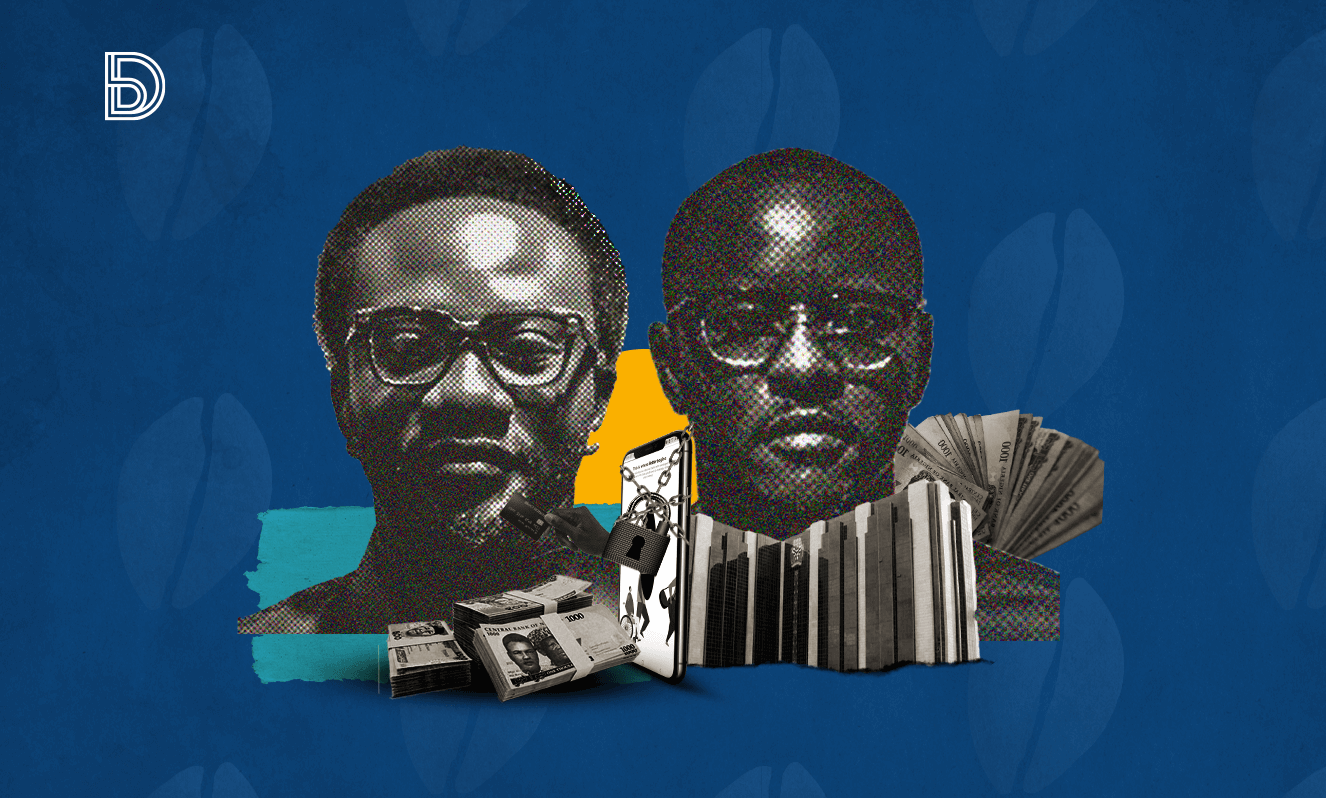

Inside Eyowo’s excruciating ordeal with Nigerian regulators and the neobank’s path to restoration

Two months shy of its second anniversary as a Nigerian digital bank, Eyowo faced its biggest setback ever: the revocation of its banking license. In this article, the founders shared what happened and the arduous attempt to turn the tide.

On May 22 2023, executives at Eyowo were halfway into a Monday morning meeting planning for the next iteration of the Nigerian-based digital bank when some side chatter took over the meeting. Yomi Adedeji, Co-CEO of Eyowo, was initially startled by the distraction but the reason soon became apparent when he checked his phone notifications.

Some executives had gotten a circular from the Central Bank of Nigeria (CBN) citing that it had revoked the licences of Eyowo and 46 other companies. The apex monetary regulator followed with a list of another 132 Microfinance Banks, Finance Companies, and Mortgage Banks, whose licences were also revoked.

Initially, it was a bit confusing to the team because there were two lists from the CBN — only one had Eyowo listed.

“Some people were saying maybe we weren’t part of it but once some media publications pushed out the story of the CBN revoking the licence of Eyowo and others, there was no turning back,” Adedeji told Bendada.com over a call in January 2024.

