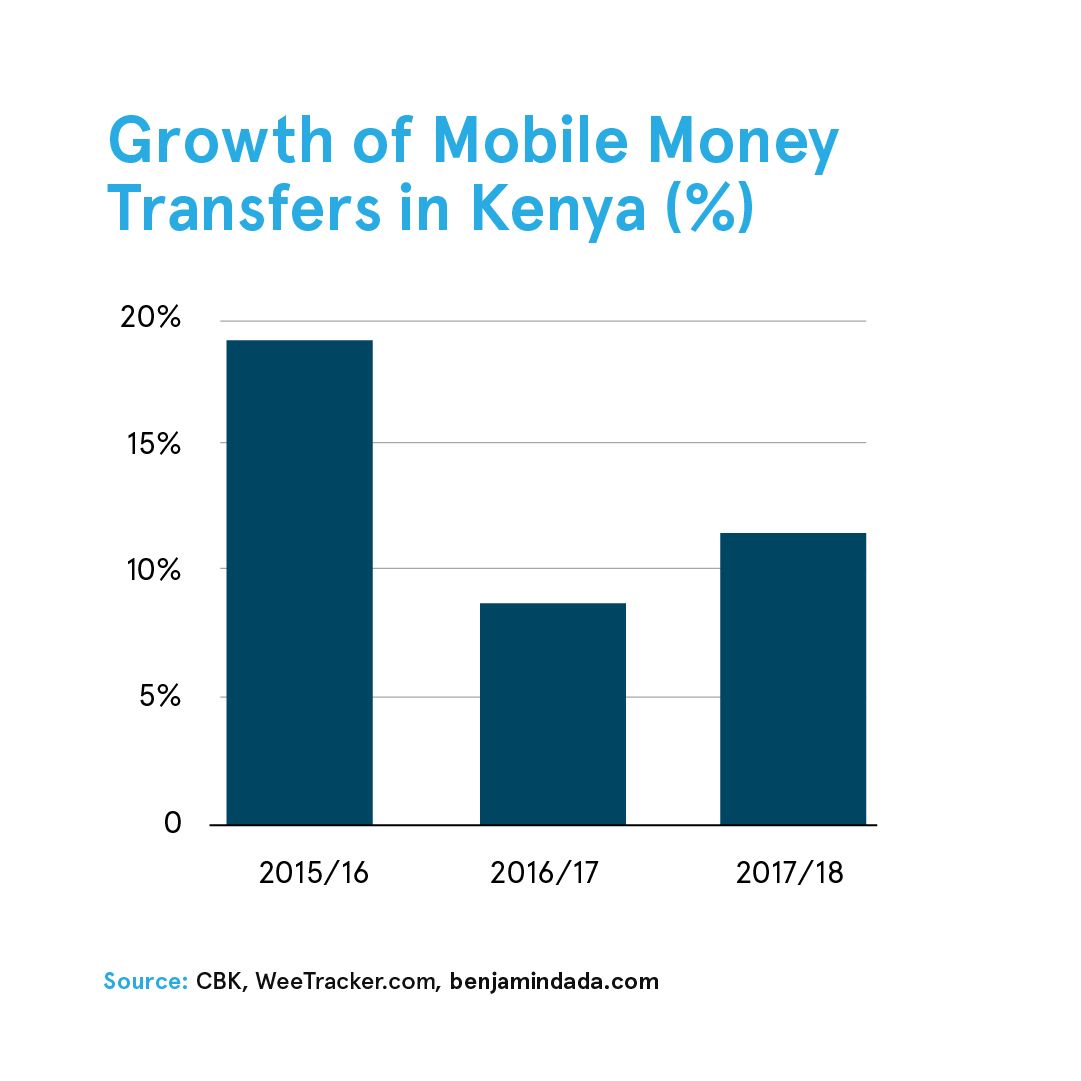

In 2019, Kenyans moved a record Sh4.35 trillion through their mobile devices as gathered by the Central Bank of Kenya (CBK), a Sh361.39 rise following the previous year. Further insight into CBK data revealed that mobile money transactions represented 46.1% of the estimated size of Kenya’s economy (GDP). Between 2015 and 2019, Kenya has recorded year on year growth in mobile money transactions.

In recognition of Kenya’s leading mobile money transactions, Mr. Nduati, former head of the National payment systems at CBK, in a recent interview, said “Financial services such as credit are now offered on this platform which is very flexible, thanks to the facilitative regulations. In fact, the rest of the world copied from us, but many have not been able to craft as good regulations as we did.

How does this compare to other African countries?