Once the media got wind of the news, the story spread like wildfire causing confusion and panic in the tech ecosystem. There were many unanswered questions as the announcement came without any forewarning. The reason for this decision according to the circular was that the entities affected “remained inactive, insolvent, failed to render returns, closed shop, or ceased to carry on the type of banking business for which they were licensed for more than six (6) months”, but many financial institutions affected denied this.

“The reason CBN gave was that we were insolvent and non-operational,” Adedeji, said. “But it’s impossible for us to have been insolvent if we were still facilitating payments and loans for about 250,000 users and had always filled our monthly report to the central bank.”

Immediately the word got out, banks and other financial partners – not wanting to be found complicit – disconnected Eyowo from its services or restricted access to its funds. Customers who had their funds trapped were unsure of how or when they could get their funds out.

“I just really need to know when this is going to be fixed and when I can access my money because I’m about to be homeless,” Chikaso, a customer lamented on a Twitter Space conversation with the Eyowo team in August. “I put my rent savings in there and need this fixed in a week or two. If not, I don’t know where I’m going to be sleeping.”

Over the next six months, the team at Eyowo scampered around as they tried to assuage customer concerns and revert the revocation of their banking license. To help customers like Chikaso who had dire personal or medical needs, the team pooled together ₦300 million ($300,000) in June from family and friends to help. Within nine hours of making these funds available, it was exhausted. Patricia Andeshi, a businesswoman with a pending rent payment, shared with Bendada.com over a call that in June she was given the ₦100,000 ($100) needed to complete her rent.

There was also a couple of multiple one-off assistance given to other users who reached out in dire need. One of the beneficiaries who spoke under anonymity told Bendada.com that he received ₦500,000 ($500) out of his savings with Eyowo in November 2023.

At the beginning of March 2024, Eyowo sent messages to its customers that they could access their funds after nine months of their funds being trapped with the neobank. This message came to the delight and surprise of many.

“For them to have returned the money even after almost a year, it shows that they truly kept to their words,” Andeshi said.

The origin of Softcom and Eyowo

Launched in July 2018, Eyowo was a product within Softcom, a self-funded IT solution company co-founded by Yomi Adedeji and Omoseindemi Olobayo. Softcom started in 2007 as an IT solution company during the nascent stages of the telecom industry.

“Then Nigeria had approximately 9 million internet users. We were just a group of tech enthusiasts who came together to build products to simplify access to goods and services,” Adedeji said.

One of Softcom’s first products was a platform, ReloadNg, that allowed people to purchase airtime electronically, at a time when airtime was predominantly bought on the streets in voucher form. Subsequently, they developed an online payment gateway to address issues customers had with paying on ReloadNg and making payments online generally. This service catered for about 11,000 customers who struggled with paying and using their cards online, according to the founders.

As the company grew, it morphed into a software development agency which designed and built tech products for many enterprise companies such as MTN, NLNG, GlaxoSmithKline, BOI and OSGF.

“We played in about five industries with one in every top 3 market leaders being our customers. We rarely got briefs, mostly problem statements, ” Olobayo said.

These early ventures and enterprise engagements, according to the founders, laid the groundwork for Eyowo's inception.

By 2020, Softcom was due for a change in direction, shifting from services to creating products like Eyowo, Kwiksell (a sales and inventory management software), Useform (an online survey tool), and Usepass (an identity and access control system). This shift involved productizing the services it had rendered over the first 12 years of its existence, according to Adedeji. Over the next two years, it decommissioned 19 clients as it built out and focused on these new products.

This transition was bumpy as Softcom moved employees to work on these new products and had high expenses that didn’t match its dwindling revenue.

“For example, we thought about how well the enterprise services team would fit into a product-centric startup environment. We were also reluctant to just lay off some people who had worked with us for almost a decade, especially during Covid,” Adedeji said.

“Eventually, we still had to lay off and supported everyone affected in various ways we could. Before starting Eyowo, we had saved money for about 3 years of operation. But as things took longer and roadmaps moved from 3 weeks to 3 months, these scope creeps meant missed targets and the need for a longer runway.”

Eyowo began with the promise that payments could be disbursed using phone numbers riding on the fact there were more active mobile connections than bank accounts in Nigeria.

A beta test that validated this idea was when the Nigerian Federal Government used it to disburse cash incentives to two million Nigerians through the TraderMoni programme in 2018. The success of this programme led the team to consider expanding Eyowo’s functionality.

As the team built out the product and connected the experiences, it became clear that they needed more licenses for regulatory compliance. In 2019, they acquired Bethesda Microfinance Bank to hold customers' deposits. Afterwards, they acquired the Payment Solution Service Provider (PSSP) license and a Payment Terminal Service Provider (PTSP) License (approval in principle) from the Central Bank of Nigeria. By 2020, Eyowo was spun off as a stand-alone entity from Softcom.

“We acquired these licences to ensure that customers didn’t have to hop through different product experiences due to the limitations of individual licences,” Olobayo said. To put things in context, the PSSP license gave Eyowo the ability to process payments without holding money, with the MFB license they could now hold customer funds, give interest and also provide additional financial services such as lending.

The company, which became a fully-fledged digital bank in 2021 was focused on acquiring more users and building out its features until the CBN’s hammer came down on it.

The compliance visit

What made the revocation surprising was that the Eyowo team had undergone a CBN compliance audit in March 2023 and the audit results did not suggest any imminent regulatory action against Eyowo.

“Almost every audit feedback is categorised around – team, structure, systems, risk framework, fraud prevention – at varying levels. So there’s always room for improvement,” Olobayo explained. “The way it works is you have to make sure the feedback is implemented and issues are fixed before the next visit.”

At the end of the audit, the CBN made a few recommendations bordering on capitalisation, financial ratios to be maintained, and better KYC compliance. The KYC compliance was noteworthy because the company combined licenses and the KYC requirements differ for each licence.

A culmination of this visit and the product roadmap led the company to announce on May 19 that it would no longer allow users to register on the app until July 1. This was to enable it to serve its existing customers better and resolve delayed and failed transfer issues that had been happening for a few weeks.

“We were already thinking about how to stop competing solely based on where value is stored and give people a sense of how money can work for them intelligently,” Olobayo said.

Getting the licence back and convincing partners

About 180 entities had their licenses revoked and some of them sued the CBN, according to the founders. But Eyowo took a different route by submitting a 52-page appeal in June which explained the different compliance requirements the neobank had fulfilled and why the circular didn’t apply to them.

During its waiting period, Eyowo undertook recapitalization and operational changes, which included a workforce reduction of around 11%. Even before the license revocation, the company had been facing financial difficulties, including struggling to pay employee salaries.

On October 27, the company got their approval-in-principle licence back but as one of the requirements, it had to change its company’s name to Entrepreneur MFB. The name change, according to founders, was because a gazetted circular couldn’t be overturned. The Eyowo brand and product are poised to continue operating as the revoked license pertained specifically to its MFB (Microfinance Bank) operations.

The return of the licence was a cause for celebration but it didn’t mean they could return to business as usual.

“This was just the first administrative step. We still needed to receive the full licence after the issuance of an approval-in-principle, connect to NIBSS Instant Payment (NIP) and other banks,” Adedeji said.

Many of Eyowo’s banking partners wanted to receive a formal confirmation from the CBN before they did anything. To complicate matters, a system freeze was instituted by some financial institutions towards the end of the year due to the high volume of transactions. This freeze prevented them from integrating new services to avoid any system malfunction.

As the team tried to get the CBN to reach out to the different financial institutions, a new CBN leadership team was announced in November causing further delays.

“In addition to not hearing back for a few weeks, the new leadership team had aired their desire to change the fintech regulatory framework, causing us to wonder if we were safe. We were in a limbo,” Adedeji said. It took another two months of follow-up leading up to the new year before there was some clarity.

Lessons, support from the ecosystem and the journey ahead

Every relationship is tested in trials; this experience has greatly taught Adedeji and Olobayo. The duo are grateful for the support they got and understanding of those who couldn’t help.

“Our partner bank, ProvidusBank was supportive in enabling access for our customers. The regulators were also swift in protecting customer deposits and resolving the license issue. Some of our friends and partners also supported us with capital,” Adedeji said.

For those who couldn’t help Eyowo, Olobayo believes they might have acted out of fear due to the seemingly impossibility of the situation. He shared that in the history of Nigeria, it's extremely rare for a government decision to be rescinded after it has been officially published.

“Perhaps people weren’t wrong to have thought that there was no way out for us. It’s also easy to think that someone is in a position to help you, but you can’t tell what they’re also going through” he said.

When probed further on why their license was initially revoked, Adedeji attributes their experience to Nigeria’s regulatory environment which is still maturing. He likens it to the abrupt disruption of ride-hailing service companies in 2019 and the government ban on crypto payments which rattled crypto services in 2021.

“The regulators have to do what is in the best interest of the public and the market. But as the market operating environment improves these issues won’t happen,” he said.

It’s a new era at the digital bank, as it’s set to return to business as usual soon. To reduce the chances of this not happening again, the team is looking to improve its back-office activities for better operations and compliance.

“We’re going to share a lot more because many times the issue is that the regulator doesn’t know what you’re doing,” Adedeji said.

The company is also focused on improving the digital bank and helping customers achieve better financial outcomes irrespective of where their funds are stored.

“We want to provide individuals and businesses with the intelligence to achieve financial freedom irrespective of where their money is stored,” Adedeji said.

Editor's Note: Benjamin Dada, publisher of Bendada.com, was employed by Softcom from 2018 to 2021. To ensure transparency and avoid any potential conflict of interest, he recused himself from all editorial decisions related to this story.