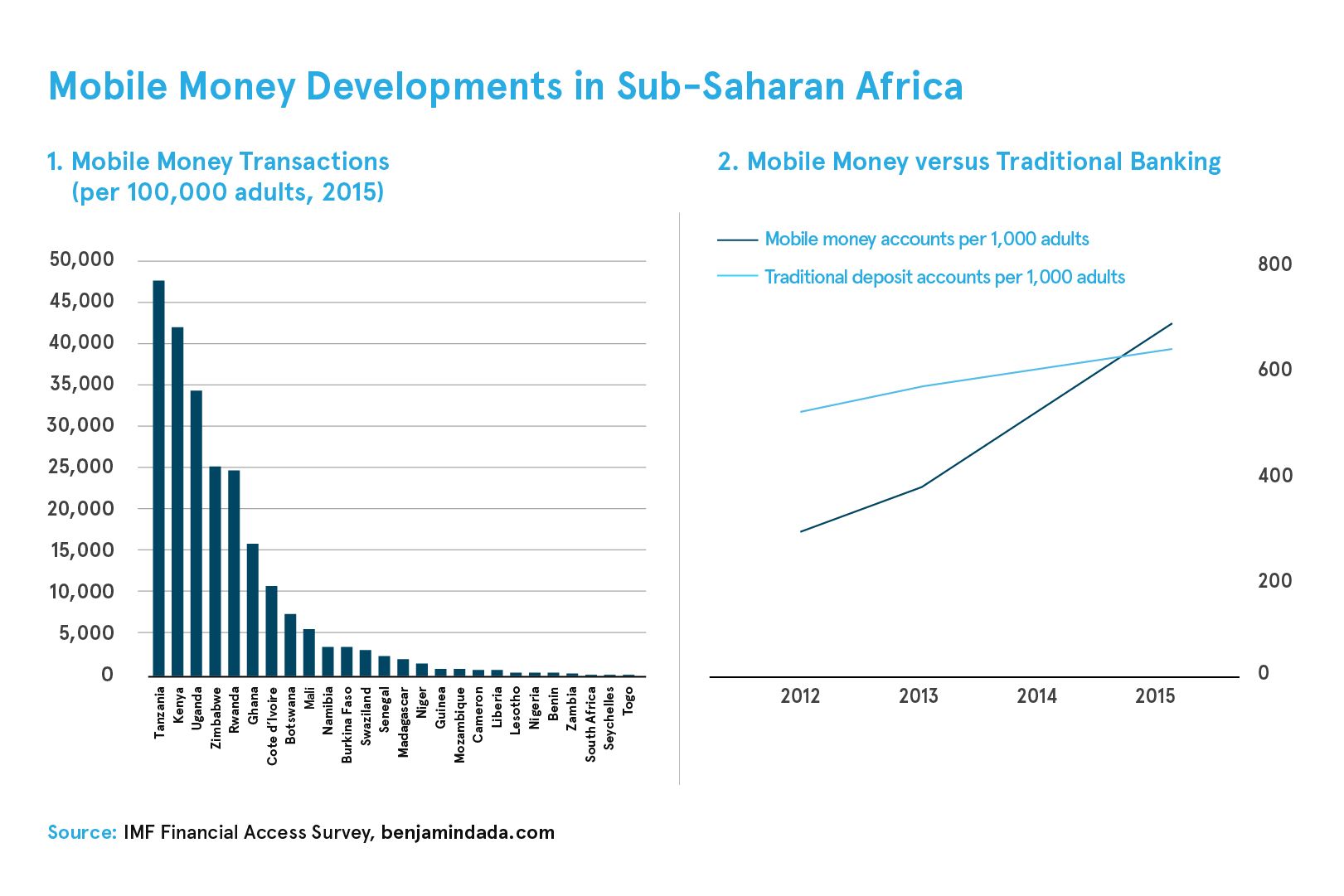

Data from the figure demonstrates mobile money transactions across African countries and identifies Kenya’s fintech companies as dominant leaders across all of Africa. In 2020, East Africa recorded more active mobile money users than any other parts of Africa with 94 million active accounts and 199 million accounts deemed inactive. Within East Africa, Kenya records the most of these active mobile money accounts as stipulated by Statista.

Other African countries, following the rise of Kenya's financially inclusive economy, have committed to driving banking innovations. According to GSMA, by the end of 2018, West Africa recorded an increase of 23 million mobile money accounts following the previous year

What factors accounted for Kenya’s rapid mobile money adoption rates?

Kenya favored a telecom led regulatory model which was adopted across East Africa. In executing this model, telcos work with financial regulators in building financial instruments for the populace. These telcos have large market shares and allow most payment users to operate on a single platform. Further, traditional brands with many years of working with their consumers have a great opportunity to offer financial services in the financial space to their clients. As a result, Kenya's fintech success is based on the citizens' deep trust in it's telco-fintech hubs.

Kenyans, like every other developing country, demonstrated a need for access, trust, and studies in the financial sector. Access was met by Safaricom's M-Pesa and Airtel's Mobile Money through their highly efficient mobile based banking infrastructure. USSD technology was used where necessary. Distributed ledger technologies and digital currencies were well adopted by the Central Banks and Ministry of Information, Communication, and Technology.

Similarly, Equitel's mobile virtual network operator is offering a full suite of banking services on mobile devices. Utilizing global technology partners, it is prudent for leading African companies to pivot into financial inclusion in order to reap the full benefits of their individual offerings. And evidently, in 2017, Kenya became the first country in the world to sell government bonds via a mobile app (M-Akiba).

According to S&P's global financial literacy survey, Africans scored the worst in terms of financial literacy globally. Financial literacy helps individuals to budget, manage debt, and create savings or retirement accounts. Without a good hands-on interest in the subject, most people would show no interest in fintech services. Kenyan fintech companies, by choosing their influencers carefully, have offered good insight about fintech services and products to their customers.

The world has witnessed different waves of Fintech evolutions from the US to China, and now to Africa. The history of fintech has provided much insight into changing consumer behaviors and how newer technologies can be leveraged to develop better financial solutions for consumers.

The desire to trust, access, and learn about financial services remains core to consumers from across all economies. Kenya, through a framework of excellent regulatory policies, adoption of diverse technologies, and government-private partnerships, have created a financially inclusive economy. By adopting these tested market methods from Kenya, China, US, and many other African countries have the opportunity to advance in their quest for financial inclusion.